Stress testing is a critical component of insurers’ enterprise risk management framework, yet not without its challenges. Our interest in the topic is driven by the clients we serve. As we assist clients in managing their enterprise and investment risk we are motivated to “get it right,” i.e., to assure a better understanding of the inherent risk within their insurance and investment portfolios.

Insurers need to conduct stress tests for events having an impact on multiple facets of their business. Primarily, these include insurance underwriting and investments. Whereas the focus of this Quick Takes and a more in-depth General ReView is investment stress testing, a thorough risk management framework requires integrated tests.

Regardless of the stress testing methodology, the practitioner must decide some subtle but very important criteria. First, is the time frame intra-period or end-of-period? Second, is the periodicity monthly, quarterly or annual? Third, are multi-year outcomes a consideration? Fourth, are only realized losses relevant? And lastly, what is the proper role of taxes? Too frequently these criteria are not evaluated.

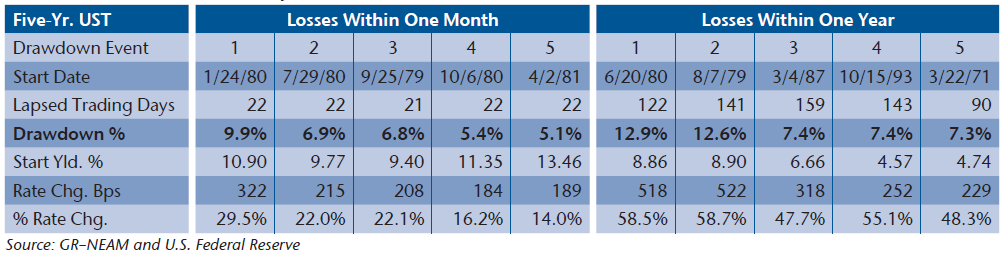

Relying upon daily return data from 1962 (the earliest period of continuously available daily data) thru 2014 we review various periods of maximum stress within the context of the above considerations and evaluate their implications. For example, Table I displays the five largest independent total return drawdowns occurring within a monthly and annual time interval on a rolling daily basis for the five year U.S. Treasury bond.

Table 1. Five-Year U.S. Treasury Maximum Total Return Drawdowns 1962-2014

The seventies and early eighties are the dominant drawdown periods for short duration U.S. Treasury bonds. In the case of a monthly time interval all but one of the five largest drawdowns used the full 22 rolling trading days. On a one-year basis, the maximum drawdowns occurred as quickly as within 90 consecutive days and as slowly as 159 days.

The following are a few highlights from our review:

- In contrast to insurance underwriting results, investment yield volatility appears tame–behaving more evolutionary than episodic. However, changes in fixed income yields and spreads can translate into greatly amplified total return results. And, because investment leverage (assets-to-capital) is a multiple of insurance leverage (premium-to-capital), investment volatility can be as destabilizing to insurers’ capital as adverse underwriting results.

- Some of the more “popular” stress events fail to offer a meaningful perspective of potential downside loss. The reasons include that the events themselves had little measurable impact; other un-named “events” eclipsed their outcomes; and current market levels are not at all comparable to those associated with the periods of greatest stress.ii

- Conventional wisdom is “in periods of stress, (all) asset valuations become highly correlated.” Credit sensitive instruments do highly correlate with one another during “credit events” but high quality assets’ valuations might very well increase while lesser credits’ valuations’ might collapse and equity valuations are not bound to generalizations.

- More conservative intra-period versus end-of-period time frames yield markedly different outcomes. The outcomes are different in two significant ways. First, the end-of-period estimates are a (small) fraction of intra-period losses. And second, the most severe drawdown dates for both monthly and annual time intervals are approximately the same for the two differing time frames in less than one-half of the cases.

- Similarly, periodicity, monthly versus annual, greatly impacts the estimate of stress losses. Focusing on year-end valuations masks the possibility of ruinous outcomes at any time prior to that reporting period as well as at either end-of-month/quarter or intra-month/quarter. Conventional methods appear not to address these considerations and regulators and rating agencies provide mixed guidance.

We operate in an environment where we must make investment and other financial decisions using imperfect or incomplete information. Stress testing is one means to highlight areas where our decision making process might be weak, or even where opportunities might exist that we could otherwise overlook. As we consider ways to “stretch” our understanding of enterprise and investment risks, let’s be mindful of the reality of the past, understand its relevance to our future and not be subject to blind obedience to any method. The following link will take to you the full analysis: General ReView.