December Overview

With inflation trending downward, and the labor market softening, market expectations for a reversal of Fed policy are gaining traction. The fight against inflation however is not over in the eyes of the Fed, whose median projections still see it above their target for the next few years. In their efforts to remain strong at the helm, they have attempted to craft a balanced message, acknowledging the turn in certain key metrics while remaining vigilant as their work is not done.

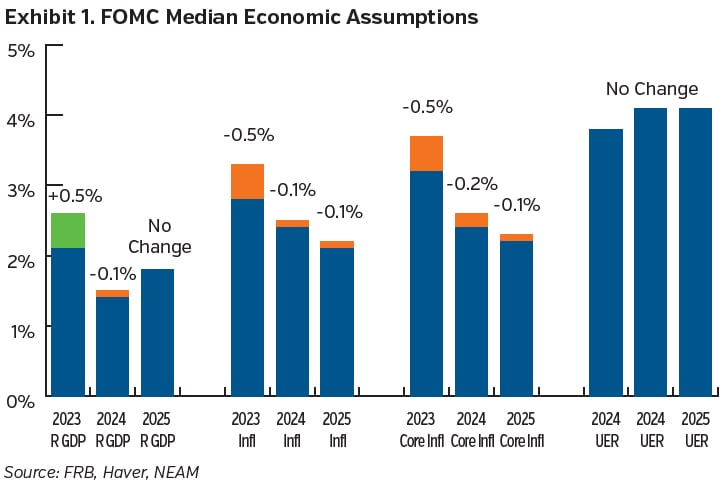

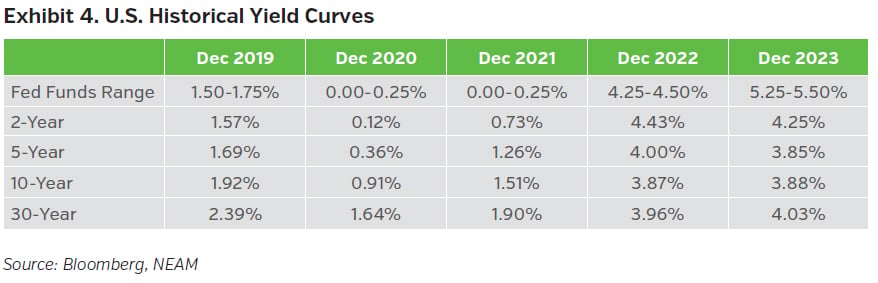

The Fed decision mid-month, in which the benchmark rate remained unchanged, was widely expected by the market and marks the third consecutive meeting that the Fed has not changed its range. Language appearing in its accompanying statement, relative to the last meeting, called attention to the slowing of economic growth as well as the “easing” of inflation “over the past year.” Additionally, the “extent of any additional policy firming” hinted the Fed is most likely finished with its rate hiking this cycle, although as has been its practice of late, it left the window for further policy tightening. The vote was unanimous. In its summary of economic projections, the Fed sees lower but still elevated inflation and slightly slower growth relative to its last release in September, while median unemployment projections remained unchanged. Its projections now call for 75 basis points of easing before year-end of 2024, an increase relative to the last publication. The Fed still wants to tow a taut line, appreciating that if it sends too dovish a signal, it risks reinforcing market expectations and possibly loosening financial conditions more than it already has. Powell noted however that the Fed is “aware of the risk” that they could “hold on too long,” and noted that one would want to be “reducing the restriction on the economy well before 2 percent.”

December’s monthly payroll numbers came in at +216K, with November’s numbers revised downwards to +173K. Gains were concentrated in the healthcare and government areas, with healthcare and social assistance alone making up close to 45% of the total gains on a three-month moving average. Other major additions came in the leisure and hospitality and construction sectors, while losses in transportation and warehousing offset the strength of these areas last month. A longer-term view shows the downward trend in job additions remains in place, which can be expected as growth slows. To this point, monthly payrolls averaged +225K in 2023, down from +399K for 2022 and +606K in 2021, while unemployment sits at 3.7%, up slightly from the end of 2022. Wages increased slightly, up +0.4% for the month in the private sector, but at 4.1% relative to last year the pace of wage increases is slowing as the number of job openings relative to unemployed fall.

Confidence changed tack over the month, with the University of Michigan Consumer Sentiment Index reversing course. Both underlying constituents of the survey, targeting consumers’ current views on the economy and expectations for the future, improved, with the driving force behind the reversal of recent months tied to consumers’ belief that inflation will now be lower than previously assumed.

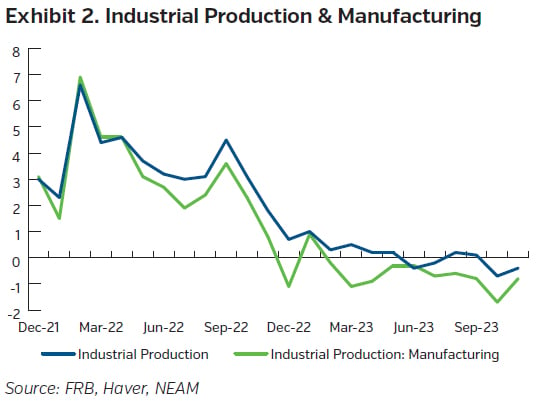

On the investment front, the November PMI figures released at the beginning of December showed that the manufacturing sector continues to face challenges. Companies appear to be dealing with the pressure of tighter financial conditions, including higher rates and weakening demand. To this point, overall industrial production increased 0.2% for the month, helped by a 0.3% jump in the manufacturing sector due to a reversal of the automaker strikes. Excluding the impact of these events, however, manufacturing production fell 0.2%. Elsewhere, core durable order growth was negative for a second month in a row, with the annual growth rate now approaching zero, down considerably from its most recent peak in 2021.

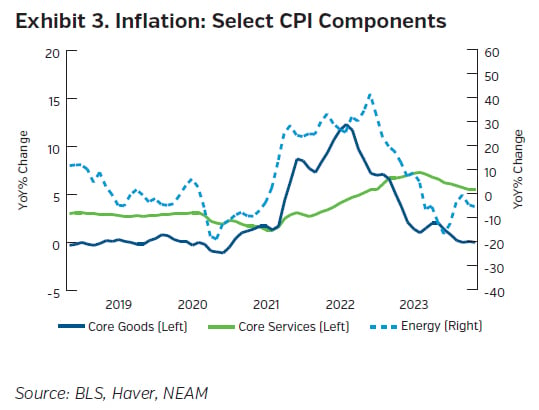

In terms of prices, the most recent CPI print may have given the Fed’s inclination to hold at current levels more support. Headline inflation fell, dragged down by a drop in energy prices (-2.5%) led by lower gasoline (-6%), tempered by a modest increase in food costs. At the core level, core goods continued to show deflationary tendencies, down for the sixth consecutive month in a row (-0.3%). Contributing to the decline, were declines in apparel and new vehicles despite a gain in used vehicle prices which showed its first price increase in six months. On the core services side, price increases rose to 0.5% on the month. Leading the charge in this camp was a bump in shelter costs due to higher owner’s equivalent rent combined with higher medical care costs and a rise in transportation costs despite a drop in airline fares. Although shelter continues to lend its weight to increases, various service indices excluding shelter bumped up again after ticking downward last month. While core inflation remained level at 4.0% for another month and remains on a largely downward track (it was 6% last November), the lack of consistent progress could lead the Fed to hold rates constant for longer.

Capital Market Implications

In a reverse of recent months, Treasury yields fell decently, with more pronounced changes further out the curve as economic data showed some slowing tendencies. Equity markets gained, as rates fell and expectations for further Fed rate hikes dissipated, while credit spreads ended the month tighter.

Capital Market Outlook

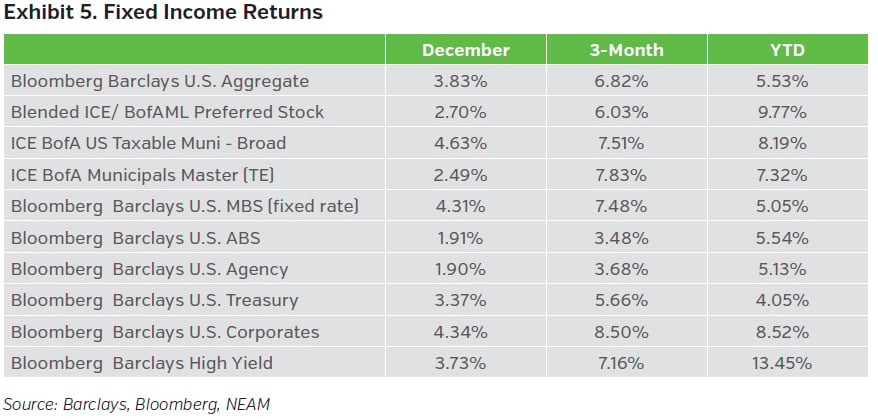

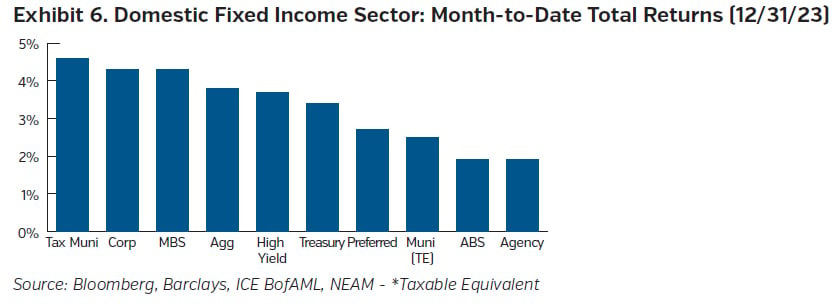

Fixed Income Returns

Markets reacted forcefully to the Fed’s release. Although the Fed held its benchmark rate constant, Treasury yields fell decently, with more pronounced changes further out the curve, while equity markets gained as rates fell and expectations for Fed rate cuts increased.

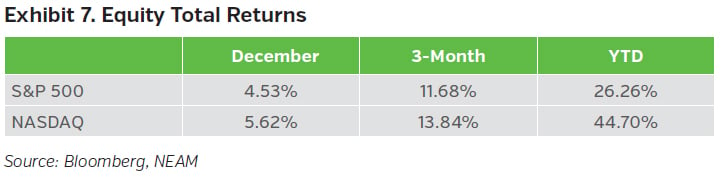

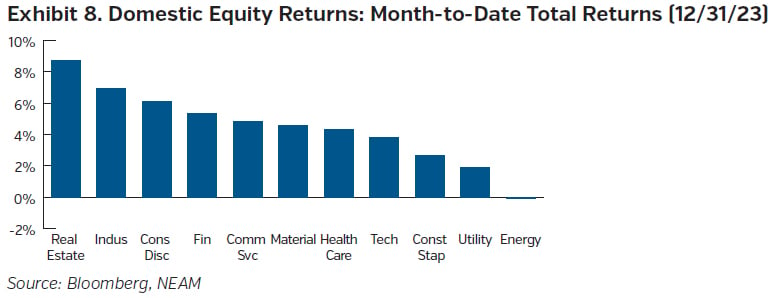

Equity Total Returns

Equities rallied throughout the month as falling Treasury yields and reduced volatility, combined with a growing belief that the Fed may have reached its peak rates, helped major indices rise. The Dow, S&P, and Nasdaq all ended the month higher.