November Overview

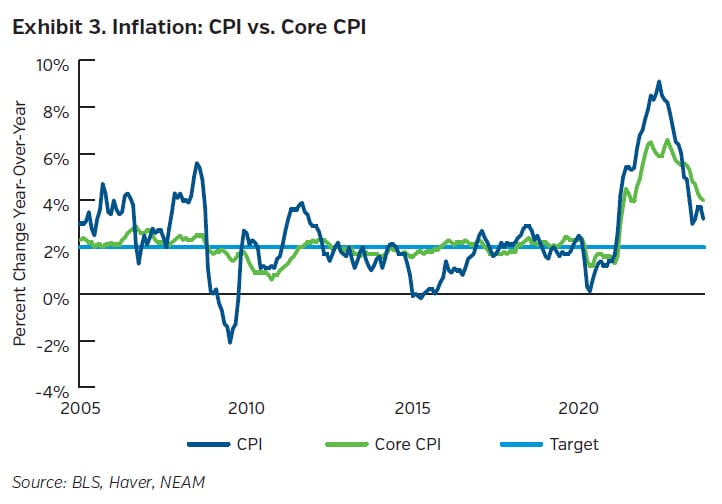

Labor and inflation data cooled over the month, raising the odds that the Fed may be through with its hiking cycle. However, despite market projections related thereto, the Fed is not ready to concede this position. While inflation is falling, and the labor market is slowly softening, there remains some distance between where the economy sits and the Fed’s desired targets. Until then, they see fit to remain vigilant.

With no decision this month, and one more before year-end, the market continued to debate the Fed’s future actions, questioning if recent data is enough to dampen the Fed’s current policy stance. The Fed minutes provided some insight. The minutes reiterated that the Fed is ready to undertake action if the more recent disinflationary prints are not sustained and economic data surprises to the upside. Furthermore, barring any moves upward, the Fed will look to maintain its restrictive stance for some time until it sees the progress it desires. In speaking at the IMF conference this past month Powell remarked that, although they consider their benchmark rate to be restrictive, the degree to which this is so is still up for debate. The Fed wants to see a sustained return to 2%, with any pause on the way potentially meaning that the Fed needs to keep rates higher for longer, or indeed if warranted, raise them again. Powell stated that the gains have in part come from the right siding of supply-side issues, which have plagued the economy since the pandemic, while also suggesting that the benefits of improving supply chain dynamics may be petering out, with the need for more rate moves to impact demand going forward. With that in mind, the cooler inflation print over the month was favorably viewed by the Fed, appreciating however their desire to see a trend rather than a single data point.

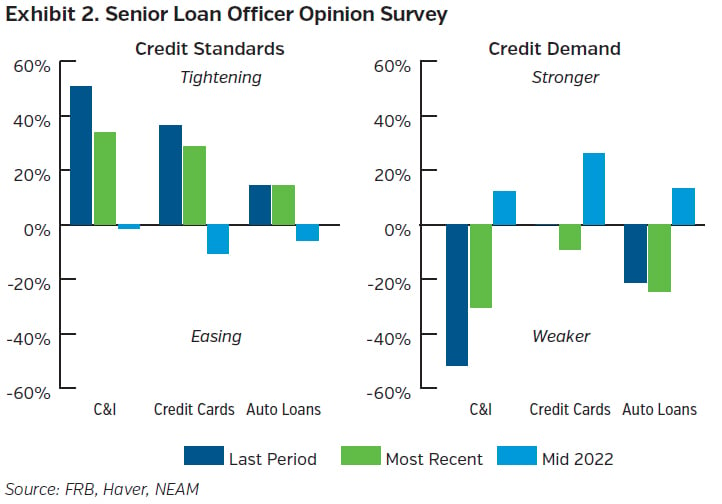

With the jobs market still tight but softening, wage gains slowing and rates higher, consumers are facing several headwinds. Continuing claims are rising. Banks have tightened credit, and credit demand is weak, as evidenced by the Senior Loan Officer Opinion Survey (SLOOS) which ticked down last quarter for credit cards and autos. Importantly, credit standards are firmer, and demand has weakened since the middle of 2022. Indeed, the percentage of consumers stating that tighter credit or higher rates are impacting the purchase of a car has increased according to the University of Michigan, and in the case of buying a home even more.

Consumer sentiment was mixed over the month, with the University of Michigan measures for current conditions and expectations falling back given concerns over higher rates as well as geopolitical unrest, while the Conference Board’s measures ticked up slightly although similar concerns presided.

On the investment front, SLOOS data improved, but it still represented a very tight lending environment for firms, both large and small. On balance, the net percentage of banks tightening versus easing fell, representing an improvement, but a still extremely low level and one that illustrates the tighter climate in which firms now must operate when making decisions relative to investment. Manufacturing is still showing weaker tendencies, with the most recent industrial production showing manufacturing down 0.7% for the month, although adjusting for motor vehicles due to the auto worker strikes showed it up just 0.1%.

On the inflation front, headline inflation was flat for the month, while core inflation increased 0.2%. On an annual basis, this amounted to 3.2% and 4.0%, down from 3.7% and 4.1%, for the headline and core areas, respectively. At the headline level, prices were weighed down by a drop in energy prices, with gasoline prices falling, despite an uptick in the cost of food. At the core level, core goods price changes were negative for the fifth month in a row (although less so this month), with used vehicle price reductions leading the charge. On the services side, price increases throttled back to a more modest 0.3% from the 0.6% gain last month. Shelter prices, which carry significant weight, helped to set that level, led by a drop in owners’ equivalent rent and lodging away from home. Encouragingly, core services ex-shelter also slowed after ticking up last month. While still some distance from the target, the downward trending numbers are sure to be welcomed by the Fed as they work to continue to harness overall price inflation.

Capital Market Implications

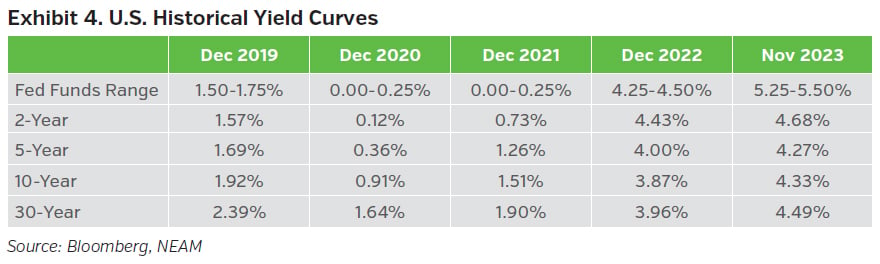

In a reverse of recent months, Treasury yields fell decently, with more pronounced changes further out the curve as economic data showed some slowing tendencies. Equity markets gained, as rates fell and expectations for further Fed rate hikes dissipated, while credit spreads ended the month tighter.

Capital Market Outlook

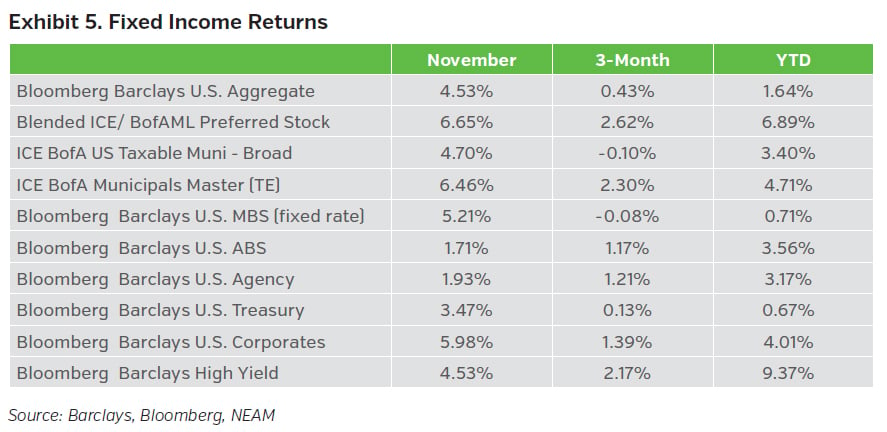

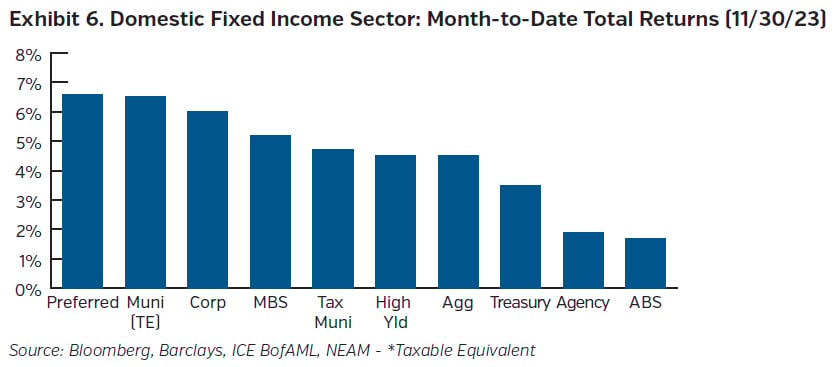

Fixed Income Returns

With no rate decisions over the month, slightly softer labor conditions, tempering inflation, and mixed commentary from Fed officials, markets began to discount a greater chance of Fed rate cuts occurring next year. Treasury yields fell as economic data showed some weakness, with more pronounced decreases at the long end of the curve. Credit spreads tightened, with a strong tone pervading the market, while interest rate and equity volatility fell.

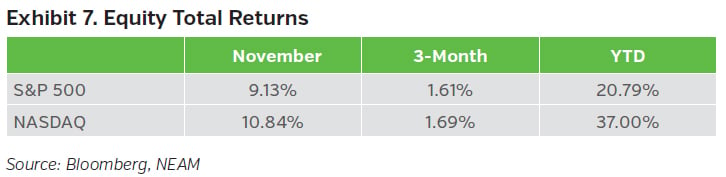

Equity Total Returns

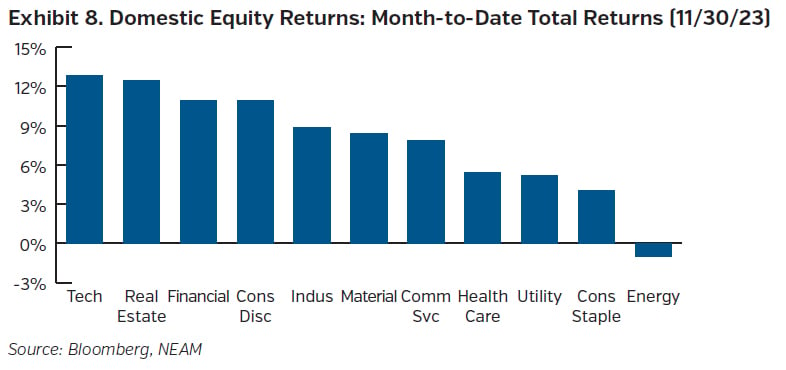

Equities rallied throughout the month as falling Treasury yields and reduced volatility, combined with a growing belief that the Fed may have reached its peak rates, helped major indices rise. The Dow, S&P, and Nasdaq all ended the month higher.