In previous writings,1 NEAM has called the insurance industry’s attention to the FHLB program. The benefits of the program are numerous and in these uncertain times, even more relevant. Insurance companies’ invested asset pools are not immune from the financial crisis being inflicted by social distancing measures taken to stem the spread of COVID-19. In times of market stress, characterized by increased volatility and declining asset prices, the ability to source another avenue of capital (albeit secured) without having to sell assets into dislocated markets can be advantageous.

FHLB Overview

To recap, the FHLB Bank System consists of 11 regional banks that are government sponsored enterprises created under the Federal Home Loan Bank Act of 1932 and regulated by the Federal Housing Finance Agency (FHFA). Working as cooperatives, the FHLB banks aim to source and subsequently provide reliable, low cost funds to member institutions with the intention that such funds are then used to promote investment in real estate and community development. FHLB banks fund themselves through debt issued on a joint and several basis into the capital markets through the Office of Finance. As of Q4 2019, the combined entity had approximately $1.1 trillion in assets, the predominant portion of which consisted of $641 billion “advances” made to its member institutions (58% of the combined FHLB entity’s asset base).2

Insurance Companies and the FHLBs

In the case of insurance companies, advances from the FHLB have historically been used for a variety of uses; namely acting as a ready source of liquidity, lowering overall cost of funds given the FHLBanks’ high rating, offering greater financial flexibility, facilitating ALM and aiding in investment portfolio management. In recent years, this may have been carried out by augmenting lower investment yields. In today’s environment, use of liquidity could be used to help guard against the need to sell securities at a loss or alternatively, accommodating investment in the capital markets when cash is low but opportunity sets are attractive. As markets do not operate on a set schedule, becoming a member of an FHLB facilitates the ability to access funding, whatever the intention, at desired times. To this point, other than the amount of money invested in membership stock, funding is available when needed, and interest is only paid on advances when drawn. Please note “activity stock” needs to be purchased if an advance is taken. This offers members some optionality on when to access funds and allows participants to be flexible in the timing of their use of the program.

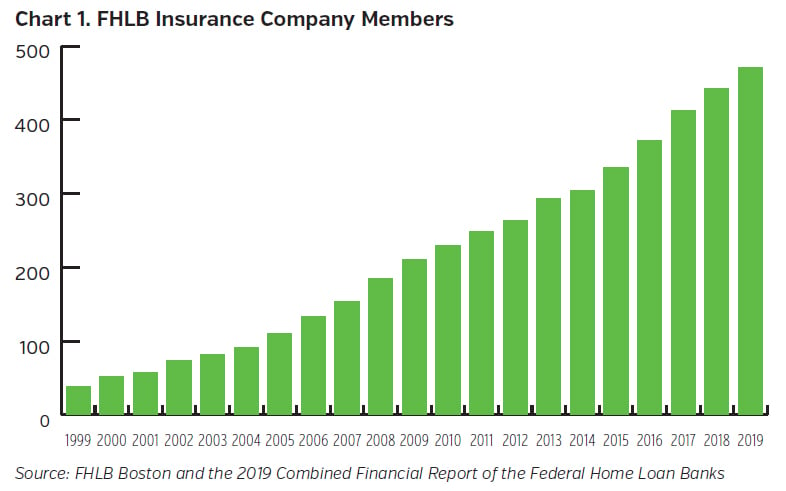

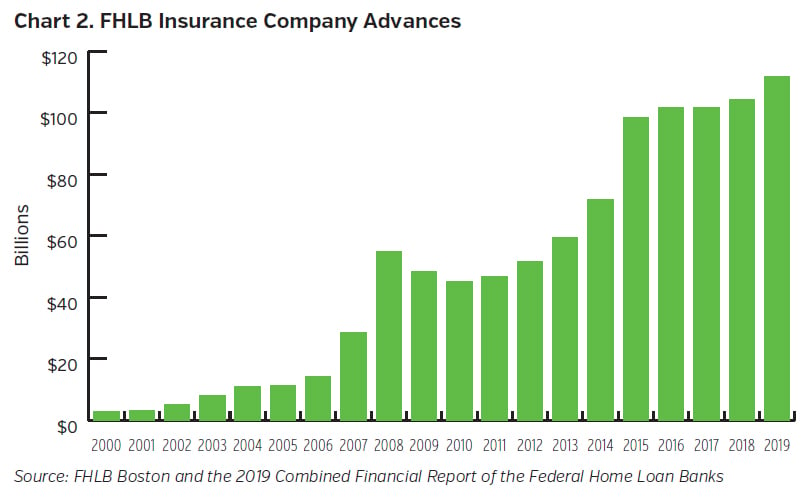

Membership is specific to a certain bank (e.g. FHLB Boston), with the location of the company’s principal place of business largely dictating which bank one can join. At the end of 2019, the number of insurance company members at the individual banks varied with a range of 16 (FHLB San Francisco) to 69 (FHLB Des Moines)3 while there were 471 insurance members of the FHLB system overall, as shown in Chart 1.2 This represented a 255% increase in membership since 2008. Insurance companies comprise 7% of the FHLB’s members while ranking second in their holding of the FHLB’s regulatory capital stock at 14.5%.2 In terms of borrowing from the FHLB, insurance companies comprised just over 5% of members that borrowed and a disproportionately more 17.5% of total advances by member type.2 While insurance companies do not dominate membership by numbers, their use of the FHLB was greater on a relative basis in 2019. Additionally, Chart 2 illustrates the increased usage, including during the Great Financial Crisis.

Funding and the FHLBs

Funding through the FHLB program is secured. Members access funding through direct contact with their respective FHLBank and must post collateral to obtain funds. Eligible collateral can vary and typically consists of marketable securities such as U.S. Government Securities, Agencies, Mortgage Backed Securities (MBS) as well as Collateralized Mortgage Obligations (CMOs) and Municipals, along with other assets such as real estate loans. Advance limits are determined by applying a haircut to the collateral posted, with the level of haircut depending on the risk level and perceived liquidity of the collateral. In addition, the financial condition and credit profile of the borrowing company are taken into account when joining as a member and on an ongoing basis.

FHLB Attractiveness for Liquidity Purposes

With the emergence of the COVID-19 health crisis, which has led to an economic and financial crisis, the ability to access liquidity has been of paramount importance. Recent correspondence from the Head of the Council of FHLBanks to certain members of Congress shared that the FHLBanks continue to “function well” and that they are “actively fulfilling their mission and providing dependable liquidity at this time,” while also noting that the FHLBanks increased lending by 45% (to all members) during the 2008-2009 financial crisis.4 Indeed, a look at the level of historic advances showed that the level rose significantly into the early stages of 2008 before falling back down to lower levels as markets stabilized and liquidity needs subsided. Similarly, advances to Life and P&C companies followed a comparable, albeit higher on percentage basis, trend during this time too.

Insurance company use of the FHLBanks has grown over the last two decades. Membership has increased steadily with companies joining various member banks throughout the country. Companies that have joined have benefited from access to liquidity, albeit secured, at low rates. This liquidity can help increase financial flexibility, particularly in times of market dislocations such as now. About one third of NEAM’s clients were members of a FHLBank at year-end 2019.5

To learn more about this program please contact your Client Strategist or New Business Development at 860-676-8722.

Key Takeaways

- The FHLB program offers insurance companies a source of low-cost liquidity

- Insurance companies can use this liquidity for a variety of measures

- More recently, market dislocations highlight the increased need for liquidity

Endnotes

1 See Quick Takes, Federal Home Loan Bank Program; Quick Takes, Federal Home Loan Bank: Proposed Changes to Insurance Company Membership; and NEAM published brochures, FHLB and Insurers (2018 and 2019)

2 2019 Combined Financial Report of the Federal Home Loan Banks

3 2019 Individual FHLBank 10-Ks

4 Council to lawmakers on Covid-19: FHLBanks are ‘functioning well, supporting members,’ March 19,2020

5 Federal Home Loan Bank Membership Data. Federal Housing Finance Agency, www.fhfa.gov/DataTools/Downloads/Pages/Federal-Home-Loan-Bank-Member-Data.aspx.

There are many conditions to borrowing from the FHLB, and not all insurance companies will qualify. A qualified insurance company must, among other things, become a member by purchasing stock from the FHLB, which is not freely transferable and pledge securities in excess of 100% of the amount borrowed. Activity-based capital requirements at time of investment also apply. These financial commitments may impair an insurance company’s ability to meet other obligations or make other investments. Also, the addition of assets without additional capital can impact a company’s overall financial profile.