In a word association game, what comes to mind in response to the word “hybrid”? Your first thought might be a new breed, species or perhaps a Toyota Prius. The connotation is likely positive, as the concept suggests a combination of desirable characteristics from its contributors. Would your impression change if the term was a hybrid of two financial instruments? Before you answer, consider the following.

Within the securitization market there are a number of “hybrid” asset types with an underlying corporate element. Examples include cell tower leases, structured settlements, rental car fleet financing, and dealer inventory financing. With the recent resurgence in “whole business” securitization, a number of well-known restaurant concepts (Domino’s, Dunkin’ Brands, Taco Bell, Sonic, Applebee’s and Wendy’s) have tapped the market. Issuers are attracted to lower cost term financing (versus unsecured high yield debt) and a structure that supports increased leverage which may facilitate a recapitalization or shareholder distribution. For investors, it is a potential opportunity to earn additional yield as compensation for a unique set of diversifying risks, structural complexity and less liquidity.

Whole Business Securitization (“WBS”)

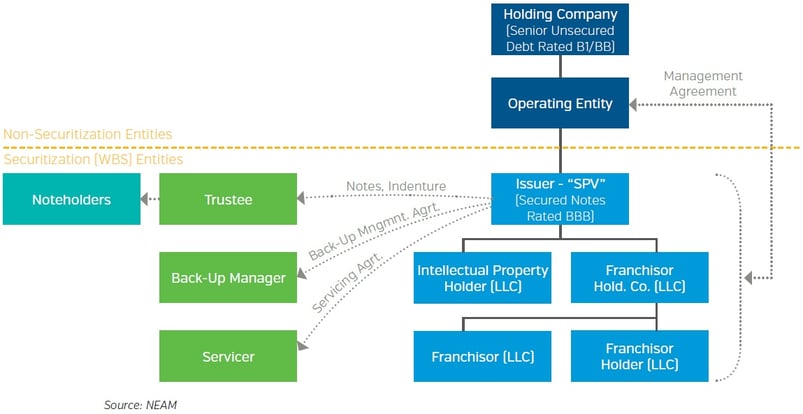

In a WBS deal, the sponsoring entity pledges the revenue-generating assets arising from its intellectual property (franchise fees, royalties, etc.) to a bankruptcy-remote, special purpose vehicle, which serve as collateral for the offered notes. Importantly, the security package creates a priority position such that the securitized notes cannot be subordinated. The cash flow stream from these assets is used to cover debt service and a base level of operating expense.

A unique feature of WBS is the sponsor’s ongoing involvement in managing the business to generate expected cash flow, maintain asset value, and nurture the brand. An evaluation of the management team, growth strategy and competitive position is thus central to the analysis.

Figure 1. Sample WBS Transaction Structure

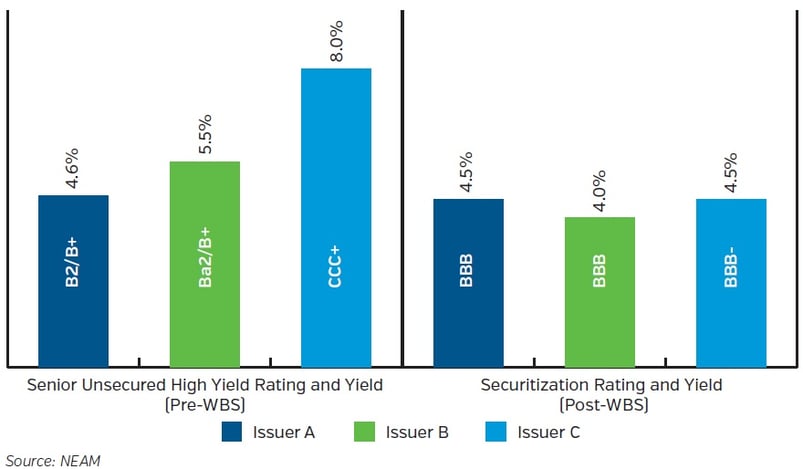

Perhaps the most important aspect of WBS is the concept of a rating “uplift” over and above the sponsoring entity’s unsecured corporate credit rating. This ratings boost is made possible by 1) the pledge of franchise rights, agreements and intellectual property, 2) financial tests and triggers and 3) a credit rating based upon repayment of principal to an extended (30 year) legal final maturity. If the borrower is unable to effect a refinancing at the anticipated maturity date (typically 7-10 years), all excess cash flow is directed to repay the notes. This feature is essential to achieving what amounts to a multiple rating notch upgrades (two to eight) over the sponsoring company’s unsecured debt rating. WBS are usually rated in the BBB category.

Not all WBS are created equally. They vary in their brand prominence, ownership structure (publicly or private equity-owned), and financial leverage. Investors need to be especially wary of transactions with excessive rating uplift resulting in “credit market arbitrage” between the high yield corporate unsecured and securitization markets. Figure 2 compares the debt ratings and yields for three issuers on a pre- and post-WBS transaction basis (note that the WBS typically pays off the senior unsecured debt of the issuer). Issuer C illustrates an extreme example in which a company reduced its funding costs from 8% to 4.5% while increasing leverage from 3.5x to 6.2x; an unreasonable relative and fundamental value proposition, in our view.

Figure 2. Indicative Yield Comparison Pre- and Post-Whole Business Securitization

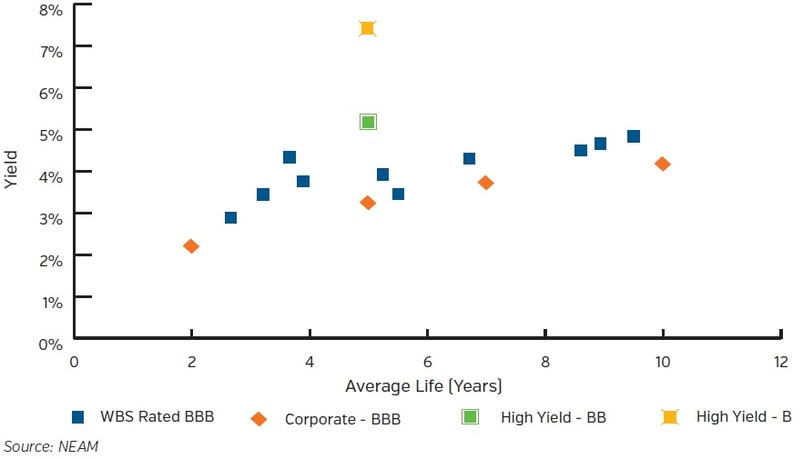

WBS securities currently yield between 4% to 5%, representing a spread pickup between 50 and 100 basis points to BBB corporates (Figure 3). Since leverage in a WBS may reach upwards of 5x (Debt/EBITDA), comparisons to corporates rated BB and B yielding ~5% and ~7%+, respectively, are also instructive. Relative to their corporate counterparts, the market is acknowledging the “hybrid” nature and inherent leverage in the WBS security.

Figure 3. Comparative Yields

- In the realm of value-added, investment grade, fixed income alternatives, WBS should be considered for potential yield enhancement and diversification.

- The sector requires an evaluation of corporate credit fundamental and financial metrics, with a structural overlay.

- The strength and persistence of the brand, robustness of structural protections, and cash flow leverage are key determinants of value.

- Investors need to avoid issuers who may be attempting to arbitrage both the rating agencies and credit markets, while creating an unsustainable capital structure for the business model.

The whole business securitization examples shown are intended to help clients understand our investment management style, and should not be regarded as a recommendation of any security for any person. These examples were selected to show examples of companies we select for our clients based on the criteria we identified. These positions represent a small portion of our current holdings in managed client accounts. Past performance is no indication of future performance. Although we focus on long-term investments, portfolio holdings are subject to change.