As we enter 2016, credit investors have much with which to be concerned. A significant decline in commodity prices, softer global economic growth, heightened event risk and thin dealer liquidity have all pressured credit spreads. While these risks remain, we turn our focus to the following question: “Where are we in the credit cycle?” The answer to this question is a key component in determining whether a rise in credit spreads is an opportunity or a warning signal of the arrival of the next credit cycle. In fact, it may be both.

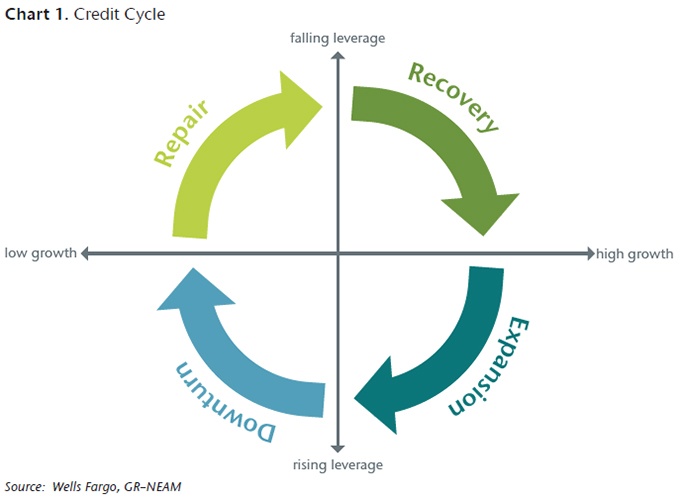

When we refer to the credit cycle, we mean the expansion and contraction of access to credit, relative to economic growth. Chart 1 displays the distinct phases of the credit cycle:

- Recovery - Restructuring efforts lead to improvements in operating margin, growing free cash flow and falling leverage.

- Expansion - Companies reach for earnings growth and shareholder returns leading to an increase in leverage and higher levels of speculative activity.

- Downturn - Characterized by a contraction in credit availability due to recession or falling asset prices, leading to increased funding pressure and rising defaults.

- Repair - Companies focus on balance sheet repair, cost cutting and generating cash for survival.

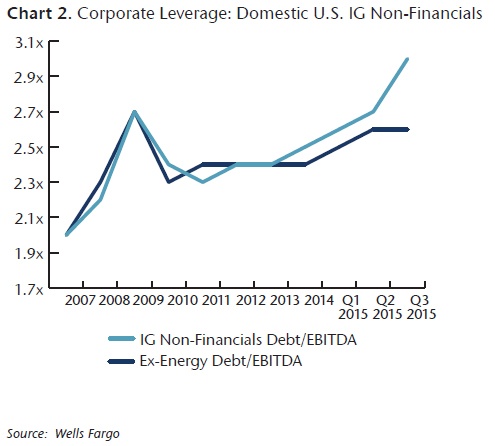

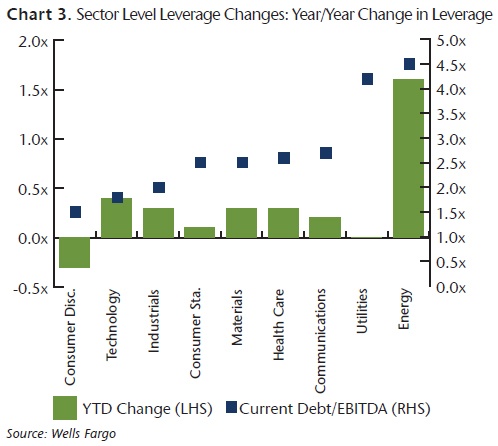

Typically, credit cycles last between seven and ten years. If we date the last credit cycle at 2008, we are approximately eight years into the current one. Today, the U.S. corporate sector appears to be moving closer to the “downturn” phase, as credit market indicators range somewhere between the “expansion” and “downturn” phases. While U.S. corporate revenues and earnings have expanded relatively consistently over the last several years, the pace of credit improvement has begun to show signs of deterioration (see chart 2 ). Record corporate issuance, with a significant portion focused on M&A has resulted in higher than average leverage in affected sectors (healthcare and telecommunications accounted for 50% of 2015 M&A activity). Additionally, the energy and metals and mining sectors have seen leverage climb, driven primarily by lower commodity prices which has resulted in a precipitous decline in operating earnings and cash flow. Weaker fundamentals have not been limited to these sectors. Leverage across the credit spectrum has moved higher (see chart 3), as many companies borrowed aggressively to pursue shareholder-friendly activities, such as stock buybacks and dividend increases. Low interest rates have enabled aggressive financial engineering by corporate issuers and this behavior has been supported, in part, by activist investors.

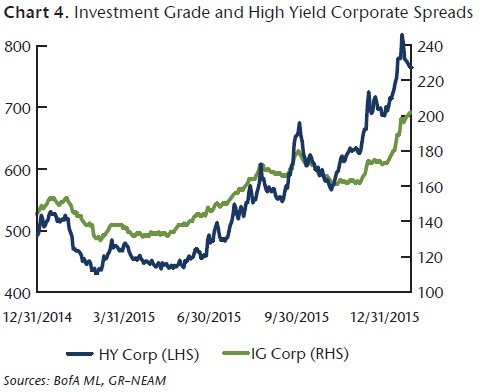

These are all indications that we are transitioning to the downturn stage of the credit cycle, increasing investor concerns that credit availability will contract, financing costs will increae and financial flexibility will diminish. Over the last several months we have seen a significant rise in both investment grade and high yield credit spreads (See chart 4), as investor concerns regarding late cycle behavior, anemic global growth and limited market liquidity have combined to push risk premiums wider.

Clearly the credit cycle is dictating a more measured approach as to which sectors and/or issuers investors should add to fixed income portfolios. While we see opportunities within the corporate market given recent spread widening, it does come at a time of increasing volatility and changing return expectations for credit investments. Additionally, default activity and ratings pressure are likely to rise, especially in the energy and metals and mining sectors.

TAKEAWAYS

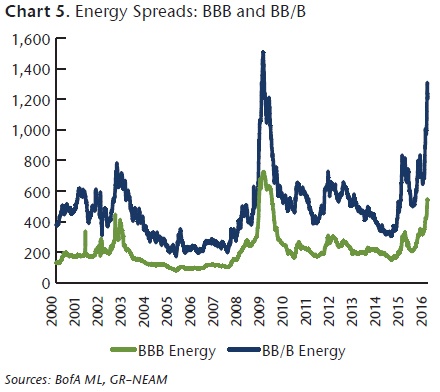

We expect 2016 investment grade issuance to be driven, once again, by the M&A pipeline and shareholder rewards. These transactions could offer attractive “concessions” to secondary trading levels and may present tactical opportunities in the current environment. In addition, the dramatic decline in commodity prices has, in our view, offered an opportunity in select issuers in the energy sector as bond spreads approach historical wide levels (See chart 5).

Overall, we remain concerned about deteriorating credit quality in many parts of the corporate market. M&A, re-leveraging activity, lower commodity prices, and a strong U.S. dollar continue to weigh on credit quality for many non-financial issuers. In addition, spreads for many corporate bonds remain comparable to, or even tighter than, longer term averages. However, dispersion has increased and we believe that spreads in specific pockets of the market currently offer a substantial cushion against further spread widening and/or credit deterioration.