Slightly over a year ago in early 2020, the United States was in a good place economically. The economy was coming off a year in which real GDP grew 2.3% and the unemployment rate was at a historical low of 3.5%. The economy was poised for another strong year and President Trump was confident that he had Made America Great Again. And then the world came to a halt. The Covid virus hit the shores of America and the U.S. economy went into lockdown. As had been the playbook in the Great Financial Crisis of 2008, the Federal Reserve stepped in, dropped rates to zero and unleashed a series of monetary support programs the magnitude of which we have never seen before.

Fast forward to today and the U.S. Government Debt to GDP ratio is now above 100%, the highest level since post World War II. Conversely, U.S. households accumulated $1.5 trillion in savings after being locked in their basements for most of 2020. With short-term Treasury rates anchored at zero, where are investors to deploy dollars in pursuit of yield and return in this low yield world? While we might not like or agree with the answer, bitcoin has broken above $50,000, Robinhood is thriving as a no cost online trading platform for retail investors, Special Purpose Acquisitions Corporations (SPACs) are being launched on a daily basis and equity valuations have been stretched to the very high end of historical valuations. Are these potential bubbles the “unintended consequences” of exceptionally loose monetary policy? How should insurance company portfolios be positioned should these potential bubbles burst and create market dislocations? Let’s look at each situation.

Bitcoin

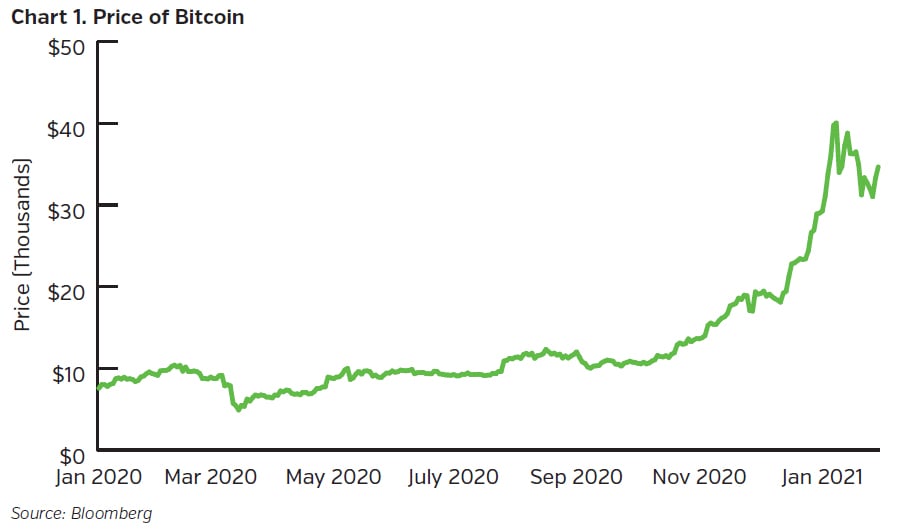

What is the value of something that has seen minimal commercial usage, pays no interest, exists in a password protected account on the internet and has been known to vanish without a trace? The answer, at the time of writing, is close to $50,000. Welcome to the world of bitcoin and cryptocurrency. As seen in Chart 1, the price of bitcoin has been on a near vertical path since the end of 2020, closing the year at just under $29,000. In February 2020 (pre-Covid), bitcoin was trading around $8,600. One of the most popular arguments we hear for bitcoin is that it is a modern version of gold and a store of value. That misses one big point that can be gleaned by looking in the closets of many Americans. Gold does have alternative uses, most notably jewelry. According to the World Gold Council, jewelry comprised 46% of above ground stock of gold at the end of 2020. Despite the headlines around bitcoin investments by the likes of Tesla and Micro Strategy, institutional investment in bitcoin remains small. Many corporate treasurers have been adamant that the volatility, regulatory issues (corporations must treat bitcoin as intangible assets like trademarks), and potential impairment issues will keep them away from this asset. The driver of bitcoin’s price is retail driven momentum trading. What happens when these buyers decide to take their money elsewhere? You don’t want to be the last person out the window.

Robinhood

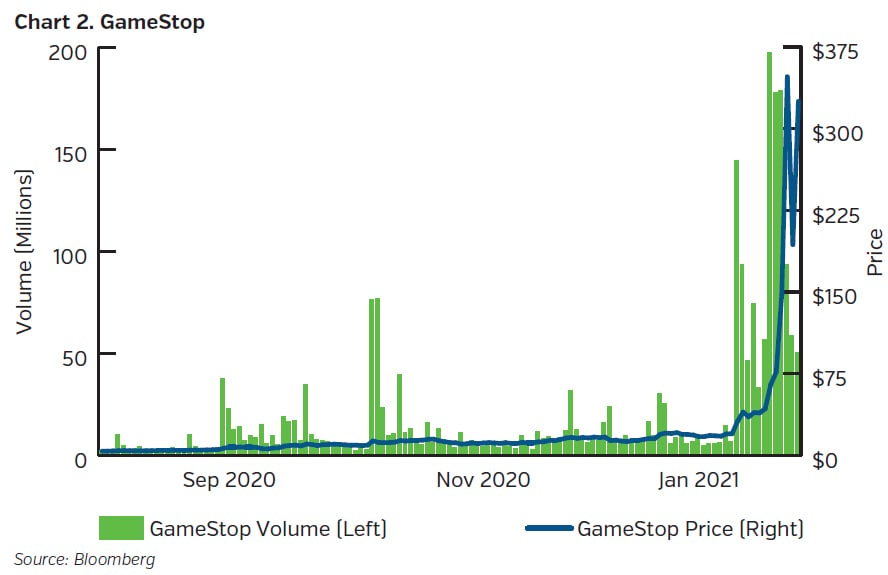

It is hard to place all the blame on the Fed for the GameStop trading frenzy, but they are not blameless. Firstly, GameStop had a float of 50 million shares but 71 million shares were sold short. This is a form of leverage and magnifies the problem when something goes wrong. Can’t blame the Fed here because it is not their job to regulate the prime brokers but a little noticed announcement from Robinhood falls right in their lap. This stocking stuffer was announced in December by Robinhood:

“Today, we’re excited to announce that we’re lowering our annual margin interest rate from 5% to 2.5%, making it one of the lowest and most competitive rates in the industry. At Robinhood, we’re driven by our mission to democratize finance for all. We started with removing barriers like commission fees and account minimums and continue to look for ways to lower the cost of investing services across the board–and inspiring others to do the same. By lowering our margin rate, we’re taking another step in passing the most value back to our customers.”

-Robinhood Markets, December 21, 2020

Low interest rates and a low cost of capital allowed Robinhood to make this offer with the end result being significantly higher levels of both stock and options trading. As shown in Chart 2, trading volume in GameStop on commission free trading platforms like Robinhood soared as millions of Americans found a new place to spend some of the $1.5 trillion of savings they had accumulated in 2020. While GameStop as a stock is not high on the Fed’s priority list, they probably should care about the overall amount of margin debt being used to fuel speculative activity in the markets.

Special Purpose Acquisition Corporations (SPACs)

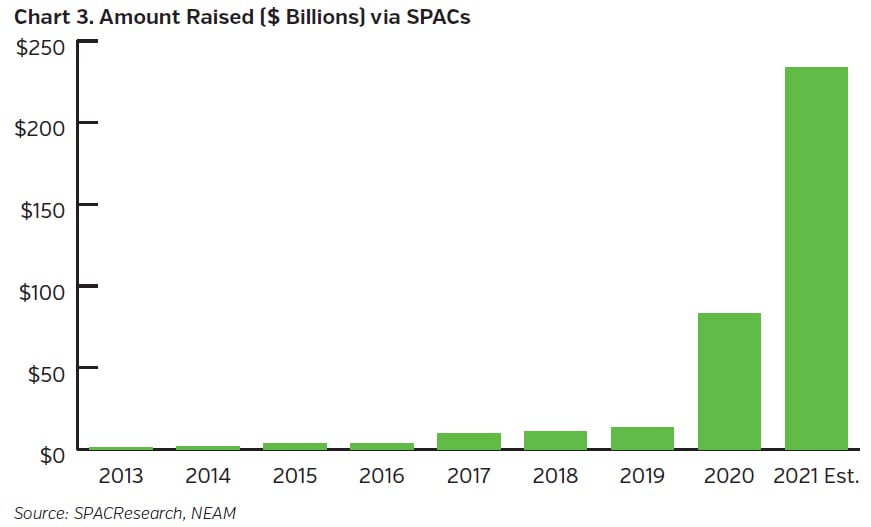

Although they have been around for years, Special Purpose Acquisition Corporations (SPACs) have exploded in popularity since the beginning of 2020. Chart 3 shows the meteoric rise in money raised by SPACs over the last 8 years. Starting with a mere $1.4 billion raised in 2013 for 10 IPOs, SPACs raised $83.4 billion in 2020 for 248 IPOs. 2021 issuance might be triple that at the current pace of deals. A SPAC is essentially a company with no initial assets or operations that raises capital through an initial public offering (IPO). The proceeds of the IPO are held in trust for a specified period of time for the purpose of acquiring a private business. SPAC IPO investors have limited downside risk given investors are entitled to vote on the acquisition and if not approved, are entitled to a full refund of their investment.

What is not broadcast widely is the fact that the sponsors of a SPAC typically receive a “promote” for sponsoring the SPAC. This generally is in the form of 20% of the shares of the SPAC for a nominal investment. Why is this important? This arrangement results in the economic rights and interests of the SPAC sponsor and IPO shareholders not being necessarily aligned. The sponsor has all the upside of the promote – all the sponsor shares and warrants will be worthless if a deal is not consummated and IPO proceeds are returned to the investors. If the sponsor buys the next Enron and cashes in the promote, the retail investor is left holding the bag if the IPO shares become worthless over time. Heads I win, tails I win. It is pretty easy to see why so many hedge fund managers are rushing to play this game. They’re looking for an easy way to add another digit to their net worth, perhaps at the expense of the retail investor who is always last to the party.

Key Takeaways

- Global monetary policy is expected to remain accommodative for the foreseeable future. Risk taking will remain elevated as investors search for yield and higher expected total rates of return

- Speculative bubbles can form and lead to higher levels of overall market volatility

- We recommend insurance companies maintain some levels of liquidity to be able to take advantage of market dislocations as they occur

- Companies should consider updating their Enterprise Based Asset Allocation™ (EBAA™) to review and better understand their capacity for risk assets