As insurers grapple with the development of an Environmental Social & Governance “ESG” strategy that aligns with company values, long-term business objectives and fast evolving public perceptions, UK regulators have been providing direction in the area of Climate Change Risk.

In this Quick Takes, we review the expectations outlined in the UK Prudential Regulation Authority’s (PRA’s) Supervisory Statement 3/19 (SS3/19) as they affect investments. We consider practical steps that insurers can take in the recognition, surveillance and governance of these risks within their investment portfolios in advance of the implementation deadline of year-end 2021.

PRA’s Expectations

Issued in April 2019, SS3/19 focuses on the management of climate related financial risks by the UK banking and insurance sectors and the PRA’s expectations of institutions in embedding these risks into their supervisory framework. In a subsequent “Dear CEO” letter, issued in July 2020, the PRA provided clarification of expectations contained in the initial statement and provided guidance on good practices and next steps in implementation.

Climate related financial risks may impact institutions through two primary risk factors:

a) Physical Risk – Increased frequency / severity of extreme weather events impacting insurance claims and potentially resulting in physical damage to financial assets or collateral. Recent examples include California wildfires, European hailstorms and floods.

b) Transition Risk – Risk arising from the process of adjustment towards a low-carbon economy. Factors include the potential value destruction from stranded carbon assets in the oil and gas sectors, the impact on auto manufacturers of the shift to electric vehicles and the added input costs for mining and beverage companies dependent on clean water for production.

Given the short duration and high credit rating profile of many P&C insurer investment portfolios, we consider both physical and transition risk to be substantially mitigated in many cases. However, it will be essential for insurers to effectively embed the measures outlined in SS3/19 to ascertain whether this is the case for their firm in the first instance and then to monitor their position over the long-term.

The PRA is pragmatic in its approach to this topic and acknowledges that firms’ strategies will evolve and mature over time as they overcome current limitations relating to tools and data.

SS3/19: Areas of Focus

This supervisory statement highlights four key areas of focus for insurers: Governance, Risk Management, Scenario Analysis and Disclosure. While these cover all aspects of insurers’ business operations, below we focus on the measures that insurers may implement with respect to their investment portfolios, specifically.

I. Governance

The PRA expects firms to have assigned clear roles and responsibilities relating to climate related financial risks to their Board, Senior Management Function(s) and relevant internal committees. Insurers’ approach to the management and mitigation of these risks should be outlined in their risk appetite statement and incorporated into their risk management framework.

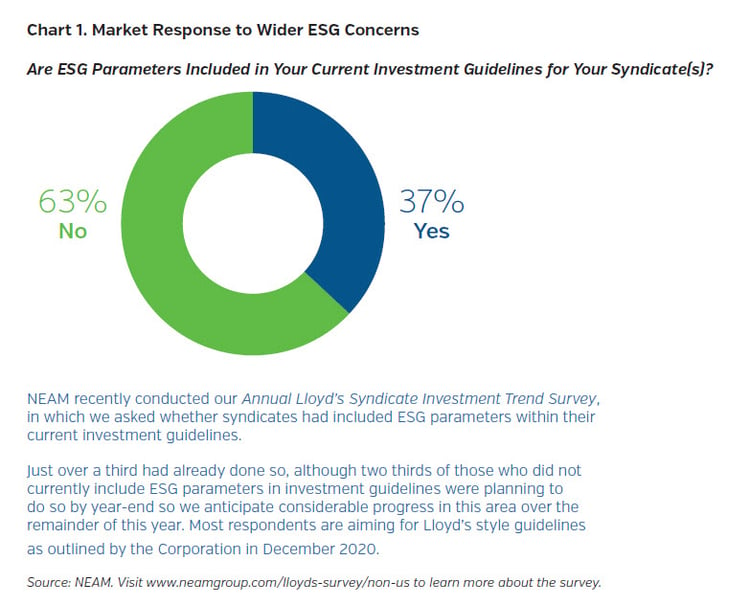

Focusing on their investment portfolio, insurers should recognise both physical and transition risks as risk factors in their investment policy statements and clearly set out a mitigation strategy for such risks in investment guidelines. To date, the most concrete evidence we have seen of this recognition by insurers has been negative screening of issuer names or sectors exposed to wider ESG risks.

II. Risk Management

The monitoring of key indicators of potential physical and transition risk to portfolios should be included in all periodic portfolio surveillance and embedded within an existing oversight forum such as the insurer’s Investment Committee. Insurers should work with their asset managers to develop a reporting framework that facilitates regular review and discussion of these risks within firm’s overall risk management framework and in relation to its risk appetite statement.

Reporting frameworks are likely to evolve over time given the continual improvements in the availability, consistency and granularity of issuer data that can be used to assess climate change risk. In our experience, while the relevant data is generally available for corporate and sovereign holdings, it is less consistent in sectors such as municipals and extremely limited for structured securities.

III. Scenario Analysis

The evaluation of climate change related risk poses some unique challenges when compared to other, more traditional financial risk factors. Historical data is of limited value when assessing the potential future impact of actions taken today. Institutions are expected to leverage forward looking scenario analysis in their assessment of the impact of climate change on their solvency and the liquidity of their investment portfolios.

To this end, the PRA has provided basic stress testing parameters1 that insurers can use as a starting point for their analyses. Our experience to date has shown that a well-diversified asset portfolio of a P&C insurer, is typically estimated to be subject to a loss of low single digit percentage.2 Depending on the nature and complexity of holdings, some insurers may deem it appropriate to develop additional, more tailored stress testing parameters.

tailored stress testing parameters.

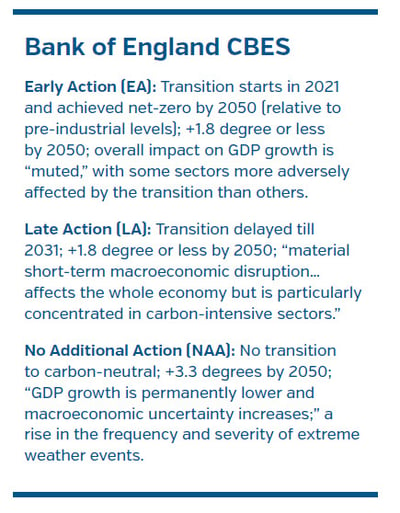

It should also be noted that earlier this year, the Bank of England launched the 2021 Climate focused Biennial Exploratory Scenario (CBES) in which larger insurers and Lloyd’s managing agents have been asked to participate. This aims to expand on previous guidance issued in relation to climate change scenario analysis and to facilitate better understanding of the financial exposure and challenges faced while encouraging participants to enhance their climate change risk management process - we anticipate this will be rolled out to the wider market in due course at which point it will replace the 2019 PRA stress testing guidance.

IV. Disclosures

While there is an existing requirement for institutions to disclose information on material risks under Pillar III of Solvency II, there is still considerable variance in the nature and granularity of climate change risk disclosures.

Firms should actively review the level of information currently disclosed in context of the evolution of their risk management framework and assess whether measures taken to understand, monitor and mitigate climate related financial risks are adequately and transparently disclosed. Reporting on the climate change related risk profile of their investment portfolio should be a key component of this.

The PRA is actively encouraging insurers to engage with the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD) as a means of achieving some consistency in this area. We think it likely that some formalised disclosures will soon be mandatory.

In Summary

By year-end 2021, UK insurers are expected to be able to demonstrate that a framework for monitoring and managing financial risk from climate change has been implemented and embedded throughout the organisation in a manner proportionate to the nature, scale and complexity of the business.

Insurers need to clearly understand their exposure to climate related physical and transition risk within their portfolios to have established a framework for monitoring these risks and to have outlined a strategy for the mitigation of any such risk identified over the medium to long-term, supported by forward looking scenario analysis.

Both ESG and climate change risk are complex and fast evolving topics. Insurers should lean on their thought partners for assistance in developing an adequate risk management and governance framework in response not only to regulatory requirements but also those of their other stakeholders.

Key Takeaways

- The deadline for UK based insurers to implement an approach to managing climate related financial risks is year-end 2021.

- The PRA is pragmatic in its approach to this topic and acknowledges that solutions should be proportionate to an insurer’s exposure to climate related financial risk and the scale and complexity of their operations.

- While we consider both physical and transition risk to be substantially mitigated in the case of many P&C insurance portfolios, this can only be properly substantiated through adopting the measures outlined in SS3/19.

- Key areas of focus in terms of ongoing management of climate related financial risk in insurers’ portfolio holdings are:

- Documented risk parameters

- Portfolio reporting

- Stress testing

- Periodic surveillance and analysis in context of the firm’s overall risk appetite statement

- We believe that a well-diversified asset portfolio of a P&C insurer, when stress tested under the PRA’s prescribed scenarios, is typically subject to a loss of low single digit percentage.2

- The industry appears to still have considerable work to do to reach the PRA targets by end 2021 and this is especially the case for medium and smaller entities.

Endnotes

1 Parameters provided as part of the PRA’s 2019 insurance stress testing exercise.

2 Calculated using the PRA 2019 parameters, on a 1 in 100-year climate value-at-risk basis.