The 2008 financial crisis caused a severe contraction in the U.S. housing sector. It led to significant tightening of underwriting standards, forcing many potential first-time homebuyers to postpone their home purchase decisions. Through a combination of unprecedented economic stimulus by the Fed, modifications of unaffordable loans and the clearing of distressed inventory through foreclosures, home prices finally stopped their decline in 2012. Subsequently, an extended period of low mortgage rates brought back borrower demand and robust underwriting restored investor confidence, resulting in steadily increasing housing activity. This positive momentum continued into 2020, with the COVID-19 pandemic sharply accelerating demand. The U.S. housing market has now surpassed its pre-financial crisis activity and price levels, leading some to speculate that a housing bubble could be forming, but we disagree.

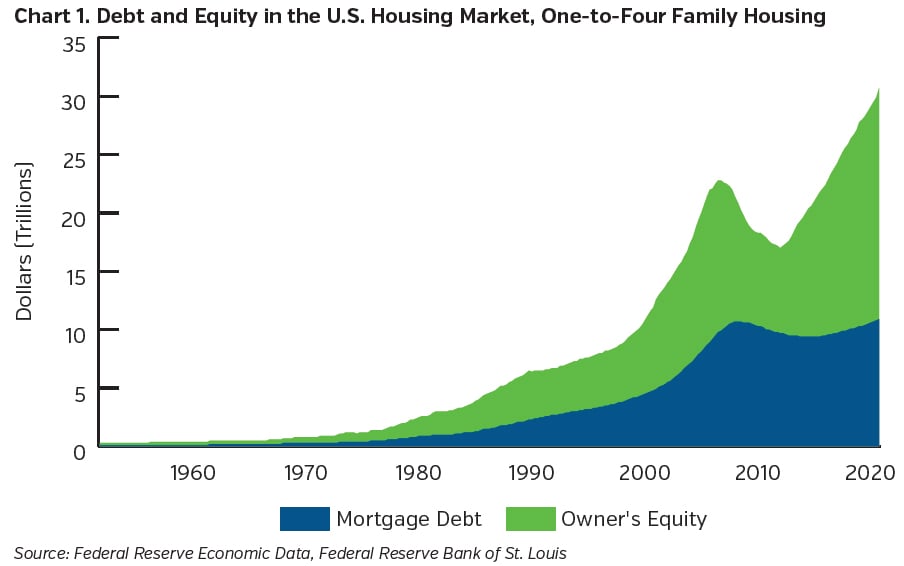

Since the financial crisis, mortgage debt has remained nearly flat while asset values have increased significantly, resulting in a substantial buildup in home equity (Chart 1). Today’s housing market differs from the pre-financial crisis housing market in a number of key ways:

- Overhauled underwriting: robust income verification, appraisal independence, and detection of undisclosed debts and fraud

- Less risky loan products: teaser/short reset adjustable rate mortgages and negative amortization loans no longer originated

- Stronger borrower credit: median credit score > 700 and median LTV < 80 at origination (ex-Ginnie Mae loans)1

- Securitization safeguards: simpler deal structures and stronger originator/issuer representations and warranties

- Early legislative intervention: temporary payment forbearance and foreclosure moratoria to prevent distressed selling during crises like the COVID-19 pandemic

RISING DEMAND

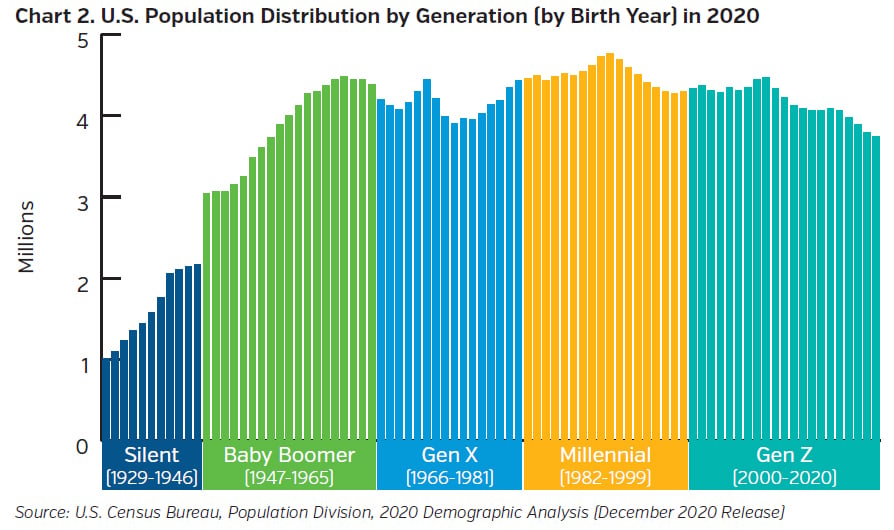

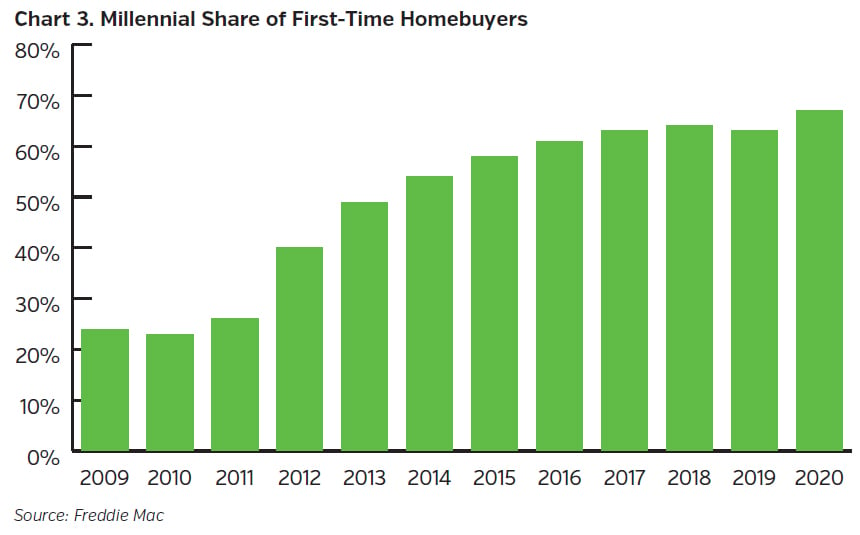

Many potential first-time buyers, especially Millennials, who put off home purchase decisions in the wake of the financial crisis are now buying homes. Millennials comprise the largest adult generational cohort and have started to buy homes in significant numbers as they enter the 30 to 35-year old age bracket. This demographic shift is set to continue, with 4.7 million Millennials having turned 30 in 2020 and an additional 4.25 to 4.8 million turning 30 every year for the next eight years.2 Compared with the roughly 6 to 7 million home sales per year at current rates, this is a substantial demand tailwind. Its impact is already becoming apparent, with Millennials comprising 67% of first-time homebuyers in 2020.3

At the same time, institutional buyers have increased their purchases of entry-level homes, often outbidding first-time homebuyers. Demand spiked during the pandemic due to both historically low mortgage rates and a preference shift from multifamily to single-family housing, driven by social distancing restrictions and work-from-home arrangements.

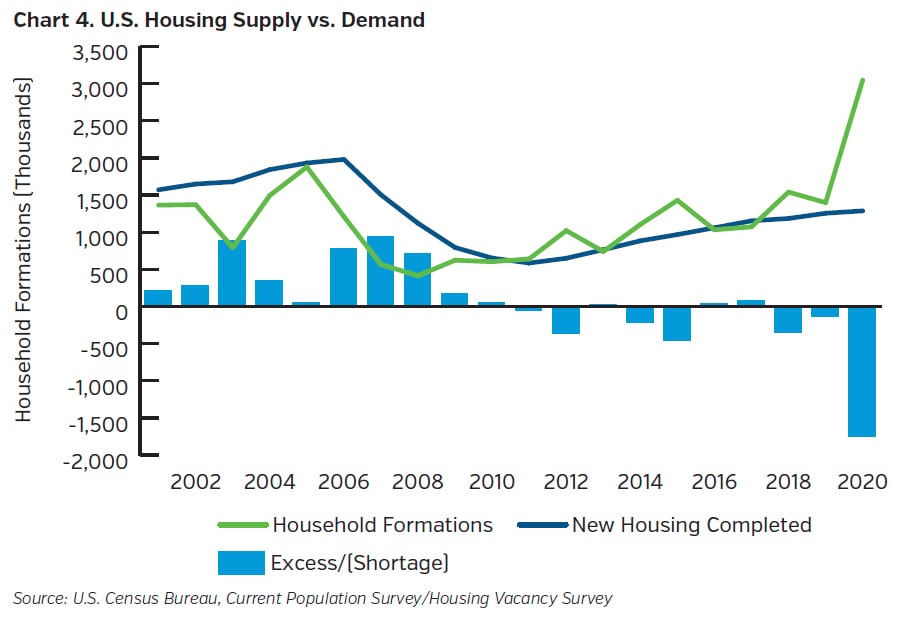

CONSTRAINED SUPPLY

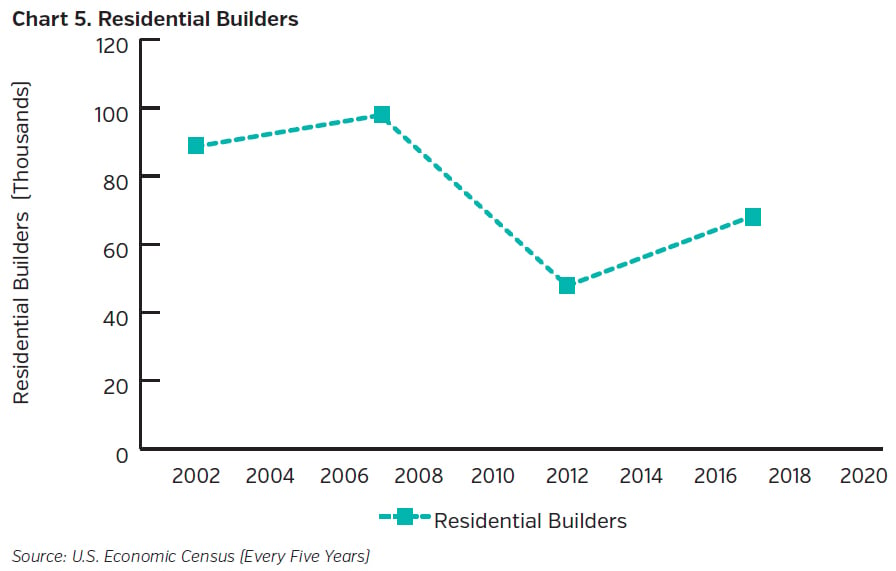

On the supply side, many homebuilders went out of business between 2007 and 2012.4 The construction payroll also shrank considerably and is only now catching up.5 While construction material prices are typically volatile, this volatility has sharply increased during the pandemic, adding delays, uncertainty, and difficulty in obtaining materials. In particular, the quadrupling of lumber prices since 2019 has added substantial cost to homebuilding.6 Short-handed municipalities have meant delays in building permits, inspections, and land clearances for new construction.

Structurally, zoning and other local residential land use regulations continue to constrain housing supply, and such regulations became more widespread and restrictive from 2008 to 2018.7

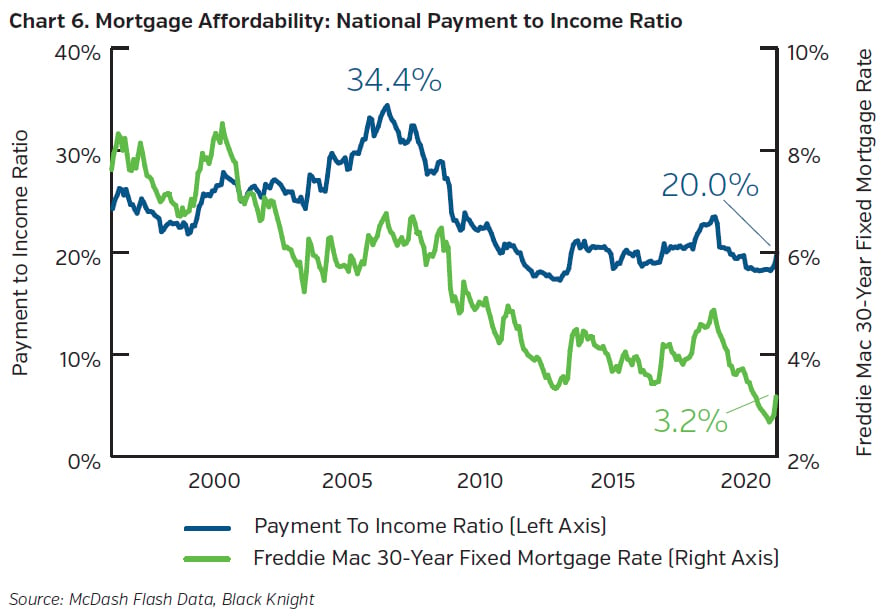

AFFORDABILITY & BORROWER EQUITY

Historically low mortgage rates have substantially improved mortgage affordability despite the sustained increase in home prices. In addition, post-financial crisis requirements for sizeable down payments along with steady home price appreciation have created significant borrower equity.

Despite the economic stress of the pandemic, the majority of borrowers have stayed current on their mortgage obligations.8 The timely help of temporary payment forbearance and foreclosure moratoria along with substantial equity in properties have helped prevent large-scale defaults and fire sales like those during the financial crisis.

KEY TAKEAWAYS

- Increased activity and price levels in U.S. housing have resulted from pent-up demand and inadequate supply rather than easy access to credit through risky products like those originated before the financial crisis. This imbalance will take some time to clear, though a restrictive rise in mortgage rates could cause a slowdown in demand.

- Elevated housing valuations are supported by economic fundamentals and low fixed rate financing. These factors, combined with substantial homeowner equity, minimize the risk in housing.

- The U.S. housing market has now entirely reversed its historic downturn, aided by favorable supply-demand dynamics, positive transformation in underwriting, low mortgage rates, and continued economic growth.

- Demand driven by the millennial generation will be a sustained tailwind for housing in the coming decade and the pandemic-driven preference shift towards single-family housing is likely to persist.

- On the supply side, record low inventory, regulatory constraints and pandemic-related medium-term bottlenecks in supply chains are also likely to continue.

- Significant borrower equity, less risky product types and proactive legislative measures will reduce foreclosures.

- Sound fundamentals in housing will continue to provide attractive opportunities in mortgage credit. As the housing market evolves, we will continue to balance credit and interest rate exposures in mortgage investments to help maximize risk-adjusted returns.

END NOTES

1 https://www.urban.org/research/publication/housing-finance-glance-monthly-chartbook-march-2021

2 https://www.realtor.com/research/first-time-home-buyers-housing-2021/

3 Data provided by Freddie Mac

4 https://eyeonhousing.org/2015/09/us-government-number-of-builders-declined-50-between-2007-and-2012/

5 U.S. Employees on Non-Farm Payrolls Residential Building Construction SA (USECBURB Index, Bloomberg)

6 Lumber Active Contract (LBA Comdty, Bloomberg) and

https://www.nahb.org/advocacy/top-priorities/material-costs/nahb-keeps-lumber-prices-in-the-headlines

7 https://www.nber.org/papers/w26573

8 https://cdn.blackknightinc.com/wp-content/uploads/2021/04/BKI_MM_Mar2021_Report.pdf