The backdrop

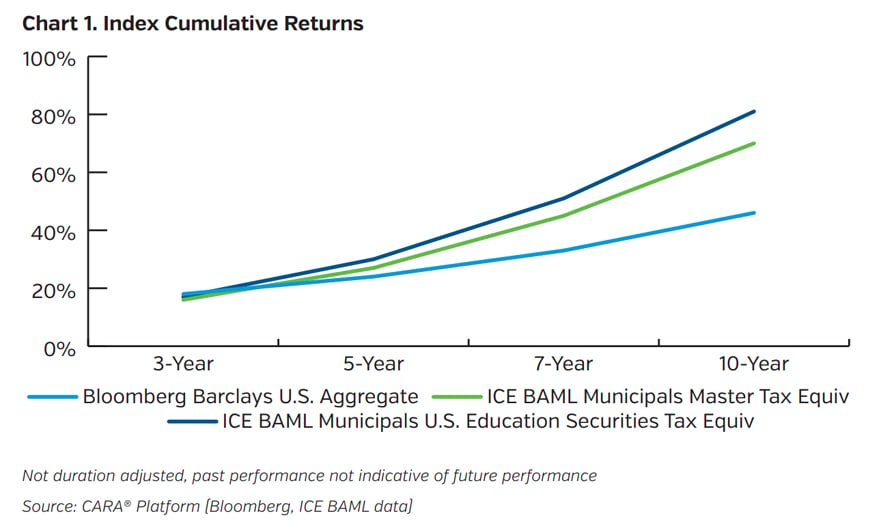

Higher education, which accounts for 6% ($30 billion) of the U.S. insurance industry’s municipal bond holdings,1 is among the capital market sectors acutely impacted by social distancing. While historically a relatively stable and well-performing sector (Chart 1), it was facing its share of longer-term headwinds even before COVID-19. Now, colleges and universities are dealing with a set of circumstances that is wreaking immediate havoc on students and administrators alike. Will the credit profile of U.S. colleges and universities be permanently damaged, or will COVID-19 simply be another mile marker in the evolution of the higher education sector?

A massive universe

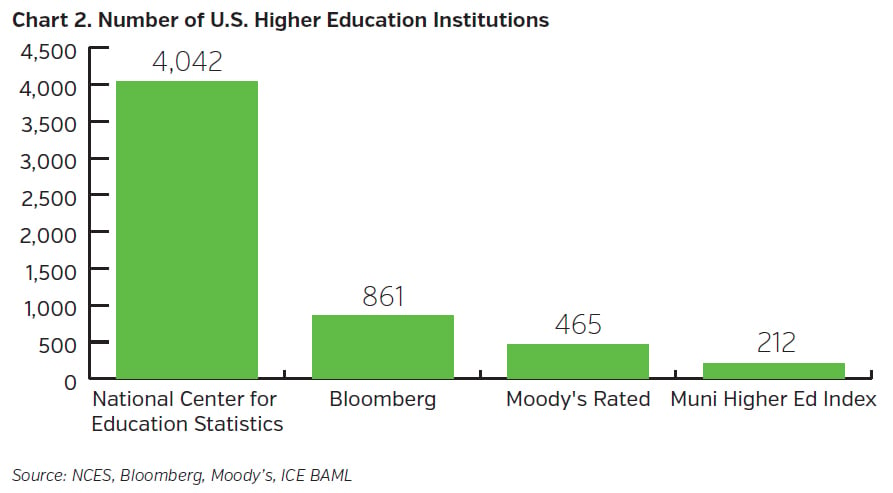

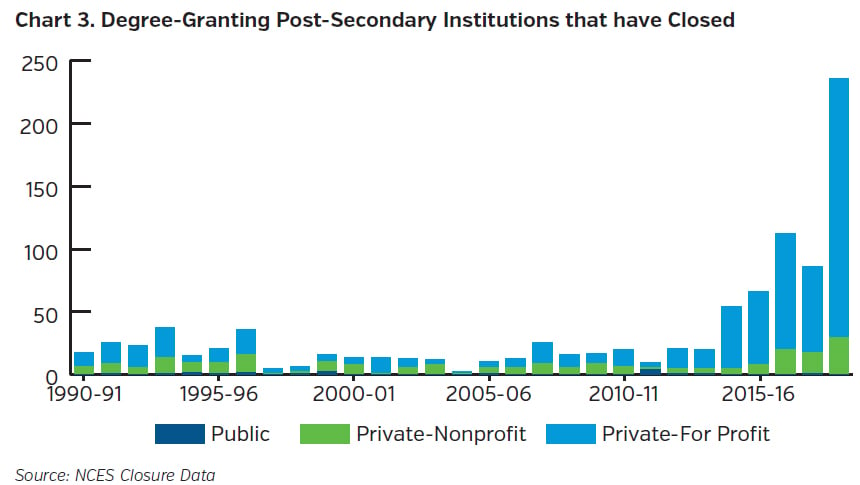

The U.S. higher education landscape is significant in terms of number of institutions, though it’s important to remember that only a portion have municipal bond debt outstanding and even fewer have rated debt (Chart 2). In terms of credit quality, Moody’s rates about 75% of the sector Aa or higher2 and defaults have been exceedingly rare (two small Moody’s-rated defaults occurred between 1970 and 2019).3 That said, the sector is contending with a host of contemporaneous risks: aging demographics in the U.S., declining international demand, affordability concerns, political/ideological dissent and rising student loan indebtedness (about $1.5 trillion),4 to name a few. While most (rated) colleges and universities have been adapting to this backdrop, closures have increased in recent years, albeit at mostly for-profit institutions (Chart 3).

The “gap year”

The pandemic brings with it a host of factors that will result in weakened enterprise profiles for much of the higher education sector. Among these are enrollment volatility, reduced revenue, wavering state support, increased technology costs and virus containment expenses. The $14 billion of CARES Act aid to date for colleges and universities will soften the blow and Federal aid to the states will indirectly accrue a benefit to public higher education. Additionally, the spectacular recovery in the capital markets has helped replenish endowment funds.

Enrollments may increase in some segments of the market, including community colleges while declines are more likely at private schools with weaker brands. Enrollment aside, campus revenue is expected to decline at even the most selective institutions. State appropriations, too, are likely to decline amid upstream budget pressure and philanthropic support may weaken amid pandemic-related economic uncertainty. Accordingly, we expect a degree of downward credit rating pressure.

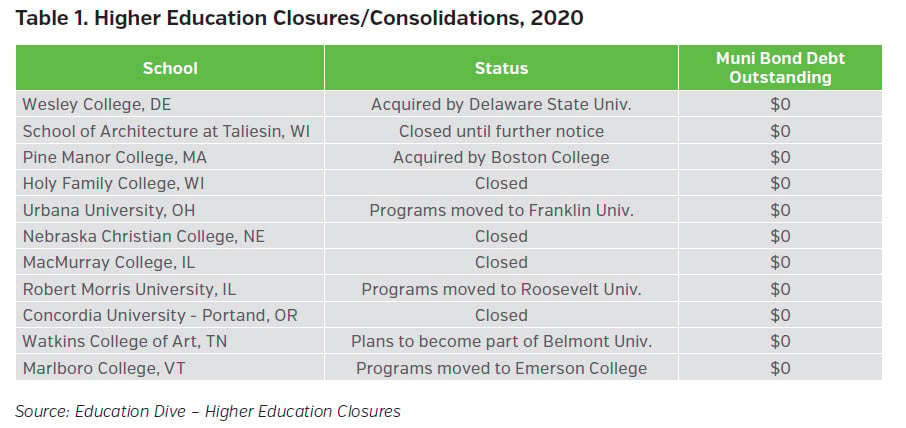

How is the sector responding? Schools are investing in remote learning technologies, offering deeper tuition discounts, spending down reserves, reducing dormitory occupancy, cutting staff and securing lines of credit. Of course, these actions don’t bode well for the enterprise and not all schools are positioned to execute on such sudden and/or costly measures. More Federal stimulus will surely help, though it’s hard to predict what Congress may or may not do. Either way, we think the disruption should be manageable for the vast majority of rated higher education issuers, though the setback is likely to accelerate industry “shake out.” Closures and mergers are sure to rise in coming years, but this doesn’t necessarily mean municipal bond defaults will meaningfully increase (Table 1).

Stakeholders

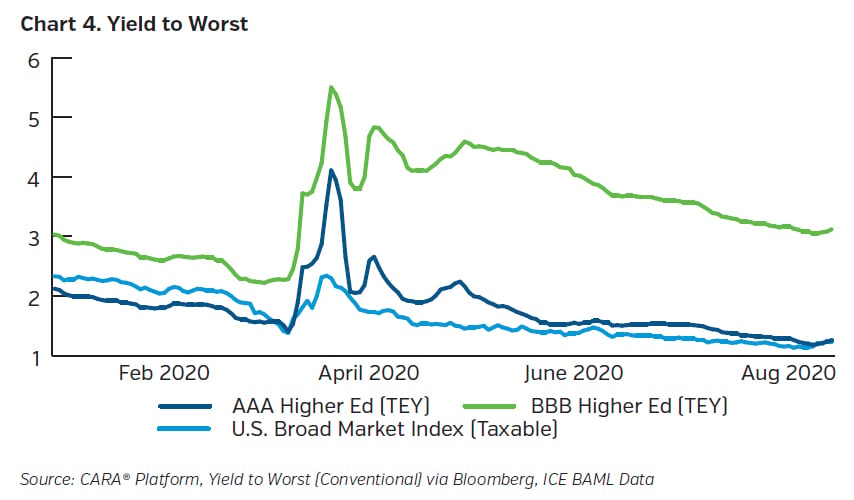

Legislators appear to be increasingly focused on the issue as more than sixty state bills relating to postsecondary education and the pandemic have been written.5 Prior to COVID-19, legislation was crafted in Massachusetts “to support financial stability in higher education and protect students and families from abrupt closures,”6 following the sudden closure of Mount Ida College in 2018. Credit rating agencies have been vocal on the risks facing the sector and the municipal market is penalizing the weakest issuers with higher borrowing costs (Chart 4).

Risk management

Despite the significant disruption, we believe the higher education sector should remain a part of insurer’s municipal bond portfolios from a risk adjusted, relative value perspective. NEAM’s focus will remain on larger public systems and well capitalized private institutions with good market position (lower acceptance rates, pricing power, etc.). We remain circumspect on private student housing transactions and credits with limited revenue support (such as dining or athletic program receipts). The outlook for higher education is challenging, though the pandemic will be transformative and should force efficiencies that may ultimately strengthen the sector.

Key Takeaways

- The higher education sector has historically been a stable source of income for U.S. insurers, and additive in terms of total return

- There are over 4,000 higher education institutions in the U.S., though only a small portion have rated municipal bond debt

- COVID-19 has created another headwind for the sector and will likely accelerate the pace of closures

- Defaults pertaining to rated municipal bond higher education credits are likely to remain rare, though downward rating pressure is expected

- NEAM remains invested in the sector with a focus on larger public systems and private institutions with stronger brands

Endnotes

1 Nauheimer, T. (2020). “The Potential Impact of COVID-19 to Municipal Bonds Held by Insurers.” NAIC and the Center for Insurance Policy and Research Capital Markets Special Report.

2 Shaffer, S. et al. (12 May 2020). “Higher education – US: Largest debt issuers are well positioned to weather coronavirus shocks.” Moody's Investors Service.

3 Medioli, A. et al. (15 July 2020). “U.S. Municipal Bond Defaults and Recoveries, 1970-2019.” Moody’s Investors Service.

4 (Q2 2020). “Federal Student Aid Portfolio Summary.” National Student Loan Data System (NSLDS).

5 Smalley, A. (27 July 2020). “Higher Education Responses to Coronavirus (COVID-19).” National Conference of State Legislatures.

6 Finlaw, S. (14 November 2019). “Press Release: Governor Baker Signs Legislation to Support Financial Stability in Higher Education and Protect Students and Families from Abrupt Closures.” www.mass.gov.