The refugee crisis in Europe is both a human tragedy for those fleeing war and terror in the Middle East and a political conundrum for the European Union. At what stage might this humanitarian crisis morph into one with serious economic consequences? In this Quick Takes we examine why some European countries appear more willing than others to welcome refugees and the likely economic costs and benefits of doing so in the short and long term. We also look at any wider potential implications for capital markets both in Europe and the U.S.

The Economics

The war in Syria has led to a surge of asylum applications across the E.U., with an increase of 85% in the first half of 2015 to almost 400,000 and expectations that this number will spike further by year end. Most are headed for Germany, attracted by both jobs and an official welcome from Chancellor Merkel. German government estimates are for 0.8 million refugees to arrive in Germany during 2015, equivalent to 1% of their population. These estimates are seen as conservative by many observers, but even higher numbers would be unlikely to impose an undue financial burden on the German taxpayer. The German Institute for Economic Research recently estimated that the budget balance would fall by €13 billion this year (0.4% of GDP), mainly due to the increased cost of absorbing refugees. Importantly, the budget would remain in surplus on the back of a strong economic recovery. As other European countries are accepting a much lower share of refugees, the budgetary implications for them will be even lower. The short term cost of the refugee crisis is therefore clearly manageable.

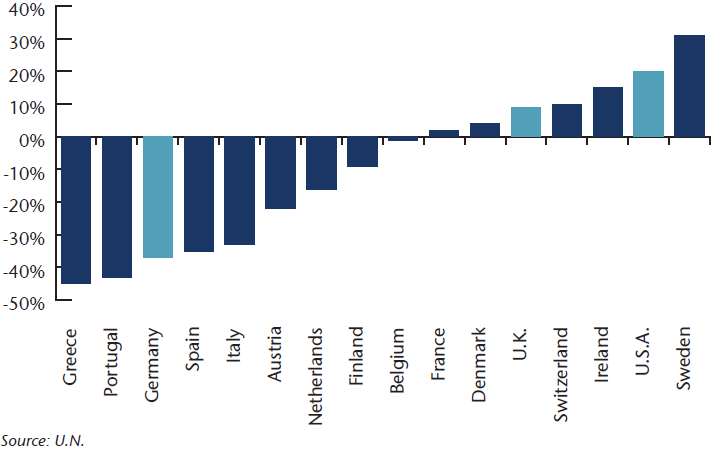

However, the longer term economic implications for Germany are potentially far greater and are positive rather than negative. The reason is the demographic cliff, with the working age population set to fall by 0.5% per year over the long term based on UN estimates (see Chart 1). A sustained increase in immigration would help close this demographic disadvantage versus the U.S. and U.K. for example, in turn boosting economic growth and sustaining Germany’s expensive social security system. These cold economic facts explain Chancellor Merkel’s unique welcoming of Syrian refugees. Germany’s history as a reception country for post conflict refugees following WWII and the fall of the Iron Curtain no doubt also played a large part.

Chart 1: The Demographic Challenge: Change in Working Age Population (2014-2100)

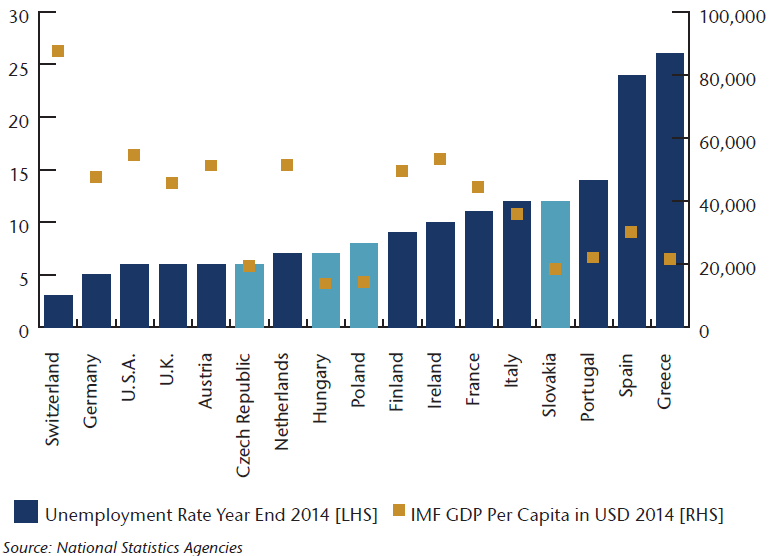

Southern European countries also face huge demographic challenges, but unlike Germany, they are afflicted with far higher unemployment rates (see Chart 2). Local voters worried about job prospects and incomes are far less likely to welcome asylum seekers who can undercut their wages, or such is the perception at least. The most vociferous opposition to E.U. enforced refugee quotas, however, has come from Eastern European states. Lower per capita GDP underlines their sense of catching up financially with the West and being ill equipped to deal with the refugee burden (Chart 2). However, the short term financial cost is unlikely to materially affect budgetary targets in southern or eastern European states, unless the flow of refugees continues at unprecedented levels for a sustained time period.

Chart 2: Unemployment and Per Capita GDP

The Politics

So if not about the economic costs, is the refugee crisis about political costs? If so, what are the implications for capital markets? Certainly in Germany, Merkel’s grand gesture has garnered plaudits abroad and mainstream support at home. But her approval rating has dropped 9% to its lowest level since 2011, whilst opposition within her own party is growing. Attacks on migrant centres have increased markedly and far right parties have seen a boost in support. Merkel and her government are secure but have nonetheless been forced to make concessions to assuage this rising domestic discomfort. Refugee benefits have been cut and Brussels persuaded to force through quotas on other European countries.

This response has been greeted angrily by eastern European countries who feel their national sovereignty has been challenged amid concern they do not possess the institutional strength to deal with an influx of refugees. In the meantime, some have reintroduced partial and temporary border controls, raising fears of an end to the prized Schengen area – the passport free travel zone within the region. Some commentators now believe the product of these tensions is a new East/West political divide to compound the existing North/South economic divide that arose during the Eurozone crisis.

The Outlook

How Europe’s political authorities respond to these challenges will determine the ultimate impact of the refugee crisis. Boosting the institutional strength of refugee agencies will be key, as will the ability to genuinely assimilate the new arrivals. This will alleviate cultural tensions and allow refugees to reach their full economic potential. Reaching a lasting agreement on a fair distribution of future refugees will reduce regional political tensions. Anything less will raise yet another question mark over the long term viability of the European project. But achieving these goals will be a long path and one fraught with difficulty.

As Europe embarks on this journey, the ECB will be watching closely. Already struggling under the strains of low growth and deflation, it may see any future major political stumbles as further reason to keep rates low for longer. This in turn could give the Fed another global worry to restrain the pace of normalisation in the U.S.

Takeaways

- The upfront economic costs of settling refugees is not significant. The long term potential benefits are material for countries with demographic challenges, assuming refugees are integrated properly.

- The political hurdles are higher, both in terms of short term domestic and longer term regional stability. The refugee crisis risks polarising opinion between West and East within Europe. The impact on attitudes in the U.K. to continued E.U. membership will need to be watched.

- The ECB may see any major political volatility on the refugee question as further cause to pause, at least at the margins. A policy of lower for longer from the ECB would further constrain U.S. interest rate normalisation.