February Overview

In the absence of a Fed meeting this month, the market combed through the Fed minutes from the January meeting to divine the committee’s thoughts on the path and timing of a reduction in the Fed Funds rate. The minutes highlighted that although committee members believed rates were at their peak, and that they expect to lower rates going forward, it made more sense to wait before acting to ensure that the improvement in inflation was “sustainable.” The minutes noted that improving supply side effects related to labor markets, productivity, and supply chain improvements, along with their currently restrictive level of policy, were helping to make continued progress towards their goals. However, ultimately the message was that it paid to take their time and focus on the incoming data. With some seeing the risks to inflation “titled to the upside” and believing the risks of cutting too quickly could lead to the possibility that “progress could stall” and prolong their battle to reign inflation back in, they were inclined to keep their rate on hold. Indeed, as Fed Governor Waller would highlight in a recent speech after the meeting, data since the end of last year has been stronger and inflation prints have risen, thus giving support to the Fed to “not rush” to begin cutting rates.

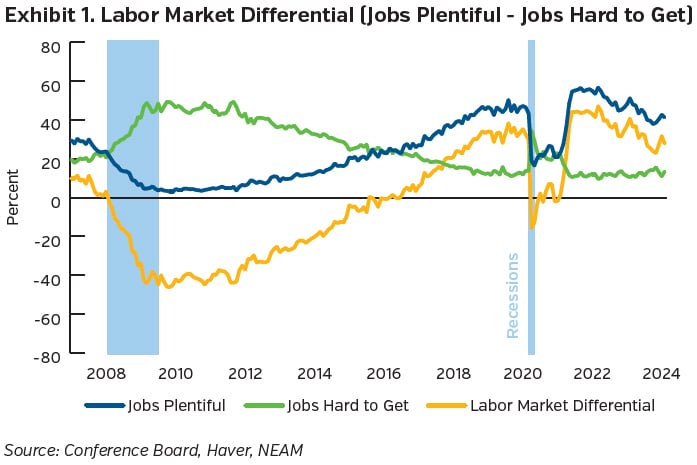

On the consumption front, indicators continue to reflect a healthy labor market despite some softening. Confidence was largely unchanged to lower in February, depending on the survey, but remains elevated relative to last year. The University of Michigan report highlighted that consumers feel more comfortable with the state of the economy and are inclined to think inflation will continue to fall and that the labor market will remain healthy while the Conference Board’s measures of the labor market weakened relative to last month. Wage gains remain above average but are down from their highs. Personal income and spending data showed that incomes rose an impressive 1% on the month, while the savings rate edged up to a still-low 3.8% rate. As for spending, retail sales numbers came in below expectations, dropping -0.8% over the month but dropping to a lesser extent (-0.4%) at the core level.

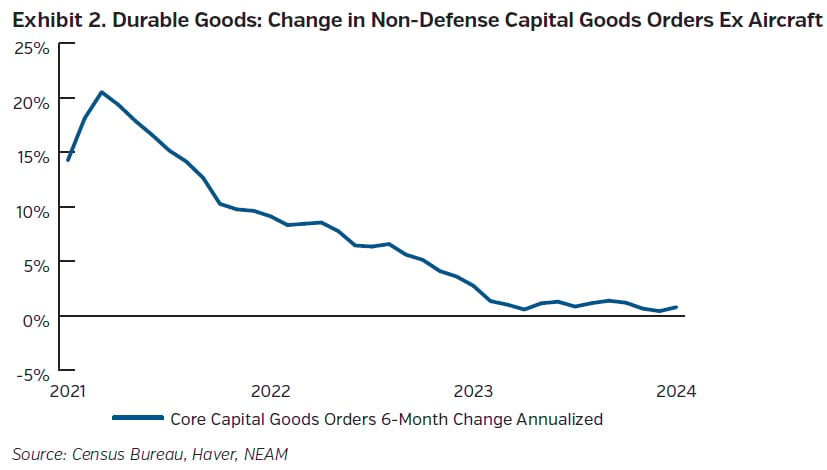

In the investment arena, industrial production fell -0.1% overall during the month. Manufacturing and mining dropped -0.5% and -2.3%, respectively, while utilities jumped 6%, with cold weather contributing to the results.

On the lending side, although still exhibiting a tightening bias, a lower percentage of banks appear to be pulling in the reigns, with many maintaining their standards where they currently are as demand for loans weakens across various categories. Despite this, CEOs appear more confident in the economic outlook relative to a year ago but will keep capital spending plans roughly the same according to the Conference Board’s survey.

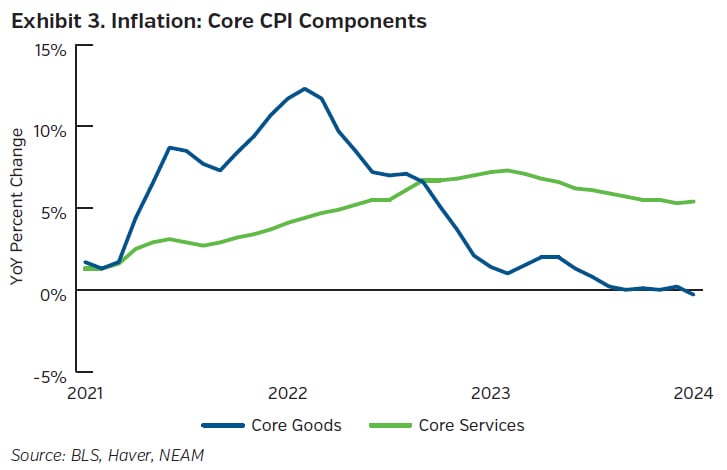

On the inflation front, data showed that the path towards a sustained level of 2% will not be as smooth and straight-lined as desired. At the headline level, price increases ticked upwards +0.3% for the month, which equated to an annual increase of 3.1%. Energy prices fell -0.9%, led by gasoline prices, while food prices increased slightly by +0.4%. At the core level, the pace of price gains increased by +0.4% relative to last month which, despite the uptick, left the pace of core gains unchanged at +3.9% relative to the comparable period last year. The higher monthly print came despite a larger divergence between core goods and services. Core goods price changes accelerated, falling -0.3%. Declines in apparel and used vehicles were notable, while new car prices remained flat. Given the string of negative price changes over the last 12 months, core goods prices now sit below last year’s level (-0.3%) for the first time since the summer of 2020. On the core services side, which bumped up to a +0.7% pace last month, shelter again played an outsized role, increasing +0.6% over the month. While rents of primary residences momentum remained the same (+0.4%), owner equivalent rents also jumped and were aided by larger than previous gains in lodging away from home, such as hotels. Stripping out the housing component of core service price changes, core services ex-housing increased, with increases in airline fares and medical services playing a part. These subcomponents highlight the divergence in goods versus services, with the latter still needing to slow to bring prices down sustainably. With the Fed’s preferred core PCE measure still tracking lower than its CPI colleague, but higher than before on a more recent basis, the data will nevertheless give the Fed more room to defend its current holding pattern.

Capital Market Implications

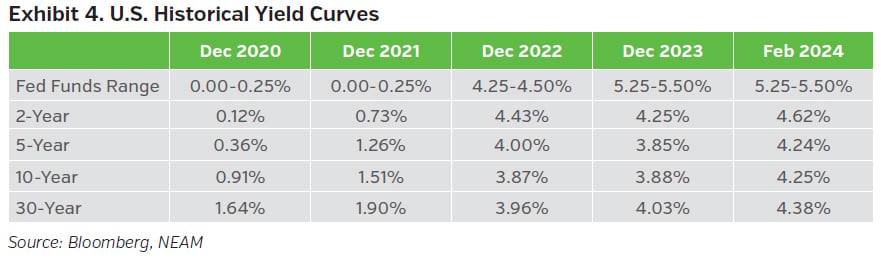

Higher-than-expected inflationary prints pushed back the market’s rate reduction assumptions and lifted Treasury yields. Despite this, equity markets ultimately benefited as stronger-than-expected data out of the technology sector helped propel indices higher while credit spreads tightened modestly.

Capital Market Outlook

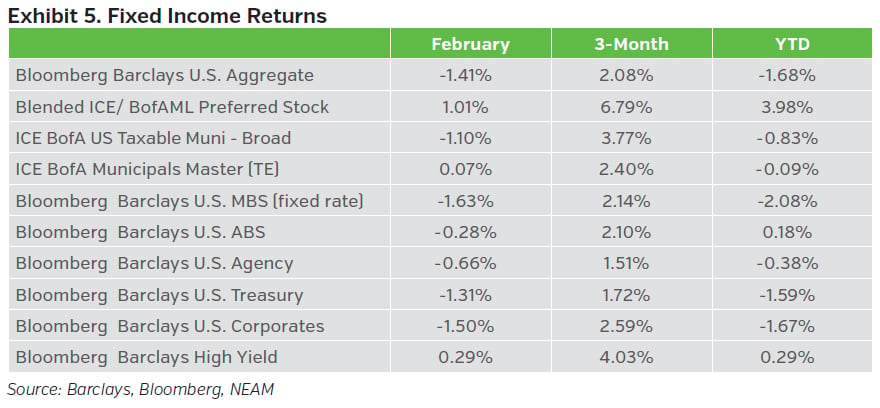

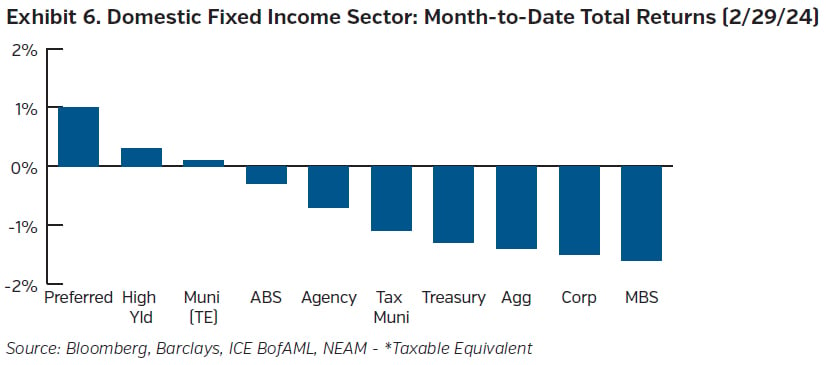

Fixed Income Returns

Slightly higher-than-expected inflation data prompted market participants to reassess their assumptions for both the start date of the Fed’s initial rate reduction, and the ultimate end level, in 2024. Treasury yields increased while credit spreads ended the month just modestly tighter, as demand kept pace with supply, and absolute yields rose.

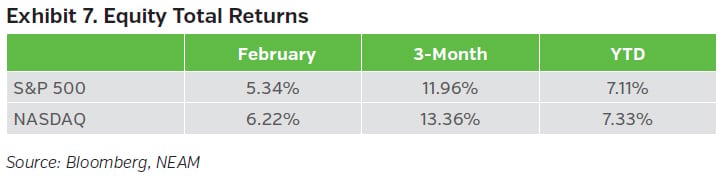

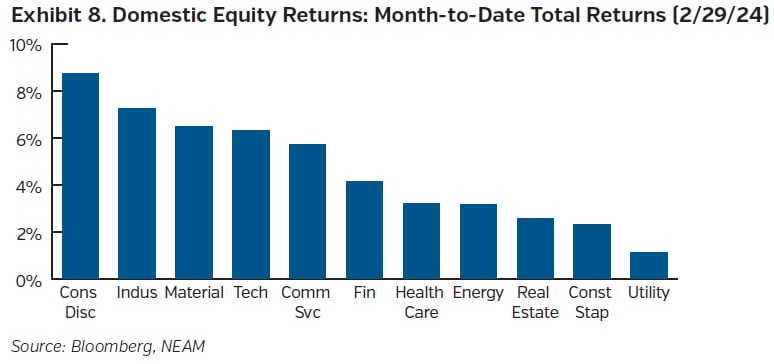

Equity Total Returns

Equity markets continued their ascent in February. Despite signals from the Fed that they were not likely to begin cutting rates until later in the year, prompting higher yields, strength in technology and AI-related companies’ earnings helped propel the market higher. The Dow, S&P, and Nasdaq all ended the month higher.