March Overview

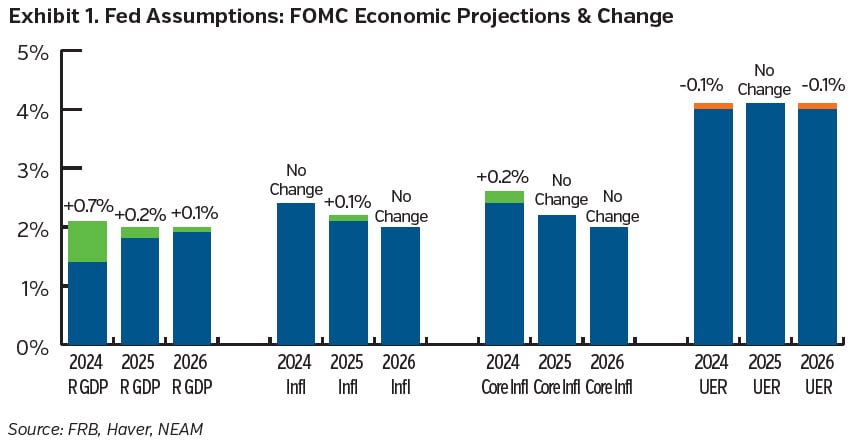

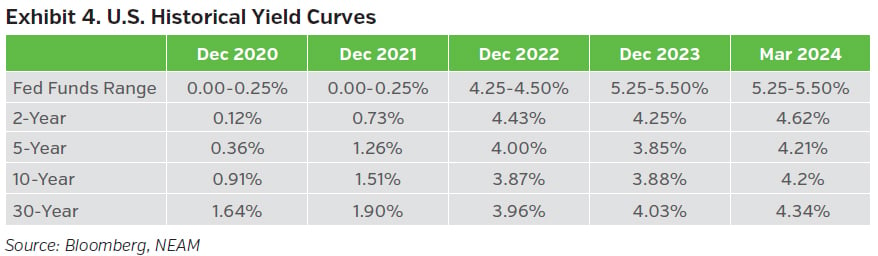

As widely expected, the Fed held its benchmark rate range steady at 5.25-5.50% at its most recent meeting. The decision to do so was unanimous. Although the median rate expectations for 2024 remained the same (4.6%), projecting a total reduction of 75 bps by year-end, estimates for 2025 (3.9%) and 2026 (3.1%) moved upwards, suggesting a slightly tighter framework than before. Median economic projections saw growth estimates increase while the unemployment rate came down marginally. Inflation readings increased for this year, presumably as readings to date have come in higher than previously expected, while estimates for the latter years remained unchanged. Despite progress made to date, the Fed remains “attentive to inflation risks,” and given growth has held up and the labor market remains resilient, it is focused on leaving rates at a sufficiently restrictive level until it gets more evidence that inflation continues to converge on their longer-term target. The result has been a shift in market expectations for the timing of the first rate cut to the summer.

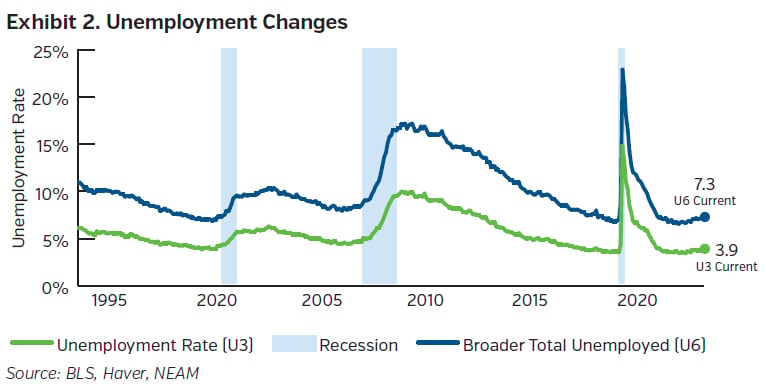

With respect to the labor market, Powell noted in his post-FOMC meeting press conference that the market continues to move into better “balance,” and the Fed noted as much by highlighting that “job gains have remained strong” in its statement. Indeed, payroll numbers came in at +275K for the month, bringing the three-month average to +265K, up from a recent trough of +198K back in November of last year. Gains were dominated by healthcare, leisure, and government additions. However, although Powell mentioned in his remarks that the labor market is still firm, citing as evidence the relationship between job openings to the unemployed population, he also stated that “labor market tightness has eased.” The still healthy three-month average mentioned above comes despite a downward revision in the number of jobs added over the previous two months. Additionally, the unemployment rate increased to 3.9%, as the household employment survey number showed a net loss of jobs, while the wider measure of unemployment, the U6, increased to 7.3%, up from their recent lows last April of 3.4% and 6.6%, respectively, for the same period. Wage growth has slowed and was relatively benign at 0.1% for the month (+4.3% for the year). Consumption-wise, retail sales increased (impacted by weather the month before) overall at the headline level but remained flat relative to last month at a core level. Indications of parity at the core level raised questions as to the sustainability of consumption which has been running strong for some time. Although a touch lower, the University of Michigan’s confidence measure showed relatively little change, save for a slight decline in expectations while inflation expectations also remained stable.

With respect to the labor market, Powell noted in his post-FOMC meeting press conference that the market continues to move into better “balance,” and the Fed noted as much by highlighting that “job gains have remained strong” in its statement. Indeed, payroll numbers came in at +275K for the month, bringing the three-month average to +265K, up from a recent trough of +198K back in November of last year. Gains were dominated by healthcare, leisure, and government additions. However, although Powell mentioned in his remarks that the labor market is still firm, citing as evidence the relationship between job openings to the unemployed population, he also stated that “labor market tightness has eased.” The still healthy three-month average mentioned above comes despite a downward revision in the number of jobs added over the previous two months. Additionally, the unemployment rate increased to 3.9%, as the household employment survey number showed a net loss of jobs, while the wider measure of unemployment, the U6, increased to 7.3%, up from their recent lows last April of 3.4% and 6.6%, respectively, for the same period. Wage growth has slowed and was relatively benign at 0.1% for the month (+4.3% for the year). Consumption-wise, retail sales increased (impacted by weather the month before) overall at the headline level but remained flat relative to last month at a core level. Indications of parity at the core level raised questions as to the sustainability of consumption which has been running strong for some time. Although a touch lower, the University of Michigan’s confidence measure showed relatively little change, save for a slight decline in expectations while inflation expectations also remained stable.

In the investment arena, industrial production rose 0.1% overall for the most recent month’s data. Gains were present in the manufacturing (+0.8%) and mining sectors (+2.2%), while utilities lagged (-7.5%). Warmer weather in February helped offset colder weather from the month before, and impacted each sector’s performance, respectively. Sector-wise, consumer goods production retreated on weaker consumer energy production despite strength in auto and appliance sectors, while business equipment and construction areas rose. Along with the gain in the industrial production manufacturing sector, more positive results out of the national manufacturing surveys showed that the sector is more optimistic than before, although mixed regional surveys suggest it still faces its share of challenges as it seeks to find a more stable footing.

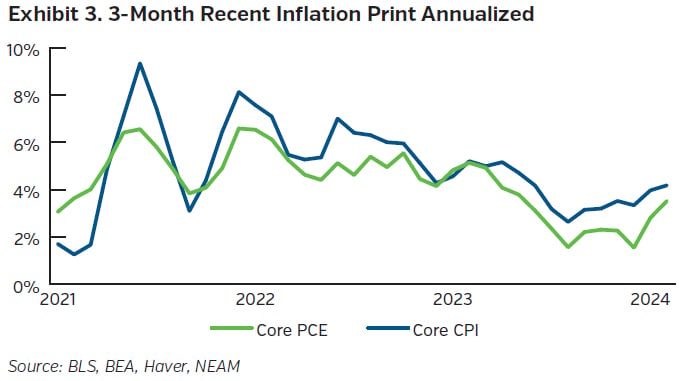

Although a great deal of headway has been made since the recent peaks, the last two monthly inflation prints have presented a slight inflection off the downward trajectory. It was never going to be smooth getting to the Fed’s target, and these prints reflect that. The most recent CPI headline rate came in at 0.4% for the month and +3.2% relative to last year. An increase in energy prices, led by higher gas prices (+3.8%) and a higher core figure (+0.4%) drove the increase while food prices overall remained flat. At the core level, prices again climbed +0.4% for the second month in a row. While this left the yearly comparative figure at 3.8%, down from 3.9% the month before and 6.6% at its peak, shorter-term measures increased accordingly. In the core services arena, although the pace of increases in rents of primary residence ticked up relative to last month’s, a smaller jump in hotel prices, combined with lower owners’ equivalent rent gains left the overall shelter figure’s (+0.4%) gain a tad lower than last month’s level. Combining this with a bump in transportation (due to a jump in airline fares), education and recreation services and core services landed +0.5% up for the month. Excluding housing, the growth in core services slowed, which is welcome news for the Fed. On the core goods side, prices ticked up for the first time in several months, with gains in apparel and used vehicles outweighing other sectors that lagged. Elsewhere, although the producer price index came in above expectations too, core PCE numbers appear to be more on track, which may give the Fed more comfort.

Capital Market Implications

The FOMC’s median estimate for three rate cuts this year remained intact at its most recent meeting. Treasury yields ended the month relatively unchanged, if not slightly lower across the curve, while credit spreads ground tighter over the month and major US equity indices finished higher.

Capital Markets

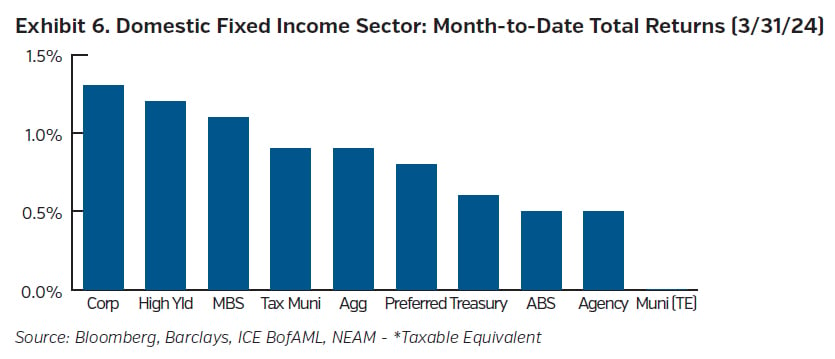

Fixed Income Returns

Despite slightly higher than expected inflation data, Treasury yields remained stable, if not slightly lower, as the FOMC’s median estimates still projected three rate cuts this year. Credit spreads ended the month modestly tighter, as demand kept pace with supply.

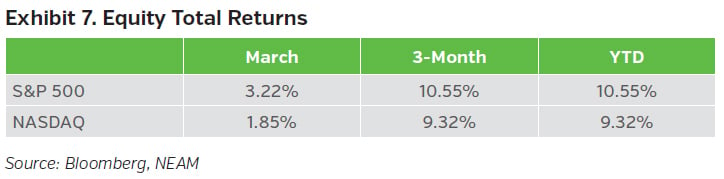

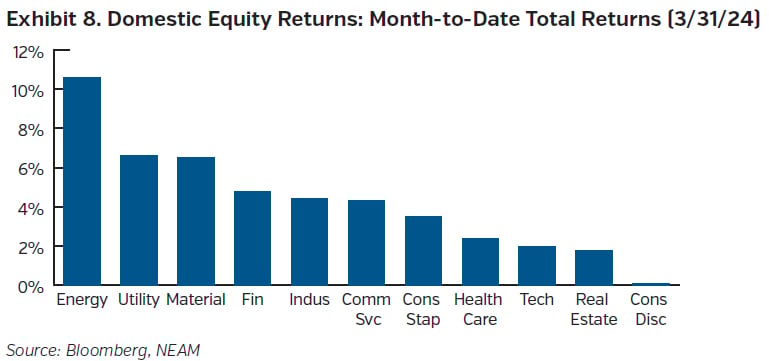

Equity Total Returns

With the Fed on hold, median estimates for rate cuts this year remaining unchanged, and economic data still healthy, markets headed north. The S&P and Dow climbed to new highs during the month, while the Nasdaq rested just below its peak to end the month.