There’s a popular adage on Wall Street: “Don’t Fight the Fed.” Investors have followed that advice religiously since 2009, when the Fed initiated the first round of quantitative easing (QE). This injection of liquidity along with a zero interest rate policy has served to support risk assets, driving both bond and equity prices higher for the last several years. By suppressing volatility and fostering an upward bias in financial assets, the Fed, playing the part of the shepherd, has encouraged investors to herd like sheep.

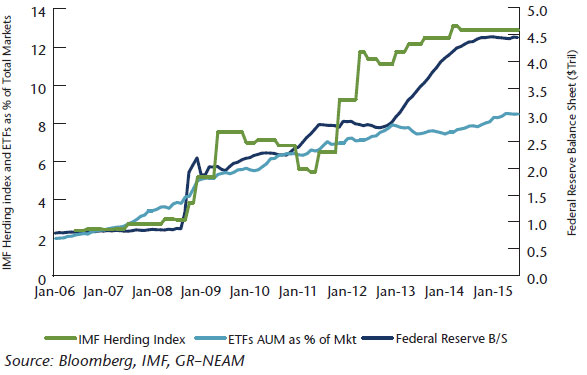

Since the start of QE, herding behavior, defined as the degree to which investors crowd into similar positions, has more than quadrupled (Chart 1). Herding increases the correlation among stocks because any stocks with similar characteristics and exposures are bid up and down together. During the “Dot Com” years when herding was rampant, investors piled into the technology sector to the point where those stocks represented over 30% of the S&P 500. By the time the Dot Com bust occurred, tech stocks comprised roughly 12% of the index. Herding pushed up all stocks associated with technology and set up the eventual stampede out of the sector, which decisively restored the laws of physics.

Chart 1: Federal Reserve Balance Sheet, Herding Behavior and ETFs

One vehicle that has facilitated today’s herding behavior was not available to Dot Com investors – Exchange Traded Funds (“ETFs”). ETFs offer “instant portfolios” composed of similarly profiled securities. In addition, investors can freely trade these securities intraday in reaction to prevailing market sentiment. ETF assets have skyrocketed, both in absolute dollars and as a percentage of the market (Chart 1). This trend was in place prior to the onset of the financial crisis in 2008 and has accelerated since. ETF transactions now account for an estimated 30% of daily volume in the equity markets.

With ETFs, investors are buying a portfolio characterized by certain exposures. These investors are not particularly interested in stock picking. Rather, they wish to obtain exposure to certain desired characteristics, trends, or macroeconomic factors. Allocating to the equity markets with indexes is, by definition, price insensitive when it comes to individual security valuation. Investors are not determining the price-to-value proposition of each component of the index, choosing instead to gain broad exposure at whatever price is being offered by the market.

Other price insensitive strategies are also booming, at the expense of fundamentally driven strategies. Among these are strategies that seek to lower volatility, identify and exploit momentum, and create “risk parity” by using leveraged fixed income securities in tandem with equities to create better risk/return profiles. These strategies are now estimated to represent $1.2 trillion in assets, according to J.P. Morgan estimates. Because the Fed’s QE program has resulted in a suppression of volatility, the investment returns to those pursuing these strategies have risen. Passive investors, through the use of ETFs, have enjoyed an upward bias in the equity markets with nothing more than garden variety volatility in three years. Investors looking to minimize volatility, especially institutional investors, have seen historically low standard deviations in that same time period. All in all, it has paid, and paid well, to de-emphasize valuation when the Fed has implicitly provided a floor to markets.

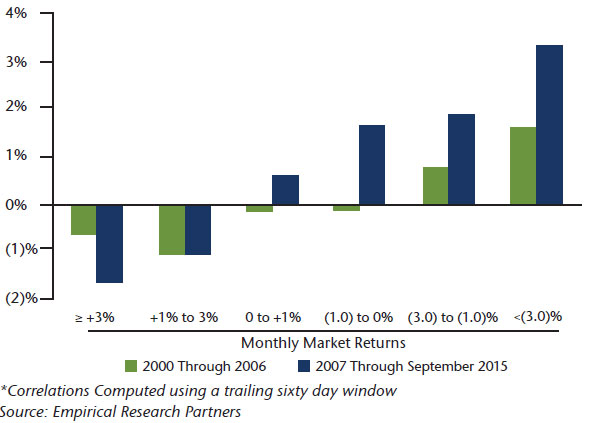

Because of these strategies, we’ve seen an increase in correlations in the equity markets. This particular market cycle has exhibited a slightly different twist in that correlations have been rising on down days (Chart 2). The reason is that those who target volatility typically sell equities when the market declines (and volatility spikes), while passive investors get spooked by the same unexpected declines. When herding dominates, market movements feed on themselves to the point where correlations rise.

Chart 2: S&P 500 Change in Correlations Among Constituents Measured Monthly Depending on Market Returns*

What is the impact to a fundamentally driven, prudent investor in an environment where the price-to-value proposition is secondary? As the correlation chart would suggest, it has become tougher to beat benchmarks. Most prudent managers achieve alpha through downside protection because, in sharply rising markets, riskier portfolios typically do better than prudent portfolios. When correlations increase in down markets, some of the downside protection inherent in those less risky portfolio is lost, albeit temporarily.

As herding has become a way of life for many investors, we worry about the growing gap between underlying fundamentals and price. Eventually though, the “one way” trade becomes exhausted and mean reversion becomes inevitable. Over the long run, security prices cannot remain above fundamental value.

For now though, we are in an environment where markets are driven by herd instincts and not fundamentals. While we could remain here for quite some time, we feel these conditions are long in the tooth. As value investors, we must adhere to our prudent investment discipline of preserving capital and seeking compensation for risk, even at the risk of near term underperformance. We expect to be rewarded when the market reverts to long term mean valuations, especially if it does so with a stampede.