At the beginning of this year, we wrote a piece called “The Song Remains the Same.” The basic message of the article was that we should expect the current environment of slow economic growth and low interest rates to persist. Given that developed world economies continue to struggle with structural issues such as large debt burdens and aging populations, we believed, at the time, that global monetary authorities would continue with their extraordinarily accommodative programs and that interest rates would likely stay at (or near) their historically low levels. In short, we did not see a lot to get excited about. Our return expectations for the year were modest and our general view of the risk/reward tradeoff in capital markets was uninspiring.

Where are we now?

Since the beginning of the year, these overall conditions have only exacerbated. In other words, the Song Remains the Same, Only Worse. With the exception of a short-lived flare up of risk in February, the movement year–to-date in financial assets has been a one way train.

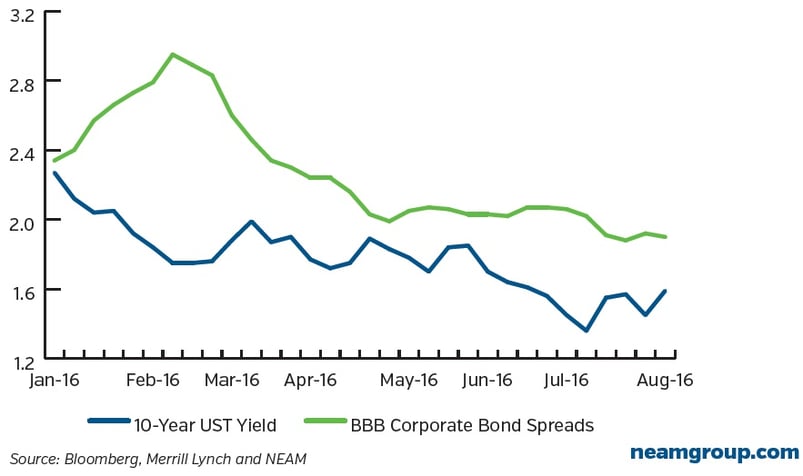

Interest rates have touched new lows (with many developed government bond markets entering negative yield territory), risk spreads have continued to compress to below average levels and stock prices have renewed their ascent with U.S. equity indices at all-time highs.

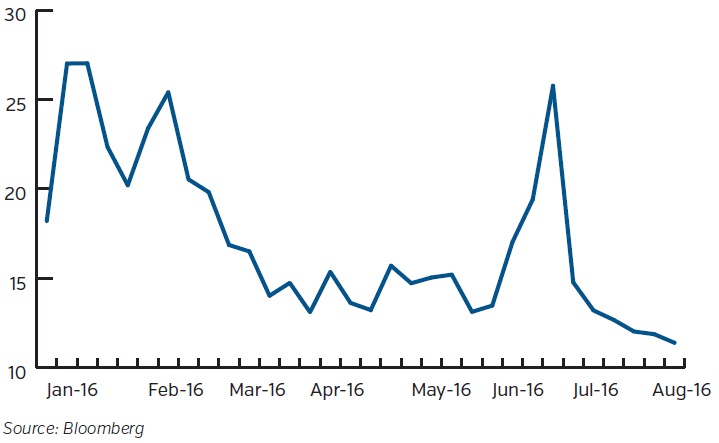

Complicating this investment environment further is the element of complacency that has seemingly crept into markets. This is demonstrated by low levels of volatility as measured by the VIX Index.

These movements in the financial markets would be more understandable if they reflected an improvement in underlying fundamental economic conditions. Unfortunately, this has not been the case. The U.S. economy has been steady but certainly unspectacular. Real GDP growth and employment growth have both decelerated from last year’s rate while at the same time, corporations have been unable to break out of their pattern of meager revenue growth and declining earnings.

Insurance Company Investment Strategy

What is an insurance company to do? The pressures of this low yield/tight spread environment are unrelenting, causing an instinctive search for additional yield. But it is an uncomfortable, if not uneasy, position to assume incrementally greater levels of risk in pursuit of enhanced return or additional yield in today’s market. Our view is that recognizing this deteriorating risk/reward trade-off (Only Worse) should help shape an insurer’s investment strategy as we work our way through the second half of the year.

One of the primary ways to maximize the accumulation of capital through the investing cycle is to continually adjust your portfolio’s risk profile in light of the compensation for risk that is available in the market. As the risk/reward tradeoff shifts, an insurer’s portfolio should adjust its balance between risk seeking investment behavior and an orientation toward preservation of capital. Given the movements that we have experienced year-to-date, the portfolio risk pendulum should be swinging toward the latter. We think a prudent investment strategy for the second half of 2016 should emphasize the following elements.

Points of Emphasis Concentrate on carry. We see more limited appreciation potential for the balance of the year from lower yields or tighter spreads. Thus, the primary source of return in the near term will likely come from coupon income. Focus on finding those instruments that offer strong income components of return.

- More selective risk taking. While there still are some pockets of relative value, generally speaking, one is currently not being well paid to move out of higher quality, more liquid assets.

- Senior over Subordinated. The incremental value in moving down in the capital structure appears limited. In general, a more defensive orientation as it relates to an issuer’s balance sheet seems prudent.

- Stay close to the cusips. Valuation disparities across sectors are currently modest. So, the best opportunities to generate excess return will likely come from individual security selection.

- Selling into strength. By using market advances to trim certain risk positions, an insurer can take some risk chips off the table for when better opportunities emerge.

- Be prepared to take advantage of volatility. Knowing your capacity and tolerance for risk while building some dry powder, will position an insurer to assume a more aggressive risk posture when the inevitable flare up in the price of risk occurs.

VIX

The VIX is popular measure of volatility created by the Chicago Board Options Exchange (CBOE). The VIX represents a measure of the market's expectation of stock market volatility over the next 30-day period and is often referred to as the "investor fear gauge." A low number of the VIX index corresponds to a low measure of market “fear” and vice versa.