Earlier this year, China’s national legislative body, the National People’s Congress, lowered economic growth forecasts for the country to a mere 6.5% to 7.0%. By most standards and definitions, this rate of real economic growth would be superb–sufficient to create enviable conditions for any citizen fortunate enough to be part of it. Unfortunately, Chinese statisticians and economists appear to be either wildly optimistic or (perhaps more accurately) under pressure to maintain the status quo. Their estimates appear to be bordering on wishful thinking, perhaps musing about the average growth rate going forward versus the current trajectory of the Chinese economy.

Chinese exports, the backbone of growth for the last several decades, have slowed materially for two main reasons. First, global economic growth in the aggregate has been in a slowing trend, as we’ve discussed before (“The Song Remains the Same,” January 2016). Even though China has cemented its place as a stalwart of global manufacturing, slowing global growth is beginning to bite. Additionally, the value of the Chinese Yuan has maintained a “soft peg” to the dollar, even as the People’s Bank of China (PBoC) moves slowly toward making it a “free floating” currency. This tether to the U.S. Dollar was a major benefit for the world’s largest exporter after the financial crisis in ’08-’09 (Chart 1). After all, the U.S. aggressively cut rates to zero and engaged in large scale quantitative easing to bolster its economy. The weakness in the USD caused by such aggressive easing gave China a relative advantage, since their economy grew far faster with a currency hitched to a weak USD than it would have had they allowed the Yuan to appreciate. They exploited this advantage, maintaining an edge which kept their export machine humming. The chorus of officials dubbing China a currency manipulator grew louder as China’s cost advantages and relatively weak currency spurred continued economic momentum.

It’s been said, however, that he who lives by the sword shall die by it. The resurgence of the U.S. Dollar over the last two years along with the maintenance of the “soft peg” has put incremental pressure on the Chinese economy beyond what it was already experiencing after the post-crisis investment binge. We have maintained for some time that eventually China would need to weaken its currency further to offset an economy that has slowed (in our opinion) far more than the 6.5% to 7.0% growth estimate would lead one to believe. Chinese officials are balancing the benefits garnered by a weaker currency against the anxiety caused by the same – an anxiety that has already lead to massive capital flight.

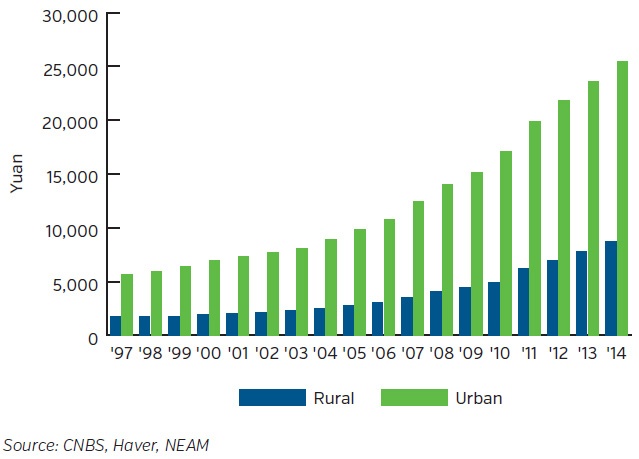

Meanwhile, the Chinese consumer has come a long way as “boom times” prompted a surge in spending (Chart 2). China’s goal of growing the consumption based portion of the economy has been successful by most accounts. However, the profits recession that has been underway for some time has taken the proverbial bloom off the disposable income rose. Further, the government has decided to allow the capital markets to administer discipline, even on state owned enterprises. This decision has spurred additional labor market anxiety as corporate default rates accelerated sharply during the first quarter of 2016. This is particularly true for high yield issuers.

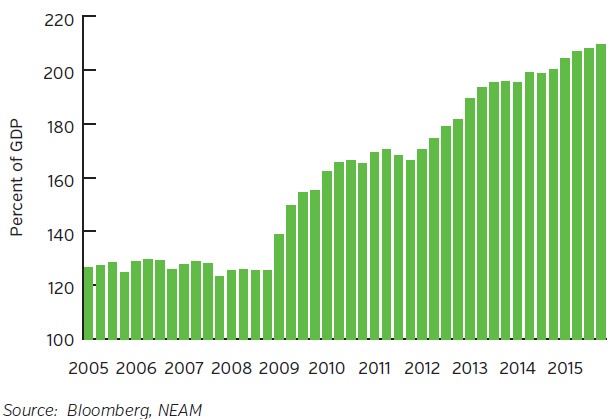

Given the sharpness of the slowdown, the PBoC has taken to using FX reserves at an aggressive (some would say alarming) rate. This has been done in order to plug budget gaps and defend the Yuan against speculators who have laid large wagers that China will eventually have to abandon its defense of the currency and that mass capital flight will beget further economic pressure. This, in turn, would fracture the banking system which is laden with consumer debt – an outcome which is entirely plausible given the rapid growth in consumer loans since the financial crisis (Chart 3).

The angst in recent months over this prospect has given way to relative calm for now, thanks to somewhat stronger Chinese economic data and a plateauing U.S. dollar. The landscape is not materially different from a few months ago though and the issues discussed above have not magically disappeared. Hence, Chinese investors and citizens alike are skittish and have aggressively been trying to move money abroad. Individuals are sending as many dollars offshore as permissible and investors are continuing apace on their next buying binge – U.S. and U.K. real estate.

Key Takeaways

- Anxiety over China’s economic trajectory will persist, albeit episodically.

- As we head into the summer months, we expect a return of volatility

- China, Britain’s “Brexit” referendum and another round of discord regarding the Greek bailout will provide catalysts for renewed angst.

- We’ve added value to client portfolios by adding risk at attractive prices over the last several months and are now content to be a bit more defensive. A pick up in volatility should provide better investment opportunities in the second and third quarters of 2016.