Policy dominated the recent quarter due to the second dovish pivot this year by Chairman Powell. The first occurred in January with the Fed’s pledge for patience regarding further interest rate increases, effectively curtailing a three-year process of policy tightening. The dovish tone accelerated after May’s downside volatility, and the central bank posture quickly hinted at potential rate cuts. Weakening economic data provided an important catalyst as the escalation in trade tension clipped both U.S. and global growth. Benign inflation, now termed “persistent” versus “transitory,” further enabled an easing stance in conjunction with global uncertainty. As the 2nd quarter closed, the Fed appeared willing to act preemptively to elongate the economic expansion, suggesting a broader scope underlying its mandate. Equities rallied over 7% in June, the strongest in over 50 years, as the Fed once again indemnified risk. This appreciation enabled the S&P 500 index to finish the quarter up over 4% and extended year-to-date gains to north of 18%, the strongest in twenty years.

Cautious messaging in the bond market contrasted with the buoyancy of equities after yields on the U.S. 10-Year Treasury fell 40 bps in the 2Q and 78 bps from the January high. The slope of the yield curve also suggested muted economic prospects, a key underpinning to corporate profitability. Trade pressured earnings with shifting supply chain costs and weaker industrial demand. Policy governed returns with equity prices rising despite earnings erosion as lower interest rate expectations, used to discount future cash flows and validate stock prices, benefited valuations.

Despite new highs reached in late June, sentiment remained guarded. Asset flows favored fixed income with equity experiencing continued global outflows as individual and institutional investors remained noncommittal. Defensive sectors, including utilities and consumer staples, paced closely with the overall market through May. Gold and yen, traditional safe havens, also exhibited strength. Yes, risk assets rose handsomely, but not without a defensive undertone as the mosaic revealed the struggle between weaker fundamentals and the broadened reaction function of the Federal Reserve.

Fed Reaction Function

The monetary policy of the Federal Reserve intends to foster economic growth conditions to achieve both price stability and maximum sustainable employment. This dual mandate imbeds expectations of inflation, heretofore judged as 2% measured by the annual price change in Personal Consumption Expenditures (“PCE”), and the associated level of interest rates to maintain stability. In a disinflationary global environment, inflation has failed to reach this target over the last decade. In recent testimony by Chairman Powell, the dubious and prolonged lack of inflation and its impact on the definition of full employment buttressed the dovish shift of U.S. central bankers. When viewed through this updated prism, Powell concluded that current policy might not have been as accommodative as they thought! If this posture seems odd to you given that equities are at record highs and the unemployment rate is hovering around a 50-year low, then you are not alone.

The Federal Reserve uses many tools in its monetary policy deliberations. The Taylor Rule, one such tool that establishes a linear relationship between interest rates, inflation and the output gap (the difference between GDP and its potential), has been a long-standing economic model used as a vital input in the policy debate. Some pundits question its relevance in a zero bound world as policy rates have been below the levels implied by the Taylor Rule for a sustained period.

While not as explicit, financial conditions also play an important role in monetary policy. The Federal Reserve of New York argues that downside risk to GDP is primarily a function of financial conditions, and monetary policy that factors in this information mitigates GDP skewness.1 In other words, by considering financial conditions, central bankers can aim to dampen the variance of the output gap distribution. In a recent cross-country study, the New York Fed suggests the optimal path is an augmented Taylor Rule in which monetary policy can respond to financial conditions. This approach would incorporate more globally linked factors and in effect, broaden the reaction function of the Fed. Powell showed some inclination toward a wider scope for the Fed by the stated goal to elongate the business cycle via looser financial conditions.

Equities have become overly accustomed to dovish central bank behavior, and the liquidity backstop it provides for the market. Over the past five years, when liquidity tightens, stocks have fallen (Chart 1). The market now craves stimulus as much as most living organisms crave oxygen or a dieter craves sugar. There is little evidence that it can accelerate economic activity at this stage of the cycle or that it improves the variables addressed in the Fed’s dual mandate, but in the end, their efforts are more about warding off disinflationary impulses versus anything else. The Fed knows that with rates as low as they are, it has limited firepower to combat the deflationary fears that come with recessions. Hence, they appear to be ready to reduce rates to bolster inflation expectations and support record equity prices, and unemployment be damned.

First Rate Cut – The Next Chapter

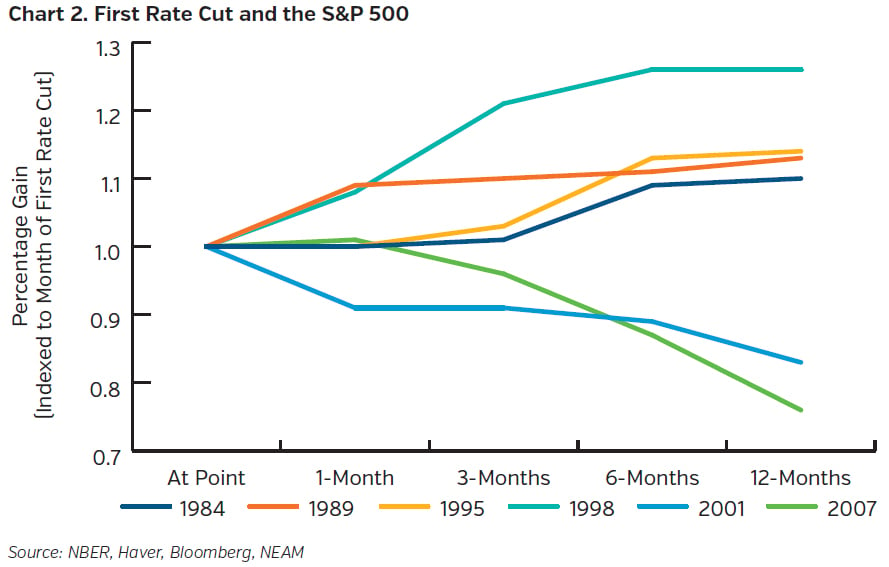

The rationale behind why the Fed is easing merits attention since the Fed’s ability to support the equity markets by cutting rates is non-linear. The initial reaction typically spurs excitement, but the ultimate outcome depends upon whether an economic slowdown emanates from a soft patch in the economy or a full-blown recession. As depicted in Chart 2, bad news often begets initial good news as it supports further easing by the Fed. This reverses course when it culminates in a weaker economy than anticipated and the recession unfolds. This was evident in 2001 and 2007 cycles that resulted in negative equity returns after 12 months.

There is an inherent trade-off between earnings and valuation during these periods. In analysis by Goldman Sachs, on average the S&P 500 multiple expanded by a median of 3% over the 12 months following the initial cut. The outliers include 1998 when multiples expanded by over 30% in the following 6 months post rate cut and 2007 when multiples contracted approximately 20% for the 12 months before the eventual recession.2 Were the Fed to cut rates in July, the key point is whether this rate cut presages a recession or is indeed an insurance cut as pundits describe.

Incremental dovish policy has driven multiple expansion and has completely offset the negative profit cycle so far this year. Consequently, the market recorded new highs. Despite these new highs, the market feels like it may maintain an upward grind as financial assets inflate further into the easing cycle. Morgan Stanley notes, however, that equities historically produce double-digit returns in the lead up to the first cut and average single digit returns afterwards.3 Ultimately, the timing of the next recession will dictate equity returns over the intermediate term. Although the chances of a recession in the next 12 months are not negligible, the New York Fed model assigns only ~30% probability to this scenario.

Risk vs. Reward

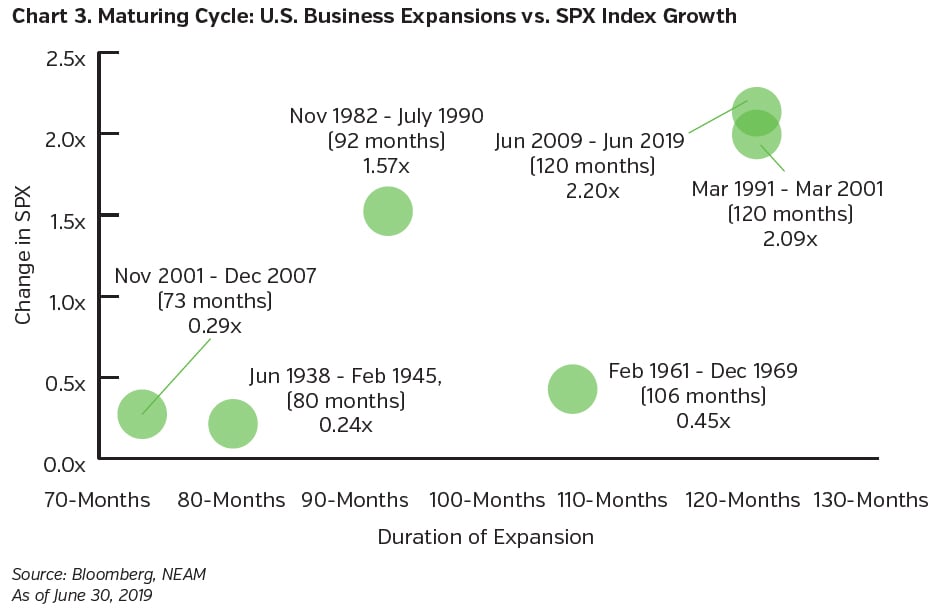

Conventional risk reward analysis occupies a long-standing role in investment analysis. Given the mature business cycle and aging equity bull market, it is sensible to triangulate what gains may remain. Chart 3 provides this framework as it depicts the length of the past and present business cycles and the corresponding equity appreciation. Effective July 1st, the current expansion now dates as the longest in United States history. While length alone does not portend its imminent demise, economic growth needs to strengthen, and the earnings recession reverse in order to enhance the fundamental foundation of the market. History would suggest modest prospective returns as appreciation has been lucrative to date, already exceeding the magnitude achieved in the expansionary period in the 90s, the closest comparable.

As shown earlier, the range of outcomes vary in an easing cycle. If history repeats the 1998 example, also seen as an insurance cut, any earnings acceleration could be capitalized at a much higher multiple, producing double digit upside, the potential melt up scenario. By contrast, if the 2001 or 2007 corollaries prove more indicative, the market could experience double-digit downside. Theoretically, risk/reward appears balanced, but this is misleading due to the timing of this easing cycle. The Fed does not typically ease in a late cycle backdrop nor when the economy is near full employment. Traditional risk/reward analysis is trumped, no pun intended, by policy and the broadening reaction function of the Fed.

Continued reliance on policy is risky. First, the easing cycle may not sustainably boost growth. Trade resolution would be a clear positive toward improved economic momentum as the global manufacturing sector has stagnated. Second, disappointment risk rises if this does not prove to be a sustained easing cycle or encompass the depth investors seek. Investors could also discern that late cycle cuts often precede recession and tolerate risk differently. Lastly, asset bubbles could emerge as liquidity benefits financial assets and borrowers with free money such that negative interest rates now exist in some parts of the world. Not only are interest rates negative, but we have crossed the rubicon to negative yields on select high yield bonds in Europe, showing the power of policy. With Central banks pulling the levers, there appears to be no limit to the distortions that are possible.

Investment Implications

Tension between weaker fundamentals and the broadening reaction function of the Federal Reserve complicates the investment backdrop. Policy has the power to levitate asset prices further given the benefit of lower interest rates used to capitalize earnings as investors continue to heed the adage “don’t fight the Fed.” However, weaker fundamentals are a real risk, and recessionary warning signals exist alongside disinflationary global uncertainty. The smoothing of the business cycle, or efforts to “mitigate the GDP skewness,” in the words of the New York Fed, may prove to be a near impossible task challenging risk assets.

Against this backdrop, NEAM continues to endorse equity exposure within a long-term strategic asset allocation as a means to enhance surplus and add diversification. Equities also currently remain attractive relative to fixed income with the dividend yield of the S&P 500 above the 10-Year U.S. Treasury. Within U.S. equities, NEAM favors income-oriented securities, given the lower volatility profile and dividend income stream. These securities have historically provided solid risk adjusted returns over time. Likewise, value strategies are attractive given the disparity in valuation to growth-oriented equities.

NEAM continues to focus on security selection in our domestic active strategies. Within the portfolios, our positioning still features some defensive elements that we believe will accrue benefits over a full market cycle. NEAM continues to assert that valuation matters. Reversion to the mean, likewise, remains a guiding principle in our investment views, as does a long-term return horizon; both require patience. NEAM expects volatility to continue, potentially offering opportunity for fundamental stock picking to drive alpha.

While there are structural differences across economies, international exposure exists at reasonable comparative valuations. We continue to use international exchange traded funds (“ETF”) vehicles as a prudent diversification tool where supported by enterprise risk capacity. While the majority of our equity allocation will remain domestically focused, international equities merit investment dollars as part of a long-term strategic equity allocation.

Key Takeaways

- U.S. fundamentals exhibit moderating economic data and some erosion in consumer and corporate confidence due to lingering trade concerns and slowing global growth. Insurance rate cut(s), aimed at elongating the business cycle, have been telegraphed by the Federal Reserve.

- This helps usher in a new Fed reaction function whereby the risk of disinflationary global uncertainty outweighs the unknown cost of preemptive action and future instability.

- In this type of regime, historical economic relationships feel less relevant to investor decision making. Occurring simultaneously with late cycle dynamics, this backdrop challenges fundamentally driven risk/reward analysis.

- While easing cycles are historically supportive for equities, the timing of the next recession will be the biggest driver of intermediate returns as growth ultimately governs risk asset performance. In the near-term, equities likely grind upward until recessionary signals mount.

- Portfolio positioning imbeds some defensive elements (e.g. income orientation or value strategies, sector preferences) as recession is inevitable, yet timing unknown. Likewise, significant gains have already accrued throughout this business cycle, now the longest in U.S. history, suggesting modest prospective returns.

- U.S. equities remain attractive relative to fixed income; international equities offer relative value and diversification within a long-term, strategic portfolio approach.

Endnotes

1 Federal Reserve Bank of New York, “Monetary Policy and Financial Conditions: A Cross- Country Study.” June 2019.

2 Goldman Sachs Research

3 Morgan Stanley, Cross-Asset Playbook – July 2018 Pushing On a String, July 11, 2019