The Backdrop

The U.S. municipal bond market is benefitting from a confluence of positive factors, not the least of which is a supportive Federal government. Recent and proposed legislation is helping drive record demand for municipal bonds. From stimulus measures to proposed tax increases and infrastructure support, the stars have seemingly aligned for the municipal market. We will discuss the latest developments and the effects on municipal credit, technicals, and valuations.

Improving Credit

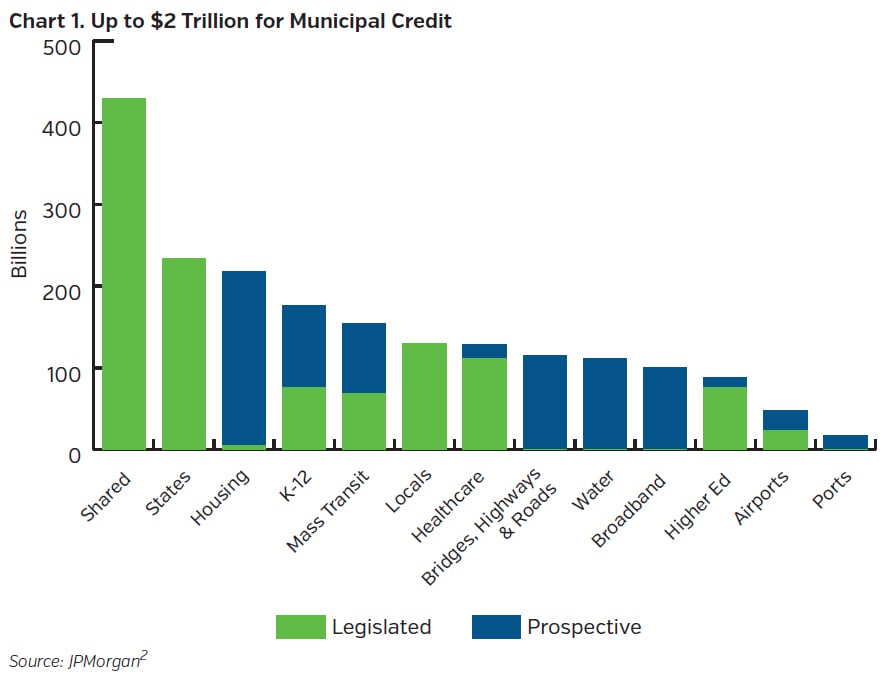

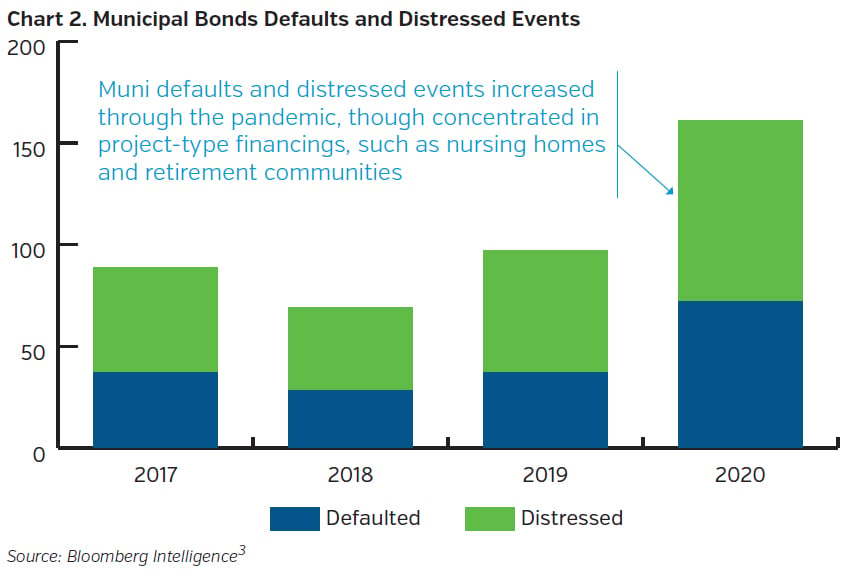

The outlook for municipal credit is positive and not just because of Federal aid. The states came into Coronavirus in solid financial condition and were surprisingly resilient through the pandemic. While defaults did increase, they were concentrated in nursing homes and senior living facilities, not general government credits. Positive momentum continues into 2021 as the economy reopens and consumer confidence grows. The $1.2 trillion of Federal aid available to public finance issuers (so far) makes the outlook even brighter. While this is not “blank check” aid, money is fungible and the windfall is surely welcome, whether encumbered or not. Further, language in the American Rescue Plan attempts to prohibit states from cutting taxes through 2024.1

Looking ahead, the proposed American Jobs Plan includes $800 billion of infrastructure spending which, in part, would have eventually been borne by municipal issuers. The proposed American Families Plan features a variety of tax and education-related provisions. The expectation of higher tax rates, both individual and corporate, has been a boon for tax-exempt municipals. With states and local governments on much firmer credit footing today than many would have guessed a year ago, where do we see concern? Firstly, the recovery has been uneven (on multiple levels) and certain sectors, such as mass transit, are likely to remain impaired for an extended period. Additionally, out-year deficits could arise if issuers don’t treat the extraordinary Federal support as non-recurring. This could be a very real risk for certain issuers.

Strong Technicals

Demand for municipal bonds has been strong – particularly for tax-exempts – as both retail investors and corporations await higher taxing regimes. For P&C investors, higher corporate tax rates encourage investment in tax-exempt municipals as tax-adjusted income will offer incremental yield over taxable alternatives. Additionally, the prospect of higher capital gains rates may dissuade households from the purchase of growth investments (stocks, alternatives, etc.) in favor of tax-exempt municipal securities. One potential tax-related caveat: if the State and Local Tax (SALT) deduction cap is removed, this may, at the margin, reduce the desire for tax shelters. Reinstatement of the full deduction will lower the Adjusted Gross Income (AGI) of many wealthy households, lowering taxable income (all else equal), potentially reducing retail demand for tax-exempt municipals.

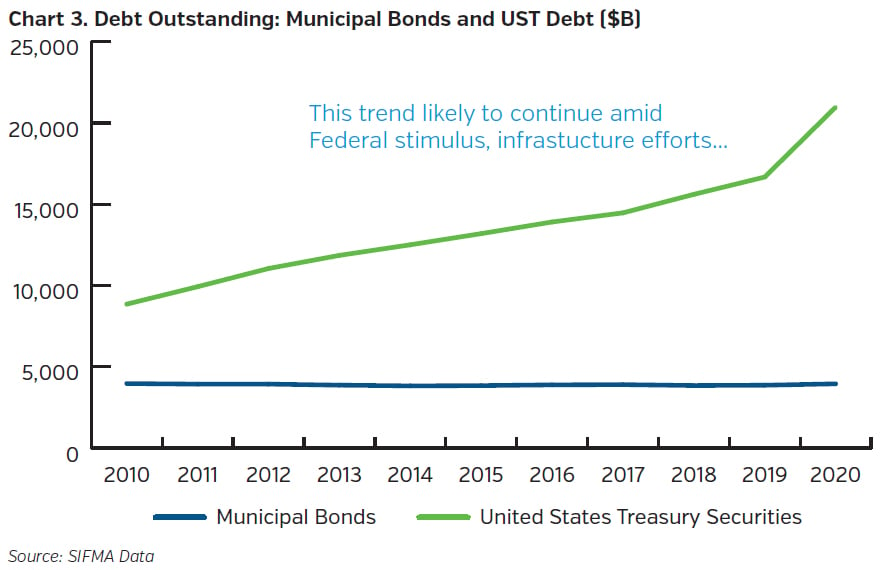

The ongoing flat-to-net negative supply dynamic has been a technical positive, as well. In the current low-rate environment, taxable municipals have been utilized to advance refund tax-exempts (as like-kind tax-exempt defeasances were prohibited by the Tax Act of 2017). While this has added taxable municipal supply to the market, it has been met with strong demand. Additionally, there has been talk of a rebirth – in some form – of the Build America Bond program (2009-2010) where municipalities can issue taxable bonds (instead of tax-exempts) and receive a direct subsidy from the Federal government for part of the interest costs (a further technical positive for tax-exempts). In sum, Federal legislation, both recent and expected, is driving the strong technicals in the municipal market, especially in tax-exempts.

Expensive Valuations

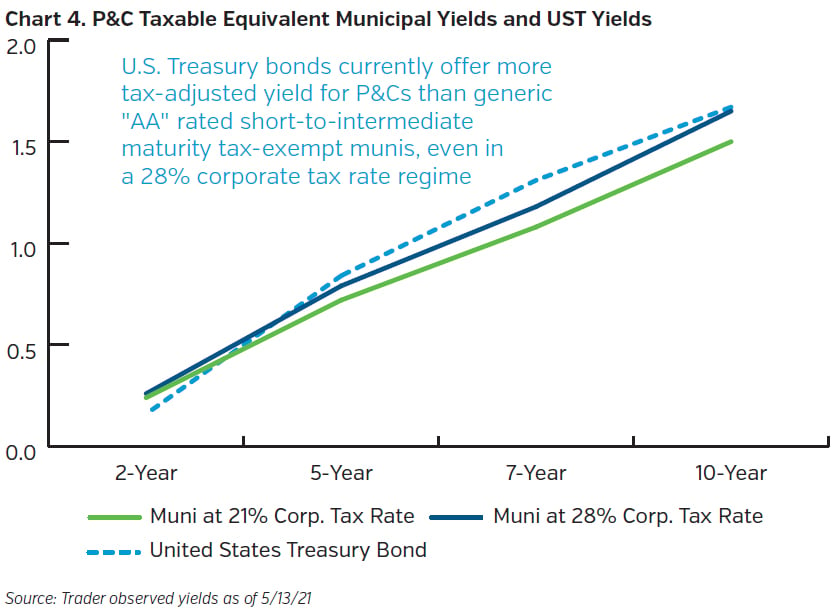

Municipal bond valuations are reflective of the supportive backdrop, i.e. munis are expensive. Ratios and credit spreads are near all-time lows and the market implied tax rate is currently about 40% (based on a relationship of tax-exempt municipals to corporate bonds).4 Accordingly, tax-adjusted yields for insurers paying a 21% Federal tax rate are not particularly compelling, especially in short-to-intermediate maturities. An increase in the corporate tax rate to 28%, as proposed, would improve relative valuations for tax-exempt municipals, though not meaningfully given the low level of absolute yields. Taxable municipal credit spreads are near historic tights too, though we believe they remain reasonable relative to other taxable asset classes.

Summary

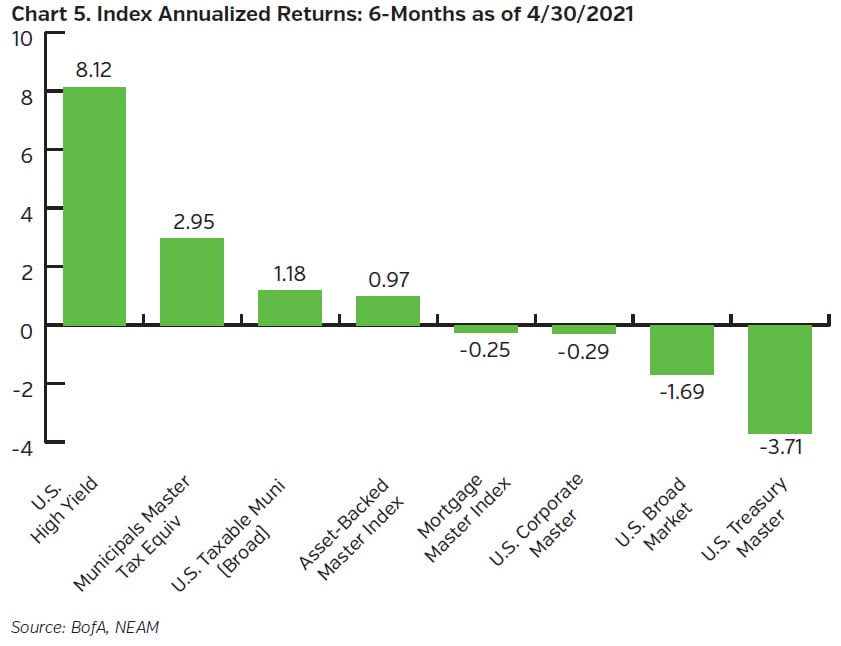

Federal largesse is contributing to the strong conditions in the municipal bond market (along with most other risk assets). The significant fiscal support should keep municipal credit on solid footing for now, though the expectation of higher taxes may be the bigger factor. Tax-exempt municipals have outperformed most taxable fixed income sectors since the presidential election and are now arguably priced for just the very highest income individuals. That said, we are maintaining tax-exempt allocations for our insurance company clients anticipating that the sector will provide further cushion from rising rates, among other reasons. Reinvestment, however, will remain selective for now (and tax-conscious, as always). In the meantime, we will be monitoring how the states manage their “newfound riches” along with further Federal policy changes. After all, what Congress giveth, Congress can taketh away.

Key Takeaways

- The outlook for municipal credit is positive, both organically and via Fed support

- Technicals are strong, particularly in tax-exempts

- Valuations are generally expensive

- We recommend insurance company investors maintain tax-exempt allocations while being selective on reinvestment; invest in taxable municipals concurrently with taxable alternative

Endnotes

1 https://www.congress.gov/bill/117th-congress/house-bill/1319/text [Subtitle M, SEC. 9901, SEC. 602, (d), (1)]

2 JPMorgan: Municipal Markets Weekly, 2/26/2021, Peter DeGroot, et al; The Wall Street Journal, Biden’s Infrastructure Plan Visualized: How the $2.3 Trillion Would Be Allocated, 4/1/2021, Luis Melgar and Ana Rivas

3 Bloomberg Intelligence: Bloomberg Muni Strategy Dashboard data, Erik Kazatsky

4 Morgan Stanley Research: Muni Strategy Playbook, May 19, 2021, Michael Zezas, et al.