The treatment of securitisations in Europe has gained some publicity recently with updates coming from the EC and EIOPA on Solvency II. In this Quick Takes we review the changes and provide additional comments on our interpretation of the regulatory requirements of holding such assets on the balance sheet of an insurance firm.

Background

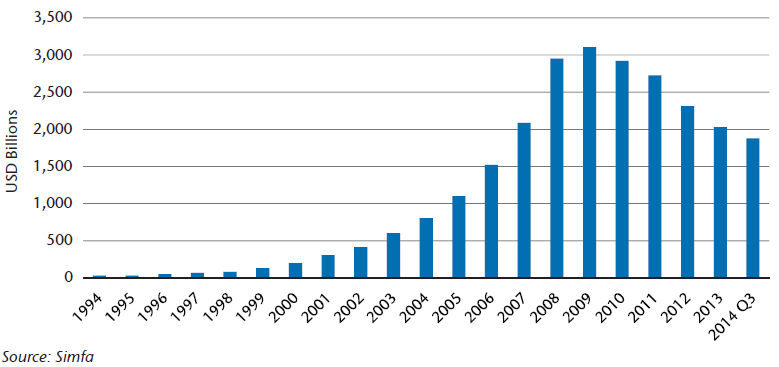

Asset-backed securities have been used by investors to gain exposure to groupings of what would otherwise be highly illiquid and inaccessible assets. The underlying assets come in a variety of forms from auto loans to credit cards and from residential to commercial mortgages. For the end investor, the pooling mechanism coupled with the credit enhancement (through tranching, overcollateralization and insurance wraps) was seen as an attractive risk return proposition. However, during the financial crisis, in many instances the instruments did not deliver on this potential. As a result, the market capitalization of European ABS is now approximately USD 1.8 trillion in size, down from the 2009 high of USD 3.1 trillion and back to 2007 levels.

Chart 1. Europe Securitisation Outstanding (in USD Billions)

While issuance has been lower in recent years, the projected issuance for 2015 was given a boost recently with the announcement of the ECB ABS Purchase Programme (ABSPP). With a willing and able market participant in the form of the ECB, coupled with the European-wide hunt for yield, we would expect ABS issuance to increase and sector spreads to tighten, despite the technical headwinds from the regulatory treatment of these securities.

In the past, a common theme among regulators in Europe was the generic treatment of ABS securities with little or no distinction between deals while relying heavily on rating agencies and credit ratings. This blunt approach ultimately had a negative effect on the sector. In Europe, both the European Banking Authority (EBA) and European Insurance and Occupational Pensions Authority (EIOPA) are currently working on frameworks that distinguish between different ABS deals and measure the risk appropriately for each type. Given that these are “live” projects, we believe that there is potential for further iterations and updates as regulators attempt to have a consolidated understanding of the sector in future.

Solvency II Treatment of Securitizations

In Solvency II regulation, EIOPA provides its own definitions of securitisations. It classifies each security as either Type 1 or Type 2 and has a detailed list of criteria distinguishing between the two. In general terms, an existing ABS security will qualify for Type 1 status if it (i) is investment grade, (ii) is listed in OECD, EEA or other robust markets and (iii) is the most senior tranche of the deal. There are further requirements that the underlying assets need to meet, for example, that deals need to be backed by a pool of homogeneous underlying exposures or that they need to meet certain LTV requirements. All deals that do not meet the criteria for Type 1 are designated Type 2. The finer granularity on these definitions allows us to distinguish between a low risk, high quality structure and one that is not, which is key to making the capital treatment more appropriate.

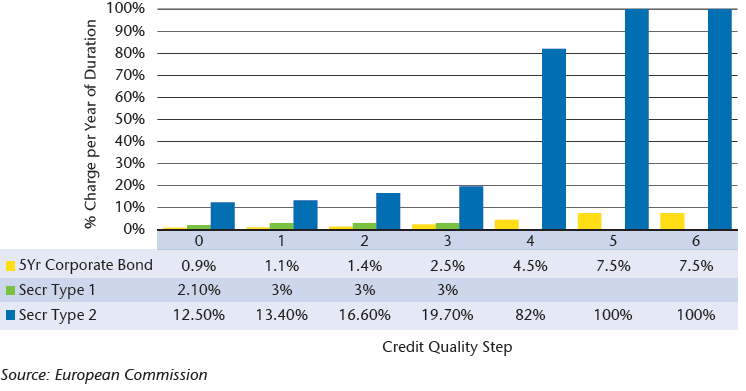

Chart 2. Spread Risk Factor by Credit Quality Step - Standard Model (% Charge per Year of Duration)

In the past, the capital charges relating to these securities have been so punitive that the sector was effectively closed to insurance companies. Recognising this, the European Commission (EC) has made efforts to provide risk factors that more closely resemble the market risk of the different types of ABS. In October 2014 the EC published revised capital charges – Type 1 risk factors were revised lower and Type 2 securities were unchanged. While the lowering of the Type 1 factors has been largely welcomed, they still remain punitive when compared to similarly rated corporate holdings and also when compared to the charges calculated if an insurance entity directly held the underlying assets of a typical high-grade securitisation deal. The difference in this latter case relates to the perceived risk of the securitisation structure and is believed by many to still be too great in the current approach.

Many insurers may find that implementing their own internal model will provide a more favourable treatment of these securities given that they are able to model securities using observable prices rather than using the standard model factor-based approach. However each internal model and approach will need regulatory approval.

An overarching requirement for securitisations is the retention requirement where the originator, sponsor or original lender shall retain a material net economic interest in the deal of no less than 5%. The retention rule is not detailed as part of the Type 1 or Type 2 definitions but has been previously deemed a requirement for all securitisations held by insurance entities. We note that the language used around risk retention is particularly strong in the EC documentation. The documentation also states that continued failure to comply with this particular regulation could result in what authorities deem as a “significant deviation” from the insurer’s system of governance and in turn could be subject to imposed capital add-ons.

Finally, the adoption of any new regulatory regime is always going to require additional effort. The effort is significant and should not be underestimated by insurers wishing to invest in securitisations. Sourcing the deal level data needed to distinguish between Type 1 and Type 2 is one matter and the ongoing surveillance with respect to the risk retention is another.

Conclusion

For insurance companies which are subject to Solvency II, investing in securitisations remains a “work in progress” for the moment. Additional progress should be made in 2015 with the regulatory clarifications but we believe that given the regulation changes, evolving definitions and the differing capital treatment of securitisation deals, the market will likely become more complex and fragmented over the coming period.

EIOPA has set the bar high with regards to the regulatory requirements of insurance companies that wish to make investments in securitisations. Considerable effort is required on the part of the companies and we feel that many may struggle to succeed. Furthermore, with the prospect of imposed capital add-ons by the supervisor, investors will need to carefully consider the benefits of investing in the sector. It remains unclear at this point if investing in ABS represents an economic opportunity for insurance firms subject to Solvency II, however we do believe the market and regulation are moving in the right direction.

Takeaways

- While EIOPA has recently reduced the capital risk charges associated with Type I securitisations, they remain punitive relative to similarly rated corporate bonds.

- Risk retention requirements and the ability to document compliance with risk retention rules remain a barrier to investing in the ABS sector.

- At this point, while there may be some relative value in certain Asset Backed Securities, more clarity and possibly more capital relief will be required to justify participation in the ABS sector by insurance companies subject to Solvency II.