How have we got here?

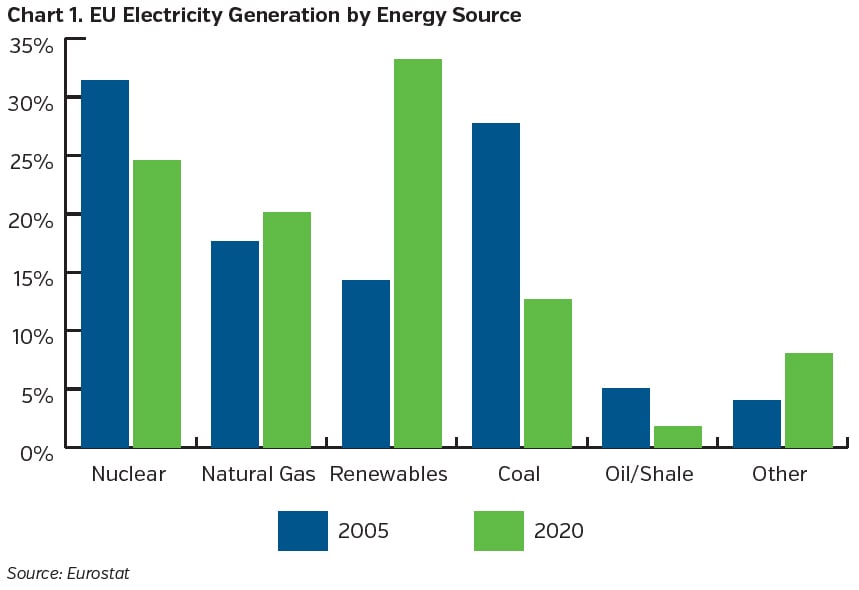

Over the last 25 years, Europe has taken the global lead in energy transition in terms of lower fossil fuel extraction within its borders. This was achieved by a reduction in sourcing via natural gas fields in the Netherlands and coal in Eastern Europe while increasing the footprint of renewable energy sources such as wind and solar.

As a consequence of that transition, and because electricity generated from renewables can’t be stored at scale, Europe has become very reliant on natural gas from outside its borders for electricity generation as it is generally the “last” provider of power, particularly at peak times. Natural gas was mandated in the EU Taxonomy in 2022 as an “environmentally sustainable activity,” reinforcing its status in Europe as the primary fossil fuel to be used until Europe’s electricity generation will be mainly sourced from renewables.

Europe now uses more natural gas for electricity generation then it did in 2005 – it is more important within the energy system but it is extracted from outside Europe to a large extent.

Europe’s Reliance on Russian Natural Gas

Given the prevailing environmental policy and a consequent lack of capital available to fund natural gas extraction, Europe had to find an alternative and reliable source for this “transition fuel.” This source was on its doorstep with Russia’s significant infrastructure able to deliver the gas to Europe, most notably through Nord Stream 1 (a pipeline from Russia to Germany, completed in 2012) and Nord Stream 2, which was completed in 2021 but never entered service. Combined, they have the potential to provide ~25% of Europe’s natural gas requirements.

The U.S. opposed this infrastructure (particularly Nord Stream 2) due to the outsized influence that Russia would have over Europe and its energy market. Germany argued, however, for the concept of mutual dependency and the potential to bring Russia closer to Europe, with the provision of “reliable” and “cheap” natural gas a key positive as a replacement for their shutdown of nuclear post-Fukushima. Russia’s invasion of Crimea in 2014 did nothing to deter Europe from continuing to rely on Russia for energy imports.

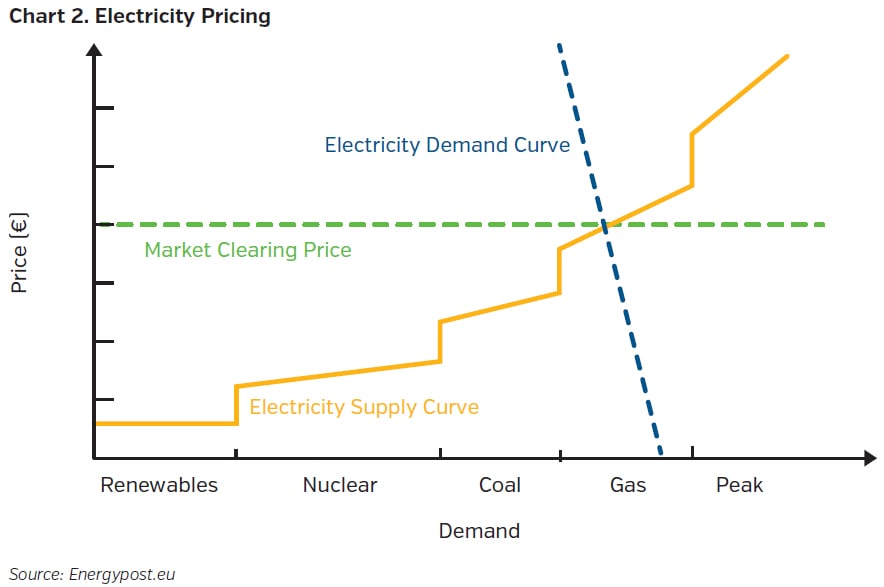

Natural gas is also the marginal price setter (see chart below noting that natural gas sets the clearing price for electricity in Europe) within the European energy network, an important fact that was not lost on Russia in terms of energy choices made since the invasion of Ukraine. The EU is looking at a redesign of the European power pricing system, away from the current marginal pricing system and therefore reducing the impact of gas prices on overall power prices. If successful, this will likely lead to less volatile (but still higher) power prices over the medium term.

European Gas Price Reaction

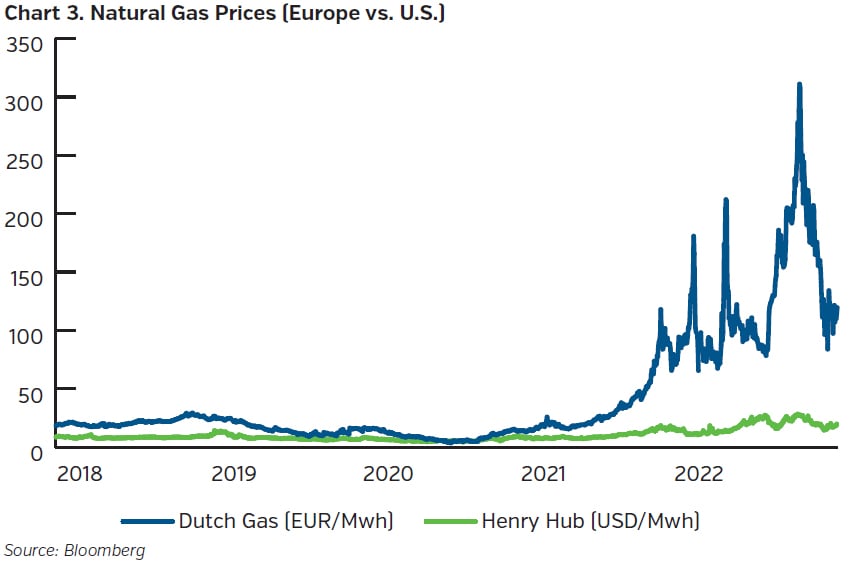

The historic price level for natural gas had remained relatively stable pre-2021, averaging <€20/mwh. Tightness in the energy market in H2 2021 alongside the Russian invasion of Ukraine in Q1 2022, saw gas prices spiral to historical highs (€310/mwh in August 2022). This was exacerbated by:

- Material nuclear outages in France due to maintenance and high temperatures

- A very hot summer in Europe causing demand for cooling to surge

- Lack of rainfall leading to downturn in hydro power generation

- Rhine water levels at record lows, disrupting transport of materials such as coal

Prices have subsided recently but remain well above historical averages, though notably higher in Europe vs. the U.S. as seen in the chart above.

What Next?

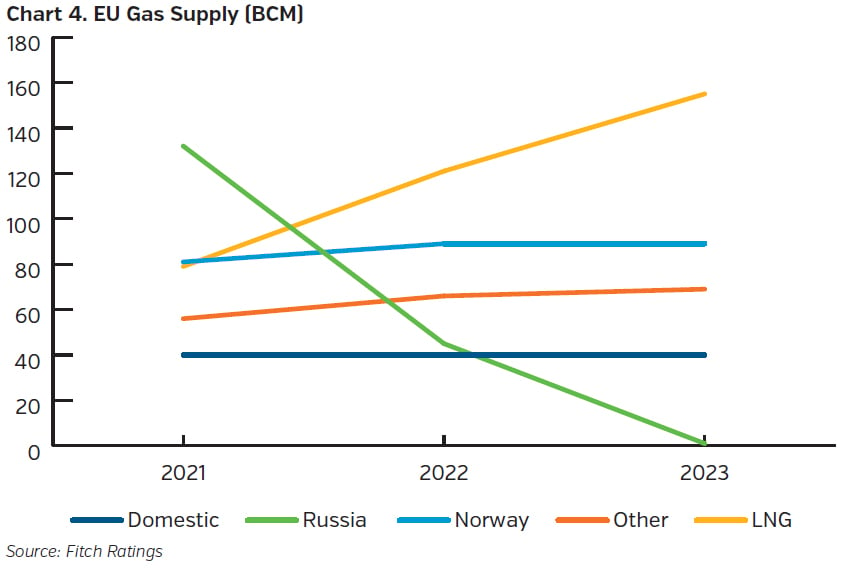

Russian gas flows into Europe have been progressively reduced since the onset of the war in Ukraine due to sanctions or Russia refusing to supply certain countries or companies. To protect itself against a potentially cold winter, Europe aggressively filled gas storage facilities to ensure sufficient supply for the important winter heating season.

Broad consensus is that from a volume perspective, absent a harsh winter and Russian volumes stopping completely, Europe will be able to survive without gas rationing. Demand destruction from elevated pricing has aided the situation along with increased LNG and strong pre-winter storage levels. That said, the situation for 2023 is likely to be significantly more challenging as Russian flows for 2023 will be close to zero meaning it will be difficult to fill storage levels ahead of Winter ‘23/’24. Also, should Chinese demand rebound in 2023 (as Covid restrictions abate), access to LNG may become more difficult.

Key Takeaways

- European energy policy over the last 25 years has decreased the region’s energy independence while increasing its reliance on natural gas from Russia.

- Natural gas and power prices in Europe in 2022 rose to historically high levels but some of this has been temporarily matched with sizable government support schemes to shield the end consumer.

- A colder than normal Q1 2023 along with Russian shutting off remaining natural gas supplies would likely see Europe exit winter 2022/2023 with very low storage levels.

- Europe will remain in a structurally weak position from an energy independence perspective for the next number of years until battery technology of sufficient scale becomes mainstream and/or LNG/natural gas storage facilities are increased materially. This could impact competitiveness and potentially see large scale energy intensive sectors seeking alternative sites for new projects outside of Europe.

- NEAM exposure to European utilities is focused on issuers with sizeable defensive regulated networks and renewable portfolios and impacted entities that have taken proactive steps to reduce reliance on Russian gas. We have historically avoided exposure to European utilities with significant direct or indirect exposure to Russia.