Unicorns rate highly among young girls and with good reason – they represent magical wonder, miracles and enchantment. Emotionally, they beckon you to believe in their existence and that anything is truly possible. In the financial markets, the term is used to classify private, venture backed startup companies valued at over $1 billion, effectively embodying this same sense of magical wonder and infinite potential.

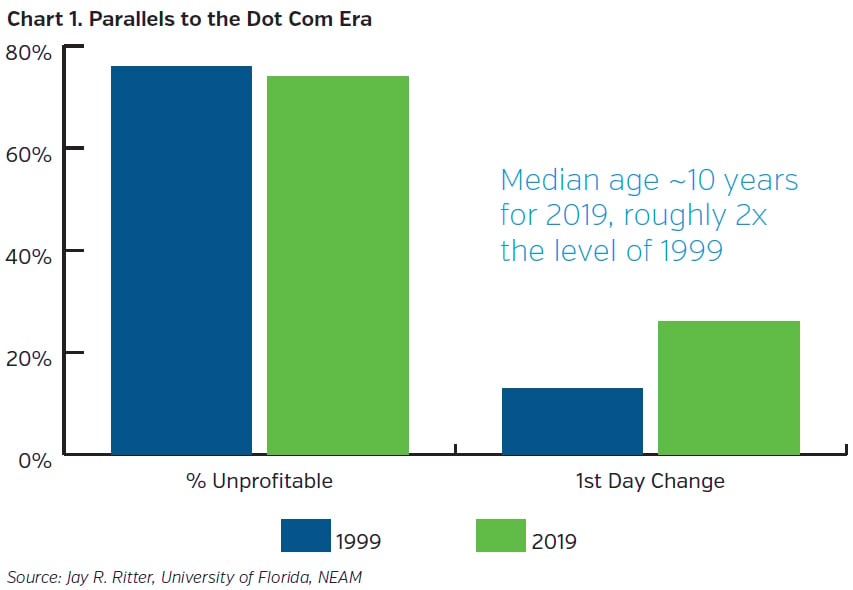

Economics typically dictates that pricing be set by the marginal level of supply and demand. Yet ultra-low interest rates and easy monetary policy defied this paradigm as funding proliferated the newest cohort of unicorns. Valuations ballooned as undemanding capital chased fewer ideas and investors focused less on differentiation. As unicorns sought liquidity in the public markets, profitability, once revered, was deemed old fashioned, enabling the proportion of U.S. Initial Public Offerings (IPOs) generating losses to parallel the level seen at the peak of the dot-com bubble.1

This exuberance continued until the momentum of misallocated capital finally collided with reality. Investors reverted back to business model economics and challenged the euphoria embedded in many private market valuations. In what was anticipated to be a monumental and potentially record breaking year for the IPO market, including the debut of some of the biggest unicorns, 2019 will instead be remembered for material devaluations, deal postponements and new-found investor discipline that helped usher in the demise of the unicorn.

Darwinism

Darwinian theory, centered around natural selection, ultimately helped tame the unicorn. Wework, the office leasing startup positioned to help fuel the “gig economy,” serves as one of the most high-profile examples of when business economics becomes secondary to vision.2 Overly enthusiastic capital compounded inadequate business processes, exorbitant growth, poor leadership and weak governance. Ultimately, this led to a huge devaluation – over 80% versus the last private financing round – before the IPO window closed. The Company was losing an estimated $219,000 every hour, an unsustainable level, as debt mounted.3 Wework staved off bankruptcy when Softbank infused emergency capital while the ultimate fate of the business remains cloudy.

Other high-profile unicorns navigated the highly coveted IPO process only to find disappointment in their stock price performance. Illustratively, each of the large ride sharing platforms bombed, averaging close to 40% reductions versus the last private stock sale and remain below the IPO debut price. While potentially well positioned in an emerging industry, the path to profitability is long and ambiguous, so Darwinian principles also influenced the public market valuation of these investments.

Some companies prospered in the public domain including Zoom Video, a video-first communications provider offering its products via the cloud in a software-as-a-service model.4 The business model generates positive operating margins and cash flow while sustaining hyper levels of revenue growth. The stock has more than doubled from its IPO pricing, after peaking closer to 3x this level. Investors differentiated the attractive economics and growth profile of Zoom Video into a richly valued entity.

Selectivity Warranted

Though bruised by the demise of the unicorn in 2019, the IPO market remained resilient and priced 110 deals.5 The number of transactions was roughly half of the planned levels according to the IPO watch list compiled by Renaissance Capital in early 2019.6 This suggests natural selection exhibited itself once again as this deal velocity equaled only 25% of the torrid pace seen at the height of the dot com bubble.7

The deals priced in 2019 benefited from greater maturity with a median age of 10 years, double the average in 1999.7 This maturity difference was key for first day price performance as seasoning was rewarded (Chart 1). Selectivity remains key as unicorns will continue to tempt investors, adding a potential source of risk asset volatility whenever these highly valued, unprofitable private companies test the IPO market. One must remain mindful of the froth as unicorns can prove vulnerable, and the current backdrop still reflects extremes.

Implications for Risk Assets

Risk appetite remains strong as evidenced by the stellar 31% return in 2019 for the S&P 500. Equities climbed the proverbial wall of worry, including trade war risk, yield curve inversion, recession fears and a potential presidential impeachment. In sum, while, the IPO market remains open, investors are tempering their enthusiasm. Business economics matter again.

We at New England Asset Management employ equity strategies focused on high quality companies with sustainable competitive advantage, strong financial profiles and attractive returns on invested capital. We believe these attributes can drive equity price performance over the long-term. A unicorn that comes to the public equity market may indeed have some of these attributes but given its life stage, growth will be paramount to would-be investors, potentially pricing it beyond reason. Illustratively, Zoom Video trades at 32x NTM revenue and 324x earnings.8 We remain alert for newly public companies that may better align with our framework, should they surface.

Key Takeaways

- Ultra-low interest rates and easy monetary policy expanded the cohort of unicorns, the most highly valued privately held companies (> $1 billion in value)

- Valuations ballooned before misallocated capital collided with reality ushering in devaluations and deal postponements in 2019

- Darwinian principles helped tamed the unicorn, and selectivity reigns as the remaining unicorns provide a potential source of risk asset volatility in 2020

- New England Asset Management equity strategies will remain squarely focused on business economics when evaluating newly public companies

Endnotes

1 Research Study by Professor Jay Ritter, University of Florida.

2 WeWork has publicly traded non-investment grade debt.

3 “What the Downfall of WeWork says about Tech Capitalism”, Gavin Haynes, October 22, 2019.

4 Zoom Video does not have publicly traded corporate debt and NEAM does not own the equity.

5 Research conducted by Jay Ritter, Cordell Eminent Scholar, Department of Finance, University of Florida. Definition excludes ADRs, natural resource limited partnerships and trusts, closed-end funds, REITS, SPACs, banks and S&Ls, unit offers, penny stocks (offer price less than $5 per share) and stocks not listed on the Nasdaq, NYSE or the former American Stock Exchange.

6 “A Giant IPO Wave is Coming as ‘Unicorns’ Whet Investor Appetite,” Bob Pisani, February 4, 2019.

7 Stats compiled from data gathered by Jay Ritter, Cordell Eminent Scholar, Department of Finance, University of Florida.

8 Source: Bloomberg, February 14, 2020.