On September 16, 2008 the investment industry saw the first retail money market fund “break the buck.” The Reserve Primary Fund held $785 million of Lehman Brothers Commercial Paper that was rendered worthless when Lehman filed for bankruptcy. Even though the holdings represented less than 1.5% of the fund, investors worried that other commercial paper issuers held within the fund might suffer the same fate. Redemptions continued and within 24 hours, the Reserve Fund’s holdings were reduced significantly. Unable to satisfy redemption requests, the fund froze redemptions for 7 days and when those measures failed to stem the redemption tide, the fund was forced to halt operations and begin liquidation. In order to restore confidence in the market, the U.S. government launched the Temporary Guarantee Program for money market funds, which would guarantee investors a stable NAV of $1 per share on money market shares held as of September 19, 2008. While the SEC instituted regulatory rules around the 2008 financial crisis, on July 23, 2014 they issued final revisions to rules regulating the money market fund industry. Those rules will officially go in to effect on October 14, 2016.

Investor TypesThe new rules redefine “retail” versus “institutional” prime and tax-exempt MMFs. Retail funds will be limited to ownership by individuals (natural persons) only. Any prime or tax-exempt MMF that does not meet the SEC’s retail definition will be considered an Institutional Fund. Institutional funds, however, are open to any type of investor, including individuals.

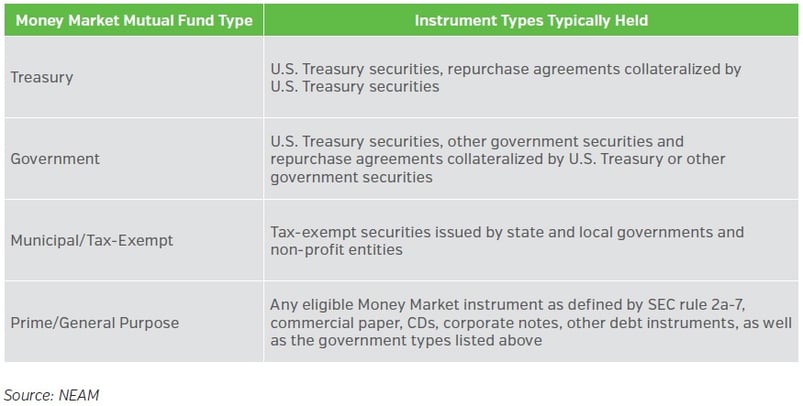

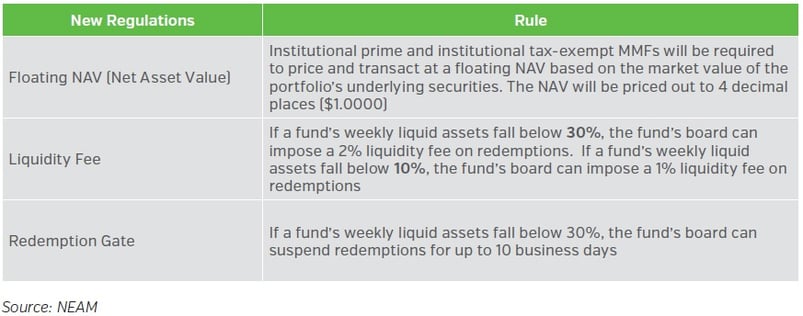

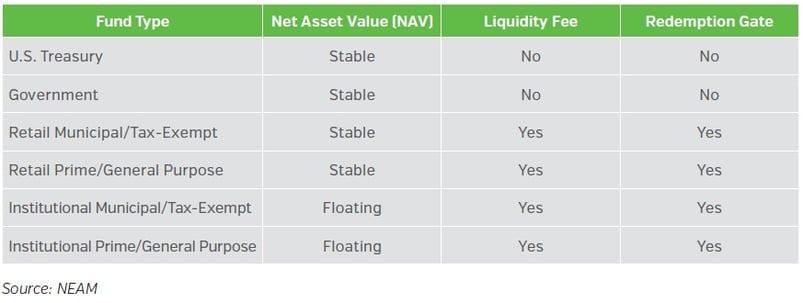

The tables below illustrate the fund type definitions and new rules governing the use of floating NAVs, liquidity fees and redemption gates.

Table 1. Money Market Mutual Fund Types

Table 2. New Regulations (Effective October 14, 2016)

Table 3. Summary of New Regulations as they Apply to Various Fund Types

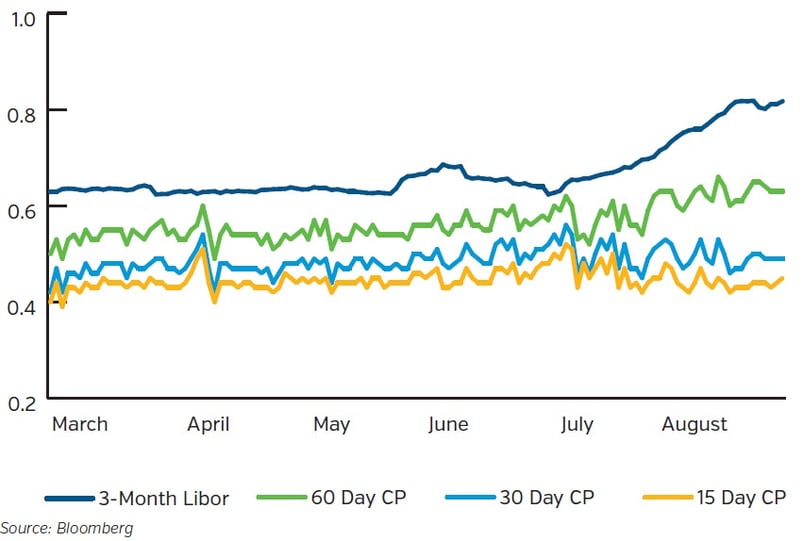

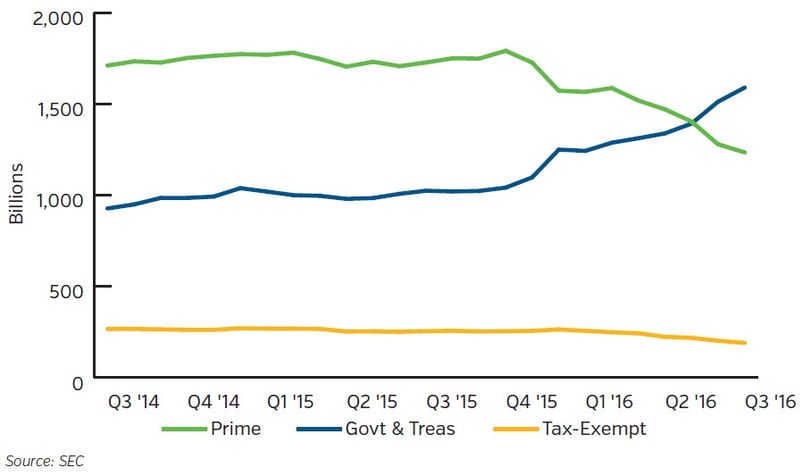

Significant outflows from Prime funds have occurred over the last several months in reaction to the upcoming rule change going into effect. The 4 week average outflow has been $23 billion but as of the week ending August 17, the outflows rose to $40 billion. Outflows will continue to put pressure on 3-month Libor as prime funds that have been large buyers of longer dater commercial paper shorten their weighted average maturities to improve their liquidity profile.

Since November 2015 through July 2016, Prime funds have decreased from $1.790 Trillion to $1.234 trillion and government and Treasury funds have increased from $1.041 trillion to $1.589 trillion. We anticipate this trend will continue apace for the next several weeks.

As inflows to Treasury and government funds continue to increase, we may see a squeeze on T-Bill rates as two things happen. First, there will be an ever increasing demand for short bills to satisfy the Treasury and government funds. Second, government regulation pertaining to the Treasury’s debt ceiling (reinstated March 15, 2017) may force the Treasury to reduce its cash balances, causing downward pressure on yields across the bill curve.

- Wider spreads on non-government paper will continue to be driven by the reduction in demand for short-term instruments that prime and tax-exempt funds have typically purchased in this maturity range. The drop in demand should continue and lead to wider spreads for credit instruments versus government securities.

- Buying opportunities should emerge in various non-government sectors including municipal variable demand notes, bank CDs, commercial paper and corporate securities with maturities between 3 and 12-months. We will look to take advantage of any of these dislocations where appropriate in client portfolios.