In the third quarter, the S&P 500 gained 4.5% with each month generating positive returns, and extending the positive monthly return streak to encompass the entire year-to-date period. Tranquility and low volatility continued to characterize this period with the CBOE volatility index trending 40% below its lifetime average since the Presidential election.1 Late in the quarter, optimism around tax reform, as a means of reflation and improved economic growth, led to sector rotation and shaped investment style performance. Consequently, cyclical sectors outperformed, and value strategies outpaced growth for September despite having lagged for the 3Q in its entirety. Prospects for tax reform likewise ignited small capitalization company performance, enabling smaller businesses to outpace their large cap brethren for the 3Q and narrowing, but not yet closing, the year-to-date differential. Technology, the commanding leader for the year-to-date period, posted another strong quarter but did lose some relative ground throughout the month of September.

Taking a moment for reflection, the year has progressed differently than many expected. In the wake of the Presidential election, many believed bond yields would rise this year as the economy gained traction, and stocks could stall as interest rate normalization unfolded. Instead, the market has notched over 35 new record highs through the 3Q, and price appreciation has been more robust than typical for the seeming late cycle backdrop. At the end of September, U.S. 10-Year Treasury yields remained below prior year-end levels anchored by lackluster inflation. With yields persisting within a down trending channel, investor ebullience did not accompany headline equity market strength. Rather, the equity market’s ascent continues to overcome the wall of worry underpinned by the supportive impact of low interest rates on equity valuations.

The Big Data Ecosystem and the Augmented Age

Ubiquitous connectivity, powered by smart phones, tablets and connected devices linked by sensors (Internet of Things or “IoT”), is leading to a proliferation of consumer data. Enterprise level data, both private and public sector, has likewise mushroomed. Cheap storage costs and cloud-based computing have equally contributed to this explosion of data. As a result, an increasing variety of unstructured data sources, including text, images, social media, email, and medical records, now accompany traditionally structured data, resulting in larger and more complex data sets. Digitization, which converts diverse data forms into discrete binary digits suitable for transmission and computer processing, permits the varied information to be intermingled and facilitates large scale data processing and analytics, known as “Big Data.” As the size of the digital universe increases in volume and complexity, the “Big Data” ecosystem has emerged, powering the digital transformation of business processes, communications, human behaviors and the economy.

As the volume of available data explodes, the challenge remains to efficiently organize and extract value from this rich asset. Artificial intelligence (“AI”) is one of the most promising developments in this effort. This technology, the ability to mimic the human brain’s intelligent decision making via a computer system, is built upon algorithms that classify the data, recognize patterns and deduce by inference. Pioneered by John McCarthy and others in the 1950s, artificial intelligence, which has grown to include machine and deep learning, has been around for decades. AI’s reach is accelerating, driven by the exponential growth in data that fuels the effectiveness of the underlying architecture, known as neural networks, and improves the reasoning and predictive capability of the machine. In sum, fueled by larger data sets, these algorithms are becoming increasingly “trained,” “intelligent” and, perhaps one day, adaptive.

Labor Productivity

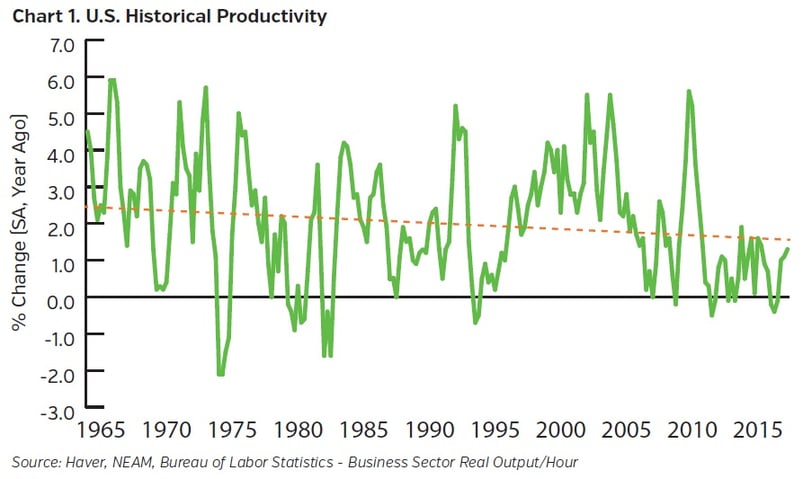

Artificial intelligence is among the most compelling technologies that can enhance human capability and usher in the augmented age. Along with the underlying digitization of the U.S. economy, this has the potential to shape the labor market of the future. According to Accenture, labor productivity should increase dramatically in the age of machine learning, conceivably reversing the decline in average productivity evident over the past fifty years (Chart 1). In a joint study with Frontier Economics, Accenture detailed its view that artificial intelligence should lead to a 35% increase in labor productivity by 2035. Similarly, by their estimate, the augmented age could accelerate annual U.S. economic growth by as much as 200bps by this time as artificial intelligence becomes more foundational to the economy.2 While achieved over a long horizon, this level is notable as it has not been seen since the 1980s.

This optimism is, however, not universally shared. While machine learning could improve productivity and accelerate growth, there is potential job displacement. Price Waterhouse Coopers estimates that 30%-40% of existing jobs could be at risk of automation by 2030.3 At this structural scale, government policy action could emerge to subsidize the level of creative destruction, ushering in a potential robot tax or universal basic income. Pundits speculate that certain jobs will become permanently obsolete while others, including data science and AI-centric positions, will see increased demand. Most simplistically, the size of the imbalance will depend on whether technology creates jobs faster than it destroys them and the extent to which new industries emerge.

Artificial intelligence will also face some limitations. Machine learning aims for computers to learn without explicit programming, and advancements in this regard may not be linear. While AI may excel at scale, scope and computation, it may prove difficult for computers to simulate intuition. Stated differently, intelligence is not the same as judgment. Likewise, deep learning involves layered learning with each hierarchical layer addressing a different aspect of problem solving. Expectations are high, and success is reliant on data integrity to minimize the risk of “garbage in, garbage out.” Nonetheless, it is conceivable to envision a hybrid approach, joining man and machine, which may lead to productivity benefits during the augmented age.

Innovation and Adaptive Business Models

Innovation should be a welcome derivative of the augmented age. With the marriage of big data sets and the human-like ability to reason, Watson, IBM’s cognitive computing offering, is already respected for its burgeoning efforts in the healthcare vertical. Illustratively, in late 2016, IBM partnered with Quest Diagnostics to offer Watson’s gene sequencing and diagnostic analytics service to oncologists. Given its ability to read and interpret words, known as natural language processing, Watson augments the physician’s capability by analyzing thousands of documents in minutes, potentially broadening the range of considered treatment options. Hence, the prospect of more tailored therapies for cancer patients, derived from broad based genomics expertise, is a real possibility.

Autonomous vehicles represent another very high profile example of innovation. A vehicle that is capable of sensing its surroundings and navigating without human input could offer many potential benefits, including enhanced mobility, lower fuel cost and improved safety. Interestingly, driverless vehicles will be part of the IoT and further decentralize data. As such, a connected car will generate five times as much data per hour as a Google map, and provide more fodder for machine learning.4 This creates a virtual cycle where innovation begets innovation.

As this technology exerts increasing influence, it is imperative for companies to develop successful strategies and leverage new available tools; data will become an increasingly valuable asset and a potential source of competitive advantage. Data enables platform companies such as Amazon and Netflix to create both a standard network effect (more users, more valuable product) and a data network effect (more users, more data, better algorithms, smarter products). These companies successfully apply machine learning to personalize recommendations for users, based on their vast volume of data pertaining to specific users. Further, demand and supply can be instantaneously matched. Uber and Lyft provide excellent examples of this advantage as anyone who has experienced “surge pricing” understands firsthand how valuable this can be. In these platform models, the data-enabled feedback mechanism drives pricing strategies and impacts profitability - a powerful combination.

Currently, the International Data Corporation (IDC) estimates that only one in ten companies have deployed machine learnings beyond the experimental stage.5 As such, legacy companies may be compelled to invest in machine learning to gain strategic intelligence, improve product development capability and empower faster decision making. Intuitively, it follows that artificial intelligence could be the biggest driver of technology spending for the foreseeable future, with the AI market forecasted to increase to $127 billion, by 2025, implying a compound annual growth rate (“CAGR”) of 51%. 5 If AI results in labor hour reduction from automation and efficiency gains, company managements may gain confidence and opt to invest in productive capital, reversing the trend of ever-growing dividends and share repurchases that has been evident since the Global Financial Crisis.

Investment Implications

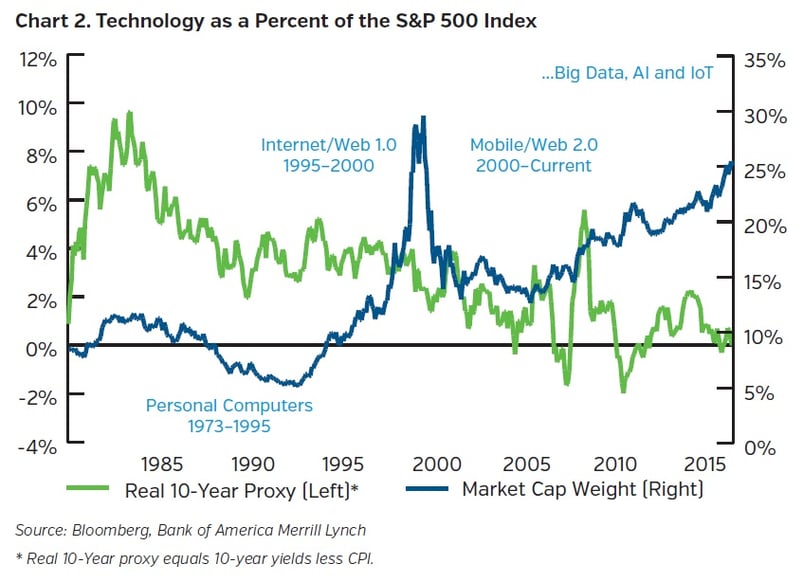

The unprecedented levels of data being created require hardware, software and service providers to address the inherent opportunity of the augmented age. Correspondingly, the technology sector already comprises a large percentage of the S&P 500 index as investors seek exposure to those companies aiming to exploit this large opportunity. While the absolute technology sector weight remains below the 2000 peak, it has steadily increased over the last decade, driven by digitalization and mobility (Chart 2). As the digital transformation shifts the structure of the economy, low real interest rates persist as digital deflation has affected wage growth, limited pricing power and benefited the equity risk premium. To the extent machine learning can have a broad based impact on company cost structures, valuations could rise further from potential margin gains, capital efficiencies and higher returns on capital. If this transpires over the intermediate term, technology could grow even larger within the S&P 500 index despite the high level of optimism already imbedded in risk asset pricing. History shows this would not be achieved in a straight line.

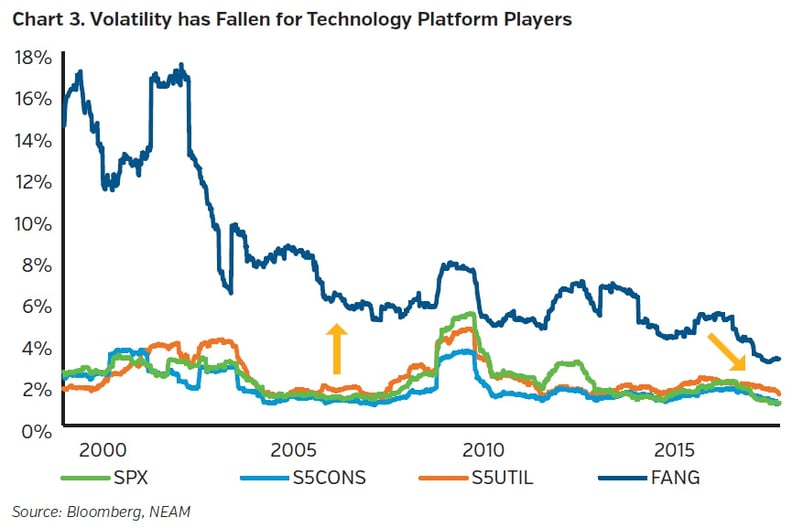

On a security level, the market favorably discounts companies that are advantaged by the data network effect. These platform companies - nicknamed the FANG stocks as these include Facebook, Amazon, Netflix and Google - are increasingly priced like lower volatility stocks, not typical for the technology sector, which faces high rates of change and obsolescence risk (Chart 3). However, these businesses are seen as so structurally significant to the digital economy that investor confidence is very high for their secular growth and ability to effectively compete. Volatility, defined as the trailing one-year standard deviation of stock price, has compressed materially for this basket over the last decade, exhibiting a smaller differential versus other stable businesses, such as utilities and consumer staples.

While redefining companies, digitization is also influencing the investment research process. The rise of alternative data sets broadens available inputs to include unconventional sources. For example, one big data research firm touts its ability to use algorithms and machine learning to determine store closures and improve outcomes for commercial mortgage bond investors. By aggregating location pings by mobile phones, demographic information, credit card bills and crowd-sourced local information, predictive analytics can be applied to identify doomed locations. Morgan Stanley has likewise adopted cognitive technologies to augment human capabilities and achieve scalability during the labor intensive corporate earnings season. Machine learning software can read volumes of filings and transcripts, enabling analysts to focus more deeply on value-added activities and accelerated insights. Within the new data ecosystem, machine learning techniques may become more universally integrated into fundamental research approaches and provide a source of informational advantage. At the same time, these techniques may also encourage flows to quantitative investment styles, contributing to the increase in passive investing.

Conclusion

The augmented age is upon us as digitization changes business processes, communications, human behaviors and the economy at an increasing rate. Ubiquitous connectivity, affordable computing power and cheap storage enables exponential data generation and the creation of a new data ecosystem. Artificial intelligence and machine learning will endeavor to harness this data to empower decision making and corporate strategy. As this technology exerts progressive influence, it is imperative for companies to develop successful strategies as data will become an increasingly valuable asset and a potential source of competitive advantage. In turn, it may have an impact on returns on capital, profitability and capital expenditures. It is certainly debatable whether intelligence is the same as judgment and whether the hype will be justified, but for those who fail to evolve, the consequences may be profound.

As the augmented age takes hold, the importance of data, automation and artificial intelligence will only grow in relevance, spawning new firms and reshaping existing companies across all industries. Opportunities may exist for select portfolio holdings, such as Microsoft, Apple, IBM and Cisco, among others, to benefit from these trends. Cost reductions may also be achieved broadly across corporate America as a result of these technological trends. In our investment portfolios, we seek high quality companies with sustainable competitive advantages, strong financial profiles and attractive returns on capital. As such, we will continue to manage our clients’ portfolios with an eye toward adding companies that, in our estimation, can best leverage artificial intelligence and thereby potentially increase return on investment, a key attribute to sustained equity price performance in our view. Likewise, we must remain equally vigilant in our assessment of deficiencies and shed those companies which lag behind peers in implementing digital change.

Endnotes

1 Bloomberg

2 Accenture, “Why Artificial Intelligence Is The Future of Growth”

3 Alliance Bernstein, September 7, 2017 - “Weekend Tech Byte: Artificial Intelligence and Job Destruction – Singularity or Stupidity?”

4 Alliance Bernstein, February 23, 2017 - “Weekend Tech Byte: Artificial Intelligence, IoT, Cloud and 5G – A Unifying Theory”

5 Bank of America Merrill Lynch, August 29, 2017 - “Thematic Investing – Data Capital – Global Big Data and AI Primer”

Microsoft, Apple, IBM and Cisco are current holdings in client portfolios as of the date of this report but may not be held after that date. We do not undertake to update this report to reflect revised current holdings or sales.