Introduction

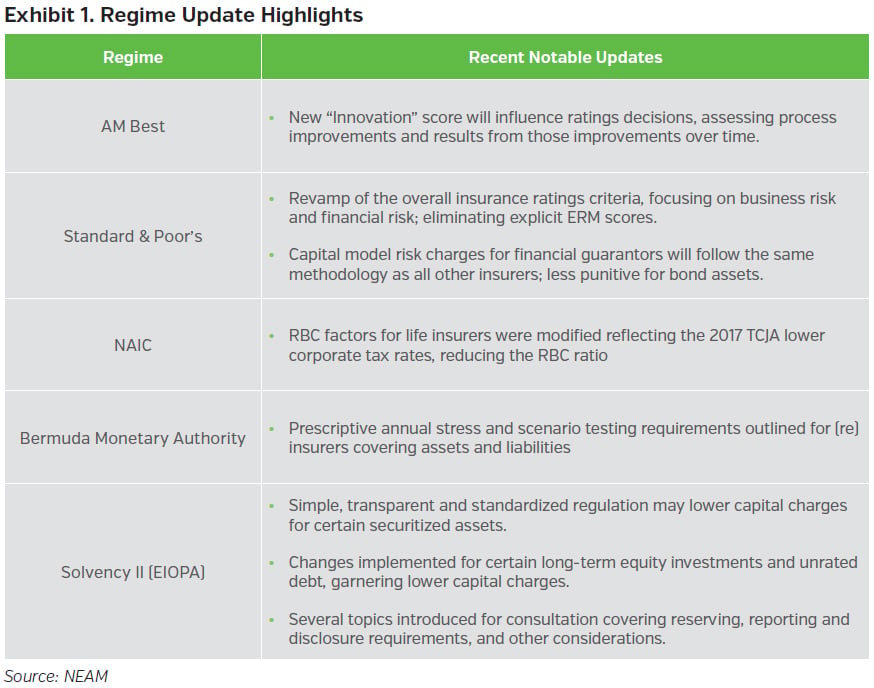

This issue of Perspectives highlights some of the recently proposed and implemented changes to ratings methodology and regulatory standards for insurers. For example, AM Best announced an innovation score in their financial strength ratings process. Additionally, Standard & Poor’s (S&P) broadly revamped its ratings methodology for insurers and modified how certain risk capital requirements will apply to financial guarantors.

The NAIC adjusted RBC after-tax factors for life insurance companies in light of the 2017 Tax Cuts and Jobs Act (TCJA). The investment RBC C1 factors remain in limbo with no clear implementation dates and next steps.

The Bermuda Monetary Authority (BMA) now requires certain size insurers and reinsurers to conduct prescribed stress and scenario analysis to assess their capital adequacy under adverse financial market and underwriting conditions.

In Europe, a suite of changes on Solvency II regulation passed into law and the European Insurance and Occupational Pensions Authority (EIOPA) started to consult on certain fundamental reforms to the regulation, with further changes to be proposed and finalized in 2020. We will address Solvency II oversight and provide a high-level reference summary of the intended changes and potential implications.

AM Best and Innovation1

In 2019 AM Best announced that a new ratings category called “Innovation” will be scored and assessed as part of the overall financial strength rating consideration. The draft criteria document was released in September 2019. According to AM Best, innovation has been implicitly evaluated to date. But, given the rapid pace of innovation in the industry, they felt it was prudent to evaluate this in a more explicit and formal format.

There are two components: an input score (influenced by processes) and an output score (influenced by results). Input facets (processes) consider: leadership, culture, resource allocation, organizational process and structure around innovation. Output facets (results) consider: innovation should be measurable, obvious tangible results of innovation, and the level of organizational transformation from innovation. It is expected that innovation will have a small influence on the rating initially, but this influence or weight will grow over time. AM Best does not expect rating changes at the initial application of the criteria, but they consider innovation as one of the leading indicators of future financial strength.

Standard & Poor’s

Insurance Criteria Revamp2,3

In December 2018, S&P announced an overall ratings methodology framework update for all insurance companies. In July of 2019, they published formal criteria. Going forward, a base rating will be comprised of two components: business risk profile (competitive position); and financial risk profile (capital and earnings, risk). The base rating is modified depending on scores for three different areas: Governance, Liquidity and Comparable Ratings Analysis.

Perhaps the most notable change within the proposed criteria update is removing distinct Enterprise Risk Management (ERM) scores from the financial strength rating; these had been part of S&P insurance ratings evaluations since late 2005.4 The strength or weakness of ERM still will be considered, but as part of an overall mosaic of the financial strength assessment. For example, risk controls, which were part of an ERM score, will be assessed as part of the financial risk profile evaluation. Other facets of ERM will be assessed as part of a new Governance score. This Governance score can only have a neutral or negative impact to a base rating. Therefore, especially strong Governance would not enhance a rating in any way, while weak governance may have a drag on a rating.

Risk Capital for Financial Guarantors5,6

In December 2018, S&P announced that bond insurers would be subject to the same capital charge criteria as all other insurers. The formal criteria was released in July 2019. The goal is to make S&P’s capital charge methodology consistent across all insurance company types. Previously, financial guarantors would have higher capital charges assigned for investing in the same types of bonds as other insurance companies – e.g., municipal bonds.

Going forward, bond insurers and other financial guarantors will be subject to the same capital charge methodology as other insurance companies. This could reduce the required capital for holding certain securities or expand the investment opportunities for financial guarantors, given the level playing field relative to other insurer types.

NAIC Risk-based Capital

In light of the 2017 TCJA, the NAIC modified RBC factors for life insurance companies to reflect the lower corporate tax rate. These modifications result in a lower tax credit and/or higher after-tax RBC charges for life insurance companies. The impact to the life industry is estimated to be a 50 to 75 percentage point7 reduction of the Authorized Control Level (ACL) RBC ratio. Regarding the investment RBC C1 bond factors, there has been no further development since the American Academy of Actuaries published the last report in July 2018 to further clarify the risk premium concept used in the modeling. NAIC’s next steps remain unclear.

The BMA Stress and Scenario Analysis8

The BMA now requires certain size* insurers and reinsurers to conduct prescribed stress and scenario testing and analysis as part of the year-end capital and solvency return submission. These stress tests encompass both adverse financial market and underwriting conditions. Financial market scenarios include a 40% drop in equity and alternative investments, extreme yield curve upward shifts, and credit spread widening. Underwriting scenarios include windstorm, earthquake, aviation and marine collisions, oil spills, wildfires, and pandemic events. Moreover, scenarios of new latent liability and deterioration of the U.S. Asbestos and Environmental (A&E) reserves are considered as well.

Solvency II

Regulation Changes

From January 2019, European insurers were able to apply lower capital charges to securitized assets, provided they are issued under Europe’s STS (simple, transparent, and standardized) regulation.9 This serves to potentially revive European insurers’ investments in securitization, and recognizes that the original capital requirement rules for securitized assets were too onerous.

In July, a further set of changes to the capital requirement calculation came into effect.10 On the asset side, two new asset classes (namely, long-term equity investments and qualifying unlisted equities) were introduced, which would require much lower capital charges than they did previously. Measures were also put in place to facilitate insurers’ investing in unrated debt, while the calculation of required capital was also simplified – a benefit to smaller insurers in particular.

2020 Reform

To further evolve the regulatory framework for European insurers, in October EIOPA started to consult on 19 important topics,11 which broadly fall into three sections:

1. Reserving approach for long-term guarantees

2. Potential introduction of new regulatory tools, notably for macro-prudential issues, recovery and resolution, and insurance guarantee schemes

3. Revisions to details of the existing framework, including reporting and disclosure and the solvency capital requirement

EIOPA will issue its final opinion on these topics in June 2020, to be acted on by the European Commission.

Summary

The wheels of oversight by rating agencies and regulators for insurance companies keep churning. We have highlighted a few of these changes. The dynamic approach that stakeholders follow to evaluate solvency and ongoing financial strength apparently is not ending any time soon. Insurance companies must navigate these evolving external factors as part of their internal decision-making process. This is essential to remain successful. NEAM continually evaluates these and other stakeholder expectations as we assist clients with investment strategy specifically, and with risk and capital awareness broadly.

Key Takeaways

- AM Best is assessing insurers’ approach and execution of innovation as part of their evaluation process.

- S&P has a new insurance company ratings evaluation methodology, which no longer explicitly scores ERM.

- S&P financial guarantors now receive the same capital charge treatment for their investment portfolios as other insurance companies.

- The life industry’s NAIC RBC ratio was reduced in 2018 to reflect the 2017 TCJA.

- NAIC’s investment C-1 capital factors remain in limbo with no clear next steps and implementation dates.

- BMA now requires financial market and underwriting stress and scenario analysis in the year-end capital and solvency return submission.

- A number of Solvency II changes came into force during 2019, with additional and more fundamental changes to be proposed in 2020.

Endnotes

1 DRAFT: Scoring and Assessing Innovation. Best’s Methodology and Criteria. (13-Sept-2019).

2 Request for Comment: Insurers Rating Methodology. S&P Global Ratings. (03-Dec-2019).

3 Insurers Rating Methodology. S&P Global Ratings. (01-Jul-2019).

4 Evaluating the Enterprise Risk Management Practices of Insurance Companies. S&P Global Ratings. (17-Oct-2005).

5 Request for Comment: Methodology and Assumptions for Analyzing Bond Insurance Capital Adequacy (03-Dec-2019). S&P Global Ratings. (03-Dec-2019).

6 Methodology and Assumptions for Analyzing Bond Insurance Capital Adequacy. S&P Global Ratings. (01-Jul-2019).

7 NAIC – 2018 Aggregate Life and Fraternal RBC Results.

8 BMA – 2018 Capital and Solvency Return Stress/Scenario Analysis – Class 4, Class 3B and Insurance Groups (30-Nov-2018).

9 Commission Delegated Regulation (EU) 2018/1221. European Commission. (01-Jun-2018).

10 Commission Delegated Regulation (EU) 2019/981. European Commission. (08-Mar-2019).

11 Consultation Paper on the Opinion on the 2020 Review of Solvency II. EIOPA. (15-Oct-2019).

* Definitions

CLASS 3B

Large commercial insurers whose percentage of unrelated business represents 50% or more of net premiums written or net loss and loss expense provisions and where the unrelated business net premiums are more than $50 million.

Class 3B insurers are required to maintain capital and surplus of $1 million.

CLASS 4

Insurers and reinsurers underwriting direct excess liability insurance and/or property catastrophe reinsurance risks.

Class 4 insurers are required to maintain minimum capital and surplus of $100 million.