A historic change will soon be coming to the mortgage-backed securities market. On June 3, 2019, the Federal Housing Finance Authority (FHFA) plans to launch the “uniform mortgage-backed security” (UMBS), a single mortgage-backed security that will be issued by either Fannie Mae or Freddie Mac. The UMBS and the platform supporting it are intended to introduce greater efficiency, improve market liquidity and potentially pave the way for more substantive reforms to U.S. housing finance.

What is the Single Security Initiative (SSI)?

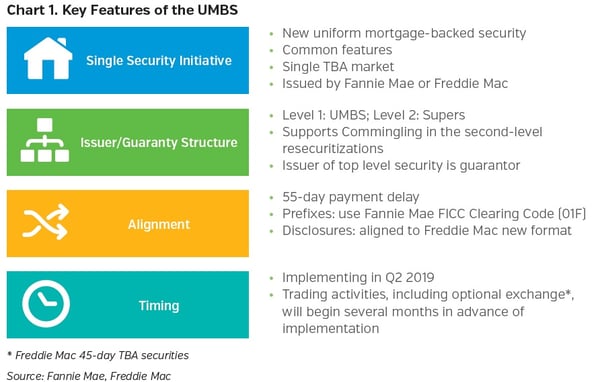

The SSI is a joint effort between Fannie Mae and Freddie Mac, under the direction of the FHFA, to develop a common fungible security to finance fixed-rate mortgage loans backed by one- to four-unit single-family properties. The common features of the UMBS will align with Fannie Mae’s current program, however, timely payment of principal and interest will be guaranteed by either Fannie or Freddie. Re-securitizations involving UMBS will be called “Supers” and will allow for commingling of Fannie and Freddie pools.

What is the genesis of the SSI and its relevance to the mortgage market?

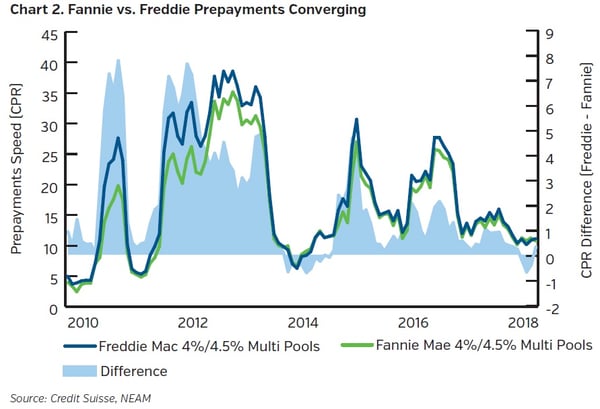

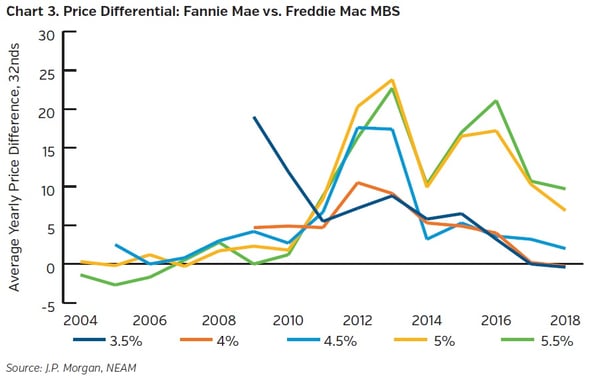

Homogeneity of the mortgage collateral pool is the foundation of the TBA (To-Be-Announced or forward) market whereby specific pool characteristics are not known at the time a trade is initiated. Due to the use of this construct, the entirety of the Agency MBS market has grown to $6.5 Trillion1 and is second in liquidity only to the U.S. Treasury market. Within the TBA market, Freddie Mac has historically traded at a discount to Fannie Mae due to its lower liquidity (driven by its smaller market share) and higher prepayments (due to originator composition and concentration) - see Chart 1. This pricing disparity (Chart 2) has resulted in additional cost to taxpayers because Freddie Mac subsidizes the guarantee fee that it charges to originators in an effort to preserve its market share. This subsidy, which ultimately falls to the U.S. taxpayer, has been estimated to be in the hundreds of millions of dollars annually.2 While the price differential has diminished over time, the UMBS is nonetheless intended to eliminate the need for any such subsidy and improve overall market liquidity by making the programs fungible.

Will existing securities be exchangeable into UMBS?

Since the UMBS will take on the characteristics of Fannie securities, only Freddie securities will be exchangeable. Freddie Mac pools can be exchanged for new UMBS “mirror” securities at no cost (investors will be compensated for the 10-day interest differential). The SEC has indicated that such transactions would be viewed as a “minor modification of existing security” for accounting purposes, and the IRS has ruled that the exchange will not be a taxable event. NEAM will monitor the market’s development under the new structure and recommend security exchanges for clients depending on the liquidity pay-up that develops between the UMBS and legacy securities and characteristics of pools that are delivered into the TBA market.

What are the key transition considerations?

The transition steps needed before a June 2019 launch of the UMBS are non-trivial. Significant changes to systems, procedures, contracts, marketing materials, and certain investment management agreements will be needed to accommodate the new structure. Coordination among all market participants and their vendors, systems and analytic providers to reflect the new standard, as well as revisions to benchmark index reporting to incorporate the treatment of “mirror” Freddie UMBS will also be required. However, as the issuer and guarantor information will continue to be provided for the UMBS, no changes to existing investment guidelines limiting GSE exposures are anticipated.

How has the market reacted to the single security initiative?

While many market participants have embraced the initiative and its potential for reduced taxpayer support, some have voiced concerns including potential market disruption, costs and resources to effect needed changes to systems, and the rationale of making such a monumental change to a market that is already extremely liquid. Market preparedness is another concern. As recently as December 2017, SIFMA summarized its views in a letter to the FHFA:

“…while we observe and appreciate the efforts that have been made to provide comfort to market participants that the introduction of a common TBA contract would be a net positive to the market, we do not believe that enough has been done, and also believe that time is running short to provide this comfort to the market if FHFA intends this effort to launch in mid-2019.”

Source: SIFMA Comments on December 4, 2017 Update on the Single Security

KEY TAKEAWAYS

- The single security initiative is intended to bring price convergence and enhanced liquidity to the TBA market. It will also result in meaningful taxpayer savings.

- A successful transition will depend on all market participants anticipating and addressing any necessary systems, vendor and analytics changes ahead of the launch. NEAM has begun the process of evaluating systems changes to ensure a smooth transition to the single security platform.

- While no meaningful impact to portfolios is expected, NEAM will continue to communicate any changes and recommendations to clients.

- This is an important market development that could set the stage for further reforms to the GSEs down the road.

Endnotes

1 SIFMA as of Q2 2018

2 Goodman, Laurie, and Lewis Ranieri. “Charting the Course to a Single Security.” Urban Institute, Sept. 2014.