The Millennials

Demographics have long shaped the consumption curve in the economy, which in turn impacts the capital markets. Today, the most relevant demographic trend in the United States is the millennial cohort, a large and influential group who stand to reshape the consumer economy. They are a unique generation of digital natives who have embraced technology in almost every aspect of life which has pricing, branding and market share implications for consumer companies. As Millennials increasingly exert their influence, it is imperative for companies to develop successful strategies as traditional competitive advantages will be challenged. Likewise, by understanding the Millennial mindset, investors can better understand both the risks and opportunities for consumer based business models, the durability of cash flows and the resulting asset valuation.

According to research by Goldman Sachs, Millennials, born between 1980 and 2000, are the largest generation in U.S. history totaling almost 88 million in size, more than one quarter of the nation’s population. This cohort exceeds the Baby Boomers, born between 1940 and 1964, comprising 72 million people and Generation X, born between 1965 and 1979, totaling an estimated 65 million people. Millennials distinguish themselves by being technologically savvy, very trusting of online social and sharing communities, and financially conservative. Millennials value authenticity and social responsibility and desire to align themselves with companies and causes that can make a difference in the world.

Technologically, Millennials are exceptionally astute. The ubiquity of the internet and deep penetration of smart phones have enabled the hyperconnectivity of this generation and have encouraged them to share more of their lives online. As a result, Millennials thrive in digitally scalable, peer to peer online social communities. They utilize social media as their primary platform to build relationships, gather and communicate information, share opinions and inform decisions they make; peer affirmation is highly sought. By definition, peer to peer communities require participants to also be content creators, and Millennials have embraced this profoundly. Millennials are three times more likely to have their own blog or personal website than non-Millennials (Source: Barkley). These behaviors have implications for the media space, in particular Pay TV and music. For one, alternate forms of media distribution have sprung into existence (e.g. Netflix, Hulu, Spotify, Pandora) and become more influential than traditional outlets. As audiences become more fragmented, ratings for traditional TV networks have been declining, with negative implications for companies such as Viacom and broadcast networks. Music sales are also being impacted as the Millennials are more inclined to stream rather than buy. Secondly, as content creators, Millennials have been the powerhouses behind the rise of YouTube, Vevo, Instagram and similar media services. This generation is rarely, if ever, unplugged, and instead creates and shares entertainment on a regular basis for their peers through pictures, videos and music. The internet has now become the primary method by which Millennials discover music and video entertainment.

Millennials are a generation of researchers accustomed to instant gratification enabled by digital scalability. Powered by mobility, they are redefining the pricing architecture for many retail businesses as price comparisons are now structural and completed in store. Further, Millennials search for exclusive deals and promotions in order to find and confirm compelling value, demanding price integrity across channels. This transparency may lead to a more deflationary trend in pricing. While Millennials often transact online, they demand an integrated, efficient omnichannel shopping experience, indicating that brick and mortar stores do remain relevant. However, as ecommerce grows, this has negative implications for square footage growth of traditional retailers. Purchase decisions and product opinions heavily leverage crowd-sourced information and peer reviews. Therefore, branding will become more and more participatory as consumers are engaged as active partners via social media with the businesses and brands they utilize. Social media allows brand engagement, a more personalized experience and responsive customer service. Companies must develop strategies to maintain an emotional connection with Millennials and build loyalty as reputational damage can be instantaneous. As a result, advertising spending will continue to show a rising allocation to social media and digital; likewise, advertising agencies will need to have dedicated, continually evolving expertise in these areas to remain competitive.

For Millennials, sharing has become a defining way of life. Technology has not only enabled the sharing of life details and information, but also the sharing of assets. Millennials have an underlying respect for capitalism, yet there remains fundamental skepticism of legacy big businesses. As a result, this generation has opted for newer, tech enabled companies that allow peer to peer sharing of assets and collaborative consumption. Examples include: ride sharing operators Uber and SideCar, accommodations facilitator Home Away and AirBnB, and peer to peer lenders Kickstarter and Lending Club. Millennials will opt for Uber versus a traditional taxi ride, or use AirBnB to secure travel accommodations versus branded hotels and seek funding from Lending Club rather than financial institutions. These disruptive elements are a direct function of the sharing ethos of the Millennials and have negative implications for legacy taxi providers, hotels, travel agencies and financial services. Interestingly, Millennials can act as both consumers and producers within this ecosystem. Millennial entrepreneurs are expanding these marketplaces into arts and crafts via Etsy and even heretofore non monetizable assets such as time via sites like TaskRabbit by completing chores and paid errands to supplement income or complement part time work.

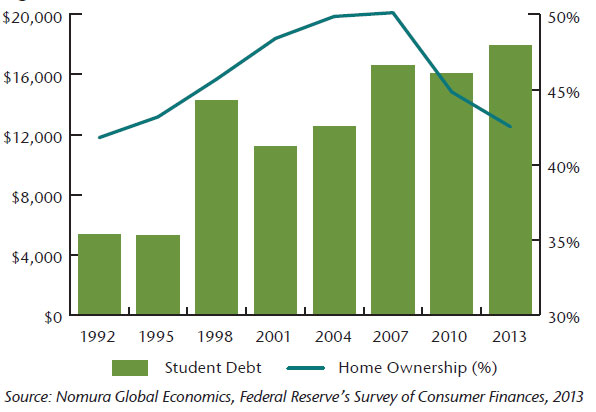

Financially, many Millennials entered the job market or were in the early stages of their career during the Great Recession, leading to underemployment and depressed wage growth. Given their lives have been characterized by more volatile economic times and diminished relative earnings, most are burdened by higher levels of indebtedness, primarily student loans. Broadly, they are debt averse, budget conscious and reluctant spenders. As a result of these traits, they opt for cash or debit cards, potentially leading to the revamping of the payment system and challenging incumbent credit card companies. Due in large part to their subdued financial profile, to date, Millennials have delayed independent household formation (Chart 1) and marriage relative to past generations. This dynamic has suppressed home sales despite supportive interest rates as many Millennials choose to reside at home with their parents. Behaviorally, the weakened financial position of the Millennial generation has delayed big ticket purchases, such as cars and houses, deferred household formation and suppressed consumption relative to prior generations.

Chart 1. Student Debt and Household Ownership Age Cohort: 25–34 Years Old

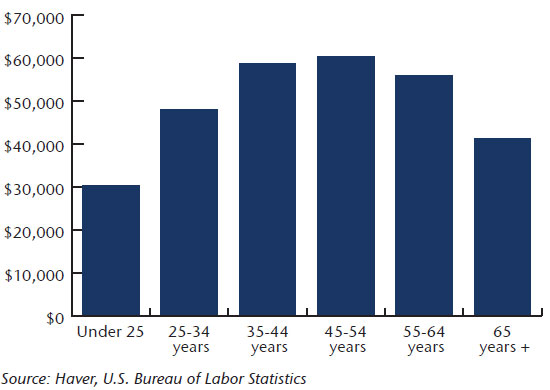

Although delayed by debt and the economy, Millennial spending is expected to accelerate from today’s estimated annual spend of $600 billion to $1.4 trillion by 2020, or roughly 30% of retail sales (Source: Accenture). The age maturation of the millennial cohort drives this increase in spending power as the oldest Millennials enter what is traditionally considered the peak spending years (Chart 2) and likely achieve deferred milestones of marriage, homeownership and parenting. As households form and family size increases, there is further consumption benefit.

Chart 2. Average Annual Consumption Expenditures by Age Cohort

Of note, the ultimate impact of the sharing economy could have a bearing on the steepness of the spending trajectory shown. As providers in the sharing economy, Millennials may forego more permanent wealth creation and financial stability. Coupled with a less secure career path, a portion of Millennials are participants in the “gig economy” as the trend to more flexible employment and contingent labor continues in the U.S. This may exacerbate the earnings gap and potentially impact the slope of their rise in spending power.

Investors are assigning stretched valuations to many companies that are well positioned for these trends. Netflix, a subscription streaming service, trades over 7x revenue while Viacom’s valuation has compressed by over one third to its current value just below 2x sales. The market capitalization of Amazon, the premier online retailer, is approaching that of Wal-Mart despite a fivefold revenue differential. Uber, reportedly valued at slightly over $40 billion based on its recent round of venture funding, is larger than the U.S. rental car market, sized at $38 billion by IBIS World, and far beyond the combined market cap of Hertz and Avis, large incumbent providers who compete for business and leisure car usage. Arguably, the frequency of renting a car is not akin to daily transportation needs or taxi alternatives. On this basis, the valuation of Uber imbeds expectations for alternate transportation forms comparable to the size of the Japanese, United Kingdom and United States taxi markets combined.

In conclusion, Millennials will continue to influence the consumer economy and consumer centric business models. More specifically, their traits and behaviors will characterize the level and nature of their spending, how and where they consume and their participation in the sharing economy. This generation has been enabled by technology to collaborate with others, fostering trust and creating the foundations for peer to peer based businesses. We would expect traditional companies to experience some disruption in their business models as the Millennial consumer, armed with peer reviews, more transparent pricing decisions, and a fiscally conservative mindset, increasingly searches out different distribution and buying patterns than previous generations. Access rather than ownership will likely assume a more prominent role in asset consumption. These trends will be further amplified by the increasing proportion of consumer spending Millennials will comprise as they reach peak spending years. Millennials will undoubtedly leave a lasting impact on the consumer economy; understanding the priorities of this generation can help align investors with well positioned companies. Business analysis, a central tenet to our investment process, remains critical in this endeavor.

Equity Market Recap

During the 2Q, the S&P 500 returned less than 1% and closed a mere four points below its March 31st closing level, giving the impression of relative calm. Those of us who review daily economic data and scrutinize capital market movements understand otherwise as volatility was a central theme in the quarter. The most prevalent source of volatility was the geopolitical backdrop, including the uncertainty around Greece exiting the Eurozone and the downdraft in the Chinese equity markets.

The Federal Reserve, which is meandering down the path of raising interest rates and normalizing policy, likewise injected volatility into the market by creating guesswork surrounding the timing and pace of future changes. The divergence in central bank policy versus that of Japan and Europe, combined with low absolute yields, continues to encourage capital flows to chase higher yielding investment opportunities. These rapid changes in capital flows bring volatility to the currency markets, where until recently, the U.S. dollar had been the unequivocal beneficiary. Evidenced by negligible 1Q average earnings growth for S&P 500 companies, the strong dollar proved to be a relatively brisk headwind for U.S. multinational companies; this earning news, largely reported during the 2Q calendar period, failed to drive the market higher. Of note, the dollar’s momentum did subside during the 2Q.

Corporate stock repurchase and M&A activity continued unabated in the 2Q and remained broadly welcomed by the market. Healthcare, one of the primary sector beneficiaries of the consolidation trend, continued to lead the index in the quarter. Utilities, given their interest rate sensitivity, lagged materially as the 10-Year Treasury yield moved higher by over 40 bps. Energy also underperformed as the dislocation in the global energy markets continued.

In our view, the backdrop is characterized by higher volatility, less compensation for risk and lower implied forward returns (see Global Economic and Capital Market Perspectives, Q1 2015 for further discussion). As such, exposure to equities is best achieved via a portfolio constructed with stocks that are attractively priced on an individual basis which can provide some measure of downside protection when asset repricing occurs. As volatility rises, divergence between stock prices and business values will likely return, making stock picking an important means to generate alpha.