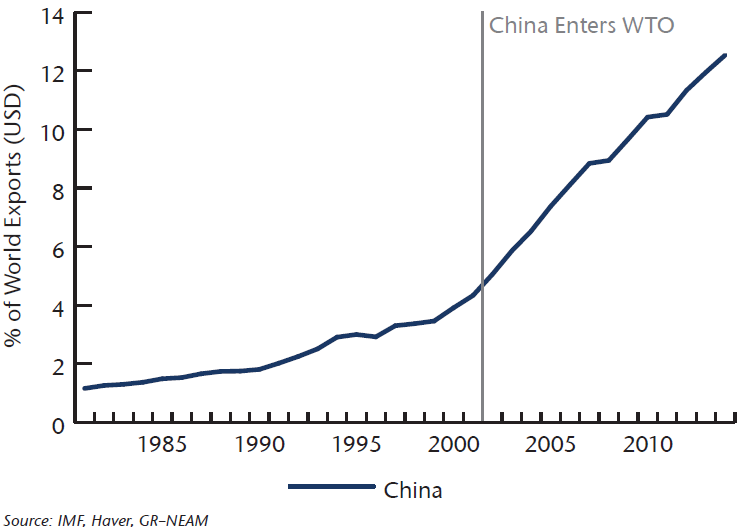

It is abundantly clear that over the last twenty five years, China has experienced exceptional growth and that this growth has directly and profoundly impacted the global economy and capital markets. What may be underappreciated is the fact that in 1990, China accounted for a mere 4% of Global GDP. Today, it accounts for roughly 17%. Its growth has been fueled by both manufacturing and exports (Chart 1), as global corporations in previous decades exploited the relatively cheap labor that China afforded them. Chart 1 : China – Percent of World Exports

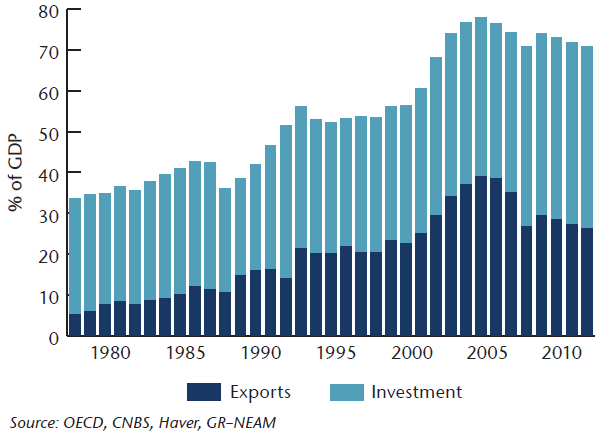

Chart 2: China – Exports and Investment as a Percentage of GDP

More recently, infrastructure investment has provided massive stimulus as China continues a steady migration from an agrarian society to one which is more urban and consumption-based (Chart 2). China’s advantage of cheap labor has diminished, as the gap between Chinese wages and those of advanced economies has narrowed. Hence, their economy is shifting from one purely defined by manufacturing to being more balanced, including the expansion of consumer and service based components. Prior to the 2008 financial crisis, China unleashed a barrage of fiscal stimulus as the urban migration gathered momentum. The 2008 Beijing Olympics, in effect, kept the pump primed for double digit GDP growth. After the financial crisis, China resumed its investment binge by further developing real estate, railroads and other infrastructure. This time though, the country’s leadership was motivated (at least partially) by the desire to keep the economy humming at a time when they sensed it was slowing. These efforts resulted in a massive consumption of resources, both human and natural. This outsized investment cycle “pulled forward” significant economic activity that would have occurred in subsequent years, forestalling an inevitable slowdown of the Chinese economy.

It was fun while it lasted.

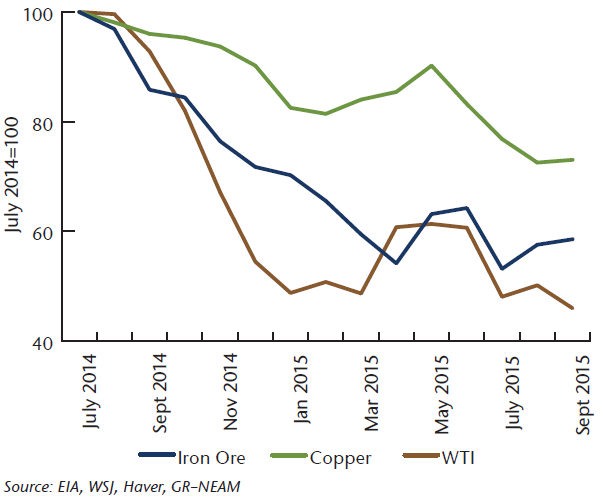

These investment efforts created excess supply for demand that wouldn’t develop until sometime in the future. The overhang that developed caused a sharp downturn in real estate prices and a massive correction in all the materials required to fuel construction on such a large scale. Oil, the king of commodities, fell by roughly 60%. Industrial metals have fared better, but are still down by a third or more from their heyday (Chart 3). While industrial commodities may very well be settling into a new price range, their precipitous decline (while not entirely driven by China) underscores the county’s growing importance within the global economy.

Chart 3: Slowdown in China Has Caused a Collapse in Commodity Prices

We can’t be sure of the magnitude of China’s economic slowdown, but we do know that it has rattled policy makers. Their surprise (albeit modest) currency devaluation in late August caused great angst in the credit and equity markets as this tactic was a departure from their previous policy. Given its soft peg to the USD, the Renminbi has remained very strong relative to other Emerging Market (EM) currencies, most notably those of Russia and Brazil. Hence, China has suffered a loss of competitiveness relative to many of its EM peers, and the markets interpreted the adjustment as the start of a new chapter in the currency wars. Recent easing efforts by the People’s Bank of China have reverted to conventional measures. They will think twice before pulling the currency lever again in the near term, even though eventually it seems quite likely.

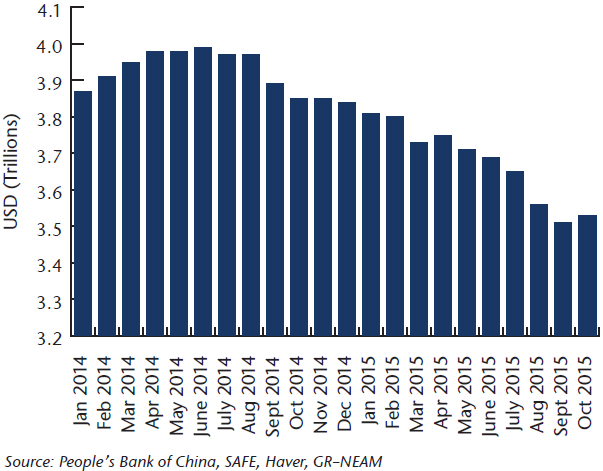

Over the past 5 years, China and EM countries have accounted for about 75% of global growth. That fact alone underscores their economic heft. However, many countries that are reliant on oil, energy and commodities now face significant budget gaps stemming from slower growth in China. FX reserves, which had been stockpiled through the 2000s, are being drawn at a fairly aggressive pace to make up the difference. These reserves are abundant and provide a very significant buffer against economic downturns. In China’s case, they have drawn hundreds of billions of dollars in reserves both to smooth the economic slowdown and, of all things, to buy equity shares in Shanghai – a move which kept a significant downturn in equity markets from becoming a complete rout (Chart 4).

China Foreign Currency Reserves

Because EM countries have accounted for such a lopsided percentage of recent economic activity, their diminished prospects have taken quite a toll on growth estimates. The IMF has lowered its estimate of global growth for 2015 to 3.1%, and this is likely still overstated. As for China, a profits recession is unfolding, employment is weakening and inventories are high. This is not exactly the “stuff” soft landings are made of, but with one year lending rates at 4.35%, policy makers certainly have enough elixir to keep the party going, if at a slower pace.

Time will tell.