2022 in Review

The past year is one for the history books. Beyond the unprovoked invasion of Ukraine by Russia, a 40-year high in inflation, the collapse of high-flying crypto concerns, and the passing of an iconic queen, it was a historically disastrous year for asset returns.

“There is nothing new in the world except the history you do not know.”

– Harry S. Truman

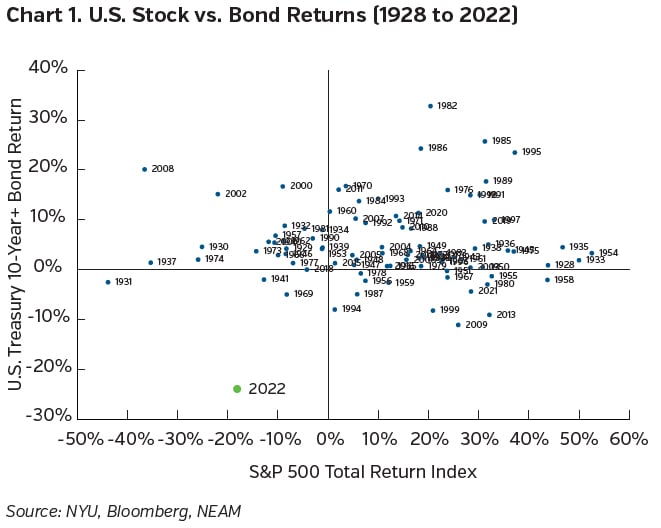

Who knew that long dated Treasury bonds could decline by 24% in one year? Or that equities and bonds would decouple from their long-standing inverse correlation? Or that, for the first time, both stock and bonds could return negative 10%+ over a year?

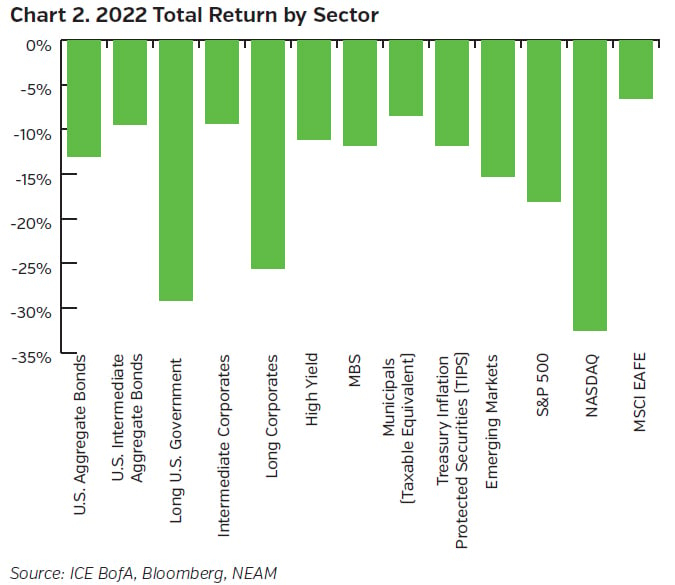

Investment returns in 2022 were historic and miserable. Long duration assets fared worst, sector diversification provided little benefit, and Treasury Inflation Protection Securities faltered. It proved to be a year with “nowhere to run and nowhere to hide.”

The breadth and depth of asset price declines caught most off guard. Surging inflation following excessive fiscal stimulus (courtesy of the $1.9 trillion American Rescue Plan), combined with a spike in commodities prices with the onset of the war in Ukraine, rendered the notion of “transitory” inflation an illusion. The Federal Reserve was behind the curve and would need to act aggressively to catch up. In the end, risk assets could not withstand the tsunami of a 4.25% increase in the federal funds rate, wider credit spreads, and an overall tightening of financial conditions in 2022. Total returns ended sharply lower across the board.

2023 Outlook

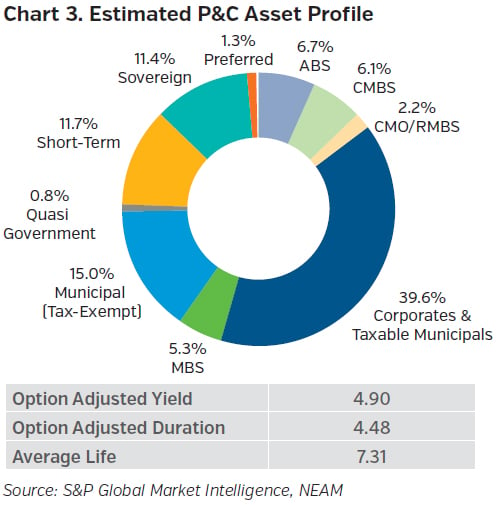

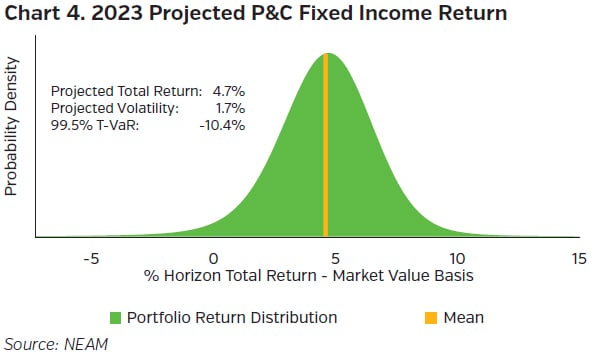

As we turn the page to the new year, we are guardedly optimistic on the U.S. economic outlook and constructive on insurers’ investment options within fixed income. Despite a plethora of recession indicators and prognostications, we point to fundamental strengths including healthy consumer balance sheets, absence of near-term corporate funding pressures, tight housing and labor markets, and a general lack of excesses (financial leverage and overbuilding, for example). While we expect economic activity to slow, we think the coming downturn will be moderate. The Fed is nearing the end of its rate hiking cycle and will pause (while holding rates at a peak level of around 5%) during the coming year to assess the cumulative effects of its actions, in our view. Taking these factors into consideration, together with our expectations for yield curve and spread movements, we project a pre-tax total return of 4.7% for the P&C industry in 2023.

Potential Opportunities

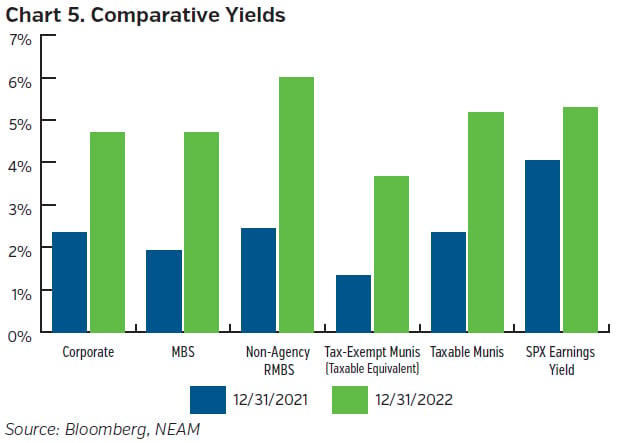

On the bright side, fixed income reinvestment yields are now attractive, enabling insurers to begin to rebuild book yield which has been steadily deteriorating over the last decade. Industry book yields ended 2021 at 2.67% after declining 55 bps and 120 bps over the past five and ten years, respectively. With higher treasury yields and the return to fair value for credit risk premiums, yields for high quality securities are significantly more compelling compared to a year ago. Furthermore, bond investors don’t need to reach for risky, volatile sectors to achieve attractive yield.

We favor segments that may be overlooked, due to either liquidity or small market size, such as taxable municipal securities (“taxable munis”). At ~17% of the overall municipal market, taxable munis represent a small portion of the retail-dominated municipal securities market. Institutional investors are the primary sponsors of taxable munis who view them as high quality, higher yielding substitutes for investment grade corporate bonds.

Another sector to highlight is non-agency residential mortgage-backed securities (NA RMBS). Following the failures of NA RMBS during the Global Financial Crisis in 2008-2009, the market reinvented itself to incorporate tighter underwriting criteria, detailed asset level disclosure, and fortified structural protections. The fundamental backdrop for housing remains strong with a shortage of homes available for sale, homeowners who refinanced at favorable mortgage rates, along with generational lows in loan-to-value ratios. Market yields of 5% to 6% for AAA rated bonds reflect liquidity and structural complexity considerations and offer extremely attractive risk adjusted return, in our view.

Key Takeaways

- The Federal Reserve is nearing the end of its rate hiking cycle but remains vigilant in its fight to bring inflation down to target levels. The Fed Funds rate should continue to move slightly higher in Q1 and then remain there for the rest of the year.

- Tighter financial conditions are slowing the U.S. economy; we anticipate the downturn to be mild in magnitude.

- Attractive current yields for high quality fixed income securities enable P&C firms to reverse years of book yield declines and to increase after-tax levels of net investment income. We estimate 2023 pre-tax total returns of 4.7% for the industry.

- High grade, “under the radar” fixed income sectors such as taxable municipals and non-agency residential mortgage backed securities currently represent particularly attractive opportunities to generate incremental book yield while staying up in quality.