2021 IN REVIEW

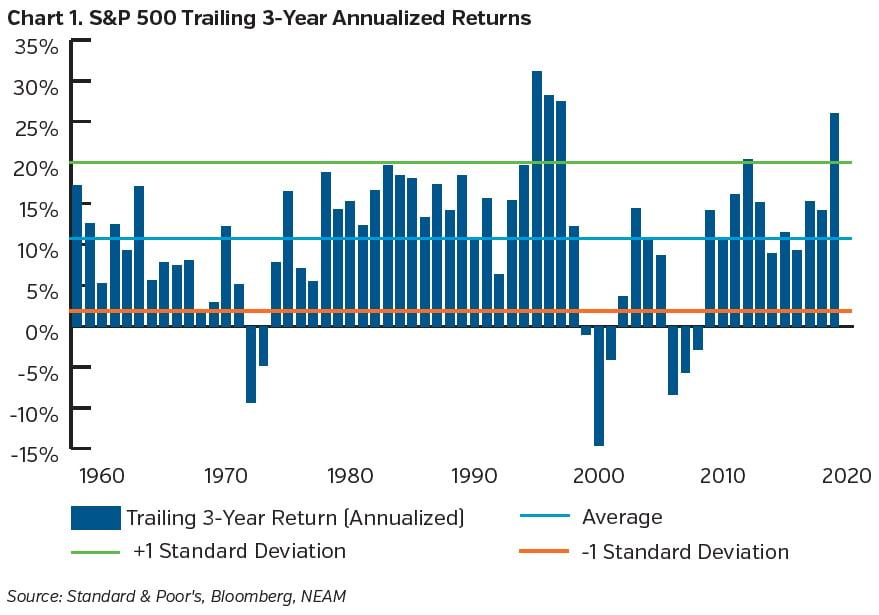

2021 proved to be a year of mixed fortunes in financial markets. U.S. stocks had another banner year with the S&P 500 returning 28.7%. This completes the hat trick which saw equity returns in double digit territory for three years in a row. It wasn’t merely double digits though. The annualized return for the S&P 500 was over 26% for the three years ended December 31, 2021. Sustained returns at this level are extremely unusual (see Chart 1).

U.S. large cap equities were again the leaders in the clubhouse with emerging markets bringing up the rear. The story in fixed income, however, was far different. In fact, we should begin the discussion with a sentence from our projected total return commentary from last year:

“If the Fed ultimately gets its wish for 2%+ inflation on a sustained basis, one of these years we will be projecting a negative rate of return for bonds (in the P&C industry).”

“Returns & Yields: Please Don't Stop the Music,” February 9, 2021

With huge Covid relief packages having provided a heavy dose of stimulus in 2020, and with the Fed still pumping dollars into the liquidity trough during 2021, we scarcely felt another stimulus bill was in order, nor did we put a terribly high probability on its passage. Then came the American Rescue Plan, a $1.9 trillion dollar behemoth which, in hindsight, appeared to provide the spark that finally lit the inflation candle. With consumers already flush with stimulus cash and stocks and housing values having rallied mightily, this last dose of largesse fueled the spending spree which now has the Fed and other central bankers squirming. This paired with Covid related supply disruptions had the combined effect of pushing input costs and consumer prices up by the highest amount in 40 years. With that as the backdrop, let’s review U.S. fixed income returns for 2021 along with our guesstimate from last year.

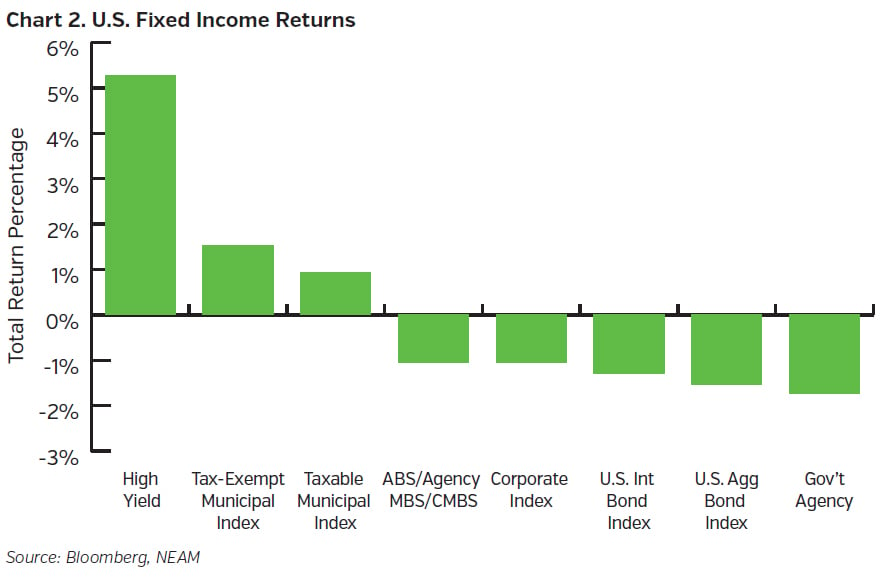

Below are last year’s returns for various sectors of the U.S. Fixed income market along with the Bloomberg Aggregate and Intermediate Aggregate (Chart 2).

These figures are in stark contrast to U.S. equity returns. The broad investment grade taxable bond market posted a negative total rate of return for the first time since the “taper tantrum” in 2013. High yield bonds had a respectable year as spreads tightened appreciably, and the municipal market also fared relatively well, at least posting figures that were north of zero.

Given our estimate of asset allocation within the P&C industry at the start of 2021, we estimate that investment grade fixed income total returns were in the neighborhood of minus 50 bps for the year. If the industry-wide allocation to high yield is included, the 2021 total return would be in the range of minus 20 bps, or a stone’s throw from zero.

With 2020’s industry returns ringing in at an estimated 6.50% to 7.00% and after a rapid journey down to zero on the Federal Funds rate in 2020, it was just a matter of time before the fixed income headwinds strengthened. Our estimate for last year was for a total return of ~+1.70 which represented our guess that spreads would continue to tighten modestly and that interest rates would be marginally higher. The economy recovered more rapidly than expected as vaccine supply filled in during Q1 and Q2, jump starting our efforts to put Covid-19 in the rear view. That combined with the additional round of powerful stimulus from the American Rescue Plan was enough to drive rates appreciably higher, sowing the seeds for a reversal in ultra-easy Fed policy.

Outlook for 2022

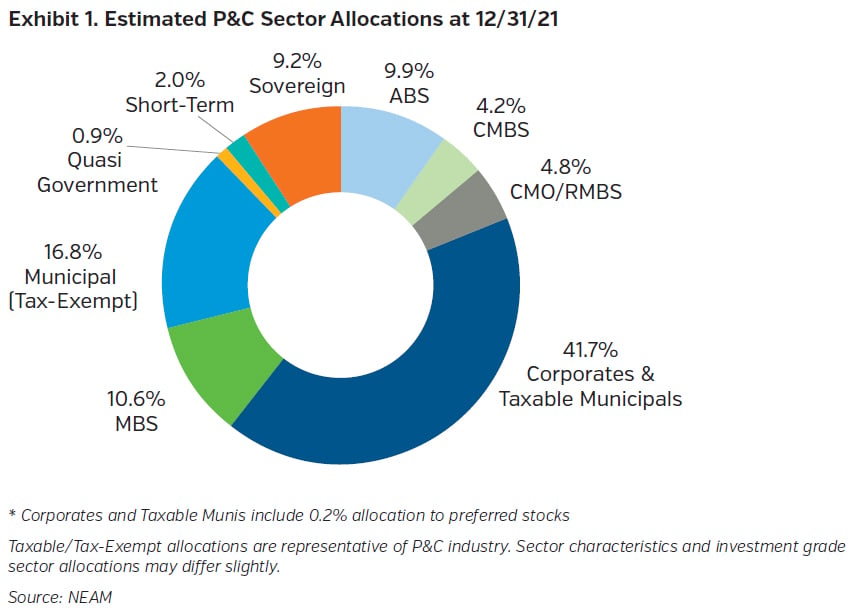

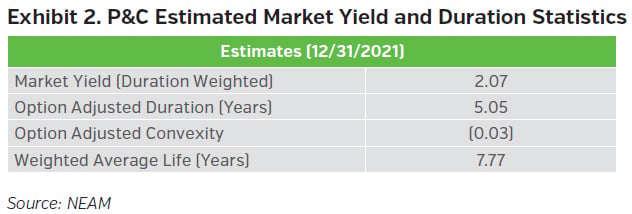

Below is our estimate of the P&C industry’s risk profile as of the end of 2021 (Exhibits 1 and 2).

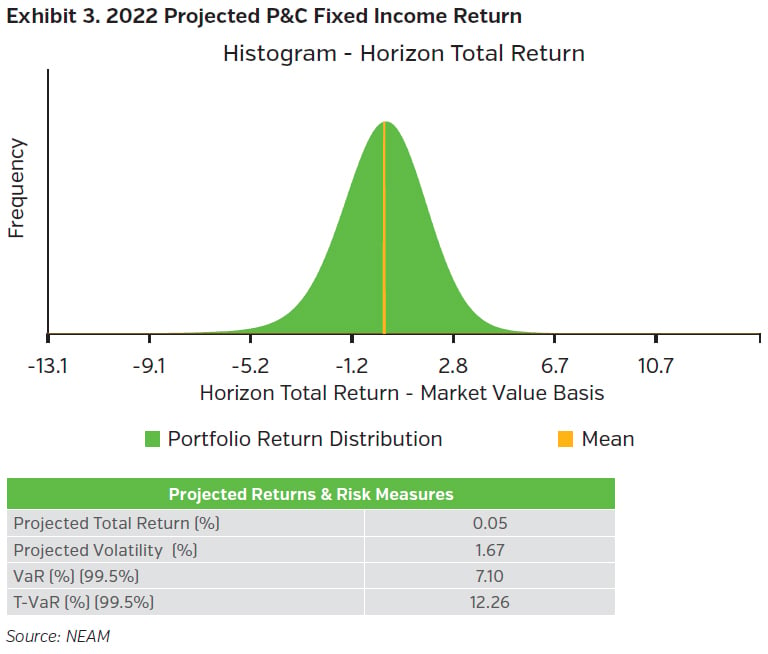

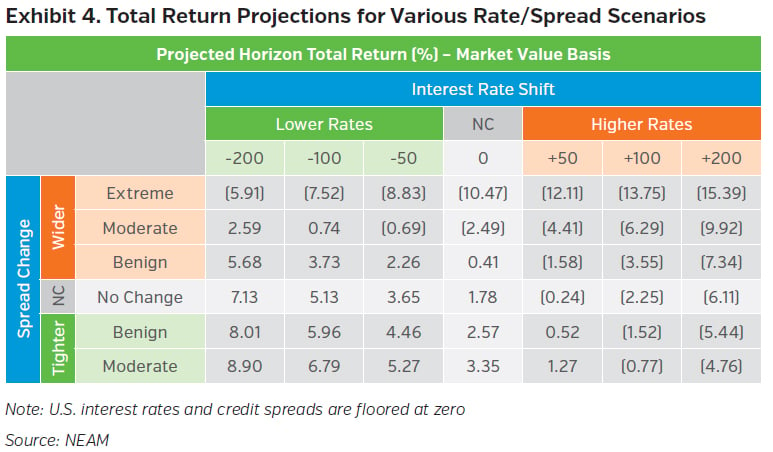

Using this sector allocation and risk profile, we derived an estimate of 2022’s industry returns along with a distribution of outcomes. Our estimate of fixed income total returns for the P&C industry for 2022 are highlighted in Exhibit 3. In addition, we’ve calculated estimated returns across a number of interest rate and spread scenarios. The results are contained in Exhibit 4.

As we finalized our estimates early in 2022, Treasury rates were backing up materially. While we don’t expect interest rates across the yield curve to continue to move sharply higher in the short to intermediate term, the path of least resistance for rates is now up with the Fed accelerating the end of quantitative easing and preparing to hike the funds rate at least a few times this year. Hence, at the moment, our projected return of effectively zero for 2022 seems like it might be generous. Rate increases (and negative price adjustments) will erode the coupon portion of returns materially. That said, however, higher rates, energy prices and consumer inflation are all applying the brakes to economic activity, just as the Fed embarks on its tightening cycle. Hence, while rates may have somewhat further to go, the markets have adjusted rapidly to the Fed’s changing background music.

Key Takeaways

- Our estimated fixed income return for 2021 of a meager 1.7% still proved to be too high given the demand created by monetary and fiscal stimulus, coupled with lingering supply disruptions due to Covid and logistical issues.

- 2022 is likely to be a year of moderating returns for financial assets with fixed income assets in the P&C industry likely posting total returns near zero. The probability of negative total returns is much higher than in previous years - basically a coin toss.

- We are focused on adding floating rate structured securities for the time being, as well as holding a bit more cash. We have minimized our participation in maturities longer than 10-years for several months and continue to do so for the time being.

- Interest rates have moved rapidly into what we believed would be a reasonable range for year-end 2022. We are proceeding with caution, as risk of an “overshoot” appears high.

- If rates move appreciably higher we will consider lengthening our duration but with credit spreads still quite tight and real rates still in deeply negative territory, such a move at present would be premature.

Please note that past performance is not indicative of future results. Expectations for 2022 are based on our capital market assumptions and are subject to change.

Estimates of P&C industry fixed income sector allocations and market yield and duration statistics in the charts and exhibits herein factored in S&P Capital IQ Pro data and other more recent market proxies. Return projections are based on a portfolio designed to resemble our aggregate P&C fixed income universe estimates. We assume numerous interest rate and spread environments. These returns are then probability weighted based on our firm’s capital market views (i.e. outlook for global growth, U.S. growth, central bank policy, fiscal considerations, etc.), which influences the expected level of returns and the distribution of those returns. Using statistical techniques, we create a distribution of returns which we then use to quantify portfolio risk and return. NEAM’s portfolio management tools utilize deterministic scenario analysis to provide an estimated range of total returns based on certain assumptions. These assumptions include the assignment of probabilities to each possible interest rate and spread outcome. We assume a 12 month investment horizon and incorporate historical return distributions for each asset class contained in the analysis. These projected returns do not take into consideration the effect of taxes, changing risk profiles, operating cash flows or future investment decisions. Projected returns do not represent actual accounts or actual trades and may not reflect the effect of material economic and market factors. Clients will experience different results from any projected returns shown. There is a potential for loss, as well as gain that is not reflected in the projected information portrayed. The projected performance results shown do not represent the results of actual trading using client assets but were achieved by means of the prospective application of certain assumptions. No representations or warranties are made as to the reasonableness of the assumptions. Results shown are not a guarantee of performance returns. Please carefully review the additional information presented by NEAM.