It is important for insurance companies to have well-grounded expectations for the coming year with respect to fixed income investment returns. In an effort to provide guidance to clients and others, we have used GR–NEAM’s proprietary return projection methodology to establish a realistic target for fixed income returns and a reasonable range of outcomes for fixed income portfolios of the U.S. P&C insurance industry for 2015.

We also share takeaways for these targets for the fixed income insurance investor.

Investment Environment

As we enter 2015, we are at an inflection point with regard to U.S. monetary policy. The Fed has ended its quantitative easing (QE) program and expectations are for a tightening of monetary policy starting in the first half of the upcoming year. Outside the United States, central banks in the Eurozone and Japan continue to use their own form of QE in an attempt to spur economic growth and to “inflate away” their heavy debt burdens. This very unusual set of circumstances makes the process of forecasting investment returns that much more difficult.

We are starting from a very low level of yields (how’s that for a statement of the obvious!). Global forces have combined to bring sovereign bond yields down pretty much across the board in the developed world. In addition, risk premiums are narrow by historical standards. In the absence of other considerations, this would imply a negative bias toward projected returns (greater likelihood of interest rates increasing and/or spread widening). However, one needs to keep in mind that there are a number of factors that could limit the upward bias for yields or even produce lower bond yields in the coming year (disinflationary forces, equity market volatility, geopolitical risks that create a safe haven bid, etc.). Recall that the consensus view was for higher rates as we entered 2014 and quite the opposite has occurred.

A major element that impacts the return projection-framework for 2015 is the monetary policy cycle in the U.S. The Federal Reserve has been clear that it is likely to begin raising interest rates sometime in the first half of the year. While the commencement of a tightening cycle in 2015 is quite likely, the pace and magnitude of rate increases are uncertain. In short, we are likely to have some modest upward pressure on the base level of yields in 2015 with a continued flattening of the yield curve driven by the Fed’s actions.

2015 Projected Returns

Our return projection is based on a portfolio of securities which closely resembles the aggregate P&C fixed income universe. We calculate total returns on the aggregate portfolio under numerous interest rate and spread movement assumptions. These returns are then probability weighted based on our firm’s capital market views. In this way, our assessment of capital market expectations influences the expected level of returns and the distribution of those returns.

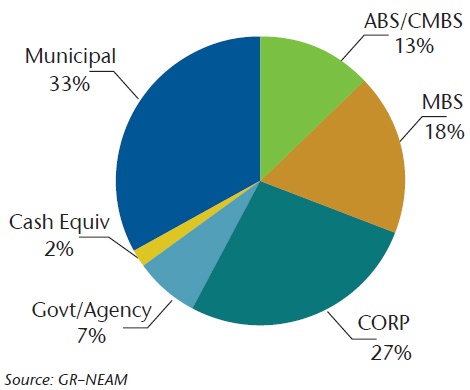

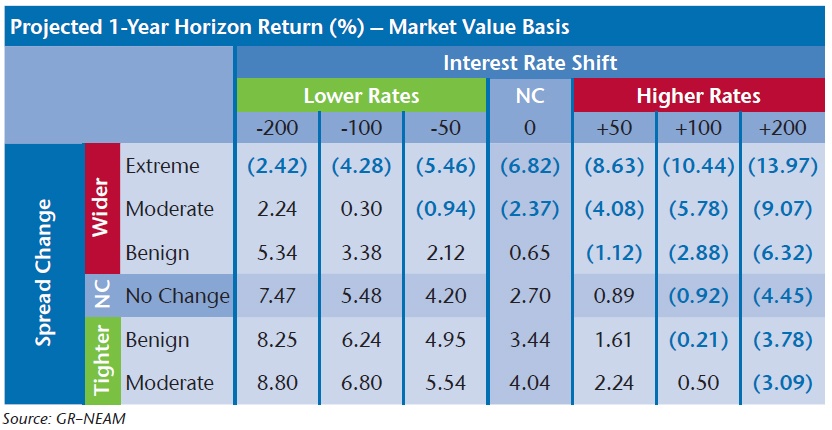

The characteristics of our aggregate P&C fixed income portfolio are represented below in Exhibit 1. Using this proxy portfolio and our expected return methodology, we calculated total returns across a range of rate and spread scenarios. Those returns are summarized in Exhibit 2 below.

Exhibit 1. P&C Industry – Approximate Sector Allocation

Exhibit 2. Projected Returns for Various Rate and Spread Scenarios

As shown in Exhibit 2, if interest rates, curve shape and credit spreads remain completely unchanged, we estimate a total return for the industry of approximately 2.70%. Instead, if interest rates rise by 50 basis points and spreads remain stable, our estimate drops to 0.89%.

Each cell represents the total return for the corresponding combination of rates and spreads. It should be noted that our model differentiates between fixed income asset classes with regard to spread widening. That is, an “extreme” spread widening is different for investment grade corporate bonds than it is for high yield or structured securities. Thus, we incorporate historical spread volatilities of each asset class when calibrating the impact of spread changes.

Our investment team has ascribed a probability to each of the outcomes above based on our assessment of the global economic environment, U.S. economic growth and relative valuation across fixed income sectors. Given the current level of rates, we’ve ascribed relatively low probabilities to outcomes which feature materially lower interest rates. Higher probabilities are ascribed to outcomes with modestly higher rates and stable spreads, reflecting our base case forecast.

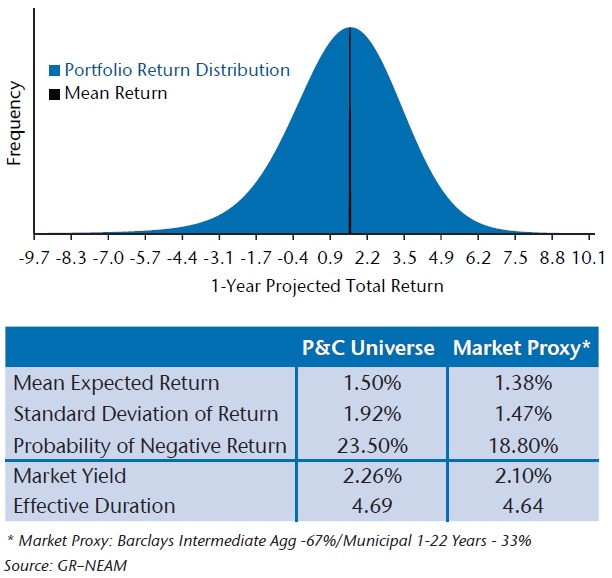

Utilizing statistical techniques, we then create a distribution of returns which is used to assess and quantify portfolio risk and return. Combining the returns above with our ascribed probabilities, we derive a mean projected return of approximately 1.50% with a standard deviation of 1.92% (see Exhibit 3 below).

Exhibit 3. 1-Year Projected Total Return Distribution and Risk Measures

Conclusions and Implications

With regard to fixed income returns, 2014 has surprised to the upside. Our forecast for 2015 is for returns to be much more muted. Our base case interest rate forecast is that 2015 will not bring much relief from low levels of interest rates and compressed spreads across fixed income risk sectors. Short-term Treasury rates should move modestly higher as the Fed begins to tighten monetary policy. The pace and timing of this will be very data dependent. We anticipate the recent precipitous drop in oil prices will manifest itself in even lower inflation readings in the not-too-distant future, thus providing the Fed even more leeway. We expect the long end of the curve to continue to be constrained by modest levels of global inflation and weak global economic growth. A flattening U.S. Treasury yield curve remains our base case outlook. Given the continued unprecedented global monetary support and elevated levels of geopolitical risk, we should expect 2015 to bring periods of higher volatility in the capital markets.

Takeaways

- Total returns from fixed income portfolios for P&C insurers are likely to be more muted in 2015 than in 2014.

- We estimate that the mean expected return for P&C fixed income portfolios to be 1.5% for 2015.

- Given the low level of rates and the possibility of rate hikes from the Federal Reserve, we estimate that the probability of a negative total return from P&C fixed income portfolios is nearly 1 in 4.