Financial theory has drawn from various scientific concepts including statistical and probability analysis, general equilibrium theory and, unfortunately, the Law of Gravity. Indeed, one might strike an analogy between securitization and Darwinism, considering the expansive application of structured technology since Lewis Ranieri created the first collateralized mortgage obligation in 1983. The evolution has been fitful, and securitization continues to suffer a bad reputation for its role (causation) in the 2008 financial crisis. Nonetheless, past experience has refocused attention on asset quality, bolstered credit support and other structural protections which, together with their currently attractive yield, diversification benefit, and shelter from corporate event risk, render structured products an appealing alternative in today’s market.

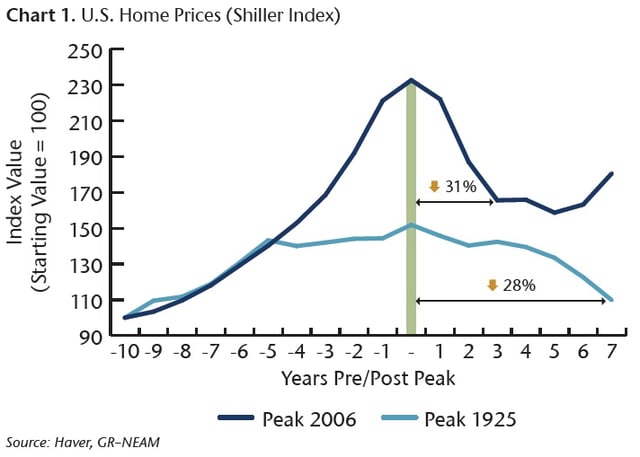

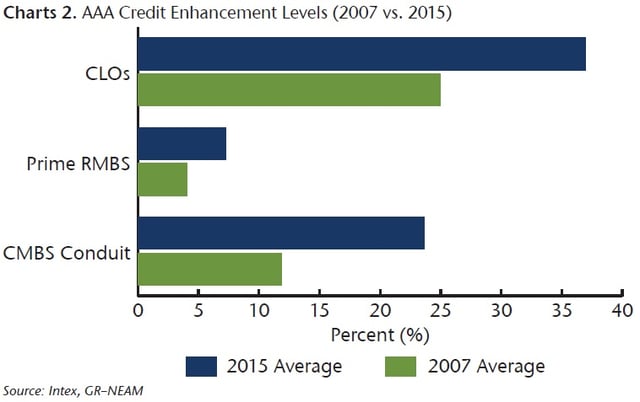

Evolutionary advances in securitization have manifest themselves through credit cycles, where “black swan” asset performance exposed vulnerabilities in the structures intended to insulate them. The 7-year peak-to-trough home price decline beginning in 1925 might well have done a reasonable job of indicating the downside housing stress in 2009 had it not been for unprecedented systemic leverage and the unproven nature of affordability loan products. A positive consequence of the Great Recession is that securitization structures have improved with more robust credit enhancement levels, simplified structures, and upgraded transaction features. In the words of Nietzsche (and Kelly Clarkson), “That which does not kill us makes us stronger.”

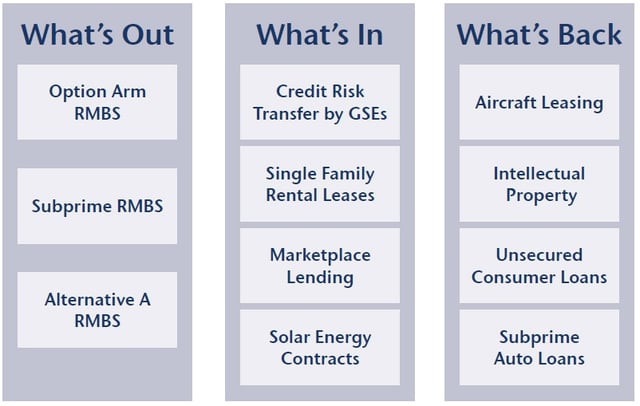

In a post-crisis world where lending standards have ratcheted tighter and bank risk capital has been redefined, securitization has stepped in to fill the void of traditional financing sources. New capital treatment of mortgage servicing rights for banks under Basel III gave rise to the acquisition of those assets by non-bank entities and funding via securitization. Novel structured asset types have emerged from the alternative energy sector (solar energy contracts) and housing collapse (repossessed homes converted to rentals). The result is a resurgence in esoteric ABS where investors should be able to extract incremental return for required asset due diligence and “early entrant” concession.

Another by-product of a changed regulatory environment is the well-publicized reduction in market liquidity. Higher and more granular risk based capital charges and the reporting of trade execution prices have squeezed dealer profits and reduced their trading footprint. Opportunistically, the new “liquidity frontier” presents an opening to investors with risk tolerance to provide (and potentially profit from) liquidity where others remain on the sidelines.

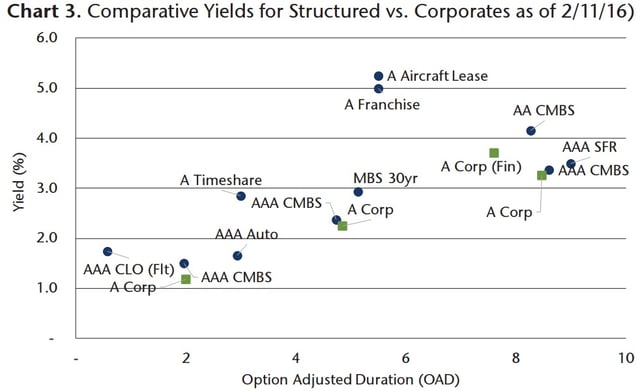

Elevated event risk in the corporate space has given investors good reason to seek out other fixed income alternatives. Many of the catalysts that drove merger and acquisition activity in 2015, including the strong dollar and anemic top line organic growth, remain firmly in place. Activist investors are flush with cash with the number of companies subjected to a public demand by an activist rising by 16% last year. Share buybacks are expected to continue to be used to rescue flat to low earnings growth and support equity market valuations. Structured securities can potentially offer investors a safe haven from these events through investments in high quality securities with attractive spreads, which in many cases generates higher yield for an equivalently rated corporate security. Furthermore, macro issues and dislocations in the energy sector are driving spreads wider in many other fixed income spread sectors, including structured securities. We view this spread widening as a buying opportunity, owing to the sector’s U.S. and consumer-centric credit drivers and highly diversified underlying pool characteristics.

Key Takeaways

As we consider the current landscape we conclude that:

- Post-crisis securitization structures are simpler, more robust, and better enhanced.

- Potential yield enhancement opportunities currently exist in non-benchmark asset types, subordinate structures, and secondary offerings.

- By their nature, structured securities are highly diversified and can offer incremental yield to corporates of the same quality rating while shielding against event risk.

In the context of a post-crisis, liquidity constrained, persistently low yield and volatile macroeconomic backdrop, investors who continue to evolve with the structured market should be rewarded with higher returns.