As insurance companies struggle with a low interest rate environment, managements have been looking for creative ways to stem the decline in fixed income book yields. The decline in book yield represents a decrease of nearly 135 bps from 2007–2008. This translates to lost investment income of nearly $12 billion1 for the P&C industry. The significance of the decline is twofold: first, the current low yield environment offers little additional cushion in the face of challenging underwriting conditions; and second, the timeline to restore these yields will take years even as long anticipated rising rates begin to occur. In this issue we examine the potential timing and magnitude of the anticipated further book yield degradation and eventual stabilization.

Current Yield Environment

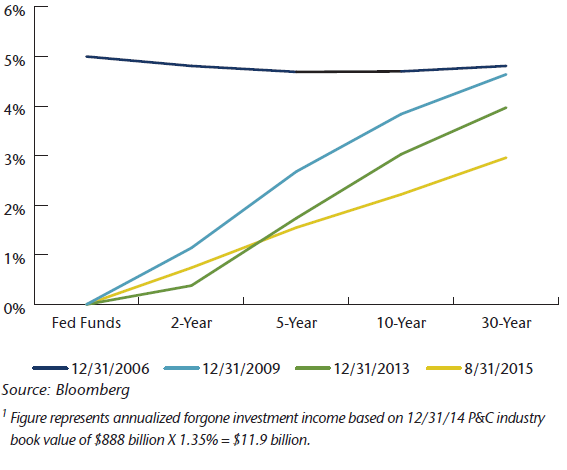

Interest rates have fallen broadly and remain at historic lows, as shown in Chart 1. This development has resulted from aging populations in advanced economies and debt levels that are too high relative to historic norms. These factors have all conspired to dampen global growth. Despite unprecedented monetary stimulus by the U.S. Fed, ECB and other central banks, low growth conditions persist.

Chart 1. Yield Curve Trend

Insurance companies are among the constituencies that have suffered the most, being forced to accept lower investment income. While the timing is unclear, higher interest rates would be welcomed by P&C insurers who expect to receive over $300 billion (over 30% of book value) in maturing cash flows by the end of 2017. We explore the trajectory of interest rates over the next 3 years and the important implications it has for the P&C industry’s future investment income.

Insurance companies are among the constituencies that have suffered the most, being forced to accept lower investment income. While the timing is unclear, higher interest rates would be welcomed by P&C insurers who expect to receive over $300 billion (over 30% of book value) in maturing cash flows by the end of 2017. We explore the trajectory of interest rates over the next 3 years and the important implications it has for the P&C industry’s future investment income.

Projected Book Yields

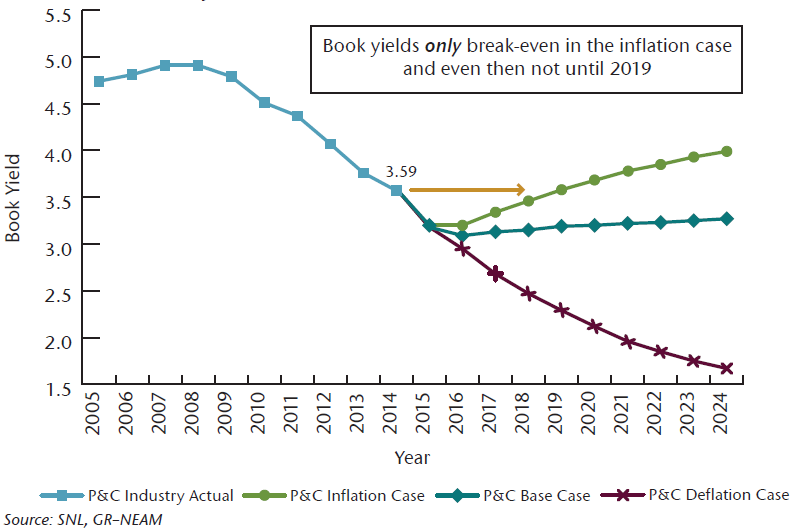

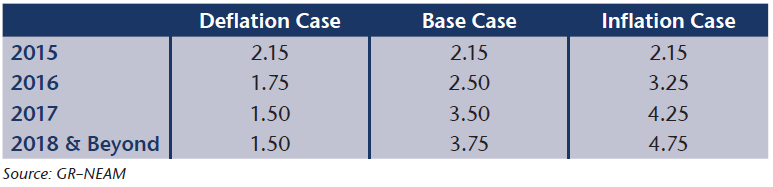

Chart 2 below shows historical and projected book yields based on 3 potential interest rate paths: a deflation case, base case and inflation case. Table 1 shows the reinvestment rate assumptions used in the forecast scenarios.

Chart 2. P&C Industry – Historical and Forecasted Book Yields

In the base case scenario, book yields do not return to year end 2014 levels over the next 10 years, despite the reinvestment rate assumption of 3.75% from 2018 on. We see book yields in this scenario bottom out at 3.09% at the end of 2016 before rising again.

Only an inflationary scenario (which, as we write this, seems remote) would result in a stabilization of book yields and even this stabilization would not occur until the end of 2019. The deflation case reveals degradation would continue for years to come.

Table 1. Reinvestment Rate Assumptions

Implications for Insurance Companies – Example

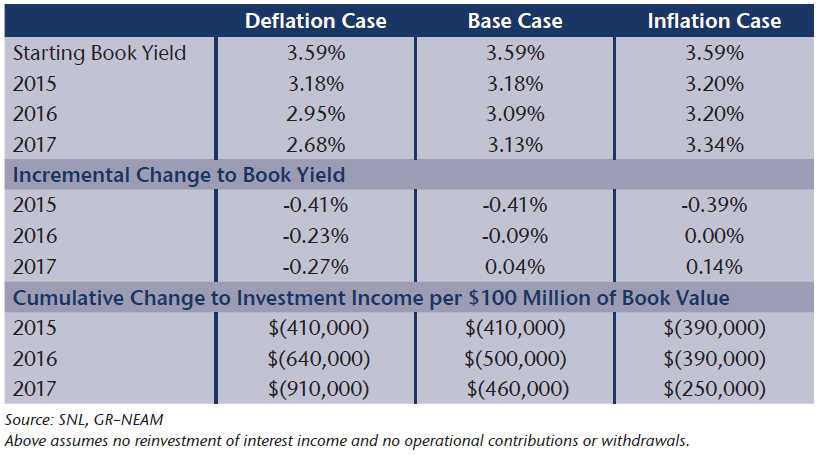

There is a measurable impact of having to reinvest at lower yields which leads to a lower margin of error for underwriting results. As older, higher yielding securities mature and the resulting cash is reinvested at market rates, investment income per dollar declines. Therefore, all else equal, insurance companies must save more in the future to earn the same investment income. If we ignore the benefit of future contributions and reinvested income to measure the efficiency of the existing portfolio, we note that forgone future income can be material, absent changes to existing portfolios.

Table 2 shows how the future investment income earnings power of a hypothetical $100 million portfolio declines as reinvested maturities lead to lower blended book yields. The impact in all cases is material at around $(400,000) in 2015 and cumulative declines over the next 3 years range from $(250,000) to $(910,000).

Table 2. Implication Example

Strategies to Mitigate Book Yield Degradation

In this environment, preserving and/or increasing book yields is paramount. Evaluating changes to investment strategies must be viewed within the context of overall enterprise risk tolerance as well as rating agency (BCAR) and regulatory constraints. Based on the analysis of interrelationships between our clients’ business lines and current investment opportunities, there may be opportunities for insurance companies to reconfigure portfolios to improve book yield profile without increasing enterprise risk.

A few examples of recent GR-NEAM investment policy conclusions to improve our clients’ book yields have included 1) rotation into long-dated municipals 2) addition of specialty asset backed securities and 3) addition of opportunistic corporate credits within telecom, media and energy industries. Actively managing portfolios to mitigate the coming decline in book yields will be critical to preserve future investment income and maintain a cushion for underwriting volatility.

Takeaways

- Book Yields have not hit bottom and will not return to the 12/31/2014 level for years to come

- Net investment income should decline in all presented scenarios until at least 2019, absent portfolio changes

- Opportunities to reconfigure portfolios to improve investment income should be considered within the context of enterprise risk management

GR–NEAM’s portfolio management tools have been utilized to provide the projected book yields based on certain assumptions. These assumptions include the reinvestment rates. These projected book yields do not take into consideration the effect of taxes, changing risk profiles, operating cash flows or future investment decisions. Projected book yields may not reflect the effect of material economic and market factors. Readers may experience different results from any projected book yields shown. Results shown are not a guarantee of future book yields. Please carefully review all of the information presented by GR–NEAM.