In revisiting our analysis of declining P&C industry book yields, this year we took stock of how closely the reported figures have followed our previous forecast. As we expected, 2017 was another year of book yield degradation for the P&C industry, despite the fact that the entire yield curve has risen over 50 bps since July of 2016 (much more in shorter maturities), providing a significantly better reinvestment rate. 2017 represents the 9th consecutive year of degradation but for 2018 we may finally see stabilization and perhaps even an increase in industry book yields.

In this issue we examine the anticipated stabilization and the trajectory of industry yields going forward.

Current Yield Environment

For years, insurance companies have struggled with a low interest rate environment forcing them to look for creative ways to stem the decline in fixed income book yields. At the same time, “legacy” assets with high book yields were paying off, fueling the slide. The decline in book yield represents a decrease of over 165 bps from 2007. This translates to lost investment income of over $15 billion1 for the P&C industry.

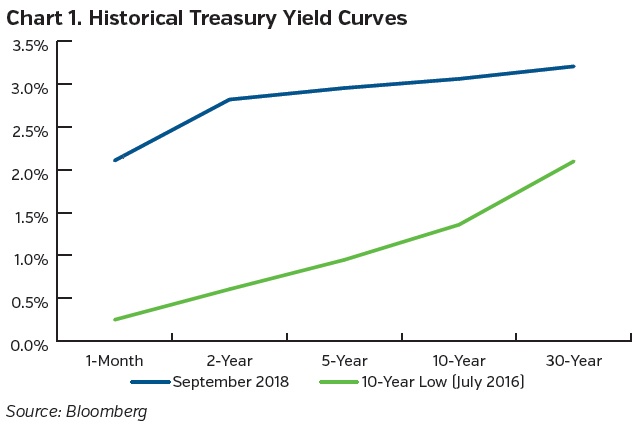

For 2018, stabilization and even future increases in book yield are anticipated. We expect this for two reasons. First, the current yield curve is higher compared to a couple of years ago when the 10-year U.S. Treasury yield was at a low (Chart 1). Second, most of the high book yield legacy securities had previously paid off, so this year’s current runoff is more from investments made within the recent low yield environment.

Insurance companies were among the many constituencies that suffered from depressed yields for a prolonged period of time. Current higher reinvestment rates are welcomed by P&C insurers who expect to receive nearly $300 billion (over 30% of book value) in principal cash flows by the end of 2020. While rising rates are welcome, the natural side effect is the advent of unrealized losses. Below we explore NEAM’s estimate for the trajectory of interest rates over the next 3 years and the important implications this has for the P&C industry’s future investment income as well as mark–to-market unrealized losses.

Projected Book Yields

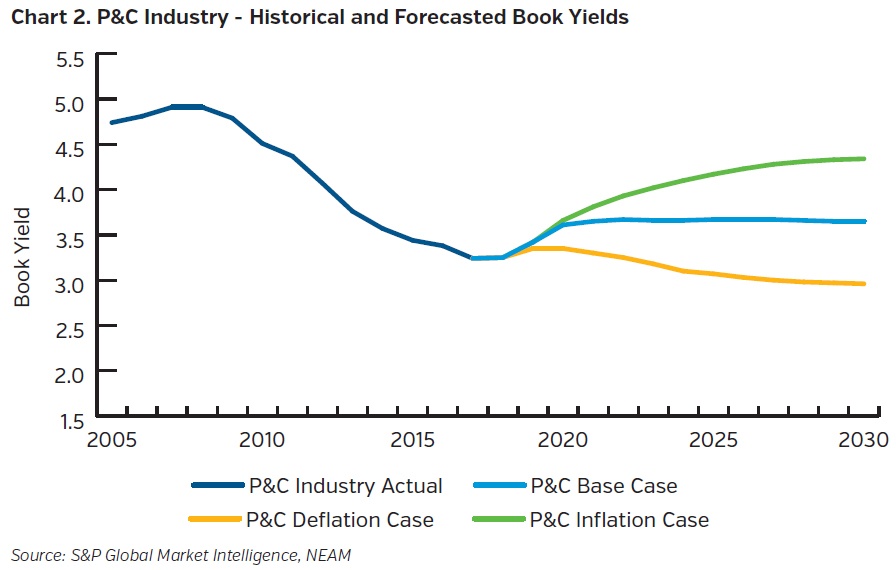

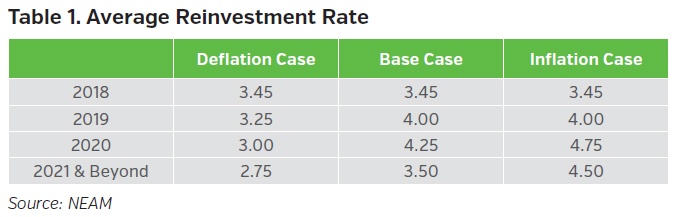

Using our Capital and Risk Analytics (CARA®) platform’s cash flow and investment income forecast modules, we have created an income forecast for the entire P&C industry. Chart 2 below shows actual historical and forecasted book yields based on 3 potential interest rate paths: a deflation case, base case and an inflation case. Table 1 shows the reinvestment rate assumptions used in the forecast scenarios.

In last year’s work, NEAM forecasted that the P&C industry’s book yield would drop to 3.30% (excluding cash) at the end of 2017. Actual year end 2017 book yield was 3.24%, a decline of 14 bps from the 2016 actual of 3.38% which represents more than $1.2 billion of lost investment income for the year.

This year we are forecasting that based on our reinvestment assumptions, industry book yield will be 3.25% at the end of 2018, the first increase in book yield since 2007. We observed that in 2017, insurance companies did not reinvest all cash flow runoff. Our forecast of 3.25% for 2018 assumes all runoff is reinvested, with the understanding that realized yields would be lower if that turns out not to be the case.

In our base case scenario, industry book yield peaks at 3.67% at year-end 2022 which is still lower than book yield for the industry as recently as 2013. Even in our inflation case, where the reinvestment rate is 4.5% in 2021 and beyond, it still takes until 2024 for the book yield to recover to year end 2012 levels. Perhaps the most interesting path is the deflation case which, bolstered by the 2018 rise in the yield curve, book yield does not show resumed degradation until 2020.

Investment Income vs. Unrealized Gains/Losses

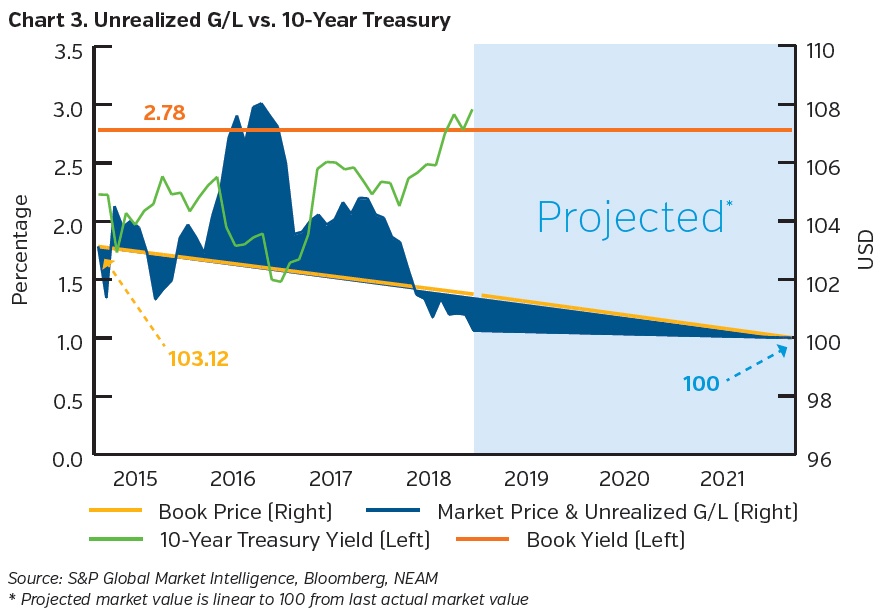

As interest rates rose in the latter half of 2017 and continued to rise in 2018, insurance companies are seeing more unrealized losses in their portfolios which is causing angst for some. However, the market value of a bond throughout its life has no effect on most bond’s book yield and investment income2 as shown in Chart 3. This chart plots the attributes of a simple fixed maturity bond that has experienced periods of both rising and falling interest rates. For purposes of this example, the bond was bought in  December 2014 at $103.12, resulting in a book yield of 2.78%. At the time, the 10-year treasury yield was 2.22%. As shown in the chart, as the 10-year treasury yield moved up and down, the market price of the bond did the inverse, as one would expect. For illustration purposes, book value below is derived using straight line amortization and the shaded area represents unrealized gains and losses. The book yield stays constant at 2.78% and investment income is approximately $28k per $1 million par every year, regardless of market price or interest rates.

December 2014 at $103.12, resulting in a book yield of 2.78%. At the time, the 10-year treasury yield was 2.22%. As shown in the chart, as the 10-year treasury yield moved up and down, the market price of the bond did the inverse, as one would expect. For illustration purposes, book value below is derived using straight line amortization and the shaded area represents unrealized gains and losses. The book yield stays constant at 2.78% and investment income is approximately $28k per $1 million par every year, regardless of market price or interest rates.

At maturity, the market price and the book price of the bond will converge to par regardless of the path of interest rates. P&C Insurance companies that are STAT filers will only realize gains or losses on NAIC 1 and 2 rated bonds if they dispose of them prior to maturity, so interest rate fluctuations would have no surplus implications. Also, in a rising rate environment, cash flows from the bond (and all bonds in their portfolios) are being reinvested at higher rates, assuming spreads are constant. Finally, based on NEAM’s forecasts, interest rates and the unrealized losses could be leveling off in 2019.

Strategies to Maximize Book Yield

In this environment, preserving and/or increasing book yields remains paramount. Evaluating changes to investment strategies must be viewed within the context of overall enterprise risk tolerance as well as rating agency (BCAR) and regulatory constraints. Based on the analysis of interrelationships between insurance company business lines and current investment opportunities, there may be opportunities for insurance companies to reconfigure portfolios to improve book yield profile without increasing enterprise risk.

Key Takeaways

- Book yields may have bottomed out and may improve in 2018. Correspondingly, unrealized losses have increased with rising interest rates.

- Opportunities to reconfigure portfolios and improve investment income should be considered while taking into account enterprise risk and tax considerations.

- We continue to assess and forecast Insurance companies’ investment income and book yields using NEAM’s CARA® platform.

- NEAM’s CARA® platform is a valuable tool when seeking to optimize portfolios to help maximize book yields for a given risk profile.

Endnotes

1 Figure represents annualized forgone investment income based on 12/31/17 P&C industry book value of $915 billion X 1.65% = $15.1 billion.

2 Structured and floating rate securities may have changes to book yields/values during holding periods based on market factors.

NEAM’s portfolio management tools have been utilized to provide projected book yields based on certain assumptions, including reinvestment rates. Changes to these assumptions may have a material impact on results. Projected book yields do not take into consideration the effect of taxes, changing risk profiles, operating cash flows or future investment decisions and may not reflect the effect of material economic and market factors. Readers may experience different results from any projected book yields shown. Results shown are not a guarantee of future book yields.