Unusual...

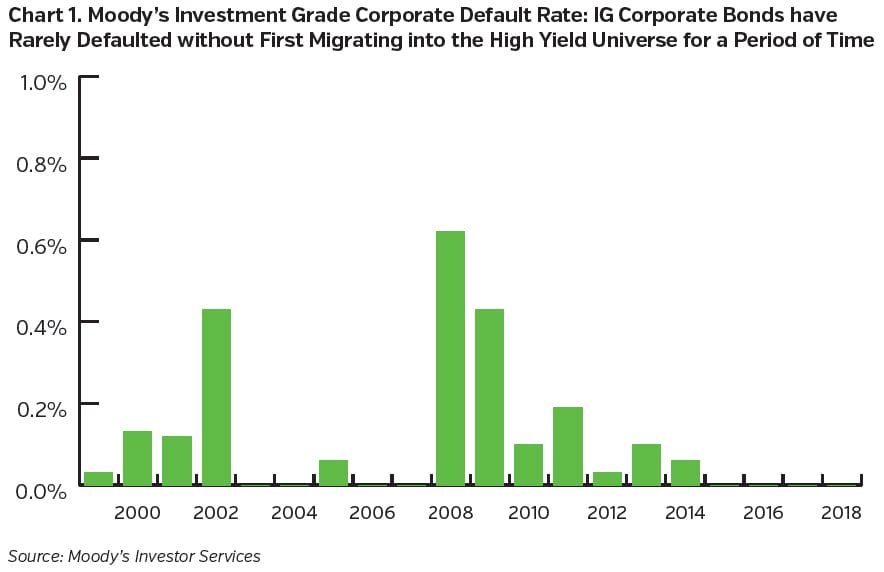

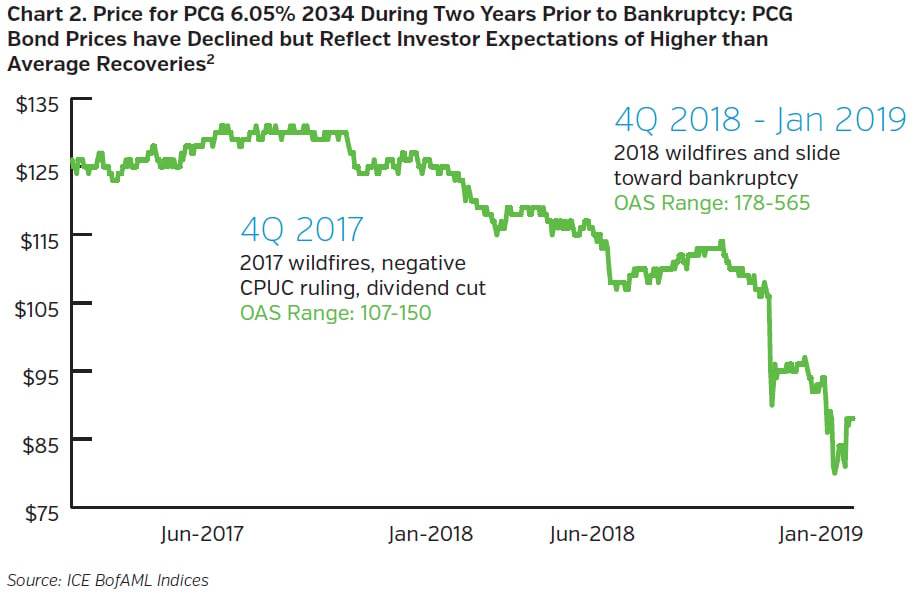

Pacific Gas & Electric Company’s swift fall into bankruptcy was certainly unusual. Bank of America’s analysts compiled some statistics on what they termed “investment grade defaults” after Pacific Gas & Electric Company (PCG) management announced that the utility and its parent company (PG&E Corporation) intended to file for bankruptcy protection. PCG’s January 2019 bankruptcy filing is just the 26th instance over the past 20 years in which a company has defaulted within a year of being included in the ICE BofAML investment grade corporate bond index, with PCG’s 2001 bankruptcy filing also on the list. Moreover, PCG’s bankruptcy filing marks just the 4th instance over the past 20 years in which a company has defaulted while still included in the investment grade index.

...But not entirely unforeseeable

The 2010 gas pipeline explosion in San Bruno and subsequent events and investigations highlighted, in our view, shortcomings in PCG’s management of operational and safety risks. A utility’s operational and safety track record, in addition to impacting the probability of a costly mishap, also has implications for regulatory support. The legal and regulatory environment in California, including the application of inverse condemnation,1 as well as the susceptibility of the state to large wildfires undoubtedly were key factors that drove PCG’s fall into bankruptcy. However, we believe that PCG’s checkered operating track record may have played a role in the company’s inability to secure more timely support from politicians and regulators, with recent safety investigations (“including resulting negative perceptions”) cited among a number of factors that the Board considered in deciding to file for bankruptcy.

A Bankrupt Company with a Market Cap of Approximately $10 billion?

PCG’s still substantial market cap is also unusual for a company that has initiated a bankruptcy proceeding. A regulated utility, of course, is different than many of the companies that file for bankruptcy; PCG continues to have a captive customer base. However, we find it interesting that the focus from many analysts is on wildfire liabilities as the key variable in estimating possible bondholder recoveries, with the enterprise value (from which these wildfire costs are deducted) treated almost as a given. While the stable, captive customer base should help to support the enterprise value of PCG’s utility operations, we believe that potential changes to the legal and regulatory environment in California (and potential changes to PCG’s corporate structure) will be key drivers of PCG’s enterprise value. We therefore believe that legislative and regulatory developments in the coming months (and years), in addition to the ultimate scale of wildfire liabilities, will be important determinants of the recoveries available to PCG bondholders, the value that might be available to PCG stockholders, and the enterprise values of other California electric utilities.

Might This Be a Harbinger of Future Utility Defaults?

While regulated utilities have had a low historical default rate, PCG’s bankruptcy filing should remind investors that, despite the generally defensive nature of the sector, one cannot be complacent in assessing potential risks for regulated utilities. Having said that, we do not believe that PCG’s challenges suggest an increase in risks for utilities operating outside of California. The scale of property damage due to recent wildfires has been much greater in California than in other states, with the combination of climate and property values suggesting that this will likely remain the case. In addition, the California Public Utility Commission (in 2017) set a higher standard than many had anticipated for recovery of costs for which a utility was found liable based on the doctrine of inverse condemnation. We believe that this currently challenging environment for electric utilities is unique to California.

Key Takeaways

- Pacific Gas & Electric Company’s quick descent from the investment grade rating universe into default was a very unusual event for the corporate bond market. Factors specific to the California regulatory environment and to the company were involved.

- We believe that recoveries for Pacific Gas & Electric Company bondholders remain uncertain, with the ultimate total of 2017 and 2018 wildfire liabilities, the amount of potential future wildfire liabilities, and possible changes to the legal and regulatory environment in California all important factors to consider.

- Notwithstanding regulatory and operational risks, we expect the regulated utility sector to remain resilient (when compared to most other segments of the corporate market) in the next downturn. We will continue to add utility credits to our portfolios as opportunities arise.

- We remain more circumspect with regard to California utilities. Pacific Gas & Electric Company’s bankruptcy is a reminder that investors cannot be complacent when investing in the regulated utility sector, particularly when considering companies that appear to have very concentrated risks, that appear to have outsized regulatory or operational risks, or that appear to have difficulty managing the risks inherent in the business.

Endnotes

1 The doctrine of inverse condemnation, as applied by California courts to utilities in the state, holds a utility liable for damages of which the utility’s equipment was the substantial cause, even if the utility is not found to have been negligent. The following excerpt from an SEC filing that PCG made in announcing the planned bankruptcy filing outlines the application of inverse condemnation to investor owned utilities regulated by the California Public Utilities Commission (CPUC):

“If the Utility’s facilities, such as its electric distribution and transmission lines, are determined to be the substantial cause of one or more fires, and the doctrine of inverse condemnation applies, the Utility could be liable for property damage, business interruption, interest and attorneys’ fees without having been found negligent. California courts have imposed liability under the doctrine of inverse condemnation in legal actions brought by property holders against utilities on the grounds that losses borne by the person whose property was damaged through a public use undertaking should be spread across the community that benefited from such undertaking, and based on the assumption that utilities have the ability to recover these costs from their customers. Further, California courts have determined that the doctrine of inverse condemnation is applicable regardless of whether the CPUC ultimately allows recovery by the utility for any such costs. The CPUC may decide not to authorize cost recovery even if a court decision were to determine that the Utility is liable as a result of the application of the doctrine of inverse condemnation.”

2 For comparison, Moody’s has calculated an average issuer-weighted recovery rate for senior unsecured bonds of 38% for the 1983-2018 period (based on trading prices following default).

3 This example is for illustrative purposes only and should not be regarded as a recommendation of any specific security or holding of any client account.