Regulatory Development

In November of 2012, the Treasury Market Practices Group (“TMPG”), an industry group sponsored by the New York Fed, announced “best practices” guidance for forward-settling agency mortgage backed securities (MBS). In keeping with the growing regulatory concern surrounding systemic risk, TMPG now recommends that parties post collateral, or margin, to mitigate counterparty risk owing to market value changes. The new regulation applies to the primary dealers (the twenty one trading counterparties of the New York Fed) and, by extension, to entities that trade with the primary dealers. The new guidance will apply to all trades with a contractual settlement greater than one business day (three business days for CMOs), with implementation targeted for January 1, 2014.

Background

Most purchases and sales of agency mortgage-backed securities (MBS) are transacted in the TBA (“To-Be-Announced”) market and typically settle on a specified date each month. This market structure exposes the investor to counterparty credit risk in the event that a trade fails to settle, potentially resulting in losses due to changes in market value. Margining is prevalent in the Treasury futures, commodities, and OTC derivatives markets where central clearing is common practice. However, periods of recent market stress (failure of Lehman Brothers in 2008) have supported the greater use of margining on a bilateral basis. In the large ($5 trillion) MBS market, it is estimated that up to $1.5 trillion in unsettled transactions are outstanding at any time. Hence, the risk to the system posed by a potential failure of a large counterparty has become an area of concern and focus of the TMPG.

Master Securities Forward Transaction Agreement (“MSFTA”)

An industry standard template, called the Master Securities Forward Transaction Agreement (“MSFTA”), outlines the terms and conditions governing collateral eligibility, timing and frequency of margin calls and exchanges, thresholds, valuation of exposures, events of default, and liquidation. Since the MSFTA is negotiated on a bilateral basis, the specific terms and conditions will vary among institutions and counterparties.

In executing the MSFTA, an important consideration for asset managers and their clients is the “Principal-Agent” concept. While the asset manager enters into the forward-settling MBS trade on behalf of the client as permitted under the existing Investment Management Agreement (“IMA”), the ultimate obligations under the MSFTA are the responsibility of the client, with the asset manager acting as the client’s agent. Specific evidence of this legal authority is required under the MSFTA and by the counterparty (dealer).

Mechanics of Variation Margin

Operational requirements under the MSFTA are not trivial. Dealers and customers will be required to measure forward exposures, mark open positions, calculate margin, issue margin calls, and deliver and receive collateral. As a matter of good practice, parties may also need to put into place arrangements for segregating funds posted as margin, such as a designated collateral margin account.

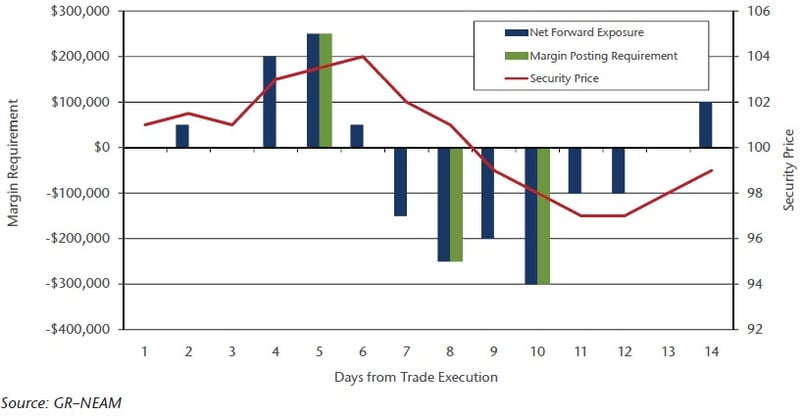

The TMPG recommends daily mark-to-market of outstanding positions to determine net forward exposure (“variation margin”) subject to a minimum transfer amount (“MTA”). Chart 1 illustrates the margining requirement for a hypothetical $10 million TBA trade using the standard $250,000 MTA.

Chart 1. Variation Margin on $10 Million TBA Trade (Execution Price = $101)

In this example, a $2.5 price deviation requires posting of margin, which raises the question as to the historical price volatility that would have given rise to a margin call. Chart 2 depicts the 20-day price change for the Fannie Mae 3% coupon since January 2009. The data show that the dollar price change exceeded a $2.5 band in 9.57% of the 1,139 observations. Given this level of price volatility, we might conclude that trades in excess of $25MM, for example, have a reasonably high likelihood of regular and ongoing margin posting, while trades of less than $5MM, for example, would be much less susceptible to a margin call due to the fixed nature of the minimum transfer amount ($250,000 in this example). It is important to note that the current guidance makes no exclusion for account or position size. In other words, an executed MSFTA is required to be in place for all counterparties facing a primary dealer, whether or not margin posting is likely to occur.

Chart 2. FNCL 3.0% Coupon Rolling 20-Day Price Change

Market Impact

The TMPG has mandated that primary dealers be “substantially complete” with their implementation by December 31, 2013. The TMPG has not provided guidance as to whether primary dealers will be permitted to continue to trade with customers on forward-settling contracts without an executed MSFTA after January 1, 2014.

In our view, the market structure could look quite different under the new margining regime, and may result in unintended consequences. Customers who are unwilling or unable to enter into an MSFTA may be precluded from participating in the TBA market, relegating these accounts to securities available on a short-settle basis, or trading with partners who are not primary dealers. This could result in diminished liquidity, higher cost access to the MBS market and potentially adverse selection in the remaining pools available on dealer inventories.

Impact on MBS Investors

Based on GR–NEAM’s market outreach, both investors and dealers appear to be challenged by the documentation process and infrastructure needs required to comply with the new margining rules, suggesting that for many the actual implementation time frame will extend beyond January 1, 2014. Practical considerations, such as the lack of a standard pricing source for calculating margin amounts, have raised concerns. Another uncertainty is the resulting change in market structure and impact for investors who choose to operate outside of the typical “regular settlement” framework.

The TMPG has concluded that market efficiency and financial stability will be enhanced by more widespread practice of margining, and is committed to applying these new rules across the entirety of the market. While the timeline and scope for the new rules appear aggressive, the TMPG has not indicated any deviation from the targeted year end implementation date. In the meantime, the countdown to year end continues as market participants contend with putting their procedures in place and preparing to digest the impact of the new practice.