Executive Summary

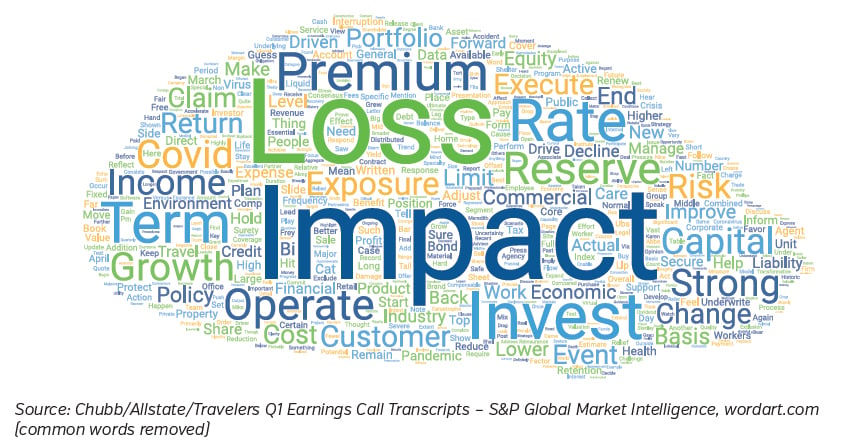

The Property & Casualty (P&C) insurance industry is arguably in the most uncertain position in recent memory. Seldom has the industry been faced with such fundamental challenges – ranging from a remote workforce and legislative and legal actions to weakened near-term demand.

Uncertainties in insurance pricing and premium volume coincide with worries about investment portfolio performance, and together they drive competitive behaviors (including those of the third-party capital providers) in the marketplace.

Faced with wide-ranging business scenarios, we believe that generally the best approach is for insurers to focus on maintaining robust capital and liquidity positions. To this end, conducting extensive scenario and stress testing on both sides of the balance sheet is key.

Many P&C insurers would also benefit from re-evaluating their investment strategy, taking into account the changing and uncertain outlook for underwriting.

UNCERTAINTIES ABOUND

To recap, what has happened in this global pandemic so far:

- COVID-19 presents the biggest healthcare, economic and societal challenge in recent memory.

- The challenge will persist for many more months, unless a major medical breakthrough is achieved quickly and deployed swiftly to the general population. Vaccines are being developed and tested at speed, but even in the best-case scenario, questions remain regarding availability and efficacy.

- The recent lockdowns and potential future lockdowns are expected to bring economic impact that is unprecedented and far reaching.

- Decisive fiscal and monetary measures have calmed the financial market and softened the immediate economic impact.

In our conversations with P&C insurance companies, the following factors are highlighted as causing major uncertainties:

- How will the actual claims experience differ from the expectation, especially after allowing for natural catastrophes, litigation and legislative actions? The last thing that the industry needs is an above-average natural catastrophe year, which could serve to compound all the challenges insurers are already facing.

- What is the sufficient level of premium to charge for new business, based upon the underlying risks? These risks could be highly unpredictable given the varying lockdown prospects.

- How will premium volume be impacted?

- How will competitors, including third-party capital providers, react?

- What happens to investment yields from here on? What will the credit default experiences be like, and where will the equity market go from here?

INVESTMENTS – STARK CONTRAST TO ECONOMIC REALITIES?

Some might suggest things are back to normal on the investment front: equities have bounced back strongly bar stocks in certain sectors, and bond spreads have narrowed with booming issuance, as the Federal Reserve and fiscal authorities have calmed the markets and boosted confidence.

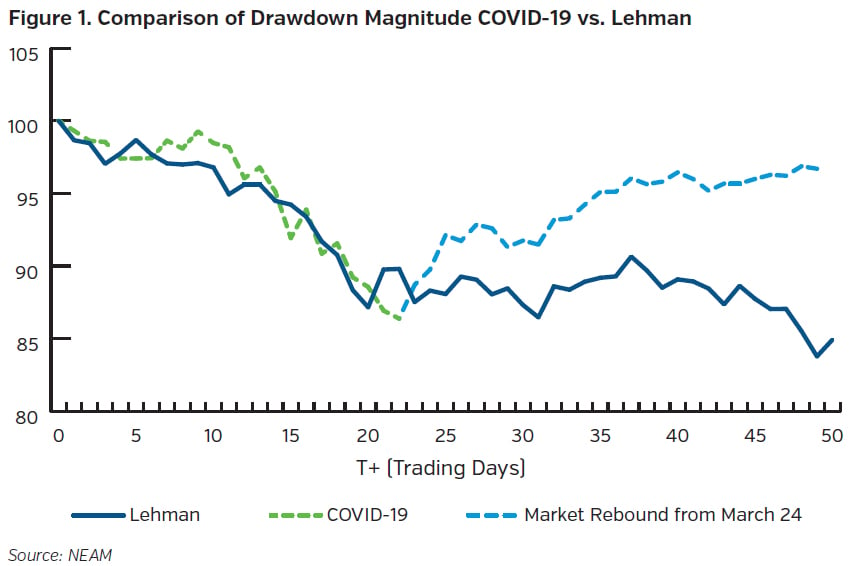

This is especially evident if we compare the last few months to the initial period following the Lehman bankruptcy.

In Figure 1, we took the year-end 2019 U.S. P&C industry asset allocation (excluding affiliated investments) and held it constant, to compare the magnitude of the drawdowns. While market values fell in 2008 by close to 15%, roughly matching the post-COVID reaction, the market values swiftly recovered this time to within 3.3% of the levels as at February 21st.

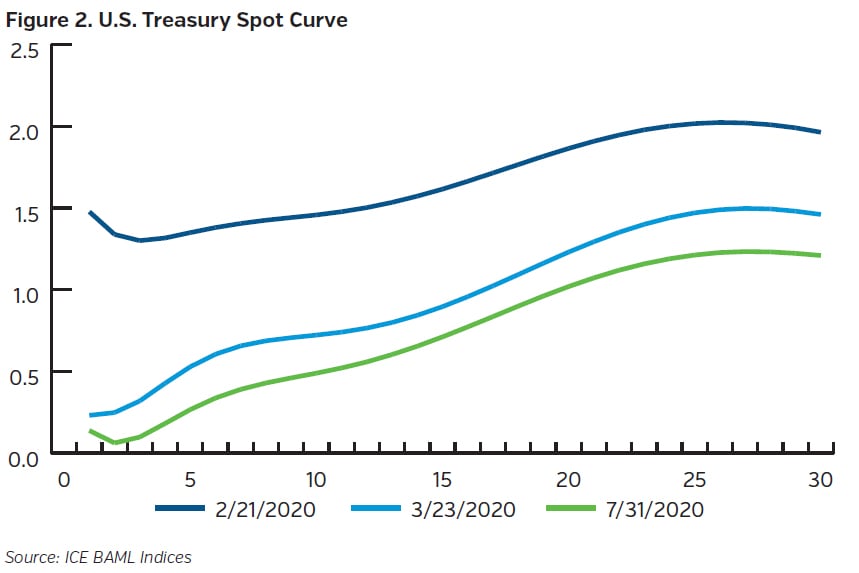

However, one only has to look at the treasury yield chart to see that all has changed. No one can confidently predict how this episode will turn out, as both the lockdown situation and the pace of the economic recovery are up in the air. For now, it’s probably wise to assume that there will be more challenges to come further down the road, though the Federal Reserve and central banks globally are unequivocally supporting asset valuations.

WIDE RANGING SCENARIOS ON BOTH SIDES OF THE BALANCE SHEET

Based on recent filings, listed insurers have expressed varying views on the market outlook. While certain lines of business are attracting lots of attention and there are cautionary comments on business volume and claims experiences, the consensus seems to be one of optimism on new business pricing. The sustainability of pricing improvement of late remains to be seen.

On the investment side, some listed insurers disclosed adding to equity and credit holdings in February and March, while some de-risked the investment portfolio before or during the market event, and still others made very few changes to their investments. Many have also taken deliberate steps to preserve or enhance liquidity to meet requirements from business operations, such as halting cash reinvestment and shortening portfolio duration. One common theme is that all are alert to the heightened credit downgrade and default risk within certain corporate sectors.

The recent financial market volatility has clearly provided insurers with a live stress test to the balance sheet strength. Now that additional information is becoming available regarding the underwriting and claims prospects (though still lacking clarity and certainty), it would be prudent to take stock, and re-evaluate the enterprise risk exposure.

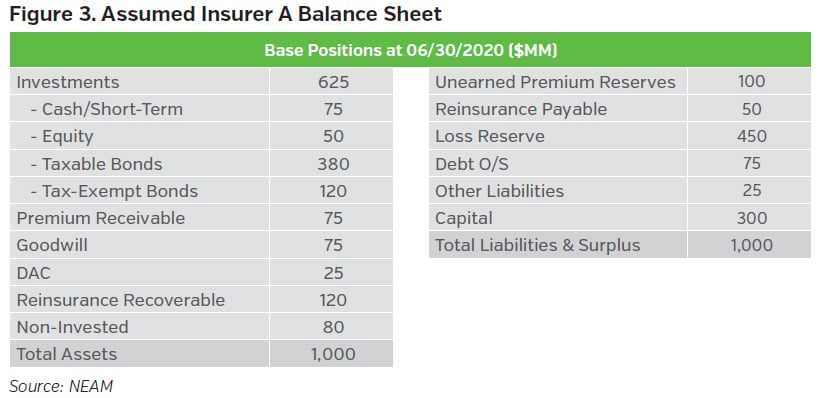

To illustrate the importance of conducting stress and scenario testing, we have developed a case study for Insurer A, beginning with Figure 3.

On the asset side, the base case assumes current market conditions and normal forward investment assumptions; the stressed scenario assumes further downward movement in Treasury yields, widening credit spreads, plus a 30% drawdown in equities in 2020.

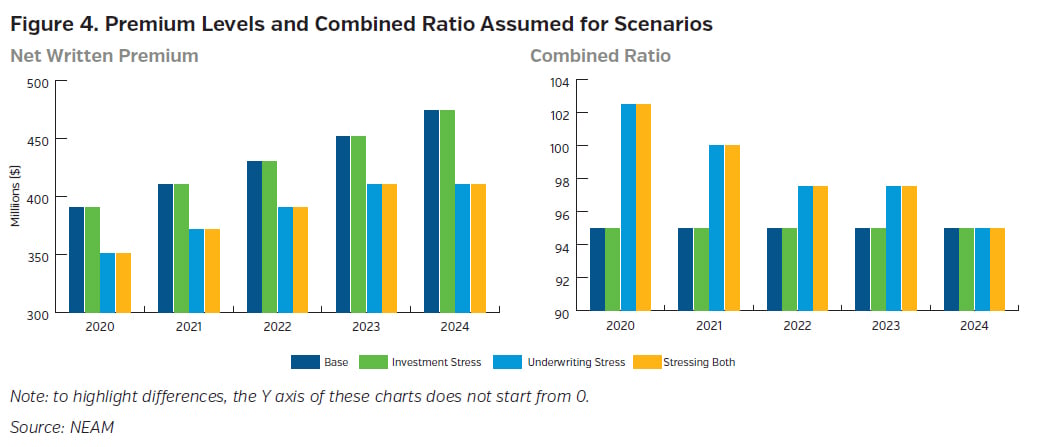

On the underwriting side, the base case assumes 5% growth p.a. at 95% combined ratio with normal pay-out patterns, and the stressed scenario assumes lower premium, higher combined ratio and accelerated pay-out patterns (an additional 10% of the overall claims are paid out in the first two years).

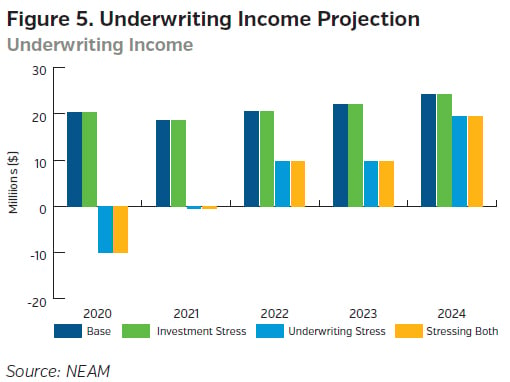

The impact from strained underwriting conditions can be seen in Figure 5. Underwriting income reduces from the base case dramatically in 2020, before starting to recover gradually.

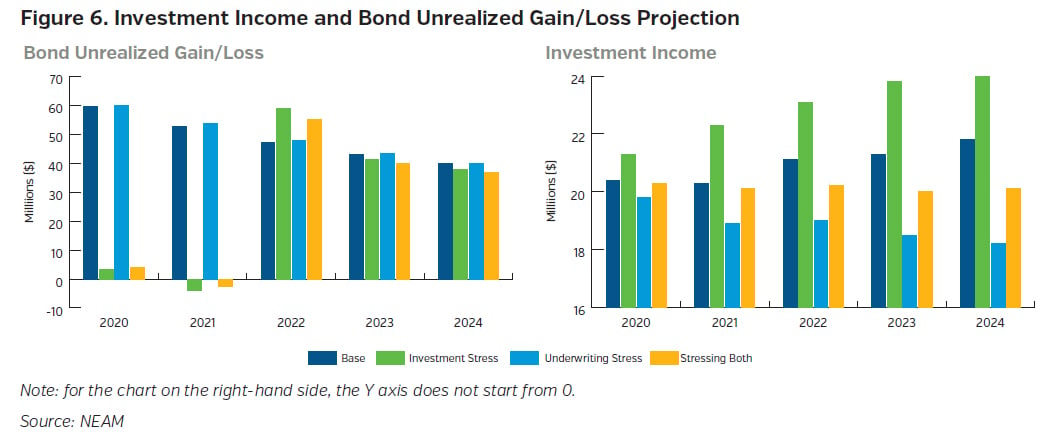

On the investment side, the impact from widening credit spreads more than offset the assumed additional reduction in Treasury yields, resulting in unrealized gains vanishing under the investment stress (see Figure 6). However, the higher spread allows Insurer A to reinvest net cash flows at higher rates, thus improving investment income (by 10% in 2022 for example). Heightened combined ratio and reduced premium levels have implications here also, with the 2022 investment income for the underwriting stress scenario being 10% lower than the base case.

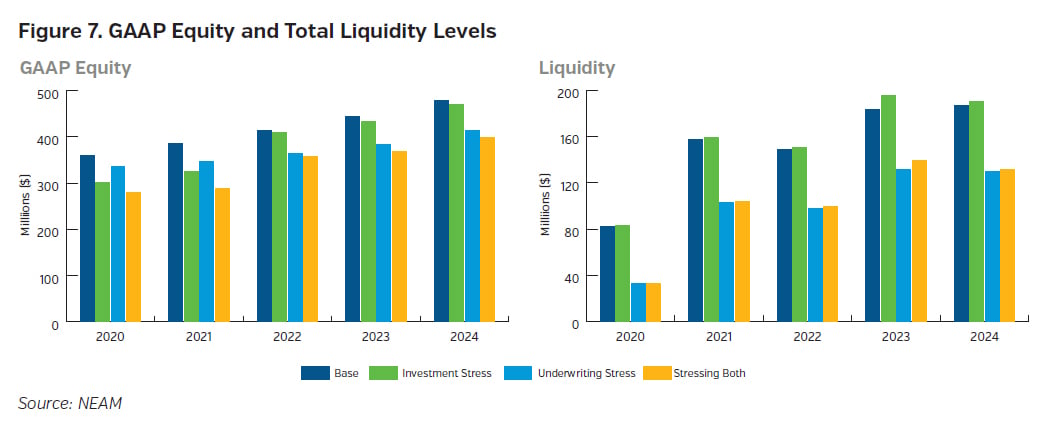

Putting the two sides of the balance sheet together, let’s look at GAAP equity levels, as well as the total liquidity available (see Figure 7). Under the assumed scenarios, the equity level deteriorates by 25% in 2021 in the most severe stress. The deterioration rebounds to below 20% in outer years. Insurer A might want to carry out “reverse stress testing”, to work out what underwriting and investment conditions would push solvency positions to its internal limits. This will help it to consider contingent options to boost solvency positions.

The total liquidity indicates cash available to pay claims. Insurer A is projected to hold $82m cash at year-end 2020, though underwriting stress consumes an additional $50m, reducing the total liquidity to $33m.

FOCUS ON CAPITAL AND LIQUIDITY POSITIONS

A negative liquidity number indicates a need to raise cash by selling down invested assets so that claims can be paid. In Insurer A’s case, the higher combined ratio and accelerated pay-out patterns serve to push down the liquidity position sharply in 2020. To restore its liquidity position, Insurer A may want to pre-emptively raise more cash by selling some investments at timings of its choosing, holding off reinvesting some cash inflows, or by revising the investment strategy.

Being forced to boost capital and liquidity positions (such as taking on additional reinsurance, and de-risking the investment portfolio) can be highly undesirable and sometimes very costly. The timing of such actions is typically outside of the control of the insurer, which can exacerbate any potential negative impact. Therefore, we advocate that insurers prioritize creating or maintaining robust capital and liquidity positions.

For P&C insurers, the primary focus in navigating the wide-ranging scenarios is to ensure that they are not forced into taking unfavorable actions. This means preserving the maximum amount of optionality, which dictates that the capital and liquidity positions could withstand the test of the stresses, as well as support exploiting opportunistic activities on both underwriting and investing.

For different firms, the “pinch point” will vary. For some, the most beneficial course of action is a revamp of the reinsurance program. Others may want to resort to contingent liquidity sources available to them, or even utilize financing options.

KEY TAKEAWAYS

- P&C insurers face uncertain and potentially challenging conditions in both underwriting and investing.

- It is essential for each firm to evaluate the balance sheet under a wide range of scenarios, so that actions can be planned, or even taken pre-emptively, to protect solvency and help ensure sufficient liquidity.

- Based on a firm’s latest assessment of future scenarios, a re-evaluation of the investment strategy may be appropriate.

HOW NEAM COULD HELP

NEAM’s Enterprise Capital Strategy services incorporate all aspects of enterprise objectives and parameters (including underwriting outlook and reinsurance arrangements), and can assist insurers in evaluating the investment asset allocation decisions in today’s uncertain environment.

Specifically, the Financial Scenario Projections tool can subject the whole balance sheet to various stresses and scenarios, and the Enterprise Based Asset Allocation™ (EBAA™) process is able to assist P&C insurers in deciding the risk capacity of the investment portfolio.

NEAM’s portfolio management tools utilize deterministic scenario analysis to provide estimates of net written premiums, combined ratios, underwriting/investment income and other portfolio metrics in the case study herein based on the prospective application of certain assumptions. No representation or warranties are made as to the reasonableness of these assumptions. Projected results are for illustrative and informational purposes only to convey the applicability of stress/scenario testing and do not represent actual accounts or trading and may not reflect the effect of material economic and market factors. Clients will experience different results from any projected information shown.