The Detroit municipal bankruptcy in 2013 was the largest in U.S. history, by far. Eighteen months and $170 million in legal fees later, the beleaguered city exited bankruptcy. Monetary losses were spread across creditors, including deep cuts for certain classes of bondholders. This landmark case offers a very public and large glimpse into the murky world of municipal bankruptcy.

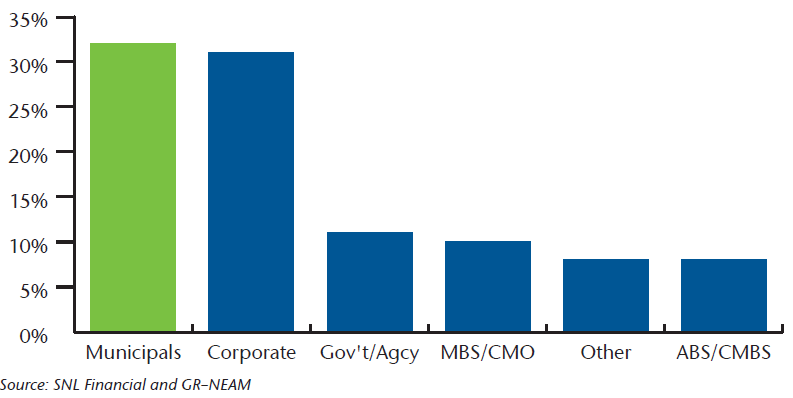

The Detroit experience (as well as other recent municipal bankruptcies) provides us with “data points” on a topic with limited precedence. Although municipal bonds are just 10% of the overall U.S. bond market they do account for a much larger proportion of P&C insurance company investment portfolios (see Chart 1).

Chart 1. P&C Industry - Fixed Income Allocation 2013

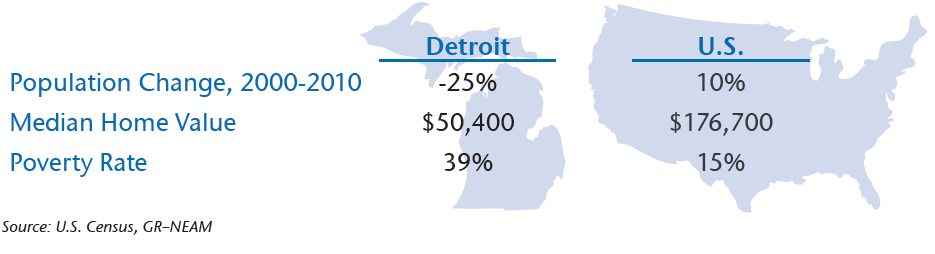

Chart 2. Census Data - Detroit vs. U.S.

What are the implications of Detroit for the municipal bond market? What are the key takeaways? And, is Detroit a harbinger of things to come?

As background, bankruptcies in the municipal bond sector are very rare and have historically been concentrated in project-oriented sectors such as housing and healthcare. In recent years, however, there has been an uptick in general government bankruptcies. Unlike a failed hospital or housing project, a bankrupt city does not close down and get liquidated…the dynamic is very different. Politics and public policy come in to play, which does not always bode well for bondholders.

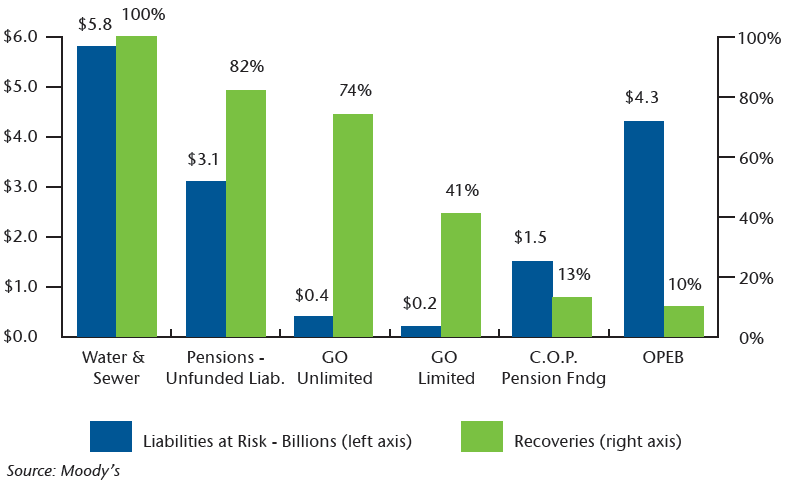

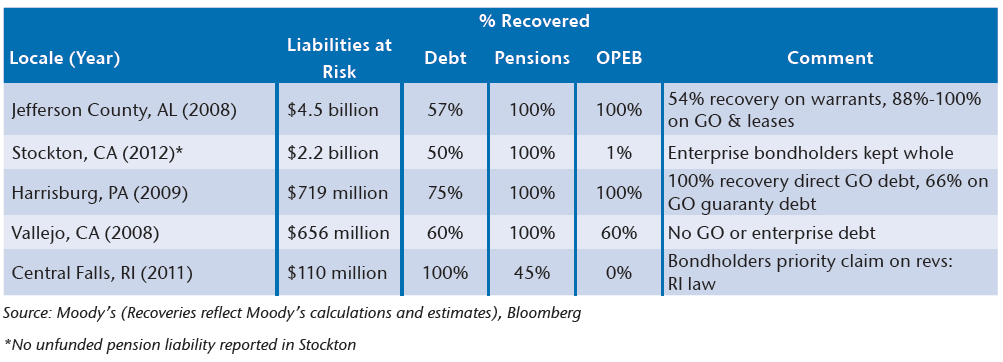

As illustrated in Chart 3 and Table 1, bondholders have proven not to be the unequivocal top repayment priority in recent cases of municipal bankruptcy (despite some preconception to the contrary). Workers and retirees have arguably fared the best, but they too have made concessions.

Chart 3: City of Detroit – Liabilities and Recoveries

Table 1: Other Relevant Municipal Bankruptcies

Key Observations

- Revenue Bonds Protected: Consistent with U.S. Chapter 9 bankruptcy code, revenues pledged for repayment of enterprise debt were kept secure. This upholds a key tenet in the municipal credit underwriting process and is significant because most of Detroit’s bond debt was that of the Water & Sewer Department. However, despite the positive outcome, enterprise bondholders were not truly immune from the debate. Prices on Detroit W&S bonds dropped considerably and credit ratings were cut to junk as the case unfolded.

- Workers and Retirees Sharing the Pain: Once considered sacrosanct, pension benefits are proving not to be protected in federal Chapter 9 bankruptcy, despite the constitutional protections that exist in many states. In Detroit, pensioners incurred losses, but to a far lesser degree than the bonds issued to fund the pension plan. Notably, a federal judge in the Stockton case also ruled that pensions could be cut, but the city chose to keep pensioners whole in exchange for the elimination of OPEB benefits.

- General Obligation Bond Losses: General Obligation (GO) bonds have long been considered the gold standard in the municipal bond market, the flagship debt instrument of most municipalities. There is very little precedent for losses on rated GO bonds as debt service is secured by the taxing power of the municipality, typically without limit. The emergency manager in Detroit, however, argued that an unlimited tax GO pledge is not tantamount to a lien on taxes.

- Not All Bonds Created Equal: Enterprise bonds fared better than GOs and leases in these cases. Does this mean that all GOs and leases are inherently riskier than revenue bonds? No, not necessarily. Legal security should be considered in the context of an issuer’s underlying credit quality. Ironically, lawmakers in beleaguered Puerto Rico are protecting their governmental credit (GO, etc.) at the expense of certain special revenue enterprise credits.

What’s Next?

Is the recent spell of bankruptcies a harbinger of things to come? Will Chapter 9 now be viewed as a viable option for municipalities to shed liabilities? No, we don’t think so. Municipal bankruptcies will continue to occur, but remain actuarially insignificant. Municipal credit has come under fire in recent years, but the vast majority of issuers have proven to be resilient and have emerged from the recession in reasonably good shape. Underfunded pensions continue to be the balance sheet issue most in need of reform but progress is being made to address these long-tailed liabilities (albeit slowly).

While bankruptcies are likely to remain rare, rhetoric may intensify in coming years as lawmakers use the threat of Chapter 9 to bring constituents to the table before ringing the proverbial bell. The Detroit experience has proven that very little is sacred when a municipality becomes insolvent. The fact that bondholders shared in the pain, while disappointing, was not a great surprise given the dynamic. The secure treatment of special revenue bonds, however, was a positive affirmation for the market.

From a municipal bond portfolio construction perspective, GR-NEAM continues to favor revenue bonds, but without dismissing other municipal sectors. With more than 50,000 unique issuers, the muni market is highly fragmented and there are currently opportunities and risks across sectors, states, and structures.

Takeaways

The Detroit bankruptcy is a unique case and illustrates many points worth keeping in mind:

- Little is sacred in municipal bankruptcy

- Certain bondholders are sharing in the pain, but the revenue bond pledge is proving durable

- Pension and benefit cuts should provide impetus for negotiation in other distressed municipalities

- Federal municipal bankruptcy code can supplant state law

- Municipal bankruptcies likely to remain actuarially rare

- Detroit an outlier in terms of municipal credit