The last year has been a challenge for energy markets with a global oversupply in crude oil exacerbated by a pandemic-induced drop in overall energy demand. Additionally, from a longer-term perspective, industry trends away from using traditional sources of fuel have been accelerating. Over the past few years, investment managers have become increasingly focused on environmental, social and governance factors (ESG) when looking to put money to work. Further, concerns over climate, sustainability of resources as well as pollution have encouraged energy-producing countries and companies to actively seek to change how power is accessed, supplied, distributed and ultimately used with the idea of limiting or eliminating negative effects on the environment. Below we discuss some developments that could change the business of energy over the coming decades.

Transition is Underway

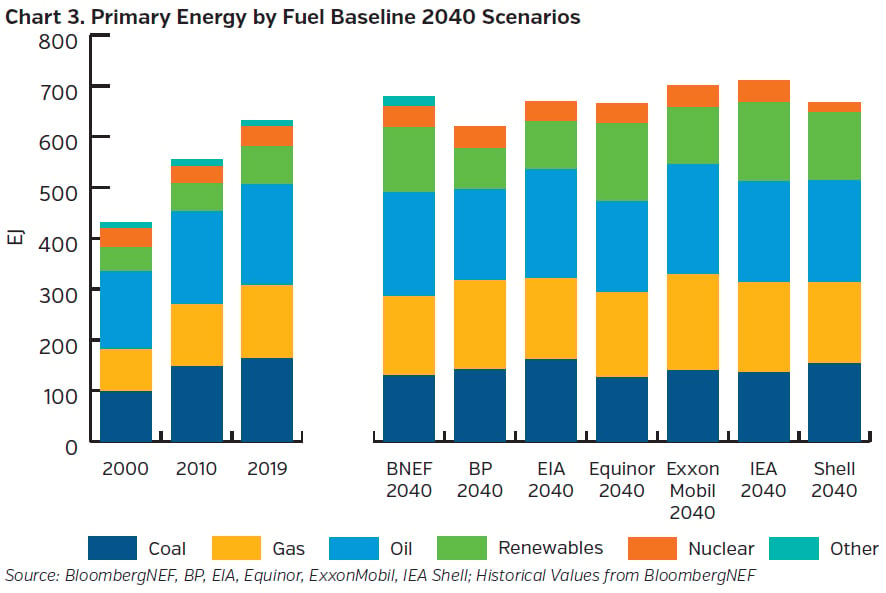

Energy transition involves shifting focus from fossil-derived fuels such as crude oil and natural gas to alternative or renewable sources of energy and working to eliminate, reduce or offset carbon emissions. Assuming development continues in technologies to harness alternative sources of energy, this should have the long-term effect of reducing demand for fossil fuels. Nations generally like to maintain or improve standards of living for their people over time, however, which requires energy. Even the most optimistic scenarios for renewables do not envision enough technological improvement sufficient to eliminate the need for traditional sources of energy so we expect fossil fuels to be part of the mix going forward.

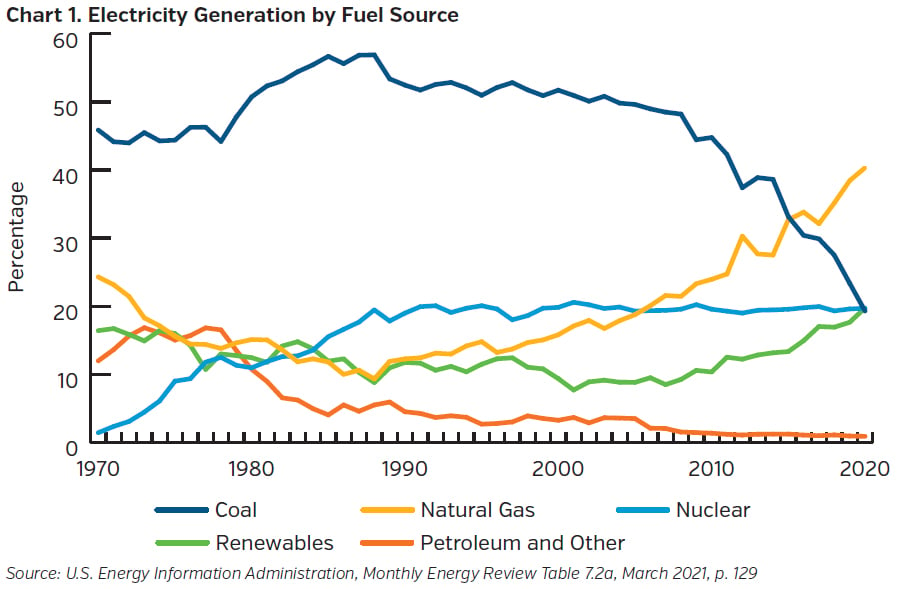

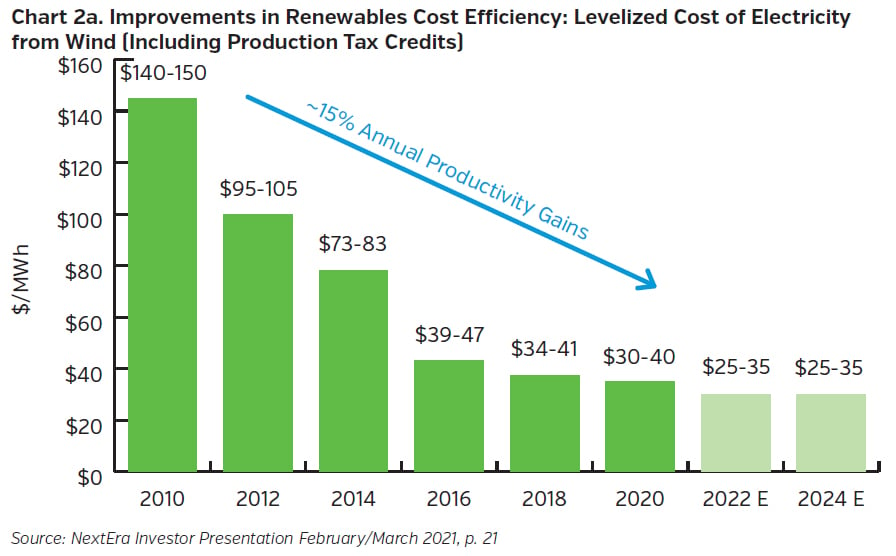

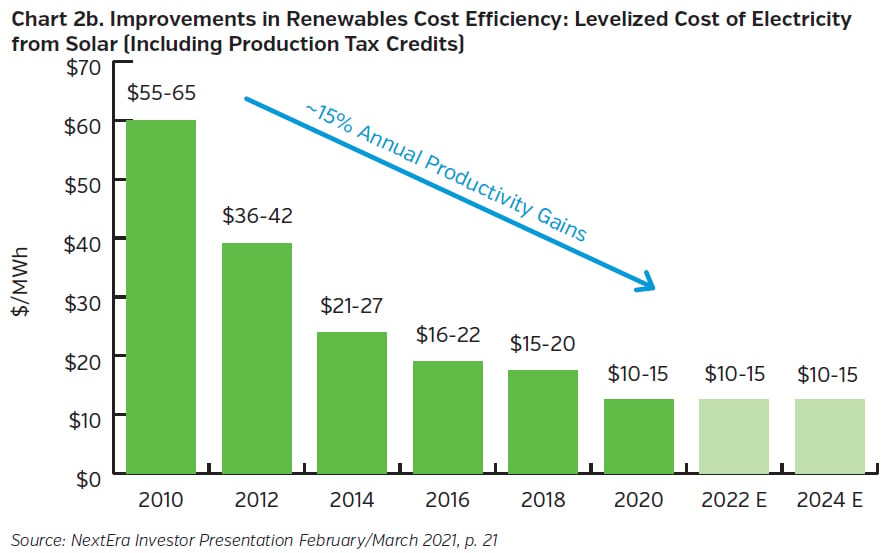

Electric utilities are significant suppliers of power which is generated using fossil fuels, uranium, and to a lesser extent, hydropower. Due to emissions and pollution concerns, utilities have been pursuing investments away from fossil fuels, especially coal. This transition has caused the percentage of electricity generated from coal to drop from just over 45% in 2010 to 20%1 in 2020. Natural gas has largely been making up the difference. The use of renewable sources of energy such as solar and wind power, however, has been encouraged through both increasingly stringent environmental requirements as well as government subsidies. Given this, renewable energy has become more important as well as relatively more cost effective. NextEra Energy Resources, one of the largest U.S. producers of electricity, has a 26 gigawatt portfolio which is 69% wind-powered, 13% solar, 9% nuclear, 6% natural gas and only 3% oil, with a construction backlog of 11 gigawatts of wind and solar. Productivity gains, especially on the wind power side, have improved to allow renewable energy to be cost competitive with fossil fuels. Absent sufficient storage capacity, however, wind and solar need to be backstopped by some form of fossil fuel.

Discovering and removing hydrocarbons from the ground or sea generates pollutants and carbon emissions, as does transporting natural gas and crude oil to refineries and then ultimately to end users. It is virtually impossible to eliminate all negative effects from this line of business but companies are taking steps to mitigate or offset the environmental impacts. In 2020 alone, $501 billion was invested in projects such as renewable power, electric vehicle charging infrastructure, hydrogen production and carbon capture and storage.2

European-based energy firms have embraced and adopted policies to prepare for energy transition with integrated energy companies outlining serious commitment to becoming carbon-neutral. Royal Dutch Shell will allocate 35% to 40% of capital investments through 2025 towards developing and maintaining transition assets. They intend to be carbon-neutral by the year 2050, achieved by adjusting operations to avoid emissions, using low-carbon fuels, increasing the share of natural gas in hydrocarbon production to more than 55%, increasing electricity sold and developing natural sinks which can be used to absorb carbon emissions.3 Most of the other oil majors have adopted similar strategies to reduce emissions, achieve carbon neutrality over time, and as a group, have increased spending on clean energy investment from just over $4 billion in 2015 to $12.7 billion in 2020.4

Improvements in Renewables Cost Efficiency

Transportation is a significant consumer of fossil fuels. However, driven by government incentives, regulation of carbon, as well as looming bans on gasoline and diesel cars, the automobile industry has traveled a long way towards finding other ways to power vehicles. Countries like Norway, Belgium, India, the Netherlands, Canada, Sweden, Denmark, the UK, France, Spain and U.S. states including California, Massachusetts and New Jersey have all set dates over the next two decades for partial or complete bans on combustion engine-powered passenger cars.5 Technology for battery powered and hybrid gasoline/electric vehicles has improved, benefiting from investment from legacy automakers as well as newer disruptive companies such as Tesla with most of the major players having one if not more hybrid offerings.

2020 battery powered or hybrid car sales worldwide increased 43% to 3.2 million units or market share of 4%6 compared to the entire market in which overall demand fell approximately 16% due to the pandemic.7 In Europe, electric vehicles have market shares approaching 20% with China’s share increasing as well to almost 8%.8 As the performance gap between internal combustion engine vehicles and electric vehicles narrows in terms of battery power and driving range and the availability of public charging stations increases, expect this market share to increase over time.

Changes in the Energy Mix

It is difficult to assess precisely how much the energy mix will change and affect demand for fossil fuels over the coming decades, though it can be enlightening to look directionally at what players in the space are expecting. Bloomberg’s NEF recently put together estimates for primary energy use over the next 20 years from the International Energy Administration and several oil majors (BP, Equinor, Shell) with its own team's forecast.9 Under the baseline scenario, overall energy consumption is 10% to 19% higher than 2019 levels due to population and economic growth. These experts estimate that oil as a part of the mix will decline slightly from 32% in 2019 to 30% by 2040, while coal’s share falls from 26% to 21%. Expected natural gas usage increases from 23% to 25% while renewables grow from 12% of the mix to 18%.

Citizens, lawmakers and investors have taken steps to lessen the impact and use of fossil fuels. This has led to increases in renewable forms of energy use such as solar and wind power to generate electricity and there may be investment opportunities within utilities and integrated oil majors as they look to provide these alternatives. It does seem likely that going forward, there will be lower demand for fossil fuels due to displacement from renewables over the next several decades.

Key Takeaways

- There is clear global momentum to reduce usage of fossil fuels in favor of renewable energy

- This creates uncertainty around investing in the evolving energy landscape

- NEAM is navigating this transition in client portfolios by:

- Reducing exposure to traditional energy companies to below index weightings10

- Investing in firms we believe have the financial flexibility to withstand and benefit from change

- Limiting debt maturities on bonds from energy companies

Endnotes

1 U.S. Energy Information Administration, Monthly Energy Review Table 7.2a, March 2021, p. 129

2 BloombergNEF “Energy Transition Investment Trends ” January 2021, p. 1

3 Shell Strategy Day Investor Presentation, February 2021

4 BloombergNEF “Energy Transition Investment Trends” 2021

5 Clean Energy Wire, “Germany remains odd one out as more and more countries announce combustion engine bans,” November 5, 2020

6 EV Volumes.com, “Global Plug-in Vehicle Sales Reached over 3.2 Million in 2020,” January 2021

7 Moody’s, “Automotive manufacturers and parts suppliers – Global 2021 Outlook” December 7, 2020

8 Citi GPS: Global Perspectives, “Electric Vehicle Transition” February 2021, p. 9

9 BloombergNEF “Comparing Long-Term Energy Outlooks 2020,” March 2021

10 As of May 14, 2021, energy company bonds comprised 9.54% of the investment grade ICE BofA Corporate Index, while energy company stocks make up 2.89% of the S&P 500 equity index. Sources: ICE Index Platform, Bloomberg.