August Overview

Inflation prints of late show that the disinflation process continues. The labor market, while still experiencing historically low levels of unemployment, is directionally heading to a better supply-demand balance. Despite this, work remains to be done to move closer to the Fed’s 2% inflation target. But with monetary policy in restrictive territory, the path the Fed is walking is becoming narrower with less room for error.

The Fed minutes showed that although the committee members are aware that inflationary risks to the upside exist, the situation is becoming more “two-sided,” and they may prefer to wait a bit and sift through the data before making any future decisions on rates. The campaign to date has been one directional, with the Fed raising rates to bring inflation down. As they enter restrictive territory, the risk of overtightening appears to be gaining traction amongst some committee members and the situation now appears more balanced in their opinion. Their most recent projections in June showed the potential for another hike before taking stock, and while possibly not enough yet, a few months of cooling inflation and a slowing labor market may be giving them room to pause. Committee members want to see if the incoming data will support that the “disinflation process” and “balance” in the labor market are continuing. Economic data remains resilient notwithstanding actions taken to date. As Powell noted in his Jackson Hole address, they must be more “agile.” More data is needed so that the Fed can gain a better sense of how its work to date, combined with a right sizing of the “pandemic distortions,” is impacting different areas of the economy and the corresponding price of goods and services.

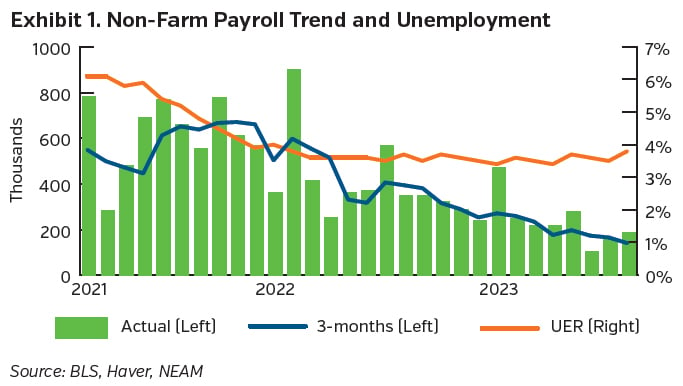

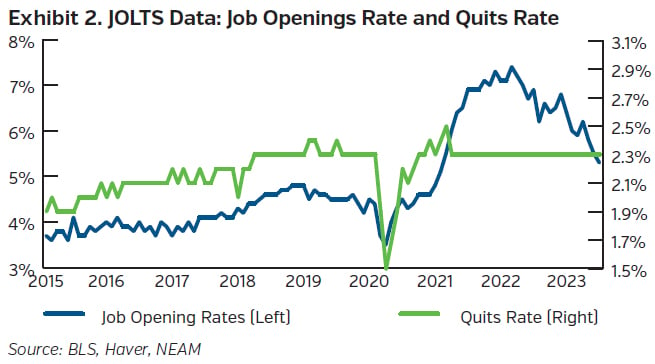

Consumption continues to show signs of strength. Real personal spending increased on the month, and the savings rate declined. Retail sales came in higher than expected for the month at both the headline and control group level, posting gains of 0.7% and 1.0%, respectively, with stronger gains in the ecommerce and dining out sectors leading the way. In terms of the labor market, nonfarm payrolls came in at +187K for August. Although above the market’s expectations, the trend indicates that the labor market is slowing, as previous months’ numbers were revised down. The unemployment rate increased from 3.5% to 3.8%, with an accompanying rise in the labor participation rate to 62.8%. Wage gains came in at +0.2% for the month (4.3% for the year), showing some signs of normalizing. JOLTS numbers also showed loosening in labor market conditions. Job openings fell to a recent low of 8.8 million, with the previous month’s reading also revised lower. At this level, openings have fallen roughly 3.2 million from their peak in March 2022, and the ratio of openings to unemployed sits at 1.4x (down from 2.0x), while quits rates are also edging lower suggesting workers feel less confident leaving their job for a new venture.

Consumer sentiment measures dipped over the month as consumers became wearier of rising rates, higher prices, and a softening labor market.

In the investment arena, industrial production jumped 1.0% for the month, in part due to a healthy increase in utilities as warmer temperatures increased the need for cooling. Manufacturing increased 0.5%, with the help of motor vehicle production, and 0.1% without. The ISM manufacturing PMI ticked upwards to 47.6 but remains in contractionary territory. Regional manufacturing surveys still highlight a challenging environment however some respondents highlighted a brighter outlook for the future. Despite the gain in industrial production, previous months’ data was revised down and manufacturing, as well as overall industrial production, remain below their year ago levels. As Powell noted in his Jackson Hole speech, the Fed’s work to date, combined with falling inflation levels, is driving real rates north, which when combined with tighter credit conditions, is weighing on activity and demand.

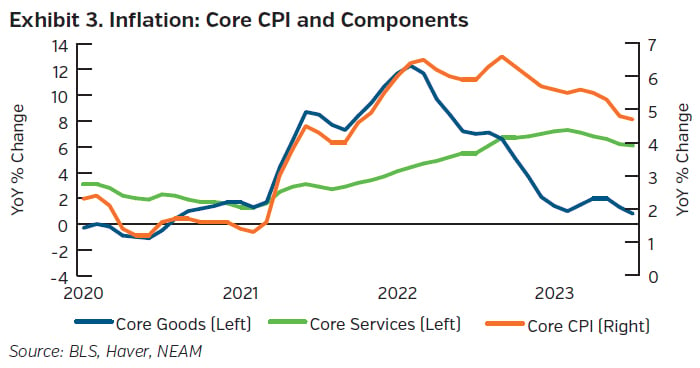

Inflation’s pace continues to moderate. The monthly headline and core inflation numbers both came in at 0.2%, which equated to a 3.2% and 4.7% yearly rate, respectively. At the headline level, prices were buoyed by an increase in food costs, with a still positive but softer uptick in energy prices contributing too. At the core level, core goods prices fell 0.3% on the month, weighed down by declines in new and used vehicles, household furnishings, and recreation. Core services meanwhile increased 0.4%, primarily on the back of shelter, whose increase more than offset drops in airline fares and medical care services and drove most of the core and overall inflation number for that matter. Excluding parts of shelter, the measure for core services ex-housing stepped up over the month but remains on a downward trend. The overall core numbers will offer the Fed some relief in their engagement with inflation and may continue to fall given shelter’s outsized and lagging contributions. Additionally, shorter term measures of inflation on an annualized basis are showing signs of cooling, and although consumers’ expectations for inflation remain elevated relative to pre-pandemic levels, they appear stable at both a near and longer-term horizon for the time being. Directionally, things appear to be moving in the right direction, and the Fed is understandably, if not cautiously, optimistic about the progress to date, but nevertheless appreciative of the continued required work to achieve its inflation target.

Capital Market Implications

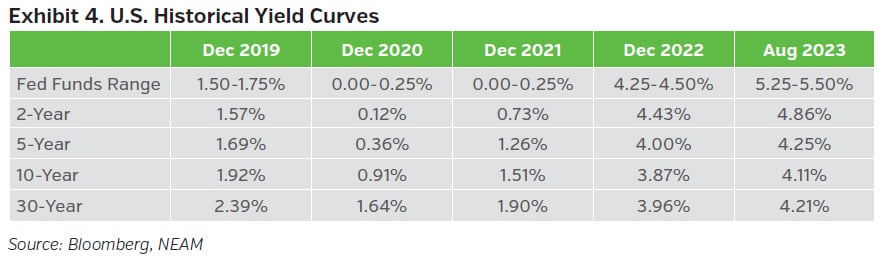

Although softer towards the end of the month, stronger than expected economic data helped to send Treasury yields higher. Credit spreads tightened as yields rose while equity markets fell.

Capital Market Outlook

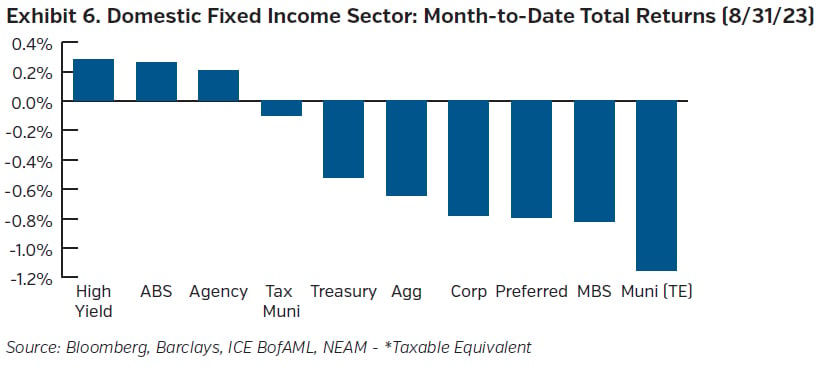

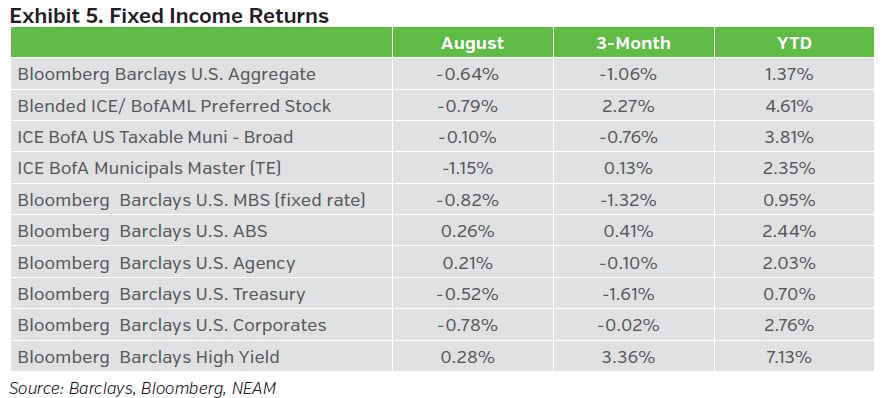

Fixed Income Returns

Fed minutes highlighted the committee’s awareness that it may need to move in a more cautious manner as the restrictive positioning of monetary policy sets in. Despite cooling inflation and some weaker labor market data towards the end of the month, Treasury yields ended the month higher. Credit spreads tightened as yields increased.

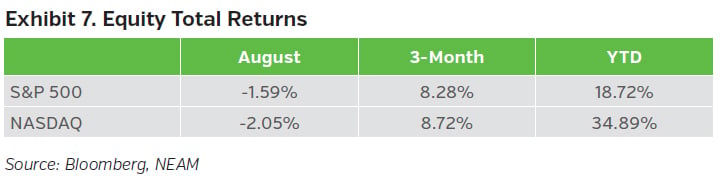

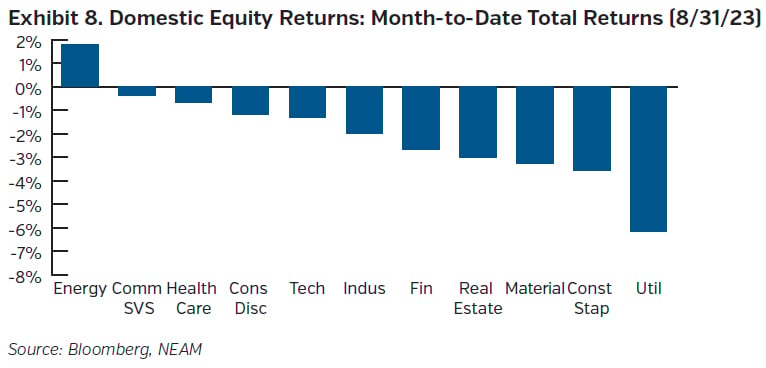

Equity Total Returns

Cooling inflation, combined with some softer labor market data towards the end of the month, led market participants to believe the Fed may hold off on further tightening. Equity markets, which had suffered early in the month on the back of more resilient data and the accompanying higher yields, rallied into month end. In the end however, the S&P 500, Dow and Nasdaq would all close lower for the month.