September Overview

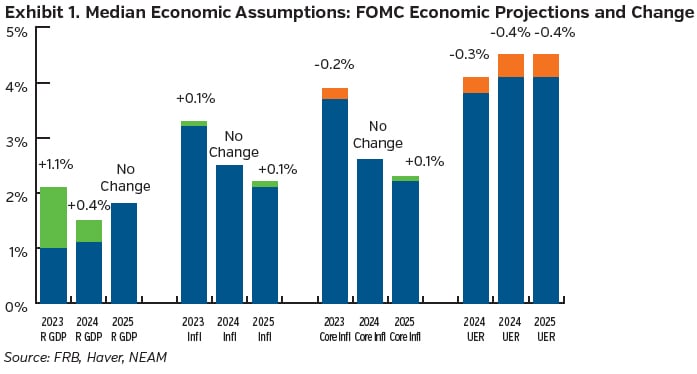

Economic forecasts are calling for slower growth, higher unemployment and tamer inflation for 2024 as compared to 2023. This is to be expected given the monetary actions taken to date by the Fed and other major central banks. While numbers continue to trend in the right direction for the Fed, they remain cautious, intimating that they may keep the pressure on the brakes for longer than the market expected.

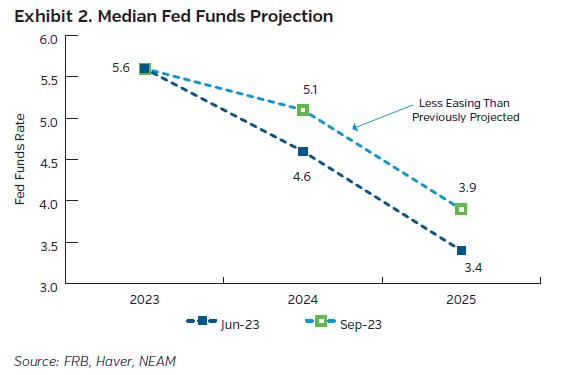

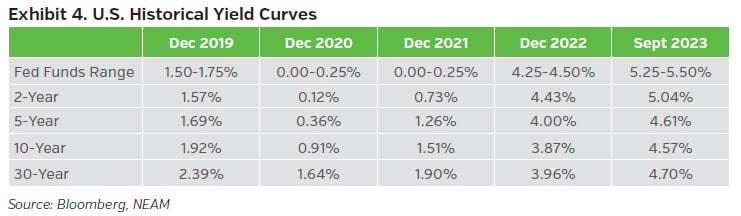

As widely expected, the Fed did not raise its benchmark rate at the September meeting. The Fed did, however, offer some illumination on how it is looking at the future through its economic projections, and the outlook appeared more upbeat than previous forecasts. To start, the Fed raised its outlook for growth for this year and 2024. At the same time, the outlook for unemployment softened, with a drop in the projected unemployment rate. Inflation projections were slightly lower for this year but remained in the same zip code further out, implying that the Fed thinks it will take longer to harness price growth and bring it back down to its long-term desired levels. The improved economic outlook synced up with a shift upwards in the Fed’s interest rate projections. While the Fed’s median rate expectation for this year remains the same, implying one more potential hike, the Fed shared that it now expects to hold rates at a higher level going forward versus previous estimates. Indeed, although the Fed’s estimate for 2023 Fed Funds rate remained at 5.6%, its forecasts for 2024 and 2025 showed levels of 5.1% and 3.9%, each 50 basis points higher than their June levels, respectively. The change telegraphed expectations for a more positive near-term economic outlook requiring a more restrictive stance for longer to achieve its inflation target. Despite the projection of slower growth, with real GDP slowing to 1.5% in 2024 from 2.1% this year, the Fed appears to anticipating a much softer landing than before. In the end, data will ultimately determine the Fed’s next steps, but for now it seems the Fed is intent on keeping more solid pressure on the policy rate until it can form a clearer picture of the economic outlook.

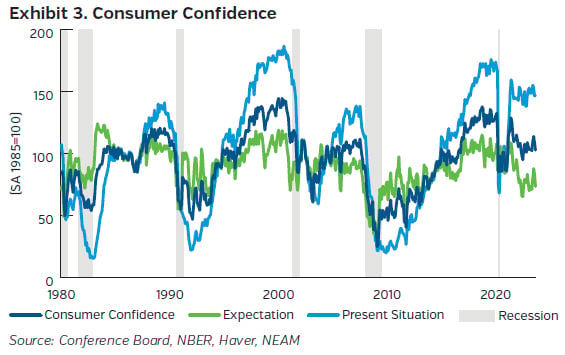

The Fed’s median projections for unemployment show the rate increasing to 4.1% in 2024. Payrolls numbers have been declining while recent surveys highlight a decreasing demand for labor, despite the rise in job openings in the most recent JOLTS numbers. Combining a weaker labor market with depleting excess savings, consumption may be facing stronger headwinds. Indeed, although retail sales increased 0.6% at a headline level, sales at gas stations drove most of the increase in line with the double digit rise in gas prices over the month seen in the CPI figure. Consumers sentiment indicators are also falling due to higher gas and food prices, and higher rates.

Within the investment sector, the most recent ISM PMI number came in higher than expected, with positive moves in the employment, new orders and production areas, while prices and supplier delivery times dropped. Although improved to a level of 49 overall, it remains in contractionary territory, highlighting the continuing challenges in the manufacturing sector. Meanwhile, capex intentions from CEO and Fed surveys, while mixed, remain on the less optimistic side and, despite a stronger month, the growth in core durable goods orders and shipments has been slowing.

Inflation’s pace stepped up a bit in September. It remains, however, well below its highs with certain areas (such as core goods) showing further declines. Headline CPI increased 0.6% over the month, representing the highest monthly increase since the spring of 2022. A 5.6% increase in energy (owing to a +10.6% rise in gasoline) fueled the gain while food cost increases remained on pace with last month. Relative to the comparable year ago period, headline CPI rose 3.7%, up from 3.2%, despite energy costs being lower than last year. The pace of core price increases nudged higher to 0.3% for the month which amounted to 4.3% for the year (down from 4.7%). While the monthly number represented an uptick from previous months at the core level, shorter-term measurements (other than one month) still show a decelerating trend. Despite slowing relative to previous months, the 0.3% increase in shelter for the month was the largest contributor to the monthly price gains at the core level. Rent increases – in keeping with trend for rents and owner equivalent rents – contributed to the increase, despite lodging away from home falling 3%. Also helping to prop up the indices on the services side were transportation services driven by motor vehicle insurance and higher airline fares as well as medical care services. Core services ex-housing ticked up 0.36% for the month, higher than the past two months prints but still representing a slowing annual growth rate. On the goods side, prices dropped 0.1%, the third month in a row with overall price decreases. Used vehicle price drops led the declines, helped by some drops in the recreation and education and communication areas, despite some positive resistance from apparel and household furnishings and supplies.

Capital Market Implications

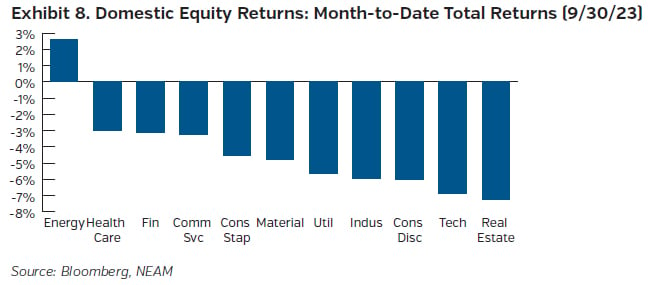

Treasury yields rose across the curve, particularly the long end as the prospect for higher rates for longer gained traction. Equity markets sold off in the latter half of the month after yields increased, while credit spreads ended the month roughly unchanged to modestly wider.

Capital Market Outlook

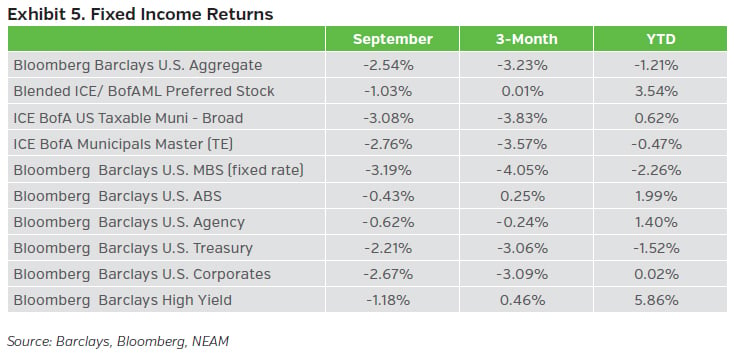

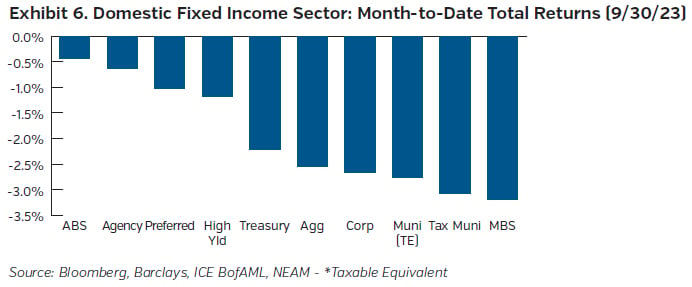

Fixed Income Returns

The Fed left rates unchanged as widely expected, but altered their message that rates may stay higher for longer while not ruling out the need for additional hikes. Treasury yields rose, as investors digested less easing going forward. Credit spreads tightened on the back of higher yields and firmer demand throughout most of the month. However, the tone of the market weakened into month end leaving credit spreads modestly wider for September.

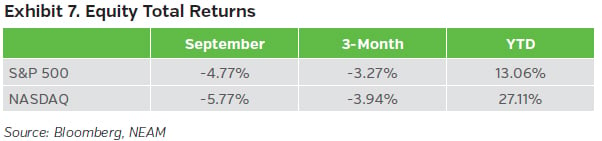

Equity Total Returns

Although the market was correct in assuming the Fed would not raise rates at the last meeting, the committee’s projections may have been among the factors that pushed Treasury yields higher. With the yield curve rising, equity market weakness accelerated after the Fed’s meeting. In the end, the S&P 500, Dow and Nasdaq all closed lower for the month.