October Overview

The question of how long the Fed will remain in restrictive territory, if not venture further, before easing continues to be debated. With the passing of time, the window for the lag for tighter policy to kick in shortens, leaving the Fed to determine if policy actions taken to date are sufficient to achieve their mandate. Although data has shown that the labor market is coming more into balance, and price gains in many areas are decelerating, economic data continues to hold up, as evidenced by the recent Q3 GDP print. The Fed remains attentive at the helm, ready to act, if necessary, with the surge in Treasury yields offering them some cover at the same time.

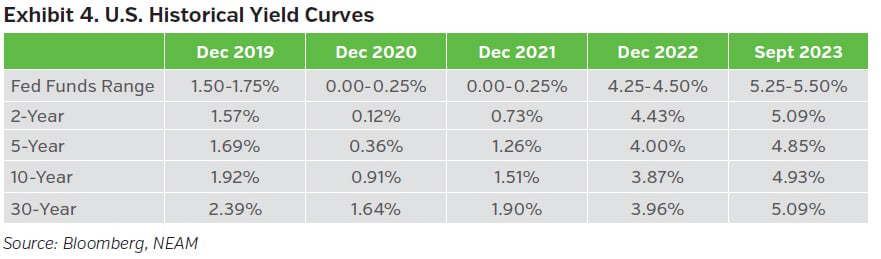

The Fed once again held steady at its most recent meeting, unanimously voting to keep the benchmark rate unchanged at 5.25-5.50% while further cementing its position to wait and see how the data plays out. Indeed, the minutes from the previous meeting in September had shared clues to their mindset, highlighting that the committee members continued to feel that monetary policy is restrictive, but that there is still work to do as inflation remains too high. They are exercising more caution in their efforts to achieve their goals, noting again that they see the risks to attaining their goals as more balanced. Although the prospect of another rate hike at some point has not been ruled out, the second consecutive pause at current levels illustrated that they feel they have enough evidence to buy some time while waiting for more data. A notable increase in longer-dated yields, and subsequent comments from the Fed relating to their potential to curb economic activity, support this position.

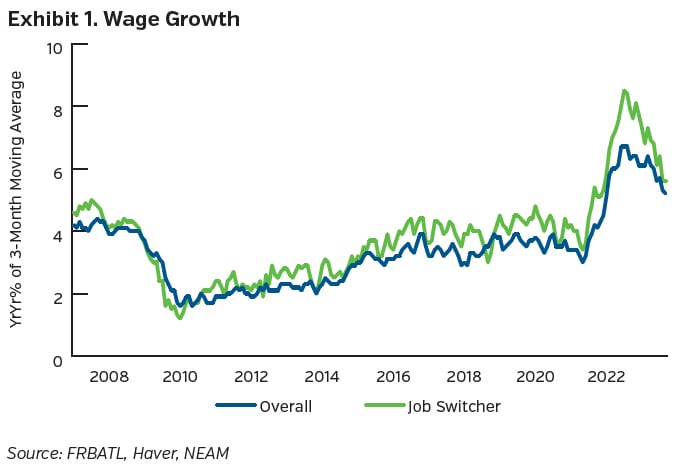

The Fed may have found some comfort in the most recent jobs report, released after their early November rate decision, which came in at a lower-than-expected +150K. Although there was some noise related to the recent auto strikes in the manufacturing category, the number, when adjusted, is still in line with the trend of declining payrolls. It followed on the heels of a higher, yet downwardly revised +297K the month before; a number that, in isolation, had prompted the market to ponder if the Fed would need to keep pressing a bit more on the brake, as the labor market is still considered tight by the Fed despite other signs of softness. To this point, the unemployment rate ticked up to 3.9%, off its recent lows of 3.4% earlier in the year, while some relief can be taken from the declining pace of wage increases which increased 0.2% over the month and 4.1% versus the year-ago comparable period. Additionally, people switching jobs essentially no longer command a wage gain premium as the labor market rebalances. With jobs nevertheless still being added at a decent rate, consumption is holding up. The most recent GDP print showed a 4.9% annualized rate, while retail sales came in +0.7% and 0.6% for the month at the headline and core levels, respectively. These prints occurred despite weaker confidence due to concerns over inflation, and consumers feeling the weight of higher prices and borrowing rates, which when combined with a few months of negative real disposable income growth, and a drawdown of savings, remain other headwinds going forward.

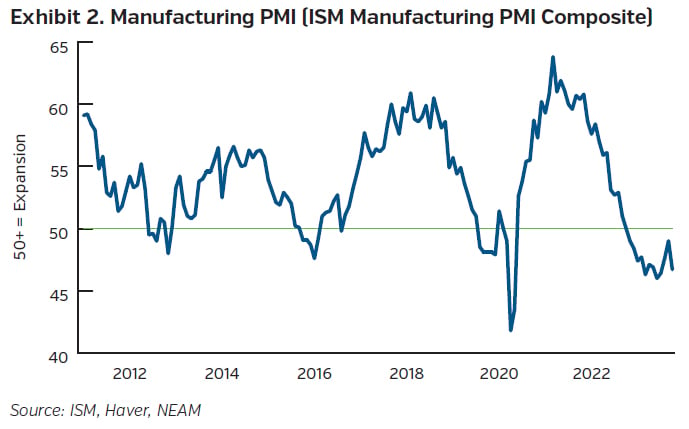

The investment landscape has been mixed. Manufacturing surveys highlight challenges in the sector. Capital spending plans are weaker and business investment fell in Q3 GDP figures on the back of lower equipment investment. Despite this, industrial production increased a higher than expected 0.3% for the month, showing that the economy is not ready just yet to roll over to the pressure driven by the Fed and higher rates. Production driven by gains in mining and manufacturing helped push the headline number up, where it now sits a touch above a year ago and close to its level at the end of 2018.

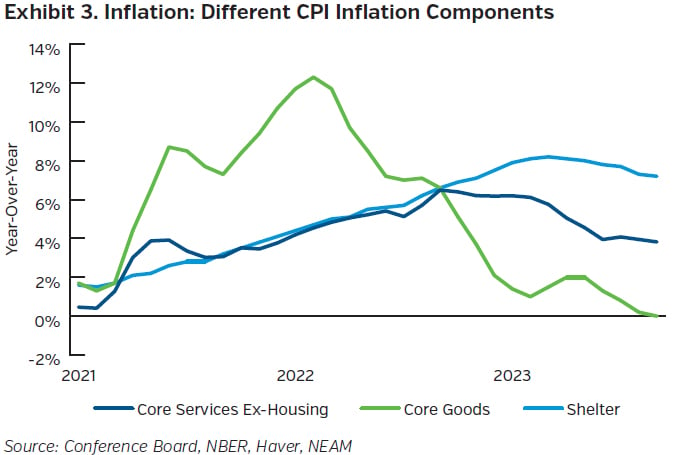

On the inflation front, headline inflation increased 0.4% for the month, while core increased 0.3%. On a yearly comparative basis, this equates to 3.7% and 4.1% respectively. Both represent a continued, albeit slowing, downward move in prices overall when compared to the year before. Taking the major representative constituents in turn for the month, energy prices increased 1.5%, with a 2.1% gain in gasoline helping. Food prices rose at the same level as last month (+0.2%), with food away from home helping to sustain the pace as food at home price gains slowed. In the core arena, core goods prices retreated for the fourth month in a row but dropped to a greater extent than recent months (-0.4%). They were weighed down by declines in household furnishings, apparel and used vehicles despite some gains on new vehicles, recreation ,education, alcohol and other goods. On the core services side, shelter once again drove the largest share of the increase, increasing 0.6%, with jumps in owner equivalent rents and lodging away from home leading the way while rents of primary residences kept pace with last month’s increase. Away from shelter, service inflation also remains stickier, increasing for the third consecutive month, although it remains lower compared to last year and the yearly comparable trends are still downward sloping.

Capital Market Implications

Treasury yields rose notably out the curve as economic data remained healthy. Equity markets sold off, while credit spreads ended the month slightly wider.

Capital Market Outlook

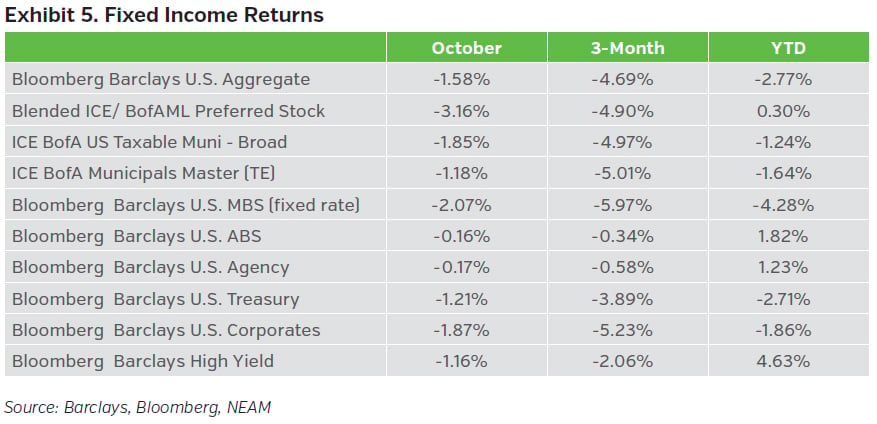

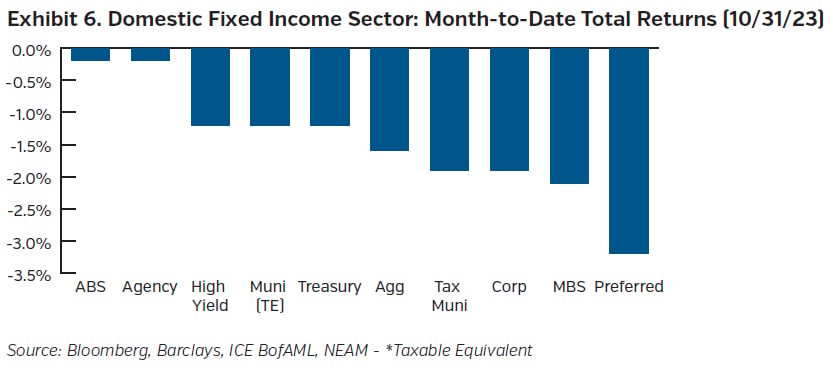

Fixed Income Returns

The Fed left rates unchanged for the second consecutive meeting and noted that caution is needed as they proceed. Treasury yields rose as economic data displayed resiliency, with more pronounced increases in the long end of the curve. Credit spreads widened as the tone of the market remained weaker on the back of heightened geopolitical risks and increased rate volatility.

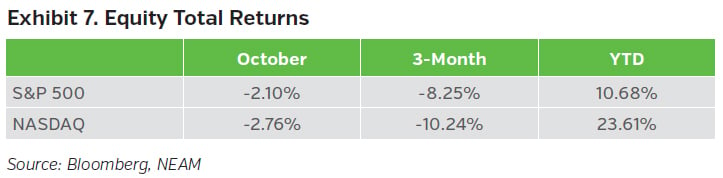

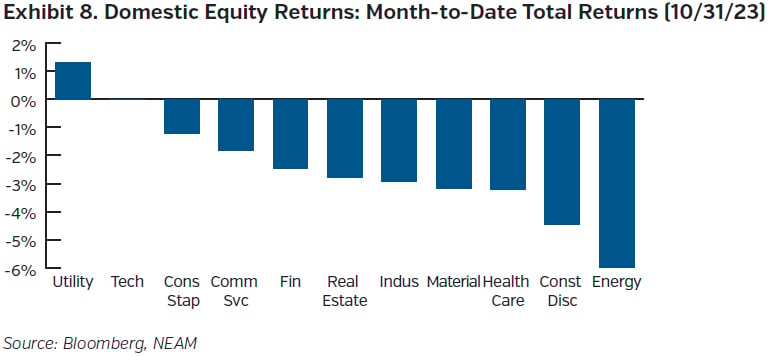

Equity Total Returns

Despite the Fed holding its benchmark rate steady, equities fell throughout the month. A combination of rising Treasury yields and increased geopolitical risk, combined with some concerns over earnings, left major indices lower. The Dow, S&P, and Nasdaq all ended the month lower.