May Overview

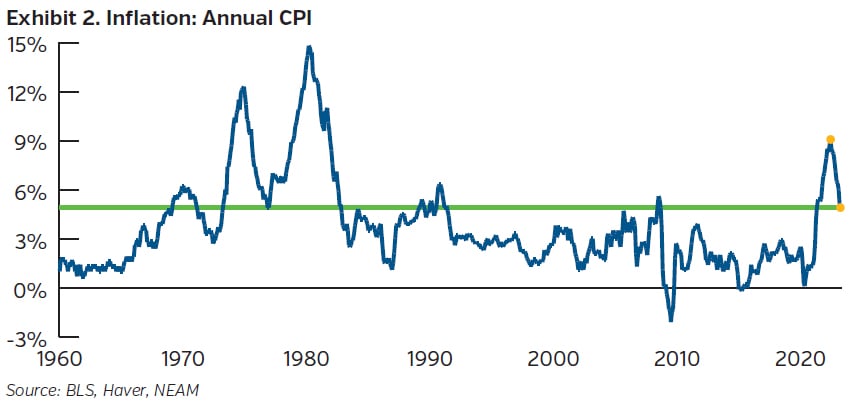

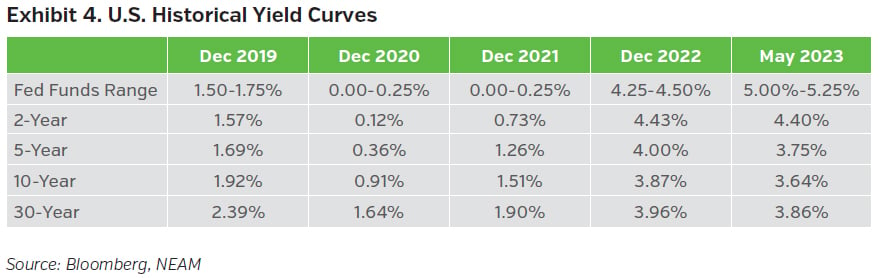

With inflation still high but moderating, tighter credit standards crystallizing amongst lending institutions, and the Fed having already raised rates 500 bps in their most recent campaign, the case for a pause in rates gained ground. Nevertheless, the resilience of economic data, particularly on the employment front - despite policy actions taken to date - is testing this position. Fed commentary is mixed with some FOMC members still pushing for more hikes while others are content to hold at current levels, leaving markets to divine the Fed’s path forward.

Although the most recent rate hike decision was unanimous, the language in the accompanying Fed statement shared that the committee was not wholeheartedly anticipating additional policy firming. The Fed is contending with a resilient economy that remains plagued by uncomfortably high inflation which it needs to dampen. Although progress has been made in bringing inflation down, there is still much room to cover until the Fed’s target is hit. The Fed minutes from the May meeting illuminated the different viewpoints amongst committee members, particularly with regards to the future path of policy. The minutes highlighted that many participants preferred the “optionality” provided by waiting. More time would offer additional color on the development of economic data and the cumulative effect of previous actions taken to date. In addition, it was important to see how the aftershocks of the recent banking issues impacted the availability of credit and the knock-on effect on household consumption and businesses. Indeed, participants in this camp felt further tightening may not be required. In contrast, some participants - who did not embrace this position - felt the slow pace at which inflation was returning to its target level called for more rate hikes, the timing of which remained uncertain. The question thus remains if the Fed will pause its rate hiking agenda for good or move forward with another increase at some point before ultimately reversing course.

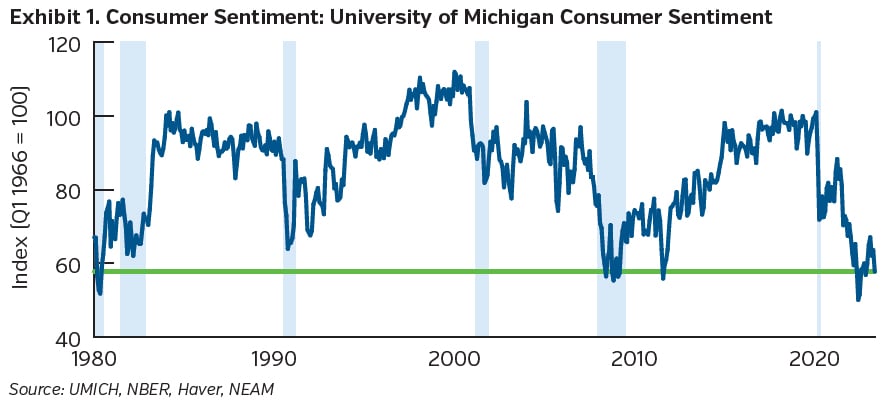

The events of late in the banking sector are navigating their way through the broader economy. On the consumer front, it is becoming tougher to get a loan. Banks are understandably pulling in the reigns as they become more risk averse considering the deteriorating economic climate and its impact on collateral values as well as liquidity and funding concerns. The most recent Senior Loan Officer Opinion Survey (SLOOS) shared that all categories of consumer lending saw tighter standards. Consumers have also signaled that they believe the economy will fare worse in the coming months, and although the labor market is holding up, with the most recent jobs number coming in above expectations at +339K, confidence is waning.

The most recent University of Michigan numbers showed consumer sentiment dropped approximately 9% this past month, held down by deteriorating expectations for the future, and although consumers’ view of the current economic situation is faring better, it too fell from the previous month.

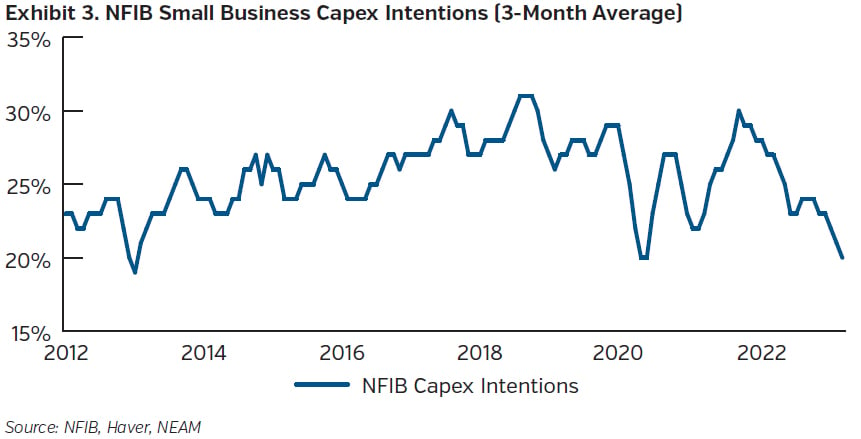

Like the consumer sector, the Fed’s survey highlighted that credit is tougher to obtain at the corporate level and banks look set to maintain this stance for the rest of the year. Elsewhere, despite a boost to industrial production from a sizeable increase in the automotive sector, the manufacturing index sits lower than a year ago while regional Fed surveys were also less rosy. Small business optimism is fading and sits at a decade low and the percentage of firms planning capital expenditures is falling.

Despite softening data in many areas, higher prices remain an issue. At the headline level, they increased 0.4% for the month and 4.9% for the year. Food prices remained steady with increases in dining out offset by prices of food at home while higher gas prices propped up the energy category. On a core basis, price appreciation amounted to 0.4% and 5.5%, respectively. Core goods inflation came in at 0.6%, a decent jump from previous months with the re-emergence of used vehicle price gains driving the increase. On the services side, shelter once again led the way, although the pace of its ascent is slowing. To this point, shelter increased 0.4% in April, down from a six-month average of 0.7%. A measure of core services - excluding key measures of housing - also slowed. The numbers highlight that inflation is falling, however, despite the notable fall from its peak, and downward trajectory in price increases, it remains stubbornly high and may not be moving as fast as some in the Fed desire. Nevertheless, the direction of inflation's path, along with tightening credit, may be enough ammunition for the Fed to pause at its current level, or at least “skip” a meeting as the prospect of another hike this year remains in contention.

Capital Market Implications

Softer inflation, weakening but still healthy economic data, tighter credit and for most of the month, the prospect of an unresolved debt limit negotiation, fueled perceptions that the Fed is likely to pause its interest rate hiking cycle before deciding its next move. Subsequently, more encouraging news on the debt ceiling being lifted late in the month and tech generated gains sent equities higher while Treasury prices fell.

Capital Market Outlook

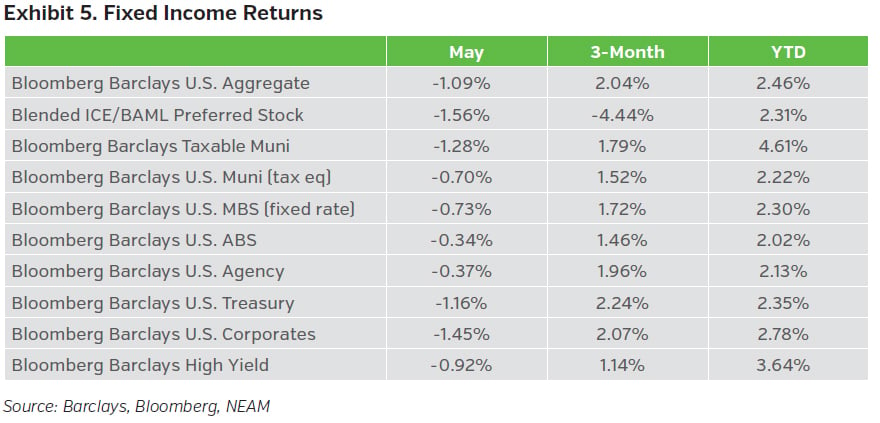

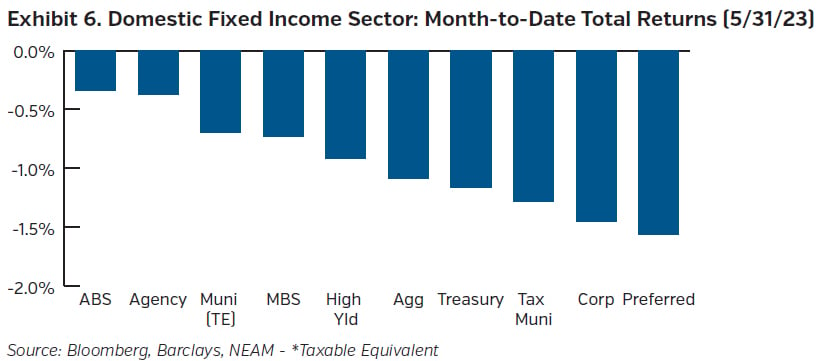

Fixed Income Returns

Despite headlines that progress was being made (and a deal ultimately agreed upon), the prospect of a government debt default left the market on edge for most of the month. Participants assessed the chance that negotiations could break down which in turn sent near-term yields soaring, while longer dated yields rose to a lesser extent as economic data proved more buoyant and inflation remained high. Credit spreads initially moved wider on regional banking sector pressure before grinding close to unchanged to end the month.

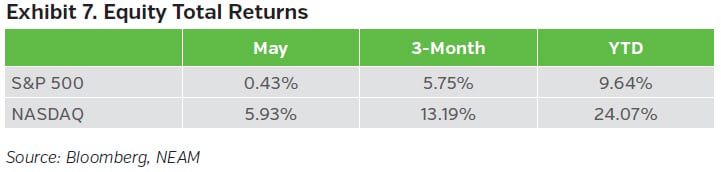

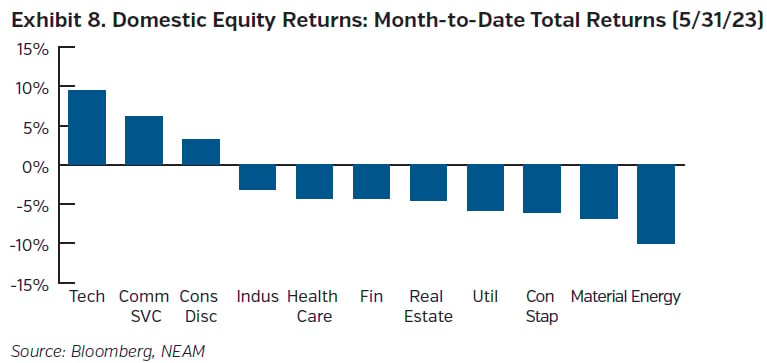

Equity Total Returns

As the market closely followed the debt ceiling negotiations, dissected the minutes of the most recent FOMC meeting to divine more clarity on future Fed movements, and considered developments in the artificial intelligence space, equity markets performance was mixed. Ultimately, the Nasdaq gained, led by a tech rally, and the S&P edged a touch higher while the Dow lagged.