June Overview

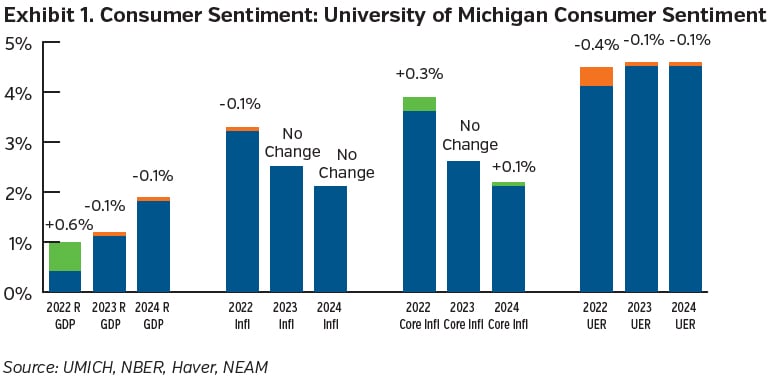

The Fed took a breather this month. They let the market know that it would be short-lived, however. Having spooned out a good deal of tightening to date, the Fed held off, but they appreciate they may have to get back in the game if the data does not support sitting back. Although the most recent Q1 GDP figure was revised higher, the economy is decelerating, credit is tighter, and inflation is cooling. Despite this, target levels have not been reached. The Fed, therefore, took a more hawkish tone in its message, noting that more work is needed to bring prices down to their target level, and that data will ultimately determine how much more policy firming is required.

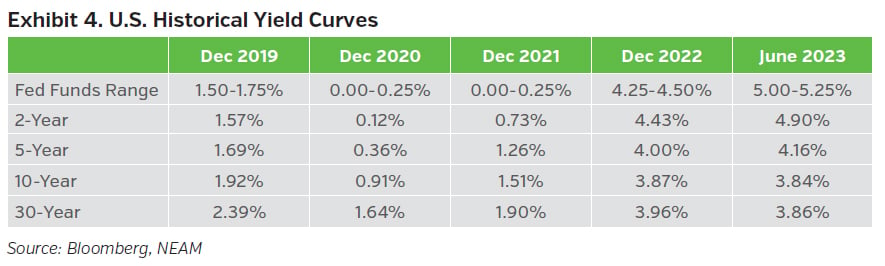

With no dissents, the Fed held its benchmark rate target unchanged in a move that was largely expected by the market. The Fed did, however, surprise the market with a change in its expected terminal rate. The Fed shared in its economic projections that its median terminal rate increased to 5.6% from 5.1% previously, implying another 50 bps of potential rate increases could be forthcoming. The projections are just that, however, and the Fed will continue to assess the incoming economic data, as well as the impact of the recent banking upheaval, to determine its ultimate course. Although the committee was unanimous in their decision to “skip” a rate increase at this session, their assumptions for the Fed funds rate at the end of the year told a different story about their views on what is necessary going forward. In total, out of 18 members, only two held the belief that rates should stay where they are in 2023, with two-thirds of the group forecasting at least 50 bps. Their economic projections supported these views. The numbers show that they expect unemployment to be lower than previously expected, while growth and inflation are expected to be higher. The Fed is managing its message while buying some time. They are messaging that they intend to raise rates going forward but prefer for now to hold steady while working to keep expectations focused and anchored.

The labor market remains steady, but conditions remain tight. The Fed is looking for a better supply-demand balance, and there are signs that this is beginning to take place. The job openings to unemployed ratio is falling, but it still leaves approximately 4 million more openings than unemployed. The pace of job growth has been on a declining trend and there are signs that wage growth is decelerating. Real personal spending growth is slowing too. This is welcome news to the Fed, just not enough at this point.

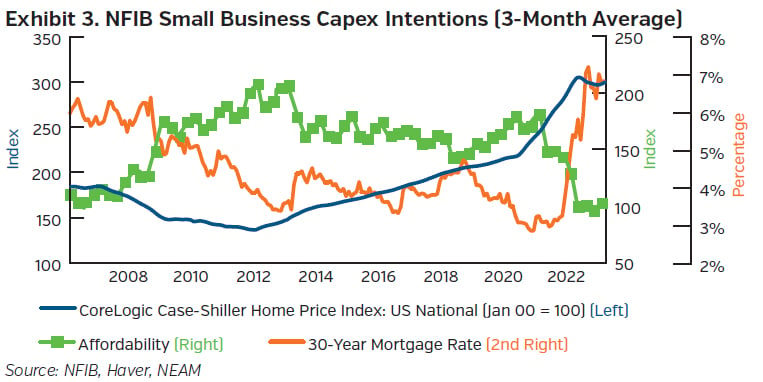

In the investment arena, May’s ISM Manufacturing PMI ticked lower to 46.9. At its current level, it sits in recessionary territory. Small upticks in production and employment could not offset declines in other categories, such as new orders. Encouragingly for prices, the survey highlighted that supplier delivery times continue to drop while the backlog of orders and prices paid indices fell again. Manufacturing grew only slightly in the most recent industrial production numbers too, but it remains below last year’s level. In contrast to these weaker manufacturing readings, both headline and core durable goods orders improved this month. On the housing front, although the sector has been weaker, housing starts showed a strong uptick, as builder sentiment improves on the back of low inventories and a normalizing of prices in the sector. Indeed, prices gained nationally for the third month in a row after a seven-month period of consecutive declines that stretched from last summer into early this year. Despite the pivot in prices, affordability remains an issue as prospective buyers and sellers deal with higher prices and rates along with economic uncertainty.

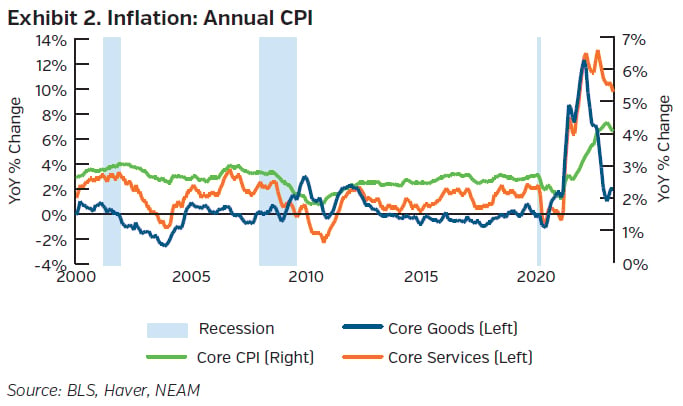

The pace of price growth continues to slow. After peaking at 9.1% in the middle of 2022, the most recent CPI print showed headline prices increasing less than half that on a year-over-year basis. The 4% gain was the lowest since March 2021. The headline deceleration was attributable to a decent drop in the rate of food price growth, and a solid retrenchment in energy prices, which sat 11.7% lower than last year on the back of lower gasoline prices. At the core level, price gains are closer to their peak of 6.6%, coming in at 5.3% compared to last year. Breaking this down further, core goods prices sat on a slightly higher gain than earlier in the year, aided in part by a jump in used vehicle prices which offset declines in household furnishings and new vehicles. At 2%, the increase of core goods prices paled in comparison to the 12.3% peak growth in 2022 as COVID-legacy supply chain issues work themselves out of the system, but still represented an uptick from previous readings. Core service numbers stayed on their recent track, with an uptick in the cost of shelter offset by declines in medical care services and airline fares. Excluding housing, core services ticked up just over 0.2% for the month, but this still left the measure up 4.6% relative to last year. This area continues to be a focus of the Fed, and while it is down from peak gains in the low to mid 6% range, it nevertheless has decent room to cover.

Capital Market Implications

Softer inflation, weakening but still healthy economic data, tighter credit and for most of the month, the prospect of an unresolved debt limit negotiation, fueled perceptions that the Fed is likely to pause its interest rate hiking cycle before deciding its next move. Subsequently, more encouraging news on the debt ceiling being lifted late in the month and tech-generated gains sent equities higher while Treasury prices fell.

Capital Market Outlook

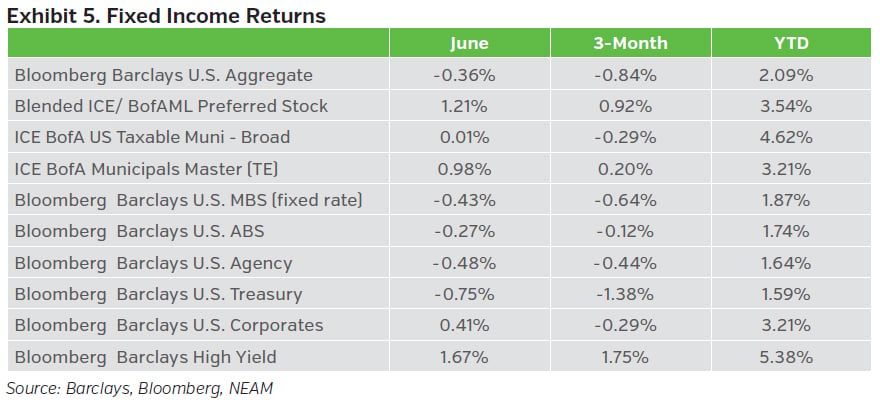

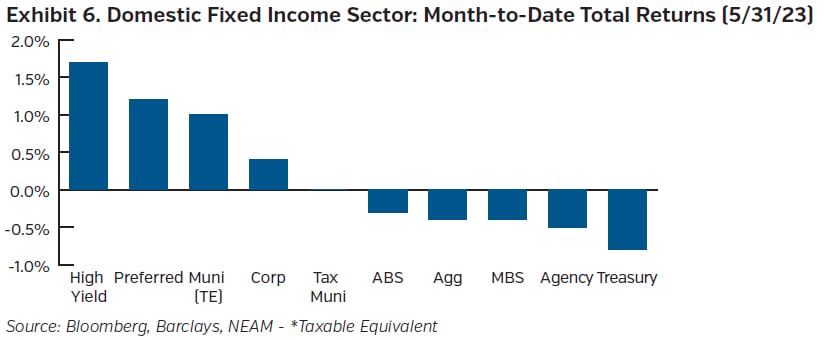

Fixed Income Returns

As the anxiety around major economic and political events faded, Treasury yields rose while credit spreads ground tighter. Although lower, the need for more progress on the inflation front, combined with a still healthy labor market, fueled more hawkish Fed commentary despite a pause at their most recent meeting, pressuring yield expectations upwards while demand for credit remained strong.

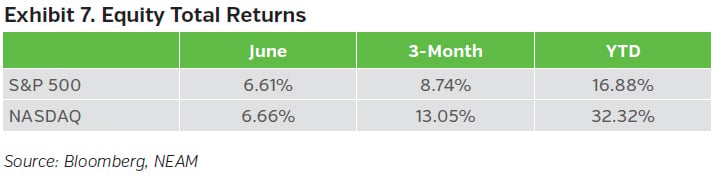

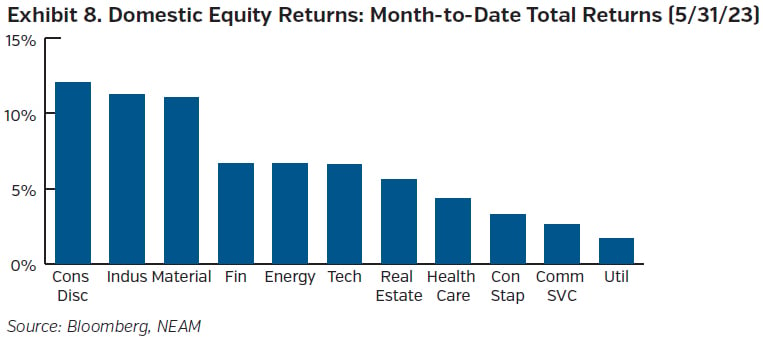

Equity Total Returns

With the debt ceiling negotiations in the rear-view mirror, inflation still high but falling, and the job market showing signs of resiliency, the market absorbed the more hawkish message out of the Fed with respect to future rate moves and climbed higher. Many of the large tech stocks that had spiked higher in the first four months of 2023 continued to rise in June. However, the equities of some companies that are typically more economically sensitive, such as cruise lines, airlines, automakers and homebuilders were among the market leaders during the month.