JANUARY Overview

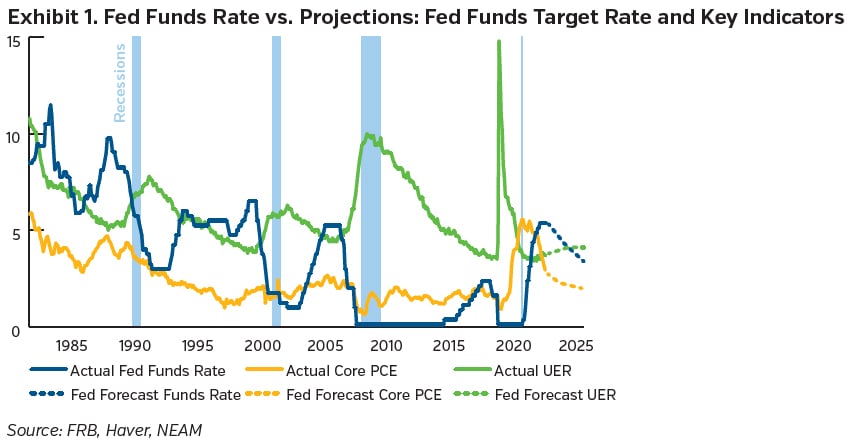

Economic growth continues to hold up. The labor market, as evidenced by the recent payroll numbers, continues to be healthy. Inflation is trending downwards. All of this is good news for the Fed. At the same time, it’s the continuity of the downward flection in price gains that the Fed wishes to see. Although the Fed is messaging that they expect rates to come down this year, they believe the extent and pace of these actions will most likely be slower than the market is expecting.

In the run-up to the Fed meeting at the end of the month, Fed officials cautioned the market on becoming too aggressive with respect to the extent of easing expected this year. The Fed’s meeting was therefore no real surprise to the market, with the benchmark rate remaining at its current level for the fourth time in a row. The Fed’s statement shared that it sees a better “balance” of the risks facing its dual mandate. It also wants to gain “greater confidence” that inflation is trending towards its 2% goal on a durable basis, while Powell shared that a rate cut in March is “unlikely.” As before, it will continue to assess the data and take more time before taking any action.

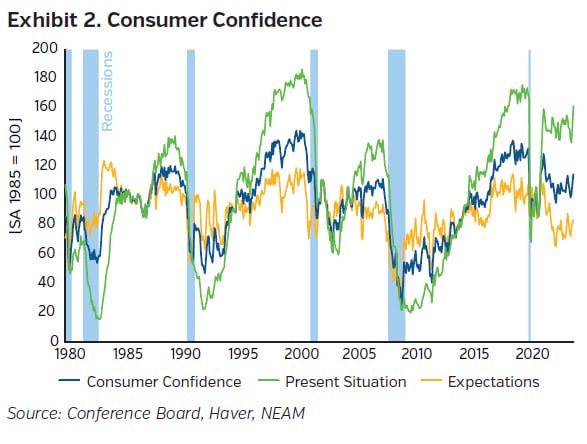

The January payroll numbers lent some support to the pushback positioning of the Fed. The economy added +353K, with job additions being spread across industries. This was much higher than the market had been expecting while unemployment remained at 3.7%. Wage gains also exceeded expectations, coming in at +0.6% for the month and increasing to 4.5% for the year. JOLTS numbers highlighted that the labor market still has some fight in it, with job openings coming in slightly higher, although they remain on a downward trend along with hiring, while the number of those voluntarily quitting their positions is also declining as workers feel less confident about getting another job. While confidence in finding another position may be waning slightly, overall consumer confidence appears to be improving, as noted by the most recent University of Michigan and Conference Board numbers. The headline indices rose again, boosted by increases in both consumers’ current assessment of economic conditions as well as future expectations, as they see inflation falling, incomes increasing, rates coming down, and the labor market remaining healthy. Real disposable incomes increased by 2.5%, while a positive post for monthly retail sales also showed the consumer remains engaged. Indeed, although lower than the previous period of measure, consumption numbers proved resilient in the most recent Q4 GDP figures, growing at an annualized pace of 2.8%.

In terms of investment, the ISM PMI manufacturing index picked up for the second straight month, boosted by an uptick in new orders and offering some light for the sector. Despite this, they remain in contractionary territory and point to the challenges that persist in the manufacturing sector from the weight of higher rates and waning demand. Encouragingly, the organization’s economic forecast released at the end of last year laid out that a majority of those polled see improving business prospects and plans for increased capital expenditure this year. Industrial production’s gain for the month (+0.1%) also masked a drop in the manufacturing sector, which fell when excluding motor vehicles, while regional surveys fell too, echoing the sectors issues at a more local level. Quarterly business investment in the GDP figures increased, in contrast to Q3, but remained at the lower end of its recent range, with all major categories contributing to the gain.

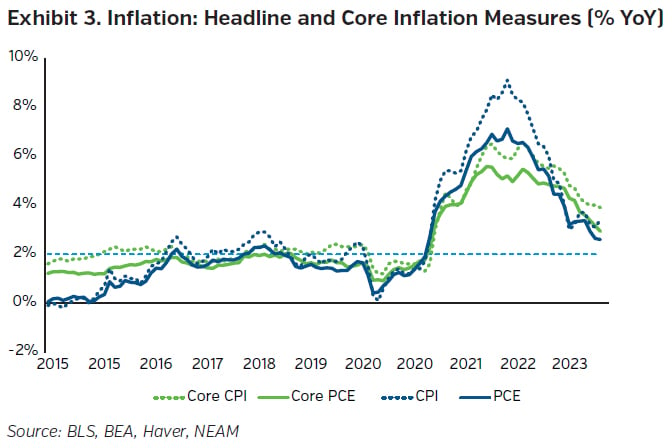

On the inflation front, recent prints show that the path of disinflation remains intact, particularly at the core level, but evidence that this improvement is sustained is needed. At the CPI headline level, prices increased +0.3% for the month, which leveled out to a 3.4% gain relative to the comparable period last year. Both energy prices, led by higher electricity and gas prices, and food costs rose this month. At the core level, core goods prices were flat, breaking a trend of several months in which they receded. On the core services side, shelter added its typical weight to the gain, with its price gains contributing more than half of the overall price increases experienced in the month. Diving further, shelter was aided by a rise in lodging away from home, which after two months of negative numbers, returned to positive territory. Away from lodging, core services ex-housing was similar to last month at +0.4%. Jumps in medical care and recreation also fueled the increase on the services side. The Fed’s preferred measure of inflation (PCE) itself came in at 2.6% for the year, and even lower over the last six months on an annualized basis. Though recent inflation readings are encouraging, Powell suggested in his post-Fed decision press conference remarks that the recent improvement in readings recently was “welcome,” but noted that more “sustainable” data of the same nature is required before making any moves.

Capital Market Implications

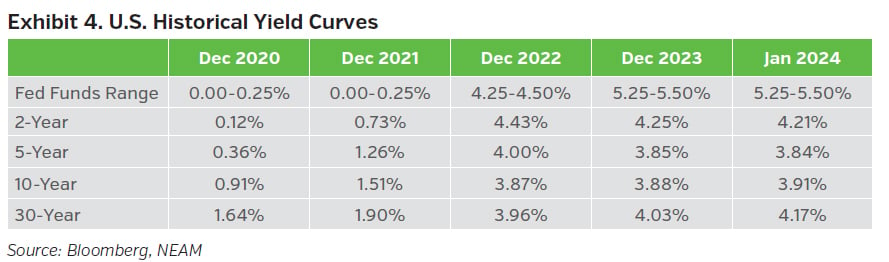

Resilient economic data and Fed commentary tempered market expectations for the timing of the Fed’s initial foray into the rate reduction cycle. Treasury yield moves were mixed, with more significant changes in the long end of the curve. Equity markets gained for the majority of the month, only to have some of their momentum dampened by Fed commentary after its rate meeting.

Capital Market Outlook

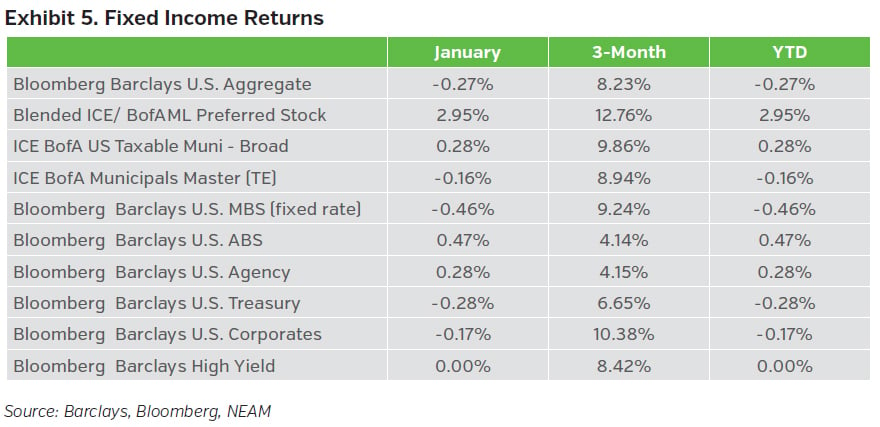

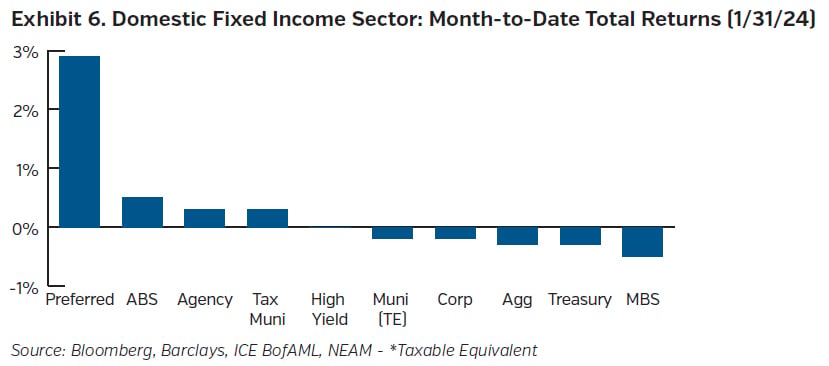

Fixed Income Returns

The Fed held its benchmark rate constant for the fourth meeting in a row and tempered expectations for a rate cut early in the year. Treasury yield movements were mixed, with longer-end rates rising while shorter-end rates fell slightly. The market experienced some modest volatility during the month however credit spreads ended the month slightly tighter with absolute yields remaining attractive and firm demand.

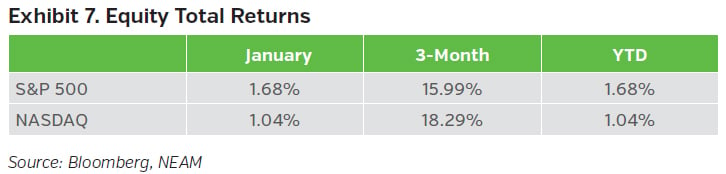

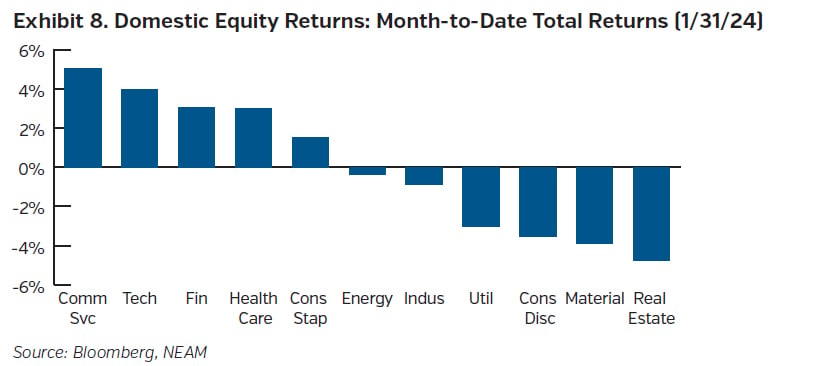

Equity Total Returns

Equity markets rose to begin the year, only to have some of their momentum dashed at month end as the Fed pushed back on the timing of its potential first rate cut and companies’ forecasts and lofty investor expectations realigned. Volatility remained muted. The Dow, S&P, and Nasdaq all ended the month higher.