JULY Overview

In as much as the economy continues to show resiliency despite the headwinds of increasingly restrictive monetary policy, inflation remains too high. For this reason, the Fed remains alert at the helm, working to bring down price increases to a more palatable and sustainable level while the market debates when they will achieve peak rates and finish this most recent campaign.

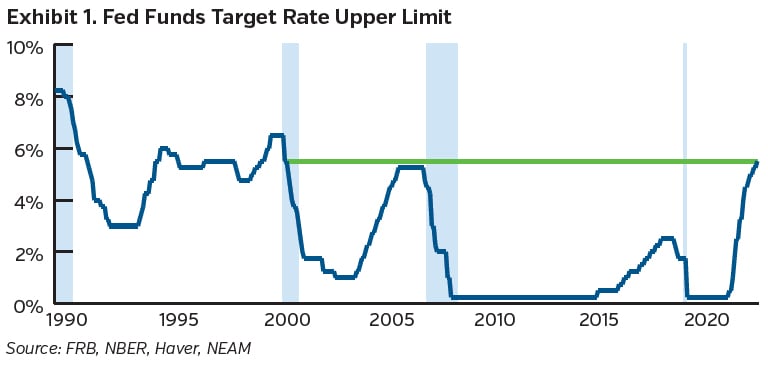

At the time of the June meeting, signs of a still healthy but increasingly softer labor market, slowing inflation and tighter credit conditions convinced the Fed to ease its foot off the brake, opting instead for more data and time to see how the cumulative effects of its policy to date were taking form. They were, however, still of the mind that further tightening was necessary. The 25 bp increase in the benchmark rate at the July meeting, despite a cooler inflation print in the interim, was therefore widely expected by the market. With the most recent increase, the Fed raised the range of their benchmark rate to 5.25%-5.50%, the highest level in over two decades. In the accompanying statement, the Fed held open the opportunity for additional firming but relayed cautiously that this will be data dependent as always. Indeed, Powell offered that the decision to pause or hike again in September, if necessary, was on the table and subject to the evolution of financial and economic conditions and the “durability” of lower inflation as it falls.

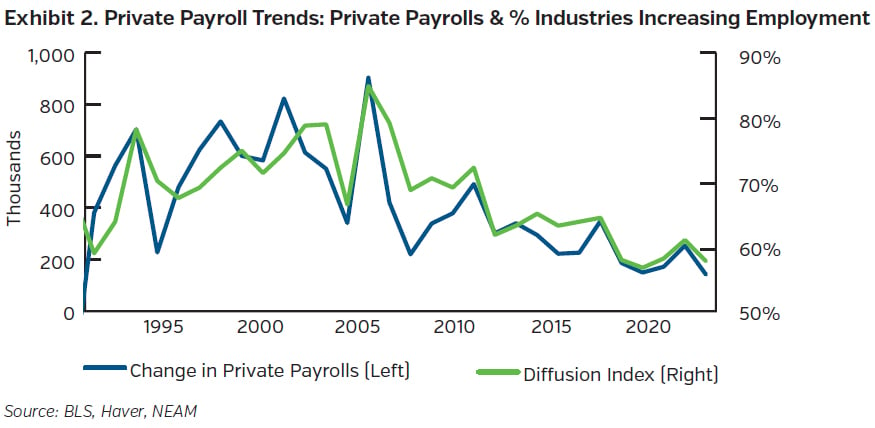

The tight labor market is showing some signs of loosening, although with unemployment at 3.5%, it remains healthy overall and wage growth sits above longer-term historical averages. The June jobs number came in at a revised +185K, while the July numbers were just a bit higher at +187K. The levels represent the lowest payroll numbers since December 2020, and the 3 and 6-month averages continue to weaken. In the July report, many sectors pulled back, and a large gain in healthcare helped to prop up the number. Indeed, although still tilted in favor of industries adding positions, the diffusion index of private payrolls has been on the decline since its most recent peak early in 2022. Despite the downward trend in jobs, wage growth has still averaging about 0.4% for the past few months and roughly 4.4% on an annual basis. With inflation falling, real hourly growth is positive which should help consumers and although measures of wage growth are pointing in the right direction and Powell has stated that the current levels of wage growth at this point are consistent with their long-term goals, the numbers are most likely still high enough to warrant the Fed’s attention going forward and continued effort to bring more balance to the supply demand relationship in the labor market. Consumers appear to be welcoming the increase in real incomes. Confidence, although still relatively low, has been seesawing its way north as the labor market remains relatively firm and inflation subsides. While Q2 GDP overall was greater than expected, figures show consumption. slowed from Q1, and with personal savings ratcheting down since the pandemic heights, it remains to be seen whether consumption can remain resilient in the face of higher prices and interest rates as this buffer recedes.

In the investment arena, June’s ISM Manufacturing PMI ticked lower again, this time to 46.0, before nudging higher to 46.4 in July, where it remains in contractionary territory. Industrial production also fell to the tune of 0.5% for the month, with drops in all three major categories contributing to the decline. Regional Fed surveys point to pressure in the manufacturing sector, and falling prices too, while Beige Book findings show that manufacturing activity has been mixed across districts. GDP investment proved a brighter spot, with business investment up and more than offsetting continued weakness in residential investment.

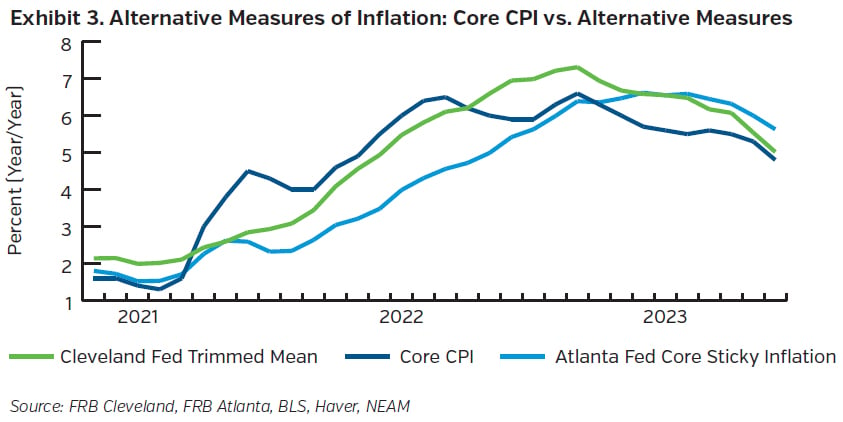

Inflation continues to decelerate. At both the headline and core level, prices increased +0.2% over the month. Relative to the prior comparable period last year, this equated to a 3.0% and 4.8% increase for the headline and core levels, respectively, and represented the lowest levels since differing months in 2021 for both. Food stayed level with last month while energy ticked up, but food price growth is slowing, particularly at home, and energy prices are down nearly 17% relative to last year. At the core level, the lower levels came about as service prices moderated while goods levels fell. On the core services side, price increases slowed to +0.3% in June. Shelter’s pace eased slower over the month (+0.4%), while an 8.1% monthly drop in airline fares also contributed to the diminishing pace of services. With respect to core goods, prices fell 0.1% over the month, bringing the yearly comparison down to +1.3%. The monthly drop was due in large part to the retreat in used vehicle prices, but also household furnishings and recreation, while gains in apparel and medicinal drugs softened the fall. Additional measures of inflation, such as the Atlanta Fed’s sticky CPI and Cleveland Fed’s trimmed mean measure are also softening. The lower levels should be welcome news for the Fed, although with the core level still a distance from their target, they still shared their intention to keep the pressure on until they see more evidence of sustainably lower inflation.

Capital Market Implications

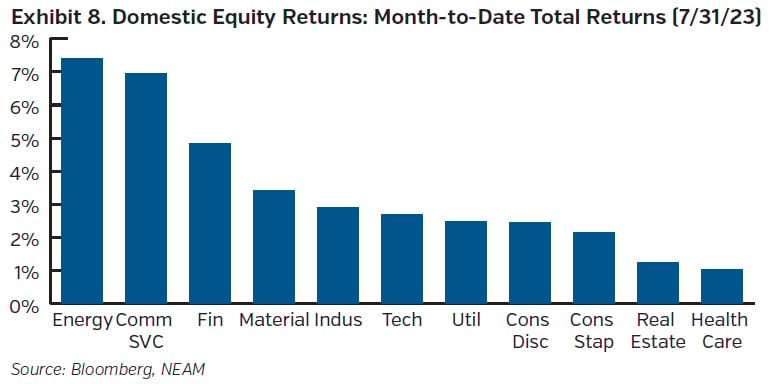

Against the backdrop of cooling inflation but a still healthy labor market and above average wage gains, the Fed raised rates further. The degree to which inflation dropped, however, left markets debating if peak rates were near, which when combined with many companies exceeding earnings estimates, drove equity markets higher. Treasury yields rose in the front and back end of the curve in sympathy with the Fed’s move and higher than expected growth while credit spreads tightened.

Capital Market Outlook

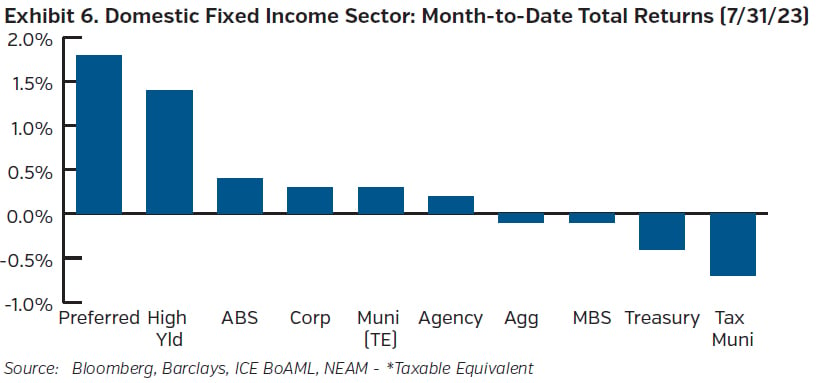

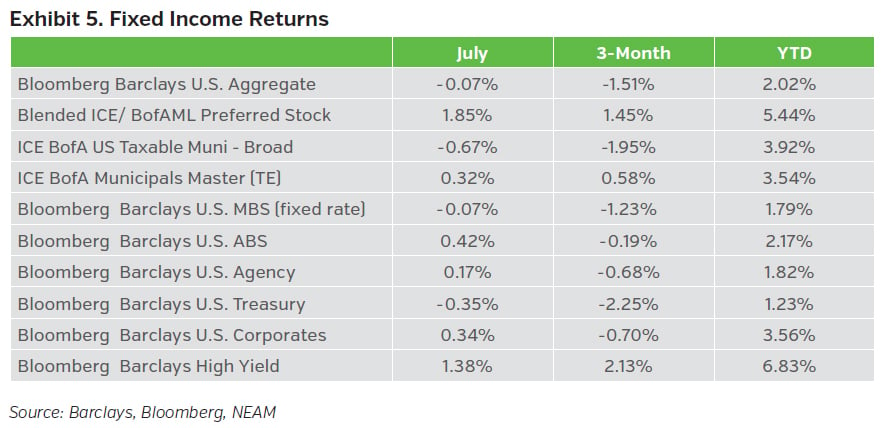

Fixed Income Returns

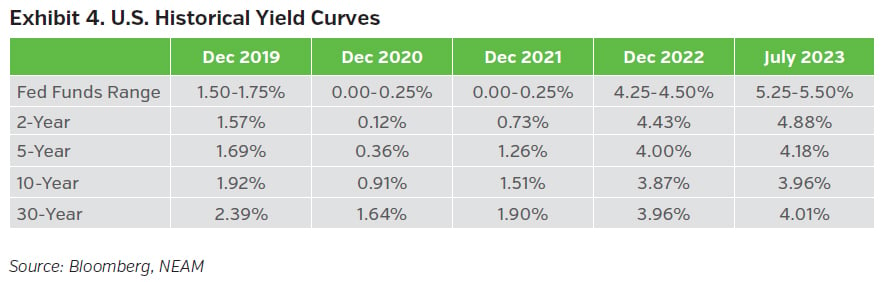

Despite slowing price growth and a tighter credit climate, the Fed still felt economic conditions warranted another rate increase. Combining the 25 bp hike with a stronger than anticipated Q2 GDP figure, Treasury yields rose in the front and back end of the curve while credit spreads ground tighter.

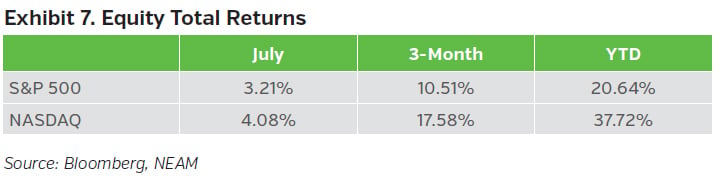

Equity Total Returns

With some evidence of easing inflationary pressure, market participants’ hopes that we may be near a peak in rates increased. Stronger than expected economic growth, combined with companies [largely] beating earnings estimates, helped send equity prices higher. The Dow, S&P and Nasdaq all posted gains for the month.

_