The Agency Mortgaged Backed Securities (MBS) market has been on a roller coaster between periods of excess demand and excess supply over the last two decades. This has been largely driven by the Fed’s quantitative easing programs, along with an ever-changing composition of the demand base. Prior to the GFC (Great Financial Crisis), Government Sponsored Entities (GSEs) could be counted on to support MBS, but that mandate no longer exists. Today, the upshot of the complex mix of supply side and demand side factors has left MBS in a more challenged technical position resulting in attractive spread levels for the high quality, highly liquid, fixed income stalwart. Yields on MBS now present an attractive entry point for insurance companies, with the opportunity to lock in intermediate-term yields at attractive risk-adjusted spreads.

Shifting Sands of Demand

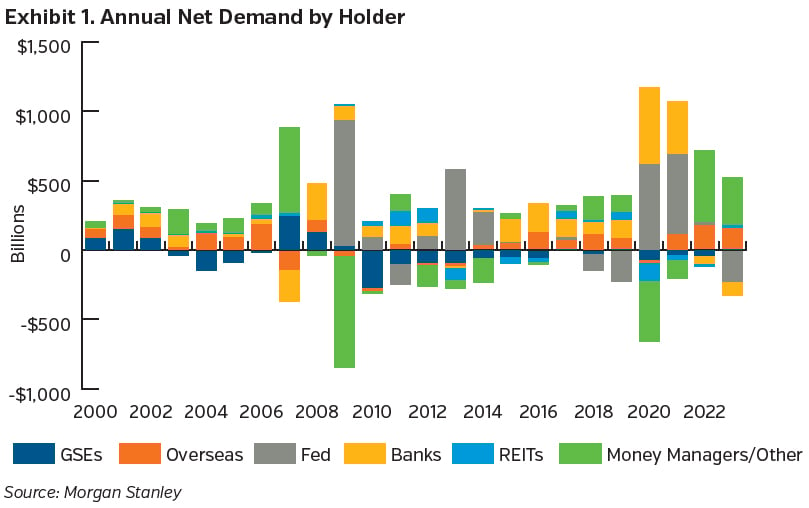

The MBS market is notable in the way that investor demand has shifted dramatically from year-to-year. This was made possible in part by the high degree of liquidity in the sector and because the MBS sector has been a target asset within the Federal Reserve’s quantitative easing program.

A few observations on this history:

- The Fed and banks have been at the center of the quantitative easing story. While the Fed expanded their MBS portfolio by $1.9 trillion from the beginning of QE3 in 2012 through Covid, banks more than doubled their MBS holdings by adding $1.7 trillion ($630 billion during Covid alone). At their combined peak in February 2022, the holdings of the Fed and domestic banks held a staggering 80% of the Bloomberg MBS Index.

- GSEs (such as Fannie Mae and Freddie Mac), who have historically supported MBS at times of spread widening, are no longer a factor.

- Fed participation has been massive and inconsistent.

- Money managers have been opportunistic; selling to the Fed (a non-economic buyer), while buying when Fed was out of the market.

- Bank participation has dwindled in 2023 owing to the failure of banking entities who were off-sides on their asset-to-liability matching resulting in regulators’ calls for additional capital for banking institutions, leading to faltering in bank demand for MBS.

While issuance has been subdued, demand drivers have led to a technical situation in which there are fewer buyers adding to their MBS allocations, keeping spreads at elevated levels.

Valuations

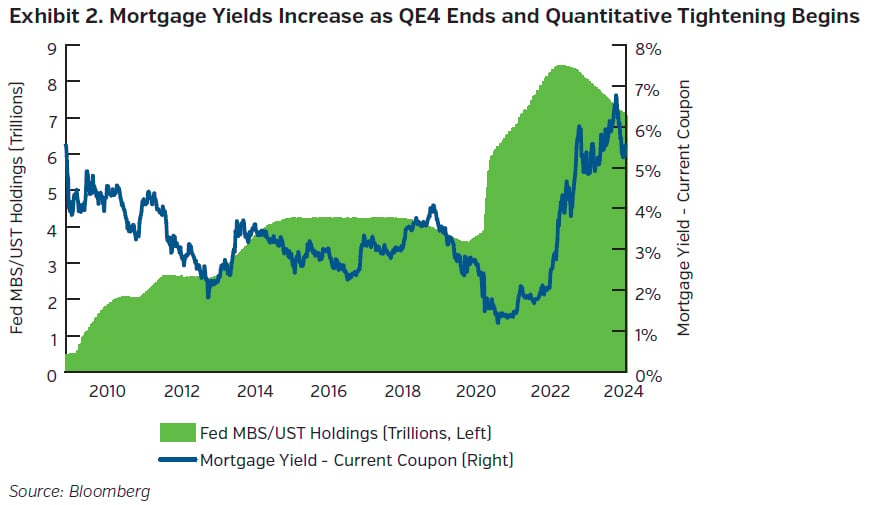

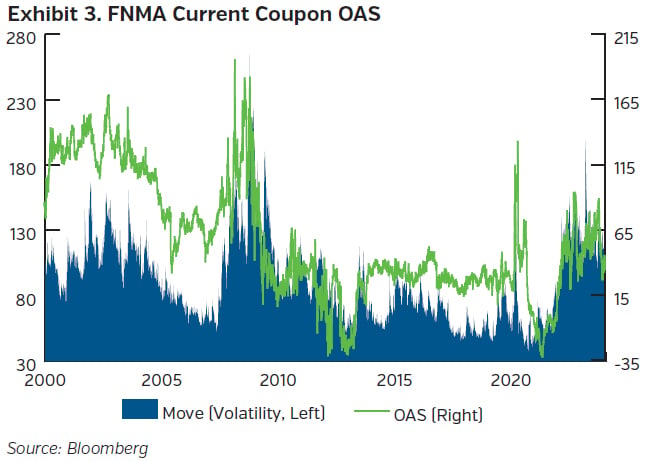

Yields on MBS began their climb in 2021 in anticipation of quantitative tightening by the Fed, pushing mortgage rates to the highest levels in decades. Because of the shifting demand backdrop, spreads (relative to Treasuries) on MBS have spent the last two years at the highest levels seen since the GFC.

The spread of MBS is driven not by credit risk but by future rate expectations and volatility of the rates market, which impacts the degree to which mortgages are likely to shorten or extend based on underlying loan prepayment expectations. The metric that best values this propensity to extend as rates rise or shorten as rates drop is Option Adjusted Spread (OAS). Periods of low rate volatility allow OAS to compress while higher volatility offers opportunities to invest at higher spreads.

Now that rates are more volatile with ongoing quantitative tightening, an opportunity exists for insurers to add high-yielding MBS that generate attractive investment income and high levels of liquidity. Spreads will likely remain rangebound at the widest levels seen in years given the technical backdrop of reduced demand from the Fed and banks, and is a situation that could persist without a catalyst to significantly change the rate environment or demand landscape. Insurance companies with stable funding should consider continuing to add high yielding MBS as other buyers remain on the sidelines.

Time to lock in higher yields

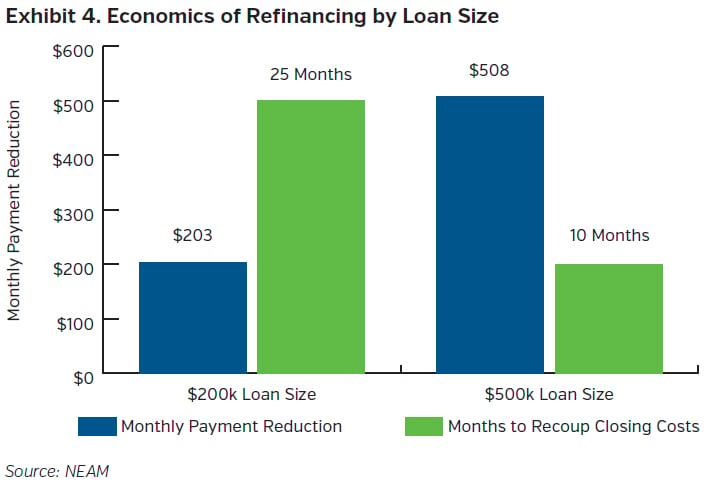

We believe the best way to take advantage of the wider spreads in MBS is to “lock-in” attractive yields with pools that have favorable prepayment protection characteristics. Certain pool attributes (loan sizes, high loan-to-value, lower credit score, loans on investor properties) are associated with lower prepayments because of the natural frictions (refinancing costs, unique underwriting requirements) associated with them. These pools are considered “specified pools” and offer options to mute the volatility of prepayments due to refinance activity. The chart below illustrates the lower refinancing incentive (lower monthly savings) and longer breakeven period (months to recover closing costs of $5,000) for a low balance ($200k) loan refinancing from an 8% to a 6.5% 30-year loan, generally making this type of pool better protected from prepayments.

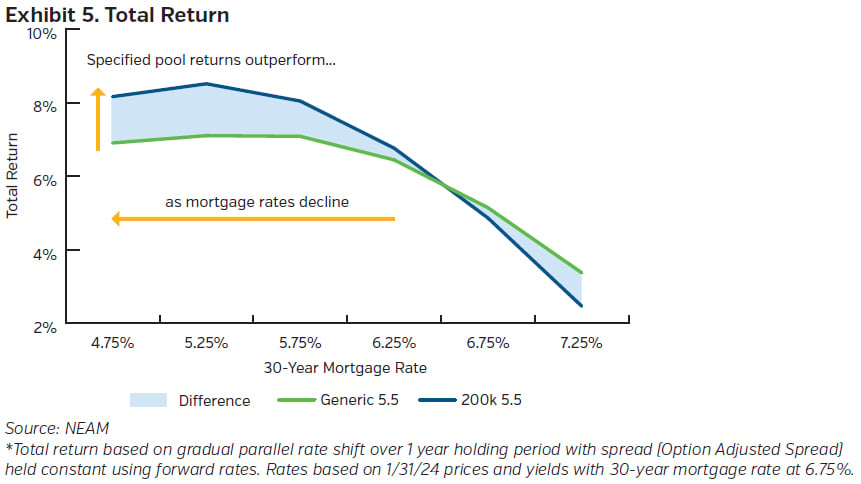

The graph below illustrates the estimated improvement in total return for specified pools versus buying higher yielding generic MBS, which we believe will tend to outperform over a longer holding period with declining rates and provide a boost to investment income for years to come.

Key Takeaways

- Quantitative easing created volatility in demand and pressured yields lower, thereby shifting the demand landscape. Quantitative tightening has reversed those trends.

- The withdrawal from the market of the dominant buyers of MBS (the Fed and domestic banks) has allowed spreads to widen to the widest sustained levels in decades.

- Yields on MBS began their climb in anticipation of quantitative tightening by the Fed, pushing mortgage rates to the highest levels in decades.

- Although higher coupon MBS offer an attractive entry point for higher yields, specified pools may help investors to lock-in higher yielding MBS by reducing the impact of prepayments and allow insurers to keep higher levels of investment income in the portfolio for longer than generic MBS.

- Given the current rate environment, premium risk is low (the Bloomberg Barclays MBS index stands at ~$88). A strategy focused on dollar prices that are closer to par ($98 to $102) helps maximize yield while assuming a still-low risk of premium dollar prices being called away.

- MBS represent an attractively valued, high quality, highly liquid investment option for insurance companies.