In June, for the second year running, NEAM Limited conducted its annual Lloyd’s Syndicate Investment Survey. In this article, we review the key investment trends for Lloyd’s syndicates as indicated by our survey respondents, examine these trends in the broader insurance sector context and highlight important considerations for Managing Agencies for the remainder of this year.

Lloyd’s - The Big Picture

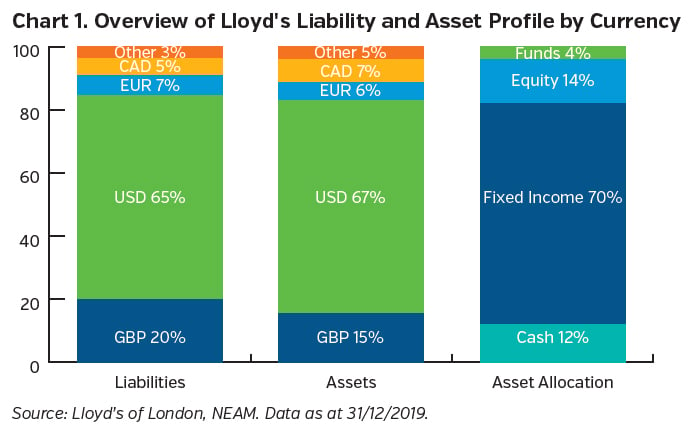

Lloyd’s holds a distinctive place in the global insurance market with over 300 years of history and coverage of a diverse range of business lines. It is something of an anomaly being London based and subject to local UK and European regulation, including Solvency II, and yet two thirds of syndicate assets are denominated in US Dollars - a result of its global liability profile, see Chart 1.

While Lloyd’s is a unique environment, the investment profile of its syndicates shares many of the same investment portfolio characteristics as that of the broader global P&C industry in that it is dominated by fixed income, with typically high credit quality and short duration.

This helps syndicates to limit the volatility of their assets and to meet the liquidity requirements of their liabilities. Due to the “lumpy” nature of certain lines of business, there is also a sizeable allocation to cash and deposits.

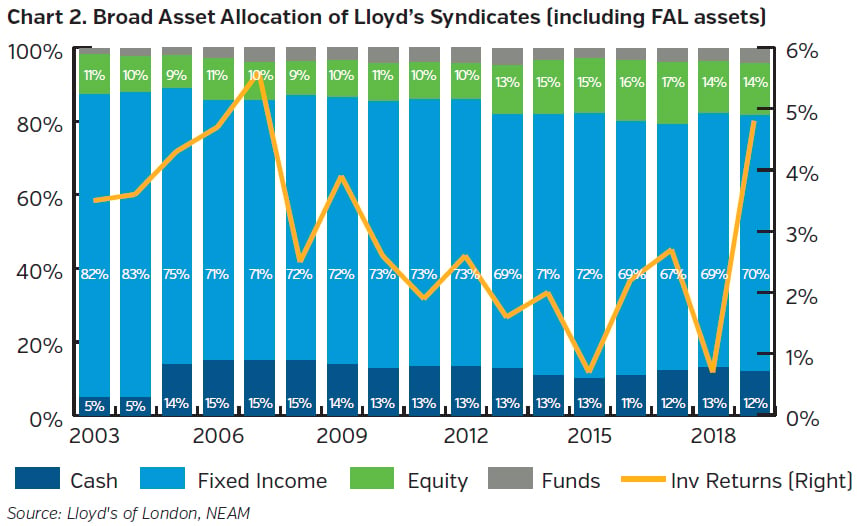

Looking back, we can see from Chart 2, syndicates’ allocation to fixed income has remained reasonably stable over the last 17 years at between 69% and 83%. This time period includes the Great Financial Crisis which saw a spike in investment yields. Since that crisis, investment yields have been subject to huge downward pressure due to slow economic recovery and a loose monetary environment.

Driven by a need for more investment return and against a backdrop of soft underwriting conditions, syndicates have marginally increased their allocation to equities and alternatives. This has helped to boost investment returns, while introducing more volatility to the investment outcome.

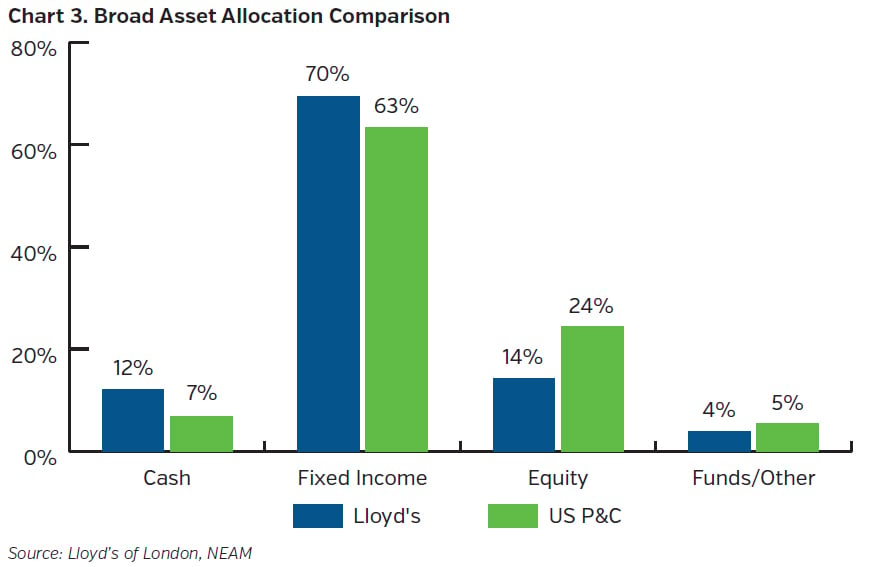

In Chart 3, we compare Lloyd’s asset allocation to that of the US P&C industry in aggregate as of year-end 2019. While the two profiles are broadly similar, the Lloyd’s portfolio has a higher allocation to cash and looks more conservatively positioned, most notably with a much lower allocation to equity.

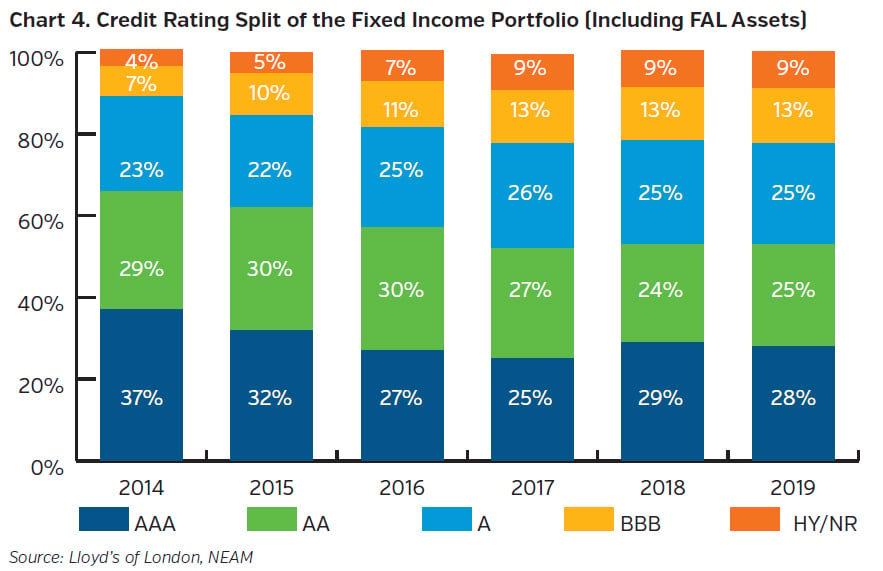

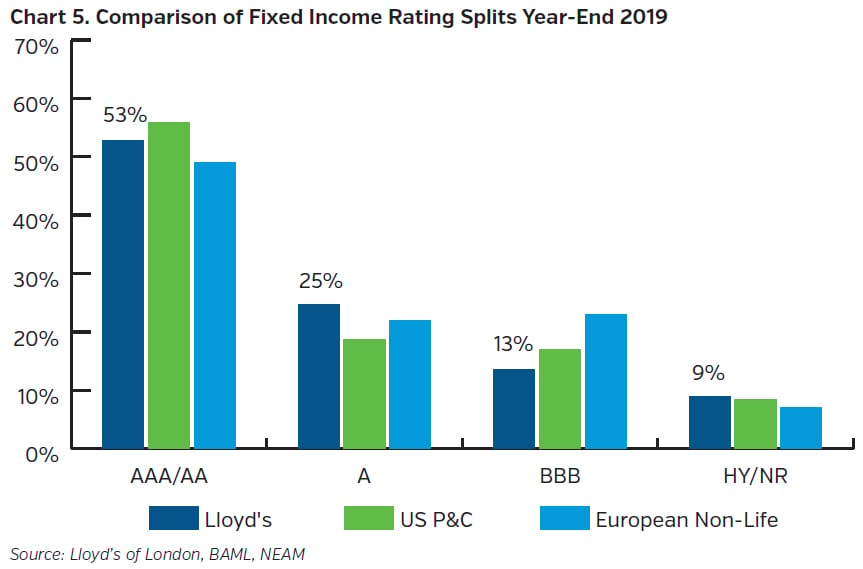

At year-end 2019, 78% of the Lloyd’s fixed income portfolio was invested in bonds rated above BBB. The downward pressure on yields, however, and the increase in BBB rated bonds in the market have pushed Managing Agencies to explore the BBB and high yield space. The allocation to bonds rated BBB or below has increased over the last five years from 11% in 2014 to 22% in 2019.

BBBs and high yield are likely to continue to be a focus for Lloyd’s investors while the low rate environment persists. The increase in BBBs also reflects the composition of the bond universe, with the proportion of BBB-rated bonds increasing steadily over time. The impact of COVID-19 is also likely to contribute to this trend with potential downgrades of issuers in Lloyd’s portfolios. However, historically conservative investment guidelines would prevent material deterioration in overall portfolio credit quality.

How does the credit quality compare with other European insurers and US P&C insurers? In Chart 5 we compare the rating split across markets and can see that the Lloyd’s fixed income portfolio is similarly conservatively positioned to peers in the US and Europe, although notably Lloyd’s allocation to BBB is the lowest and its allocation to high yield bonds is marginally the highest.

Given the majority of assets in Lloyd’s portfolios are denominated in USD, they have, to a large extent, avoided the ultra-low and even negative yields experienced over the last number of years by their European and UK peers. As we see in Chart 5, European non-life insurers have been more aggressive in investing in BBB credit, the need for positive yield often vying with the increased capital charges under Solvency II. However, as the US and global economies struggle with the impact of COVID-19, this ultra low yield environment has spread outside the Eurozone and UK into areas that had been largely insulated to date.

Some of the above were driven or assisted by the investment allocation of Funds at Lloyd’s (“FAL”). For example, after excluding FAL assets, fixed income portfolios at syndicate level consist of only 12% in BBB rated bonds and 2% in high yield at year-end 2019.

We will now focus on the asset portfolio at syndicate level (excluding FAL assets but including any “funds in syndicate”) for the rest of the analysis.

Lloyd’s Syndicate Investment Trends

Syndicate Portfolio Duration

Duration of the investment portfolio is anchored around the reserve duration, though firms are considering extending the asset duration.

The average duration for Lloyd’s syndicate fixed income portfolios is short at between 1 and 3 years. This seems unlikely to change as it is governed by liabilities and a need for liquidity, as we saw in the responses to our survey. However, downward pressure on yields may force those who have the scope to do so to move out on the yield curve and pick up any incremental yield.

The average duration of US P&C insurers’ fixed income portfolios is 4.6 years, significantly longer than Lloyd’s. This is partially explained by the differences in claims profile and accounting regimes, as well as by the fact that US P&C firms tend to view duration more as a liquidity decision, as opposed to an “asset liability matching” requirement.

Corporate Credit in Syndicate Portfolios

Lloyd’s syndicate allocation to Corporate bonds more in line with US P&C insurers than other European/UK domiciled insurers.

Lloyd’s syndicates’ significant allocation to corporate credit is notably higher than European insurers, a function of Lloyd’s having a larger allocation to short dated fixed income where short dated corporate credit is a very efficient asset allocation. Our survey showed almost half of respondents had an allocation of over 50% to corporate bonds with the majority looking to either maintain or increase this allocation.

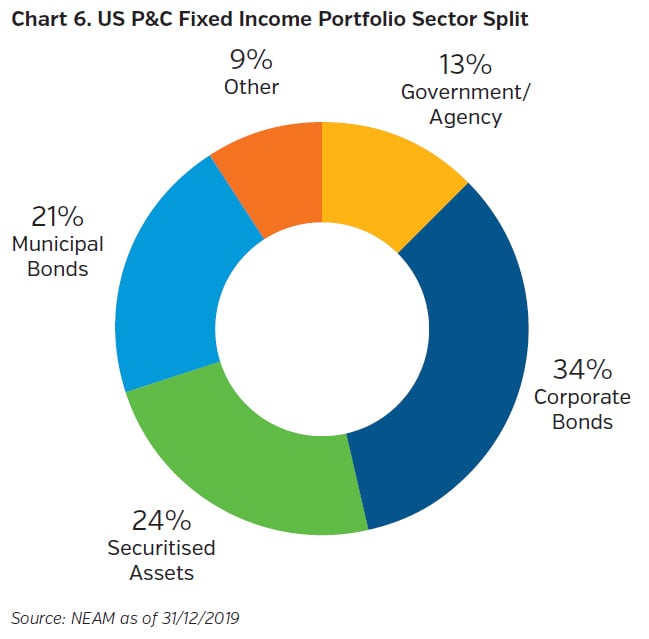

In contrast, the fixed income portfolio of the US P&C firms is more diversified from a sector perspective, with an allocation to corporates of only 34% and US municipal bonds and securitised assets comprising more than 20% each of the portfolio.

Lloyd’s syndicates have more scope for diversification than many European and British insurers due to the fact that they hold significant proportions of their portfolios in US Dollar assets. This offers a broader choice of corporate issuance, potential allocations to US taxable municipal bonds and some structured securities, although Solvency II considerations, such as significant capital charge requirements, somewhat constrain allocations to these sectors.

Impact of COVID-19 on Lloyd’s Syndicates

COVID-19 induced economic uncertainties create challenges for Lloyd’s Managing Agencies

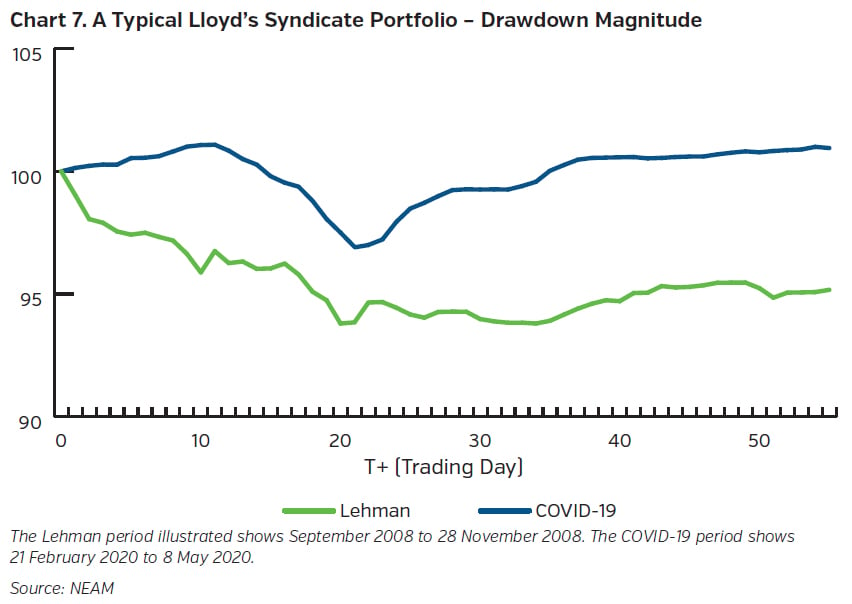

A “typical” Lloyd’s syndicate portfolio would have weathered the recent market volatility reasonably well with highly rated bonds and a short duration. Chart 7 shows how such a ”typical” Lloyd’s portfolio performed during the recent period and compares this performance to the period immediately after Lehman bankruptcy. The drawdown is less severe this time and the bounce back proved to be both sharp and quick, thanks to the actions of central banks and fiscal authorities.

Following the initial tumultuous months of the global pandemic, our expectation is that yields will stay lower for longer. In this environment, investors must stay nimble in order to capitalise on all opportunities as they arise. Maintaining book yields and managing costs and other drags on performance will be essential. Investors must also be alert to a wide range of economic and market scenarios and attendant volatility. Finally, a challenging underwriting environment calls for careful evaluation of opportunity cost, while COVID-19 related claims may create significant pressure on syndicates’ liquidity.

ESG & Lloyd's

ESG (Environmental, Social and Governance) has become an increasingly important topic for Lloyd's Managing Agencies.

Our survey showed a number of syndicate portfolios already include ESG parameters in investment guidelines with many others planning to follow suit within the year.

This increased focus stems from: influence from the parent company, customers/staff expressing preferences and increased focus by regulators. Managing Agencies are keen to implement changes on their own terms before they are instructed to do so.

Review work is currently under way at a number of syndicates as there is still no hard and fast guidance for the market. A detailed cost benefit analysis is required to prevent negative impact on returns.

Key Takeaways

- Lloyd’s fixed income portfolio maintains a high average credit rating, even though this has drifted down along with the associated bond universe.

- Duration of the investment portfolio is anchored around the reserve duration, though firms are considering slightly extending the asset duration.

- Lloyd’s allocation to corporate bonds is more in line with US P&C insurers than with other European/UK domiciled insurers.

- While many Lloyd’s portfolios were able to take advantage of wider spreads earlier this year, opportunities have become scarcer as spreads continue to tighten. As such, it will be important for investors to stay nimble in order to capitalise on opportunities as they arise over the coming months.

- ESG is an increasingly important topic for Lloyd’s syndicates with a considerable number of syndicates aiming to implement ESG parameters within their investment guidelines over the next 12 months.

For more information on NEAM Limited's Lloyd’s Investment Trend Survey 2020, visit:

https://www.neamgroup.com/lloyds-survey/non-us

NEAM Limited’s Lloyd’s Investment Trend Survey Was sent to 55 Lloyd’s Managing Agents, 24 of which responded.

The model portfolio used in this article is hypothetical, based on index data and NEAM’s assumptions on typical asset allocations within the Lloyd’s Market. It does not reflect any actual portfolio performance but rather reflect assumed performance for the given asset allocation. The hypothetical model portfolio performance figures are based on the return of the relevant indices. This model portfolio was constructed using an assumed allocation of 35% Sovereigns and 65% Corporates. The portfolios assume 100% allocation to USD investment grade core fixed income. The model performance returns do not in any way reflect the performance of any actual portfolios. In addition, the model portfolio returns refer to the past and past performance is not a reliable indicator of any future results. The hypothetical model portfolio returns are derived from certain assumptions and changes to these assumptions may have a material impact on any results.