Introduction

Lloyd’s has recently initiated Project Rio (also known as “The Principles for Doing Business”), which will replace the Minimum Standards framework starting January 2023, moving from the former rules based regime to a principles based approach.

Having submitted their first self assessments, Managing Agents are currently reviewing the results with Lloyd’s to determine whether any actions are required for the second half of 2022.

While the exercise is comprehensive with a continued focus on underwriting performance, within the Investment section, Managing Agents are required to demonstrate their compliance with the Prudent Person Principle (“PPP”), as well as benchmark against certain performance and operating standards. In this publication, we summarise these investment-related requirements and highlight what we see as key considerations for 2022 and beyond.

Background - Excerpts from Project Rio Requirements

Principle 8 – The Investment Principle:

Managing agents should ensure syndicate investment risk is effectively controlled, informed by wider business strategy and adheres to the Prudent Person Principle (PPP) requirements.

Investment Sub-Principles:

- Have a clear articulation of investment objectives and risk appetites, with rationale having regard to high level business or solvency strategy

- Have clear investment parameters and guidelines with robust processes to monitor and report positioning against limits

- Integrate investment stress testing into investment management

- Ensure investment performance and risk, including that of outsourced arrangements, are effectively overseen through monitoring and reporting

- Develop and embed a Responsible Investment Policy

- Have Asset Liability Modeling (ALM) capabilities consistent with Use Test Principles

- Have robust investment governance

Source: Lloyd's of London, "The Principles for Doing Business."

Investment sub-principles 1, 2, 3, 4 and 7 are consistent with PRA Supervisory Statement 1/20 (“SS1/20”, Solvency II: Prudent Person Principle) which was published in May 2020, so they should not pose a significant challenge for Managing Agents to evidence. However, sub-principles 5 and 6 are new measures introduced by Lloyd’s to further the integration of environmental, social and governance (“ESG”) factors and continue improving risk management practices within the market.

We note that requirements under the Investment Principle are broadly consistent with Lloyd’s Minimum Standards, bringing together investment items under the same heading (e.g. taking some items from the Risk Management minimum standards).

Operating Standards - assessing against the “expected maturity”

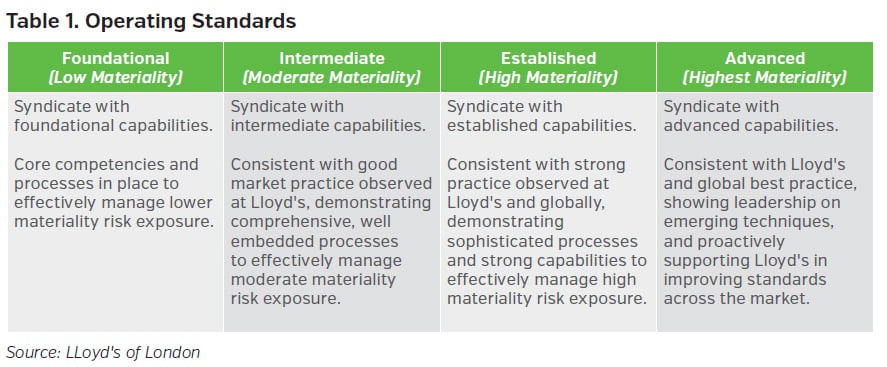

In moving to a principles based approach, Lloyd’s recognises that there will be varying ways for Managing Agents to comply with the requirements, with the determining factor being how material a certain principle is to a syndicate. As a result, Lloyd’s sets out its expectations for the operating standards, by Principle, for each syndicate (called “expected maturity”).

For Investment sub-principles, according to the technical briefing provided by the Lloyd’s Team, the default expectation is set at the “Established” level. Only in very limited circumstances could a managing agent target the “Foundational” level (e.g. more than 90% of the investment portfolio is allocated to cash and government bonds). This helps to accommodate certain syndicates that are at an early stage of being built out, while pushing the majority of the market to a higher standard than the existing framework.

The Lloyd’s Team noted that “responsible investment” (sub-principle 5) is a new area for Managing Agents and, for the time being, its stance will be “less stringent” on this than the other sub-principles.

Implications for Managing Agents

For many of the requirements, Managing Agents should be able to demonstrate compliance through providing relevant papers and meeting minutes of the Board, the Investment Committee and the Risk Committee. Collectively these should also help showcase “robust investment governance” (sub-principle 7) and address items under sub-principles 2, 3 and 4.

Up-to-date investment-related policy documents ranging from investment risk appetite policy to investment guidelines would help demonstrate the compliance with sub-principle 1.

Areas of Judgment

While certain areas are more straightforward to assess and evidence (e.g. sub-principles 2 and 3), some are subject to a certain level of judgment and therefore are expected to involve a dialogue with Lloyd’s. For example, Lloyd’s may require additional evidence regarding the “effective oversight of investment performance and risk” (sub-principle 1, “Established” level), or how the wider business strategy “informs” investment risk-taking (main principle).

The assessment on the Investment sub-principles may also be influenced by aspects of other Principles, such as the Governance, Risk Management and Report principle and the Liquidity principle. Given the continued focus on underwriting performance, strong performance on investment is not expected to sway the overall assessment of a Managing Agent and the syndicate(s) it operates.

Key Considerations for Lloyd’s Managing Agents for H2 2022 and Beyond

We expect that many Managing Agents will focus on the two areas below for the second half of 2022, to ensure meeting the new requirements for January 2023.

-

Investment Strategy Review / Strategic Asset Allocation

While PRA’s SS1/20 specifically mandates for an annual review of investment strategy under the Board’s or Investment Committee’s oversight, Project Rio adds further requirements in this area:

-

- Ensure consistency between the investment strategy and the syndicate’s business plans

- Involve the Risk Team in reviewing the investment strategy to:

- Integrate investment strategy with solvency management, and

- Meet Use Test principles regarding the market risk module of the Internal Model

-

Responsible Investment Policy and Climate Risk

Managing agents are encouraged to formulate and implement a Responsible Investment Policy, which should be consistent with previous policy announcements, namely:

-

- Lloyd’s ESG Report 2020 (phasing out investments in certain energy sectors)

- Lloyd’s ESG Guidance for Managing Agents 2021

Sub-principle 3 requires that climate scenario tests are conducted on investment portfolios and inform investment risk management. The climate scenario tests should follow the framework of the Climate Biennial Exploratory Scenario ("CBES") exercise, which was concluded by the Bank of England in May 2022.

Key Takeaways

- In shifting from the former rules based regime to a principles based approach, Managing Agents are presented with an opportunity to better tailor these assessments to their own individual operations and to focus on those aspects that are most material to their business.

- Having completed their initial self-assessments, Managing Agents should turn their attention to their Investment Strategy Review and Responsible Investment Policies, ensuring that these take a broad perspective and align objectives and goals across both sides of the balance sheet, considering not only their investments but also their liability profile.

- In evidencing their compliance with the Investment sub-principles, Managing Agents should, for the most part, be able to leverage existing documentation to evidence the required oversight.

- NEAM has been proactively working with our Managing Agent clients to address requirements from Project Rio. Our key Enterprise Capital Strategy deliverables, such as Enterprise Based Asset Allocation™ and Advanced Risk Analytics, can be used by Managing Agents to help meet relevant investment sub-principles. We have also been working closely with clients to understand ESG risks and to help them formulate responsible investment policies.