In December of 2020 Lloyd’s published its “Environmental, Social and Governance (“ESG”) Report 2020.” Referencing the report, Lloyd’s Chairman Bruce Carnegie-Brown states “This is the first time we have set an ESG strategy for the Lloyd’s market and it represents an important milestone on the journey towards building a more sustainable future.” The report covers both underwriting and investment activity, but in this Quick Takes we will focus on the potential impact of this shift to responsible investing on Lloyd’s investment portfolios.

The importance of having robust ESG policies in place is growing rapidly for Lloyd’s members, as for other insurers, due to the increased attention this subject is receiving from a variety of stakeholders. With its 2020 Report, Lloyd’s has introduced guidance towards a minimum ESG standard to which it would it like its members to adhere.

The key element for investment portfolios in this report is a recommendation to members to phase out new investments in thermal coal-fired power plants, thermal coal mines, oil sands, and new Arctic energy exploration activities from 1 January 2022, along with existing investments by the end of 2025. This approach will be replicated in the Lloyd’s Central Fund. In addition, Lloyd’s is also guiding members to adopt this phased exclusionary approach to investments in entities that derive 30% or more of their revenues from any of these four activities.

Impact of Lloyd's New ESG Guidance

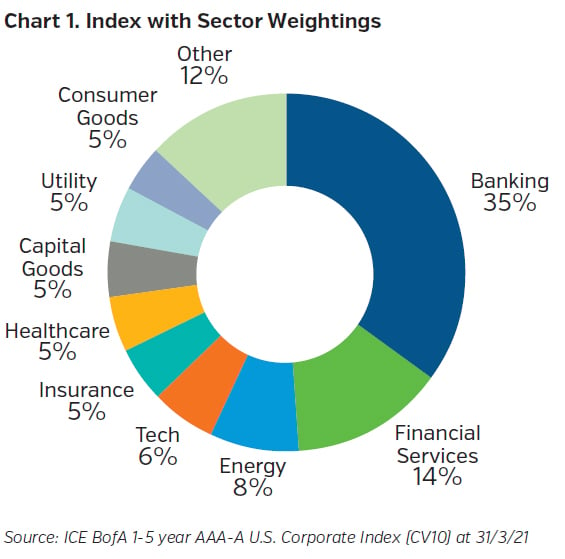

To understand the potential impact of this guidance on investment options and returns, we have analysed the ICE BofA 1-5 year AAA-A U.S. Corporate Index (CV10) as a proxy for a typical Lloyd’s U.S. Dollar portfolio. 8.1% of this index is in the Energy sector with 4.5% in the Utility sector (Chart 1). Both sectors would typically offer higher yields vs. the broad index due to perceived higher risk (due to energy transition) and lower ratings.

One challenge for analysis in this area is the lack of uniformity and depth of disclosures by issuers of involvement in the underlying activities. As such, we have complemented internal NEAM data with data from external providers to provide a more complete picture of the level of involvement at the issuer level. We note that detailed revenue information is not always available with proxies such as generation capacity used for activities such as Thermal Coal.

Our analysis has fully adopted this new Lloyd’s guidance and excludes issuers/investments which have >30% of revenues from the aforementioned activities.

What does our analysis tell us?

- Of ~1,500 issues within the ICE BofA 1-5 year AAA-A U.S. Corporate Index (analysis as of 31/03/2021), only 12 issues across 3 issuers (or 3% of the Energy/Utility universe by face value) would be omitted from the investable index with exclusions focused entirely in the Thermal Coal Power Generation space.

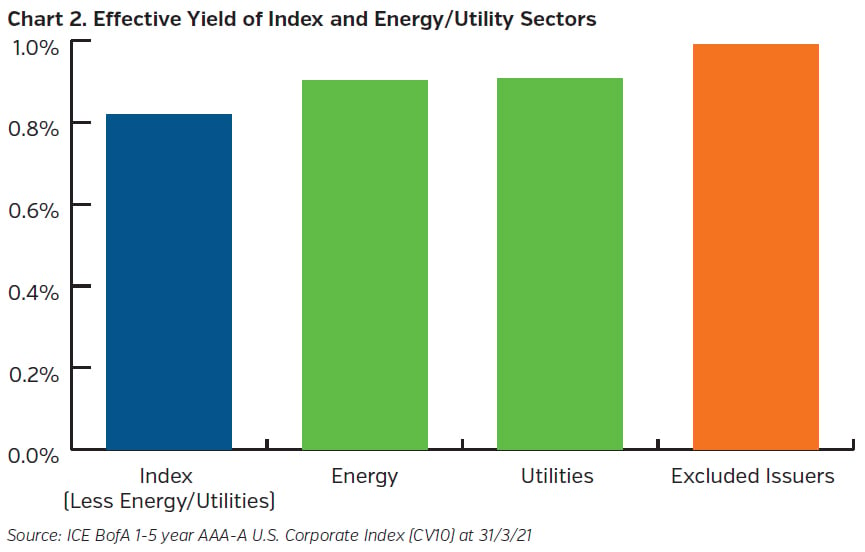

- From a return perspective, these 12 issues have an average effective yield of 0.99%. This is above the Index effective yield of 0.83% (Chart 2), however, given the limited names, the overall impact is minimal.

- To put it in perspective, if a portfolio had a 50% allocation to Corporates with similar characteristics to the Index, the overall drop in portfolio yield by adopting these proposals would be only 0.0006%.

- The impact could potentially be greater if a portfolio has holdings in below investment grade companies or exposure to bank loans due to a greater number of energy issuers with less diversified revenue streams in the high yield sector.

Looking Forward

As this topic evolves, two major themes are likely to develop over the next few years:

- Investment guidance (from Lloyd’s or regulators) and stakeholder pressure is likely to lead to more prescriptive, wide-ranging and possibly binary exclusions across many different activities which are deemed contrary to faith or value-based criteria in areas such as Energy, Environment, Defence/Military and Health/Life.

- In parallel, it is expected that issuers will continue to modify their business models to shift away from such activities so that fewer companies could ultimately fall foul of these more restrictive and wide-ranging criteria.

So, if we run the same exercise as above but reduce the revenue threshold for Thermal Coal Generation within the CV10 index to 0% (vs. initial guidance of 30%) – what is the impact?

This would impact ~23% of Energy/Utility issues (by face value) thereby excluding 96 issues from 28 issuers with an average effective yield of 0.89% (vs. 0.83% for the broad index).

While more issuers are impacted and the yield impact is greater vs. the 30% revenue example, the impact remains minimal in relative terms with a 0.002% decrease in yield for a portfolio with a 50% allocation to Corporates with similar characteristics to the index but there would be an increase in concentration risk to other sectors/issuers.

Key Takeaways

- Lloyd’s aims to phase out new investments in thermal coal-fired power plants, thermal coal mines, oil sands, and new Arctic energy exploration activities by January 2022 and existing investments by the end of 2025 in their Central Funds and want the market to follow.

- For the average Lloyd’s portfolio, the financial impact on investment returns of this approach is unlikely to be material, with less than 1% of issuers within the ICE BofA 1-5 year AAA-A U.S. Corporate Index (CV10) impacted.

- The impact could be more significant for those with holdings in below investment grade companies or exposure to bank loans, due to the greater number of energy issuers in these sectors.

- We expect that issuers will continue to evolve their business models away from unsustainable activities, but this will be coupled with even more prescriptive and restrictive ESG investment guidelines driven by the likes of Lloyd’s, regulators, and societal pressure.