Life insurers traditionally follow an asset liability matching or management (ALM) approach to construct their investment portfolios. This ALM framework is a bottom-up process in which assets are segmented to support specific product liabilities. This issue of Perspectives introduces a top-down asset allocation approach (Enterprise Based Asset Allocation™ or EBAA™process) and illustrates how life insurers can adopt this holistic approach to potentially improve their investment portfolios’ risk-adjusted returns beyond the levels derived from the traditional bottom-up ALM approach.

Considerations for Life Insurers’ Investment Construction

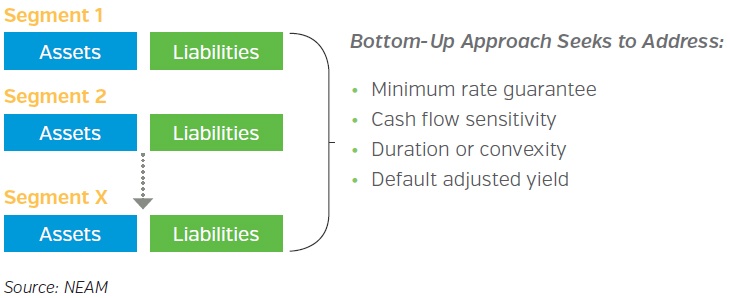

Insurance may seem pretty straight forward: insurers collect premiums or payments from customers and then pay out benefits to policyholders and beneficiaries as claims are incurred. What makes this process more complicated is the timing and severity of these claims. In the case of life insurance products, insurers typically keep (and invest) the premiums for a relatively long time before paying out the benefits or claims. The investment portfolio should reflect the liability characteristics – whether it is the guaranteed interest payment credited to policyholders, unusually long liability cash flows, or undesired timing or size of policy surrenders – and address the potential liquidity risk, reinvestment risk and optionality resulting from the interplay between assets and liabilities. The bottom-up segmentation approach seeks to address the minimum rate guarantee, convexity or duration, and potential default loss considerations. However, it does not adequately reflect the potential diversification or interplay among different segments within the insurance enterprise.

Bottom-up Portfolio Construction

It is common for life insurers to “segment” their assets to support multiple liability blocks (see Chart 1). In the U.S., the regulatory asset adequacy test (or cash flow testing) requirements may have motivated this segmentation practice. Although this may have started as a regulatory exercise, which focuses more on insurers’ solvency and policyholder protection, this bottom-up approach may ignore the potential interdependences among different segments (and components of the segment) of the overall investment portfolio1. The modern portfolio theory (MPT) offers a framework to evaluate the return and risk trade-off of portfolios with different allocations, accounting for the diversification or contagion effects. This is referred to as an efficient frontier framework.

Chart 1: Illustrating the bottom-up approach

Segment Level Optimization

As more premiums and deposits are received or benefits paid out, the asset portfolio “configuration” should reflect liability characteristics within each product line (segment). These may include minimum rate guarantee, duration of expected liability cash flows and sensitivity of liability cash flows to the capital markets environment (policyholder behavior).

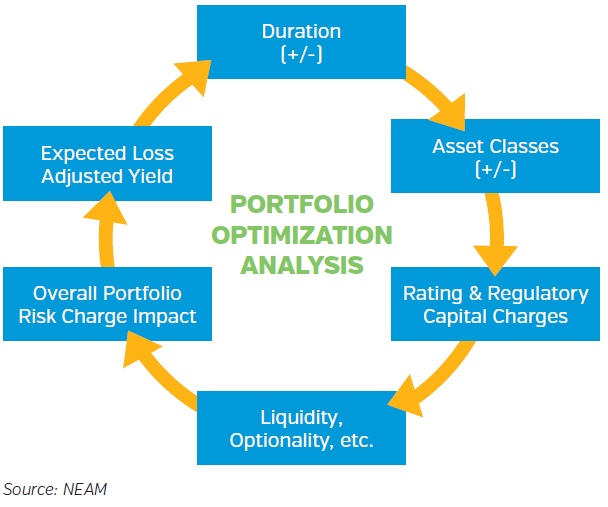

Moreover, depending on the regulatory and rating agency capital charges for different asset classes, portfolio configuration should evaluate the return versus the required capital trade-offs. In the course of portfolio configuration, these regulatory and rating agency considerations can become “constraints” in the optimization process. Given that life insurers’ assets tend to be invested mostly in fixed income securities, the credit risk (i.e., potential default losses) should be incorporated into the expected loss-adjusted yield estimate. This iterative process, as outlined in Chart 2, serves as a critical foundation for segment level portfolio construction.

Chart 2: Iterative portfolio construction process

Asset and Product Sensitivities to Capital Markets Environment

For certain annuity products (and/or Universal Life) where policyholder behaviors are sensitive to the capital markets environment, life insurers should pay close attention to policyholder optionality risk (withdrawal, lapse or surrender). For example, annuity contract holders may wish to move their contract to other insurers that offer more favorable credit rates during a sharply rising rate environment. In this environment, life insurers’ fixed income portfolio market values decline and would probably suffer a realized loss should the insurers need to liquidate the position to meet annuity contract holders’ demands. The industry has coined this phenomenon “dis-intermediation” risk. In mathematical terms, the annuity contract cash flows have a “positive” convexity; i.e., the duration of annuity product cash flows “shortened” under a rising rate environment.

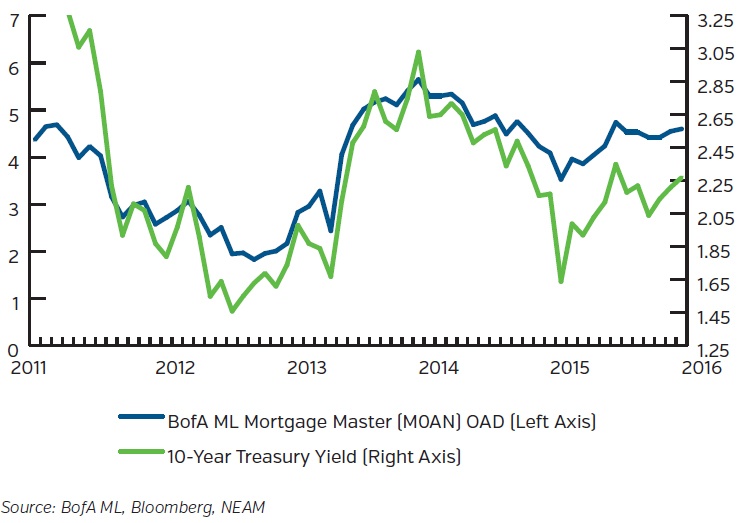

From the asset perspective, specifically, Mortgage Backed Securities (MBS) tend to have a “negative” convexity; i.e., the duration of the cash flow is “extended” during a rising rate environment. Mortgage owners are unlikely to re-finance or prepay when rates are high, as shown in Chart 3. This example of opposite interest rate sensitivity of life insurance assets and products highlights the importance of incorporating a liability profile into the investment portfolio construction process.

Chart 3: Option adjusted duration (“OAD”) BAML Mortgage Master Index vs. 10-year Treasury

Top-down EBAA™ Process

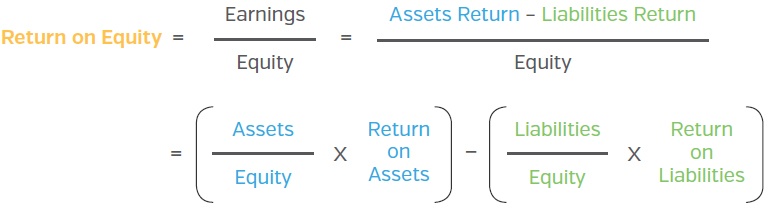

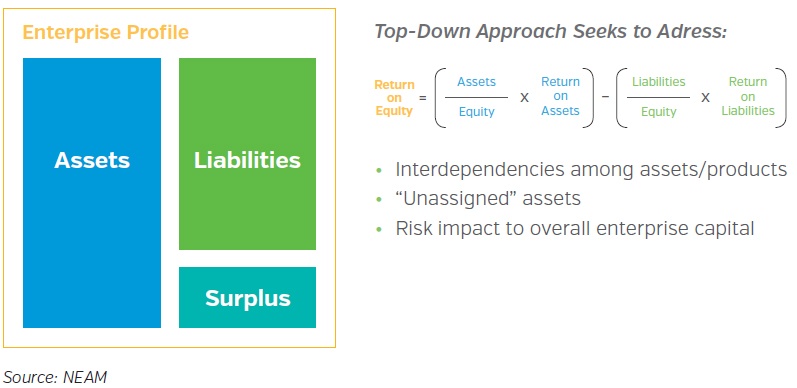

As a life insurer offers multiple insurance products (segments), the insurance company can be viewed as an “enterprise portfolio” consisting of various “segments.” A profit-seeking insurance organization needs to generate favorable return on equity for its capital providers. Starting from the traditional return on equity (ROE) definition, we can further decompose the ROE of a life insurance enterprise into the following DuPont formula:

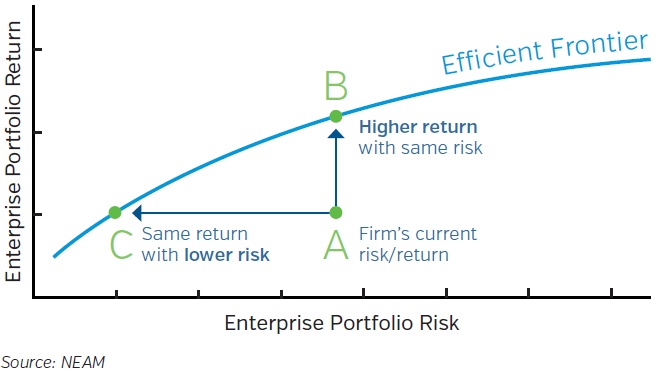

This holistic top-down approach considers the characteristics and interactions of invested assets and insurance products. The economic framework utilizes marked-to-market total return, volatility and correlation to assess an insurance enterprise’s return and risk trade-offs through the modern portfolio theory efficient frontier analysis (see Chart 4). As shown in the chart, point A represents the company’s existing return and risk profile; and the efficient frontier represents potential opportunities for the company to achieve a higher risk-adjusted return profile. For example, point B illustrates a higher return with the same level of risk, while point C illustrates the same return at a lower level of risk; both points are considered to be more “efficient” than the current profile A.

In contrast to the top-down EBAA™ process, the bottom-up approach often neglects the critical interdependence considerations within the MPT framework that insurers should address when managing their enterprise investment portfolios.

Chart 4: Modern portfolio efficient frontier analysis

The EBAA™ process provides a holistic framework2 to assist in asset optimization within the context of multiple product segment interactions. It also seeks to addresses the common question of how insurance companies should manage the assets that are not “earmarked or assigned” to certain liabilities or reserves; i.e., the assets supporting surplus or capital. This “surplus asset allocation” question should be addressed under a holistic top-down framework (see Chart 5). Depending on the asset optimization results, the optimal portfolio reconfiguration can potentially take place within these unassigned assets (surplus account).

Chart 5: Holistic top-down framework to optimize asset allocation

Top-down EBAA™ Embraces Traditional Bottom-up ALM

According to the modern portfolio theory, “enterprise-level” optimizations should yield better outcomes than “segment-level” optimizations due to potential diversification benefits captured under the global framework. Within the context of insurance enterprise optimization, the traditional segment level ALM might miss the implicit diversification benefits that are considered under the enterprise level asset optimization. However, the segment level ALM produces considerations (or constraints) that are critical components in the enterprise optimization. In other words, the top-down optimization builds on the segment level ALM and assists to further enhance the optimization outcome.

Key Takeaways

Life insurers’ investment portfolio construction should address their product and liability characteristics and requirements. The traditional bottom-up ALM approach should serve as an initial step to the investment portfolio construction. This segment level analysis provides critical information for the top-down EBAA™ process. Our suggested holistic EBAA™ process embraces the bottom-up ALM process and further incorporates the diversification considerations into the enterprise-level optimization.

More importantly, this EBAA™ approach helps to provide an integrated framework to evaluate the investment allocation for assets that are not earmarked for or assigned reserves; i.e., the surplus account assets. NEAM believes this holistic EBAA™ process would help insurers to potentially enhance the risk-adjusted returns of their portfolio. In subsequent issues of Perspectives, NEAM plans to provide case studies to highlight the potential benefits of utilizing the EBAA™ process versus the segment level ALM approach.

Endnotes

1 General ReView Issue 29, November 2004, “Partitioning Investment Portfolios: Unintended Consequences of Ignoring Correlated Results”

2 General ReView Issue 45, January 2010, “Amending ALM: An Enterprise Solution for Insurer Risk Management”